5 of MM’s favourite buys into current weakness (BIN, EHL, HLS, BHP, ALU, PGH, PDL)

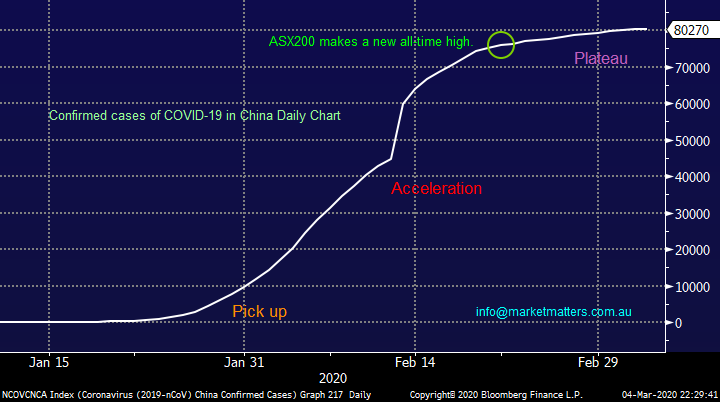

The ASX200 experienced a disappointing Wednesday falling another -1.7% on solid volume, it was another “risk off” day following the poor reaction in the US to the Fed’s 0.5% rate cut, the high Beta IT sector was worst on ground while the Financials were the major headwind for the index. The influential Australian Banking Sector remains friendless, we may be correct with our view that the “Big 4” Banks represent good value at current levels but its never wise to “fight the tape” and while the markets focusing on falling interest rates & margins MM is not going to fade the trend and go overweight the group.

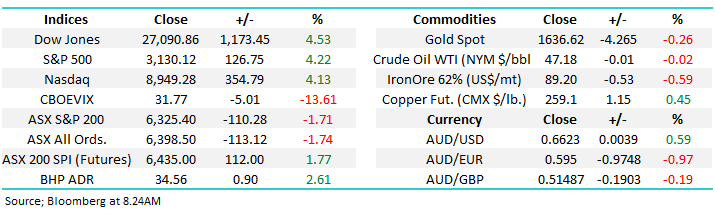

Nobody knows exactly how the COVID-19 virus will unfold from both the humane and economic perspective but it’s our opinion that stocks & bonds have already priced in some major bad news moving forward and as we all know markets often get it wrong when they panic. Undoubtedly the virus is already putting a significant weight on an already spluttering global economy but when I reflect on the slowing rate of the outbreak in China I feel that the panic could easily be overdone, the spread within the worlds most populated country is decelerating rapidly, the statistics below imply COVID-19 only appears to be a major influence for global growth, not on the humanitarian level from a relative perspective:

In late 2019 the population of China was a massive 1.43 billion people : over 250,000 lost their lives on Chinese roads including over 6,500 pedestrians, around 60,000 people drowned yet the death toll from COVID-19 is ~3,000 and the numbers appear unlikely to surge higher. I could have drawn on a number of other statistics readily available on the internet to make the point but its not a big number for such an enormous country.

However here’s both an unnerving and interesting fact reported by CNN in late 2019 – twice last year people have caught the Black Death / Bubonic Plague in Mongolia, China. In May a Mongolian couple died from the bubonic plague after eating the raw kidney of a marmot, just like the bats for old Chinese medicine reasons. At school I learned that in the 14th Century its estimated that the Black Death wiped out ~30% of Europe – perhaps it was always a matter of when not if a major disease / virus emanated from China due to its fascination with eating exotic animals.

Confirmed cases of COVID-19 in China Chart

In a similar vein to our thoughts around the banking stocks, equities in general appear to be in a clear nervous / bearish mood – they’re ignoring good news while embracing the continual flow of concerning commentary around the virus escalating through the Western world, Italy already has ~80 deaths. Markets hate both uncertainty and bad news getting too close to home, global stock markets were heading towards fresh all-time highs while the number of confirmed cases of COVID-19 was accelerating through Wuhan and China – out of sight out of mind! We believe the current panic will throw up some excellent buying opportunities this month but historically these periods of panic selling usually see at least a retest of the initial sell-off lows hence at this stage we’re looking to buy weakness not chase strength.

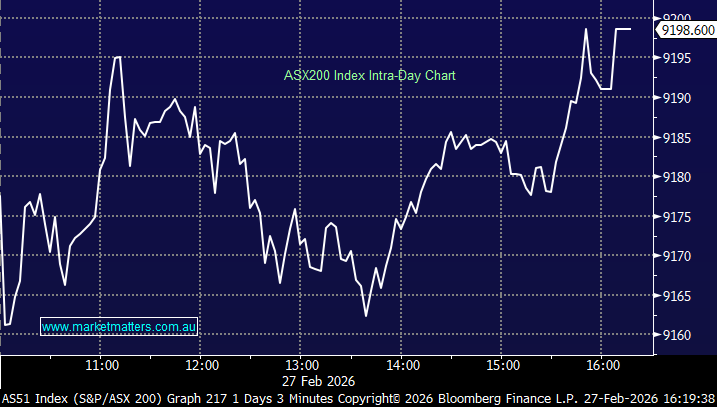

Overnight US stocks rallied strongly, the Dow Jones adding 1173 pts / 4.53% helped by a couple of supportive factors. SPI Futures are pricing a relief rally of 112pts on our market today, with the ASX expected to test the 6450 region.

1 – The more moderate Joe Biden has taken a reasonable lead over Bernie Sanders for the Democratic nomination as November’s US Presidential Election looms large– markets can actually look outside of COVID-19.

2 – Canada slashed interest rates the most since the GFC from 1.75% to 1.25%, the global central bank action we’ve flagged over recent weeks is clearly unfolding.

MM believes investors should be looking to accumulate stocks into the current virus inspired panic.

However it may surprise readers to know that over 70% of the times in over 25-years when the Fed has implemented emergency rate cuts, stocks found themselves lower in the following year by more than 10%, in other words we must keep our fingers on the markets pulse very closely in the months ahead. Today we’ve looked the market square in the eyes picking out 5 of our favourite stocks to buy, plus importantly a couple of potential funding vehicles i.e. sells.

ASX200 Chart

A snapshot of Global Markets

US equities rallied strongly overnight for the 2nd session out of 3 making last weeks panic 2855 low by the S&P500 feel like a distant memory for now at least, but in today’s volatile market this can be turned on its head in just a few hours.

MM believes US equities have now found, or are looking for a low.

US S&P500 Index Chart

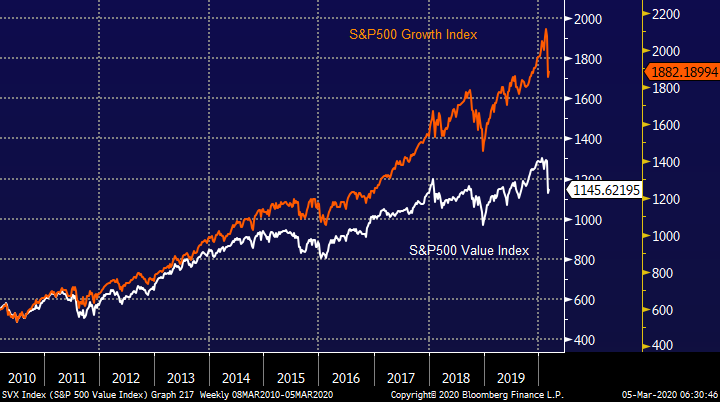

Global bond yields have bounced over the last 24-48 hours even as the rate cuts continue to wash through from central banks – MM believes we are at, or have even already witnessed, a major inflection point for bond yields i.e. a supportive backdrop for “Value” stocks compared to “Growth”.

MM is still expecting bond yields to bottom during this COVID-19 outbreak.

US 30-year Bond yields Chart

Our favourite 5 local stocks at todays levels

As we said in yesterday’s pm report a few stocks which MM likes are starting to show some compelling stories / valuations into the current market panic. While it’s hard to do, and taking losses on stocks is difficult for some, we need to try and put our blinkers on and think about the portfolio we want to have coming out of this turmoil. While there is a lot of rhetoric being written around whether or not to buy this weakness, the reality for a lot of us is that it’s now more about what we want to hold as the dust settles – a good time to reposition portfolios into the chaos.

The key view that MM holds for the coming few years is we prefer the Value over Growth stocks, a reversion that if we are correct should make Warren Buffett happy. This doesn’t mean we have no interest in the likes of Tech but it does dictate that we will be more cautious in this direction - in simple terms we believe it will be a while until investors are comfortable to drive company valuations to the extremes of last month.

S&P500 Value v Growth

Hence today I have looked at 5 very diverse stocks that we feel offer strong reason to be buying into current market weakness - remember the ASX200 is down 13.2%.

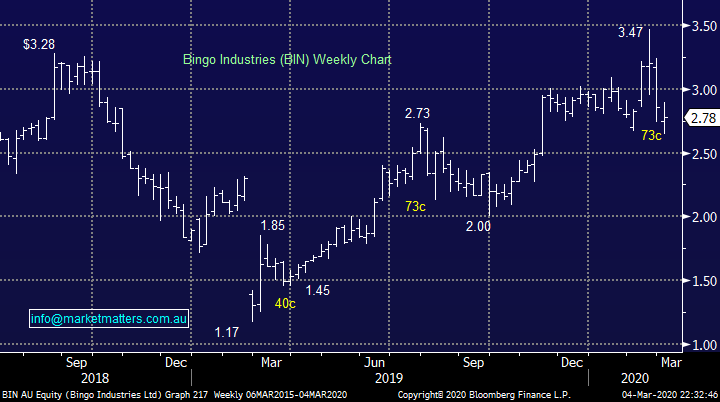

1 Bingo (BIN) $2.78

Waste management and recycling business BIN is perfectly positioned to how we see the future unfolding as Australia and the world strives to live a less wasteful world. Following its 21.1% correction from recent highs, we believe BIN looks solid value into prevailing weakness. While the markets in panic mode its ignored improving fundamentals like Scott Morrison announcing changes to procurement rules which will make it move viable to source recycled products – more demand out of Bingo’s recycling facilities. We believe this trend is just getting going.

MM likes BIN around current prices.

Bingo (BIN) Chart

2 Emeco Holdings (EHL) $1.81

EHL has been pummelled almost 30% on fears from the COVID-19 inspired economic slowdown and good news from the company has been ignored as its thrown in the “highly leveraged” bucket i.e. Yesterday a ratings agency said “that Emeco’s business profile has improved following its acquisition of Pit N Portal.”

As we’ve previously mentioned the main reason why EHL is trading so cheap is because of its high debt levels, leveraged at 1.77x operating EBITDA as at the half year result last month, carrying $US409.1m in net debt. A ratings upgrade will make it easier to refinance when the time comes, and highlights the progress the company has made over the last 12 or so months – the stocks trading on an Est P/E for 2020 of only 7.3x, and is now trading at the bottom end of its trading range.

MM likes EHL into current weakness.

Emeco Holdings (EHL) Chart

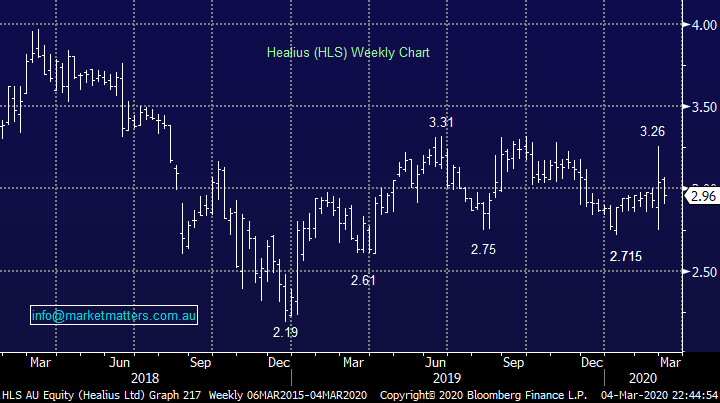

3 Healius (HLS) $2.96

HLS has received its second takeover bid in a year, this time from a Swiss private equity firm at $3.40, yesterdays close almost 13% below the bid implies the market believes it will fail but we feel the risk / reward is now becoming attractive, after all 2 bidders have told the market they believe the stock is cheap! MM believes its now a question of when and at what price HLS gets taken out not if, hence we view it as a good opportunity at current prices.

MM likes HLS from a risk / reward perspective under $3.

Healius (HLS) Chart

4 BHP Group (BHP) $33.66

BHP needs no explanation and after its recent 23% correction we feel its offering some great value to patient investors. We believe when China starts pumping the stimulus through the diversified miner will be a huge beneficiary and the stocks estimated 7% fully franked yield is certainly some attractive cream on the cake.

MM likes BHP at current levels.

BHP Group (BHP) Chart

5 Altium (ALU) $30.51

ALU develops electronic design automation software for Microsoft with their products helping to facilitate the design and development of electronic products such as printed circuit boards, like Microsoft its suffered on the prospect of a global slowdown after saying they would meet the lower end of their prior guidance range, but a 30% correction is certainly factoring in some bad news even for this high valuation IT stock – this business along with XRO is our favourite way to play a sharp correction in this high beta space but its unlikely to be a long term hold through 2020 / 2021.

MM likes ALU around $30.

Altium (ALU) Chart

NB We could have easily included Macquarie Bank (MQG) in todays list but we felt that we probably hold enough banking stocks. Whatever their skew.

2 potential funding vehicles / sells

Arguably the most important part of todays report is considering what stocks to sell if we are looking to switch to some of the above i.e. repositioning into 2020 / 2021.

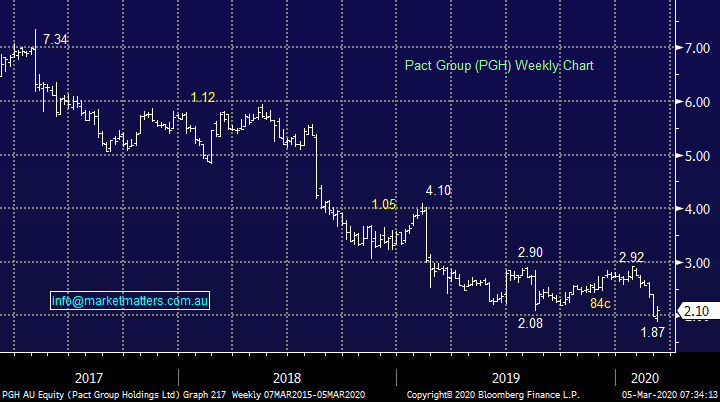

1 Pact Group (PGH) $2.10

Our original thesis around Pact Group (PGH) revolved around valuation, and an identifiable pathway for that valuation to improve as they paid down debt organically rather than raised fresh equity as the market was expecting. While this is still on the cards, we feel a global slowdown will hurt demand for packaging, and apply some pressure to its earnings at a time when they can least afford it - ultimately, the turnaround will now likely take longer.

We also hold Emeco (EHL), another business in the same boat (higher debt levels) however ultimately we feel EHL looks better post their recent acquisition.

MM believes PGH will continue to struggle unless we get a solid global economic recovery.

Pact Group (PGH) Chart

2 Pendal Group (PDL) $6.71

PDL is a very frustrating story for MM, we originally bought at $7.97, picked up the dividend which equated to 26c and discussed selling around ~$9, but ended up being way too fussy as a result of our more positive outlook on the UK economy after Boris took office (PDL generates 70% of its revenue from the UK) However our feeling is we’re now holding one too many fund managers in the portfolio given likely volatility moving forward. i.e. we also hold Janus Henderson (JHG) hence PDL is a perfect funding vehicle, especially into strength that we should see today.

MM can now see PDL falling another 10%, after a initial bounce

Pendal Group (PDL Chart

Conclusion

MM is considering selling PGH and PDL while our favourite buys are BIN, HLS, BHP and ALU for different reasons.

We already hold BIN & BHP

Watch for alerts.

Overnight Market Matters Wrap

- The US equity markets continued its outperformance against its global peers as of late, following the Congress agreeing to an emergency spending bill in an attempt to fight the coronavirus ‘domino effect’. The led to the US 10-year treasuries settled abot 1.00%, while the short term 2-year lost ground currently at 0.67%.

- On the commodities front, crude oil closed with little change at US$47.18/bbl. after trading as high as US$48.41/bbl. overnight while the VIX (Fear) index continues to retreat, slowly back to complacent levels.

- BHP is expected to outperform the broader market after ending its US session up an equivalent of 2.61% from Australia’s previous close, while RIO is trading ex-dividend today ($3.497/share).

- The March SPI Futures is indicating the ASX 200 recover just some of its recent losses and open 115 points higher, testing the 6440 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.