5 stocks MM are keen to buy into further weakness – (ANZ, BLD, OZL, WPL, WSA)

The ASX200 was clobbered 146-points / -2.2% yesterday with 90% of the market closing down on the day, take gold stocks out of the equation and there was almost zero “green on the screen”. Across the 11 major sectors losses were pretty evenly spread with all down by -1%, or more, but the Telco’s did just manage to grab line honours falling by -3%. In times gone by, Telstra has done well in a down market however yesterday’s performance highlights a theme we’ve mentioned a few times of late, that TLS is no longer the defensive traditional yield type investment and no longer trades like one – not a bad thing, just a change.

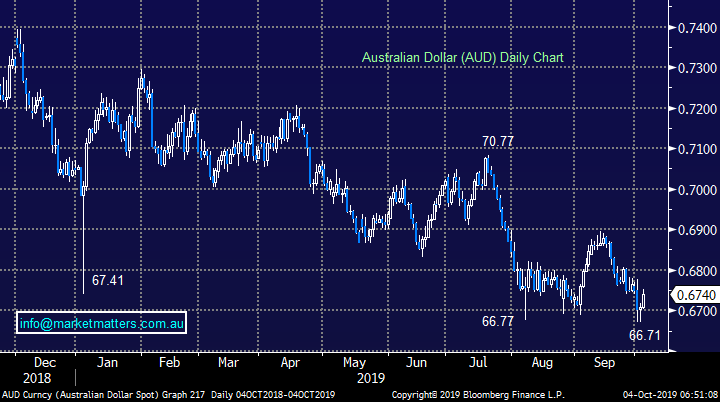

Overnight we saw US stocks recover marginally from their steep losses over the previous 2 sessions with the Dow bouncing 122-points, not a huge recovery considering we remain down well over 600-points for the week. The market optimism was spurred by increased hopes for a rate cut by the US Fed as soon as this month, the futures markets are now pricing the cut as an 80% possibility – clearly an attempt to offset the economic damage being created by the US - China trade war.

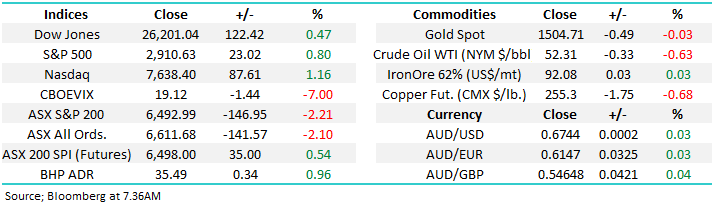

We expect the ASX will at least bounce this morning enjoying some relief that the US didn’t plunge again overnight although it was down heavily at around midnight AEST. Our best guess at this stage is we will see a period of consolidation, ideally around the 6500 area, but importantly our preferred scenario is still we see a break by the ASX200 towards 6300. Stocks may have kicked off the new quarter in the worst fashion since just after the GFC but MM remains keen to buy only ~3% lower.

Short-term MM is looking to significantly increase its exposure to stocks around 6300, basis the ASX200.

Overnight global stocks bounced as touched on earlier with the NASDAQ recovering 175-points / 2.3% from its intra-day low. BHP is set to open up +1% this morning, regaining around a third of yesterday’s losses helped by iron ore which remains firm.

This morning we have briefly looked at 5 stocks we are looking to buy into ongoing market weakness.

NB As we stated yesterday we don’t want subscribers to be scarred / overawed by the number of alerts if stocks continue their current decline.

ASX200 Chart

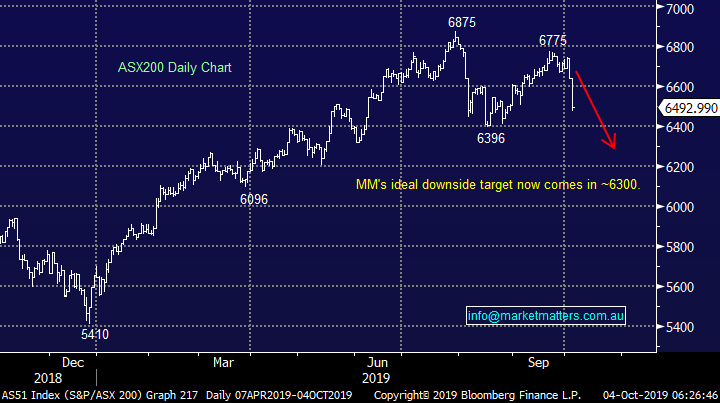

Overnight the volatility Index (VIX) gave back some of its weekly gains but it remains relatively elevated closing the day above the 19 level. While the VIX is clearly well above its lower band for the last few years there’s been no real panic spike.

Ideally we will see a panic rally towards 30 by the VIX generating contrarian buy signals for stocks.

The VIX (volatility) Index Chart

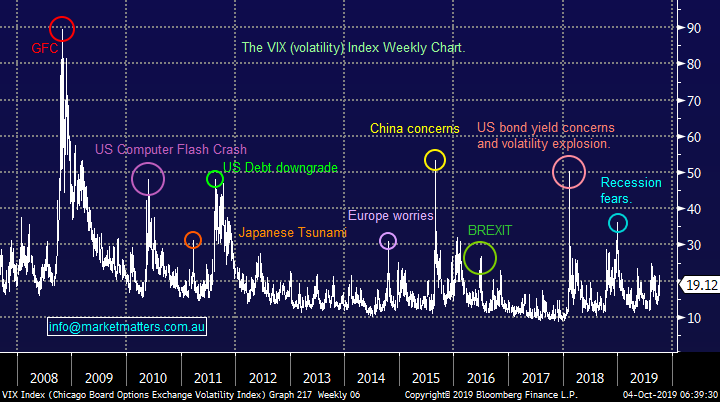

It's felt like the Aussie dollar has literally had the kitchen sink thrown at it this week but here we are on Friday morning and its fighting to be unchanged for the period, overnight it received a helping hand as markets increased their bets on an interest rate cut by the Fed, a move that would make President Trump very happy.

MM remains bullish the $A from current levels – a very contrarian opinion.

The Australian Dollar ($A) Chart

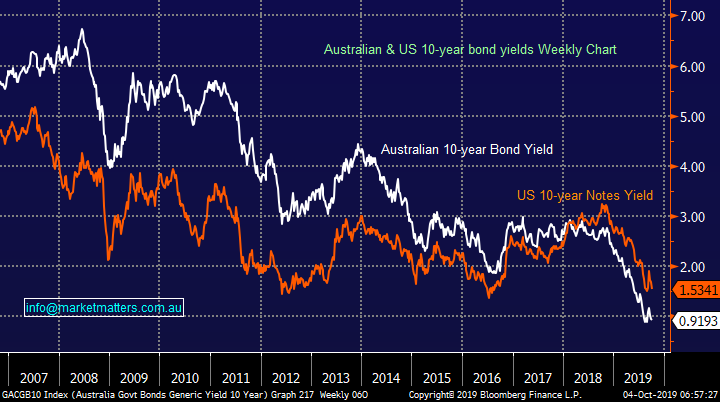

The Australian bond yields have been winning the race to the bottom, especially against the US, as we can see below – this has created a constant headwind for the $A which is not used to being a low yield currency on a historical basis. However, at MM we believe that while bond yields look destined to make fresh lows for 2019 on a simple risk / reward basis this is a buying opportunity of yields, or selling of the underlying bonds themselves.

MM believes bond yields may well be close to a major inflexion low.

Australian & US 10-year Bond yields Chart

Australian 3-year bond yields have made fresh 2019 lows this week as markets have fully embraced the prospect of another rate cut to 0.5% by the RBA, potentially in 2019. Pundits are also now discussing the possibility of unconventional QE as everybody appears to be desperate to avoid a recession on their watch – history tells us they are actually part of the normal economic cycle but the GFC has apparently changed many peoples mindset.

We have been targeting a test of the 0.5% by the 3-years which most certainly doesn’t put us on an island but MM is now leaning towards the risk of a major bottom being formed in 2019 – this is a contrarian view and one which has us primarily looking at value orientated cyclical over hot growth stocks over the weeks / months ahead. Today I have briefly looked at 5 stocks we are considering plus importantly our ideal entry levels.

MM is now watching closely for signs of bond yields bottoming.

Australian 3-year Bond yield Chart

5 stocks MM have our eyes on

The below 5 stocks are on our radar if / when we see the ASX200 correct towards 6300 but obviously markets are not perfect and some of them may reach our ideal buy areas earlier, while others not all.

1 Western Areas (WSA) $3.01

Nickel producer WSA has already broken our initial $3 support area but with the ASX200 looking poised to correct another 3% we haven’t pressed the buy button just yet.

MM likes WSA around $2.90, or 3.5% lower- getting close

Western Areas (WSA) Chart

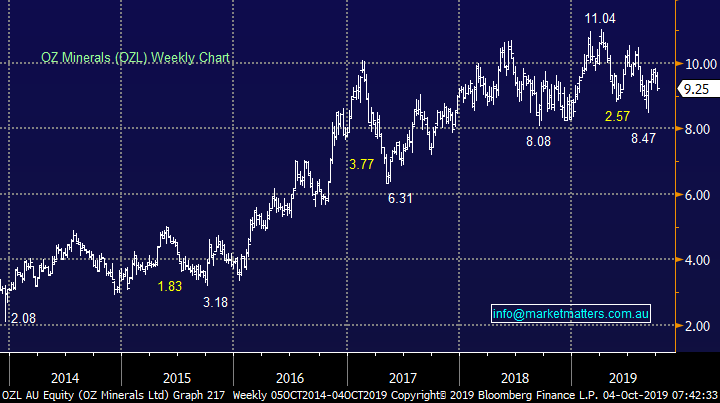

2 OZ Minerals (OZL) $9.25

Copper producer OZL remains undervalued by the market in our opinion, we remain keen buyers in the weeks ahead. The current period of weakness in the copper price due to global economic concerns may provide an optimum entry opportunity.

MM likes OZL around $9.20, or below.

OZ Minerals (OZL) Chart

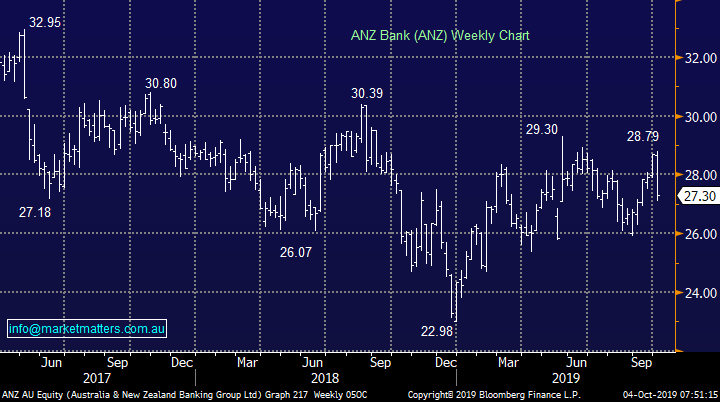

3 ANZ Bank (ANZ) $27.30

ANZ Bank (ANZ) has endured a tough week, along with the whole banking sector, falling over 5% from its highs of the week. If this weakness continues MM will look to increase our ANZ position below $26 i.e. a similar degree of weakness to what we’ve already witnessed this week.

MM likes ANZ below $26.

ANZ Bank (ANZ) Chart

4 Boral (BLD) $4.52

Stepping up and buying another building facing business is fairly aggressive after our experience in 2019 with Adelaide Brighton (ABC) and the sectors clear downtrend, although CSR has been good to us in the Income Portfolio. However if we are about to see both fiscal and monetary policy unleashed on the Australian economy it should eventually flow through to construction, if it doesn’t then the RBA will have a failed and a deep recession is likely to follow.

MM likes BLD around $4.40

Boral (BLD) Chart

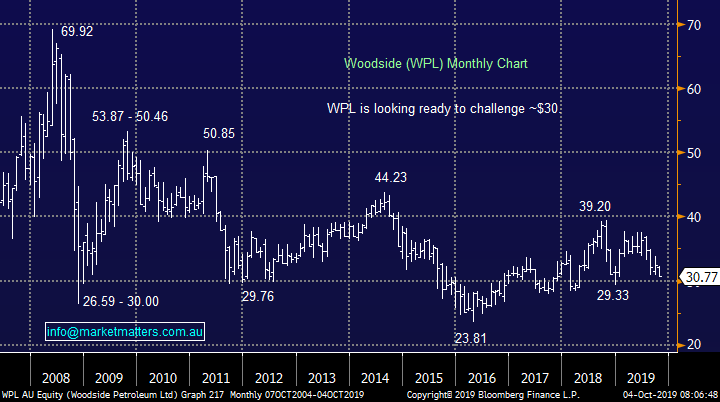

5 Woodside Petroleum (WPL) $30.77

Heavyweight energy producer WPL has endured a fairly tough 2019 but as the chart below illustrates its simply chopping around in a large trading range implying we should be buying in periods of weakness. We are looking at stepping up if some recession inspired weakness sends the stock below $29 the Income Portfolio may also consider averaging its holding at this level.

MM likes WPL below $29.

Woodside Petroleum (WPL) Chart

Conclusion (s)

Stock markets are following our anticipated path lower but to-date we’ve refrained from pressing any buy buttons, the ASX200 is set to open around 6525 this morning which represent over 50% of our targeted decline i.e. its encouraging but not yet time for action.

At MM we have sat on our hands through September, now markets are starting to unfold as we expect a little patience feels prudent.

Global Indices

This week’s aggressive decline by stocks looks to have put the wheels in motion for the stock market correction MM has been patiently waiting for, a short sharp spike towards the 2740 area for the tech based S&P500 looks ideal i.e. around 5-6% lower.

US stocks have generated short-term bearish signals.

US S&P500 Index Chart

Similarly European indices now look bearish technically with another 5% downside feeling likely. The UK FTSE looks set to target its Christmas low, not a good indication for BREXIT in the weeks ahead.

UK FTSE Chart

Overnight Market Matters Wrap

• The US gained little from its recent loss overnight, with investors now thinking positive and increased its wager for a new round of stimulus to be implemented to assist the current state of its economy – tonight we will hopefully see some clues if this comes to fruition as the US Fed Chair to speak tonight.

• With the current global growth showing signs of a slowdown, the yields across the US, Europe and home have all ended lower as investors still seek some safe haven assets at present.

• On the commodities front, crude oil continued to slide down, currently at US$52.31/bbl. with BHP expected to outperform the broader market after ending its US session up an equivalent of 0.96% from Australia’s previous close.

• The December SPI Futures is indicating the ASX 200 to open 32 points higher, towards the 6525 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.