5 major market dynamics catching our eye (BOQ, GDX, BHP, IFL)

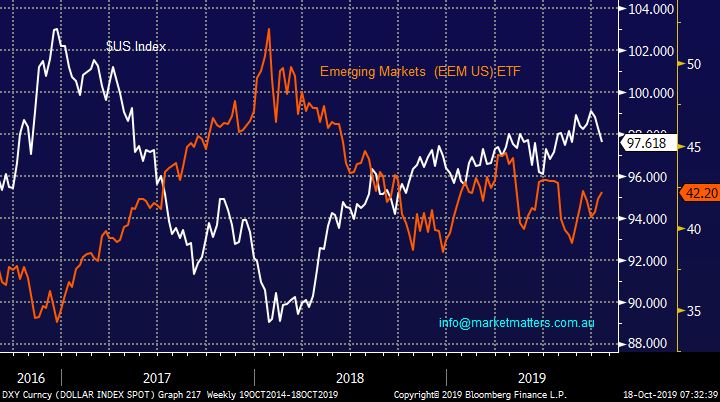

The ASX200 is continuing with its last 4-months choppy price action, rallying over 80-points on Wednesday only to reverse more than 50-points yesterday. At MM we are always looking for the “Controlling Pattern” to give us an insight into the markets likely direction and at present it appears to be the neutral set-up between 6396 and 6875 which is dictating proceedings, the majority of the last few weeks trading & arguably messy noise has unfolded between 6550 and 6750. When Thursdays am report left my inbox I thought we would be pressing a buy button or two, skewing the MM Growth Portfolio to a more neutral / bullish stance in the process but with the firming Aussie dollar, selling rolled through our market and things simply felt wrong, sitting on our proverbial hands felt the best course of action.

Thursdays better than expected unemployment numbers surprised many analysts and significantly reduced the bets for a rate cut on Melbourne Cup Day, markets are now only pricing in a 17% chance of a rate cut on one of Australia’s largest social days. Following yesterday’s data and more optimistic comments from Governor Phillip Lowe in a speech in Washington overnight we would be surprised to see the RBA act again in 2019, fiscal stimulus is our preferred option if the local economy does need a “shot in the arm” in 2020 although the likelihood is the RBA will still cut the Official Rate from 0.75% down to 0.5% if we see a deterioration in general local economic condition moving forward. This about face with regard to a rate cut next month has led to a firming $A which is likely to lead to local market underperformance for the remainder of 2019.

BREXIT appears to have a strong chance of becoming finalised later this week assuming the British Parliament approves the deal, unfortunately that’s still a big “If”. Overnight the Pound soared on the initial announcement of the deal only to give back the vast majority of the gains as the last couple of hurdles were considered higher than first thought. Our view at MM is the whole multi-year political debacle will no longer be news in 2020 enabling us to asses British and European stocks without this added ingredient of volatility. I had a chat with Rupert Lowe who is a member of the BREXIT party a few months ago, the video can be viewed here.

Short-term MM is neutral the ASX200.

Overnight global stocks were relatively quiet with the S&P500 closing up +0.3%, while the SPI is calling the ASX200 to open down just over 10-points.

This morning MM has looked at 5 market characteristics that are unfolding which are formulating many of our investment thoughts both now and into 2020.

ASX200 Chart

The Bank of Queensland (BOQ) disappointed the market yesterday with an undoubtedly poor result which showed a fall in revenue, squeeze on margins, larger bad debt provisions and a dividend cut, plus for good measure a bleak outlook for 2020 – ouch! We feel investors should be prepared for another cut to the dividend as the CEO looks to firm up the balance sheet, a logical move but short-term yield hungry investors may not react favourably.

We exited the stock in the first week of September with some of these concerns in mind although the markets -2.4% reaction yesterday felt fairly muted, we can see further selling moving forward. Clearly nobody excepted too much from BOQ and perhaps its 31c fully franked dividend due in November has kept some sellers on the sidelines but this does feel like a yield trap to MM (for now). That said, it will be on our radar following the next dividend cut, and especially on a move into the mid $8 region, the next dividend cut is likely to be the last.

MM is neutral to negative BOQ.

Bank of Queensland (BOQ) Chart

We thought its was an opportune time to take another quick look at the gold stocks as they’ve had a very tough ride on the local bourse this week e.g. Newcrest (NCM) -6% and Evolution Mining (EVN) -10%.

The global gold sector is basically unchanged this week but the local sector appears to be getting hit due to the strong $A i.e. a strong local currency lowers the earnings for Australian miners. MM has a bullish view on the $A hence we a little concerned about the performance of the local sector, especially on a relative basis but for now we believe the risk / reward favours maintaining a long exposure.

MM is still bullish the gold sector but it’s on watch due to AUD strength.

VanEck Gold Miners ETF (GDX US) Chart

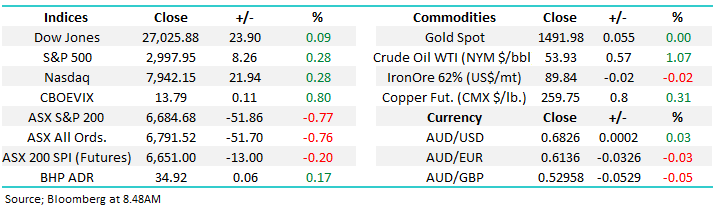

1 The $A and its ramifications

The “Little Aussie Battler” has certainly been just that since its major high above 110 back in 2011, a period I remember very well as numerous analysts were calling a top in the $A but it remained resilient basically oscillating between 100 and 110 for a whopping 2 ½ years! As we’ve said previously tops tend to be a slow rolling over affairs and this was a perfect example, I wonder if the same thing will unfold in global equities, there are many doubters out there at current levels but the markets clearly remaining firm.

MM remains bullish the $A targeting the ~80c area.

However if we are correct with this view on the $A the question is what is the likely impact on the ASX200 and its respective sectors.

Australian Dollar ($A) Chart

The $A and ASX200 are usually pretty well correlated which is easy to understand i.e. a strong economy is supportive of that local currency and businesses that operate within that economy. However due to the tailwind of a depreciating $A the ASX has seen a boom in both performance and market weighting from companies with $US earnings e.g. CSL is now the 3rd largest company in our market and Macquarie Group (MQG) the 9th.

We believe the stretched differential illustrated below will contract into 2020 through a combination of a rallying $A and struggling ASX200. However so far this has most definitely not materialised with CSL surging to fresh all-time highs this week as the go to “safe” stocks remain in vogue, a trend we regard with a large degree of scepticism.

Given the below trends, investing internationally (with a currency hedge) is a strategy that investors should consider.

MM is very wary of $US earners into 2020.

ASX200 & the $A Chart

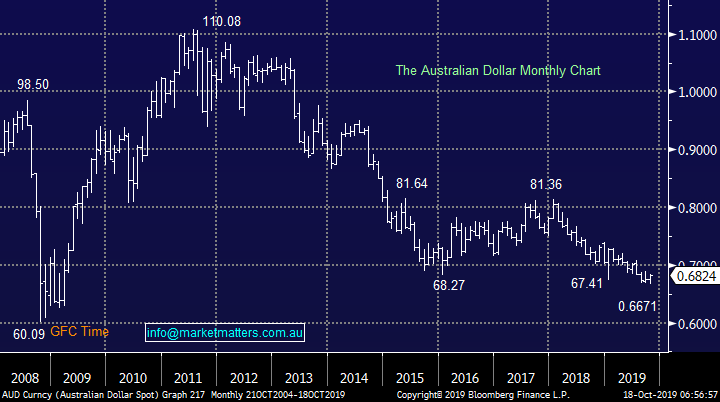

2 The $US and its ramifications

The $US has been in a bull market for around a decade but all good things come to an end and our preferred scenario is we will at least see a move ~10% lower, probably as the US looks to take their interest rates down towards the rest of the world. A weaker $US will help the competitive position of US companies and undoubtedly keep President Trump happy. It would also be supportive of $US denominated commodity prices.

MM is bearish the heavily owned $US.

$US Index Chart

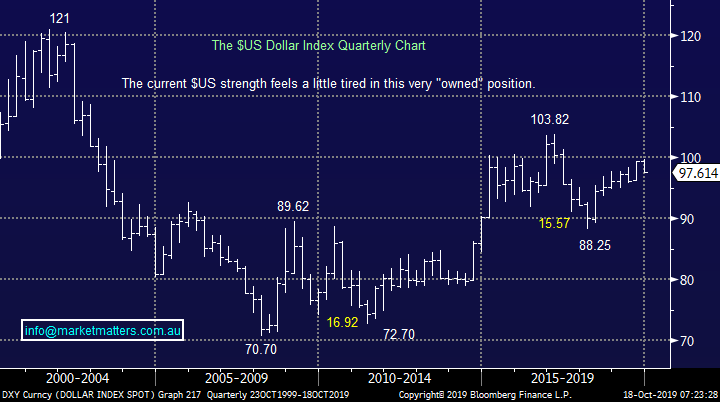

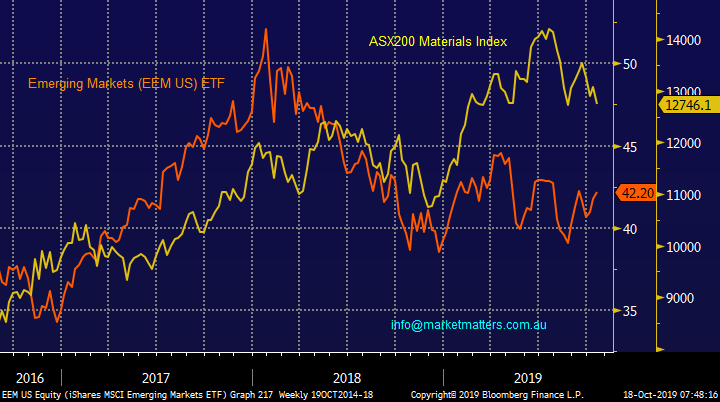

The most obvious follow on from a falling $US is with the Emerging Markets (EM), they generally have their debt denominated in $US hence they enjoy a weak Greenback. As the chart below illustrates the inverse correlation between the two is solid hence if we do see a lower $US we are likely to see higher Emerging Markets.

This is a great read for our Macro ETF Portfolio but what about the local market?

$US Index v Emerging markets Chart

The correlation between the EM and the Australian Resources is good although our resources have outperformed recently due to the weak $A. We believe the Australian resources and cyclicals will outperform the ASX into 2020 although the EM is likely to be on top of the performance pile.

MM likes the cyclicals into 2020 assuming we are correct that the $US is set to fall.

Emerging markets v ASX200 Materials Index Chart

3 The Australian IT Sector

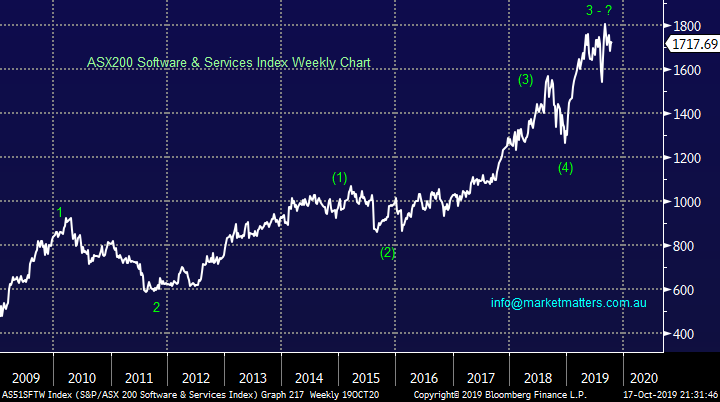

This week has seen the fall from grace of both Wisetech (WTC) and Afterpay (APT) and while they are both significantly higher than a few years ago it does demonstrate the risks of buying high value growth stocks at the wrong time. We believe the risks currently far outweigh the potential upside in the Australian IT stocks, at MM we’re simply giving them a wide berth.

MM is bearish the Australian IT sector.

ASX200 Software & Services Index Chart

4 The large cap resources

The Australian large cap resource stock have endured a tough few weeks as we’ve seen commodity prices, led by crude oil and iron ore, slip lower. A touch frustrating as we had been looking to reduce our exposure to the group into recent strength enabling us to then aggressively buy a pullback but the stocks frustratingly just fell short of our levels – unfortunately the best laid plans sometimes fail to follow through and we must be flexible with our views. As it stands, we hold around 17% on the Growth Portfolio exposed to base metals, the largest positions in FMG & RIO, while we’ve recently added Oz Minerals. We remain underweight BHP with a relatively small 3% weighting.

MM is looking to increase our exposure to the large cap resource stocks into fresh 2019 lows.

BHP Group (BHP) Chart

5 Money Managers back into play?

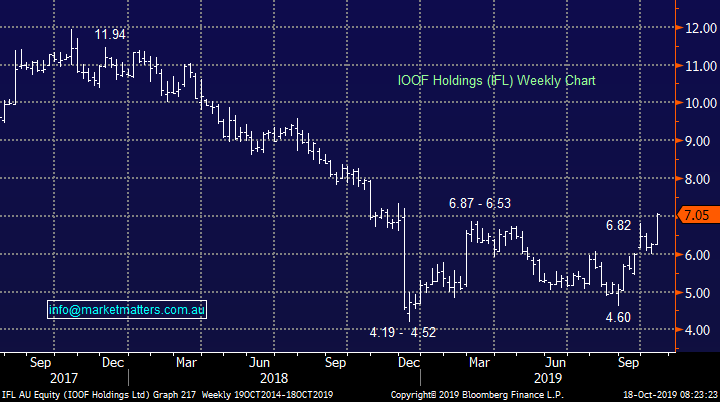

This week has seen strong rallies by the likes of IOOF (IFL) +16.7%, Challenger (CGF) +10.7% and Janus Henderson (JHG) +9.2%, albeit for very different reasons. Importantly we feel the “back of negativity” has been broken towards this cheap sector. Just as the IT sector looks to be entering an inflexion point after a solid period, the money managers appear to have bottomed after a very tough period.

The risk / reward is becoming appealing in a number of stocks within the sector headlined by IFL, buying with stops below $6.80, less than 4% risk looks an interesting trade.

MM is watching a few names to potentially add to our JHG position.

IOOF Holdings (IFL) Chart

Conclusion (s)

The same theme keeps percolating to the surface, cyclicals are very close to coming back into vogue – the AUD is a good indicator of this.

Global Indices

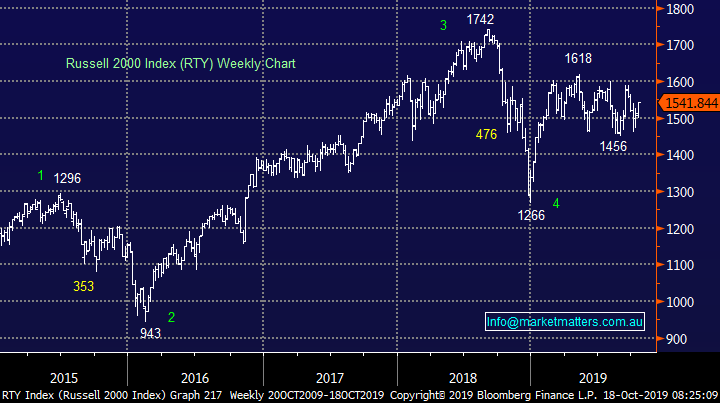

No change, we are now giving the benefit of the doubt to the post GFC bull market with fresh all-time highs ultimately feeling likely.

MM is now bullish US stocks.

US Russell 2000 Index Chart

European indices are mixed technically but with no commitment in either direction at this point in time but we have now developed a slight positive bias.

Euro Stoxx50 Chart

Overnight Market Matters Wrap

- Focus turned to the UK and Euro region for once, as a new Brexit agreement was made, with the house of commons now needed to vote in favour of this, while strong quarterly earnings continued to flow from the US , in particular Netflix and Morgan Stanley with 78% of those reported so far beating expectations.

- BHP is expected to open marginally higher, while the Aussie battler is muting the diversified miner from potential further strength, after pushing towards US68.26c.

- The December SPI Futures is indicating the ASX 200 to open marginally lower, testing the 6675 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.