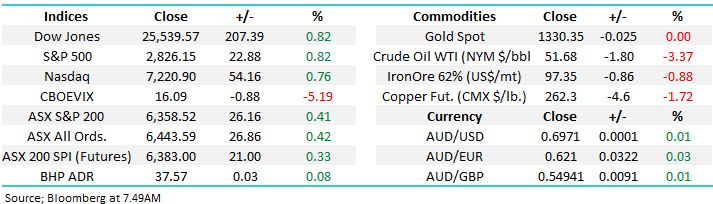

5 calls that influence our thinking on markets (CBA, NHF, RMD, RRL, SUN)

The ASX200 struggled to fully embrace the dynamic +500-point rally by the Dow but we still closed up +0.4% on the day after slowly giving back about half of the early morning gains. The “risk on” theme was back in vogue with the Financial and IT sectors leading the gains while the defensive Utilities, Real Estate & Healthcare sectors actually closed down on the day. The Telcos’ were the worst sector on the day falling -0.7% but this was heavily skewed by the -17.7% plunge by Vocus (VOC) after their suitors walked away although heavyweight Telstra (TLS) offered no support also finishing in the red.

The standout for us was watching some of the “second tier” underperforming stocks garnering a bid tone as investors voted with their wallets that a lower interest rate environment should help some of the struggling businesses get up off of the canvas e.g. Bingo (BIN) +5.5%. This is a theme we will watch carefully as we hold a few stocks in our Growth Portfolio which fit this description for this very reason.

The market had started to “feel wrong” prior to the 48-hour combination of the RBA rate cut plus speech implying another would follow and the US Fed stating they are prepared to again start cutting rates if required, which the economic statistics suggest they will. Global equities are still enjoying their longest bull market in history courtesy of low interest rates & QE hence while markets remain comfortable that central banks can avoid a global recession utilising whatever means necessary at their disposal stocks should remain firm.

At MM we are almost fully invested in local equities through our Growth Portfolio but our intention is to increase our cash position into further strength.

MM is now neutral the ASX200 unless we see a close back above 6450 but we are net bullish global equities for now.

Overnight US stocks maintained their strength with the Dow adding another 207-points taking its 2-day gain well over 700-points, locally the SPI futures are pointing to the ASX200 to open up ~20-points, still well below yesterday’s early morning high, however after the close, US Futures have traded down with US/Mexico negotiations failing to produce a resolution.

In today’s report we are going to review 5 of our favourite calls / charts to see if the MM roadmap remains on track.

ASX200 Chart

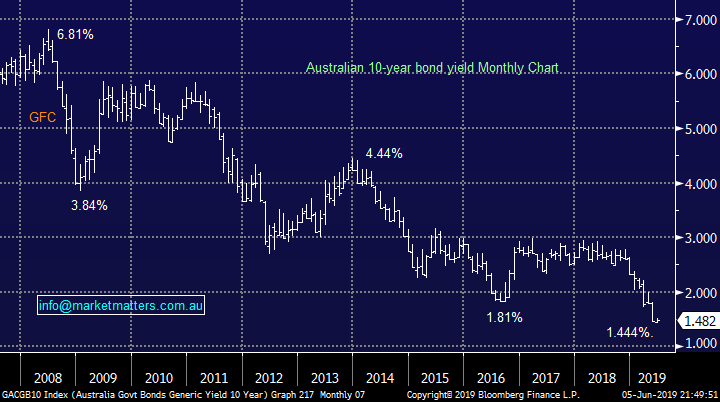

The closely watched Australian 10-year bond yield continues to trade well below 1.5% which until Tuesday was lower than the official RBA cash rate. We are very comfortable with the consensus view that Australian rates will be cut again this year taking them down to 1%.

One observation from the below chart of Australian bond yields since the GFC is once they make a meaningful readjustment (move) a consolidation period usually follows implying in this case interest rates will be lower for longer.

Australian 10-year bond yields Chart

Yesterday as global equities recovered and the $US had a breather it was time for our gold stocks to give back some of their recent gains e.g. Evolution Mining (EVN) -5.6%, Regis Resources (RRL) -4.3% and Norther Star (NST) -2.7%. MM remains keen to gain some exposure to the precious metal sector in the weeks and months ahead.

We like RRL under $4, NST below $8 and EVN closer to $3 – none of these are that close today but just 2 more days like yesterday and we might be pressing our “buy button”.

Regis Resources (RRL) Chart

Moving onto 5 of our favourite calls which in some cases have been “live” for a number of years. These key calls help us form our views on a number of markets / sectors.

1 Australian & Global Equities

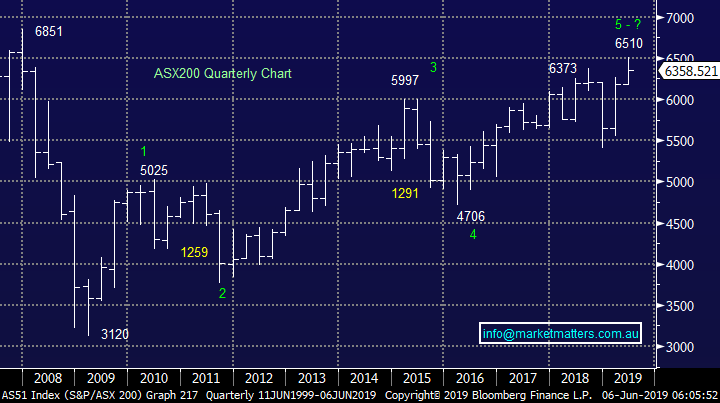

The ASX200 has enjoyed the central bank assisted post GFC bull market with the index more than doubling over the decade, before dividends. Along the way the markets experienced two very similar corrections from a points perspective amounting to 25% and 21.5%.

This rally has often been described as the most unloved bull market in history and we certainly don’t have taxi drivers talking stocks like we did in the 80’s, now its more like Uber drivers giving hints on Bitcoin! A vital part of successful investing is described by “don’t fight the tape” which has remained firm over recent years in the face of plenty of market headwinds, most of which enjoy plenty of real estate in the press – bad news sells papers. However remember Warren Buffets famous quote which feels appropriate today:

“Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a fly epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”

Basically the message is to go underweight, or even out of stocks, investors should understand they are almost “betting against the house”. However at MM we feel the time is approaching fast where higher cash positions may be appropriate e.g. if we see a global recession in the years ahead another 20% pullback by stocks is a strong possibility. We currently have one major market tailwind and a couple of headwinds that vary in importance depending on the month. If we see a short term resolution to US – China trade dispute, or even BREXIT, stocks are likely to rally strongly pushing the “risk / reward” in favour of the seller.

MM is ideally looking to increase our cash position into market strength.

ASX200 Chart

Technically MM is calling the US S&P500 to trade between 3000 and 2300 over the next few years putting the current market in more of a sell corner but no lay down misere.

US S&P500 Chart

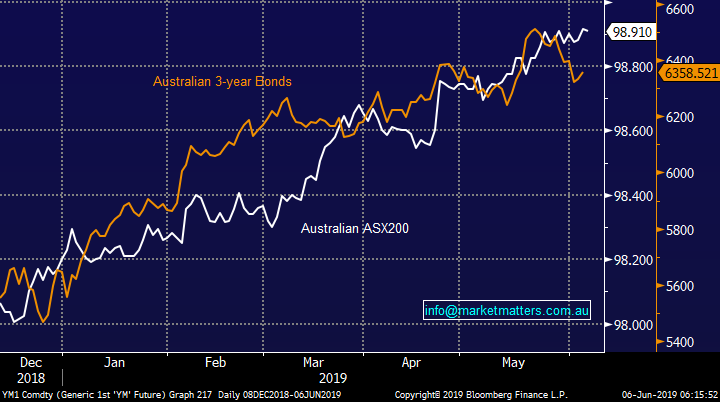

2 Stocks are all about interest rates

Bond yields are “the tail that’s wagging the stock market dog” at present and hence its vital to keep our fingers on the interest rate pulse. The correlation between the ASX200 and the local 3-year bond market illustrated below is solid and as things stand in the short-term it suggests equities should rally and play catch up.

MM will become fundamentally concerned for equities when bond yields start rising.

ASX200 v Australian 3-year bonds Chart

Similarly in the US where the below again shows the almost perfect correlation between “Junk Bonds” and the main US index, the S&P500 – junk bonds are a high-yielding high-risk non-investment grade credit that often trades more attune to equities than more traditional fixed income.

To put things into perspective in the US last year we saw announced buybacks of $US1.1 trillion, that’s simply enormous underlying support for the stock market. Unfortunately It is a form of financial engineering that does not do anything to improve business operations or fundamentals but it adds weight to the buyers almost daily.

While company boards believe a recession will be avoided and interest rates are incredibly low, even in the junk bond end of town, this major market tailwind will remain but remember all good things do eventually come to an end – we’ve seen that with Australian property over the last 12-months

US S&P500 v Junk Bond ETF Chart

3 The Banking Sector

There are many factors that play into bank earnings with a report out yesterday for example from UBS downgrading the sector due to lower interest rates which puts pressure on margins. We actually covered this topic in yesterday’s Income Note – Click here

While we take that view on board we would counter it by looking at things from a more traditional perspective.

If the RBA cash rate is going down to 1% where it should spend some time the largely sustainable yield of our “Big Four” is extremely compelling e.g. ranging from CBA 5.43% to Westpac at 6.8%, fully franked. From what we can tell, analysts are forecasting loan growth of 3-4% from here, which with lower interest rates should be achievable. If they achieve that, each of ANZ, NAB & WBC should have another $1-$2 upside on their share price, while CBA is now fully priced.

While forecasted growth is limited - and that was shown very clearly in the GDP number yesterday, we’d argue that if lower rates provide the economic support they’re meant to then bank earnings will at least hold up meaning that the yield story remains hard to fight.

Additionally, we track the disclosed holdings of large funds, and from our own analysis, larger fund managers appear to be underweight the sector hence we anticipate decent support into pullbacks when they do unfold.

MM remains comfortable with the Australian Banking sector.

Commonwealth Bank (CBA) Chart

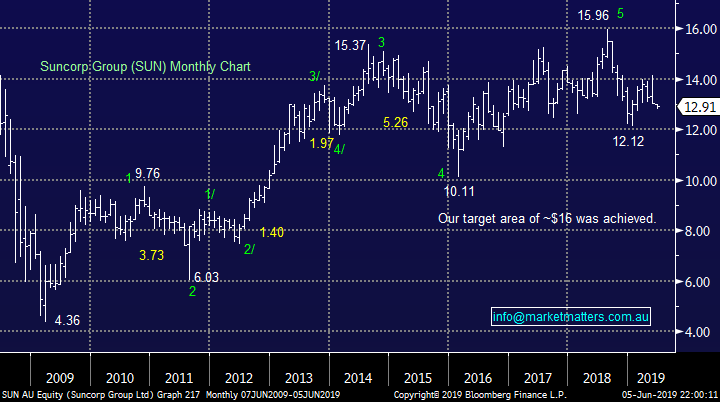

4 Suncorp (SUN) $12.91

SUN had been MM’s largest holding as it ran up to our $16 target area however following the failed attempt on this area the technical picture has turned fairly unpleasant targeting a retracement back towards $10 – the bearish picture of the last year remains intact.

Fundamentally, falling interest rates is bad news for the traditional insurance side of their business although the banking arm should be ok as discussed above. The markets talking about a possible merger with Bank of Queensland hence from a trading perspective we would not be short, however from an overall the stock just feels wrong.

MM is still targeting a further 15% lower for SUN.

Suncorp (SUN) Chart

5 NIB Holdings (NHF) $6.69.

Lastly NHF, not a big call or view per se but it may be a good short-term barometer to the ASX200. We are long the health insurer targeting fresh all-time highs, a play that’s looked great since the Liberal election victory.

We are planning to take our $$ off the table into fresh highs but if this move eventuates it may coincide with a top in indices, especially if it occurs on news like US-China trade &/or BREXIT.

MM is targeting fresh 2019 highs for NHF.

NIB Holdings (NHF) Chart

Conclusion (s)

MM is looking to increase our cash holdings into market strength in the weeks / months ahead. We still feel the local banks are ok as are equities until bond markets start to struggle i.e. bond yields are currently the key to stocks but again they will pass the baton to another economic / geo-political influence, that’s simply the nature of markets.

Global Indices

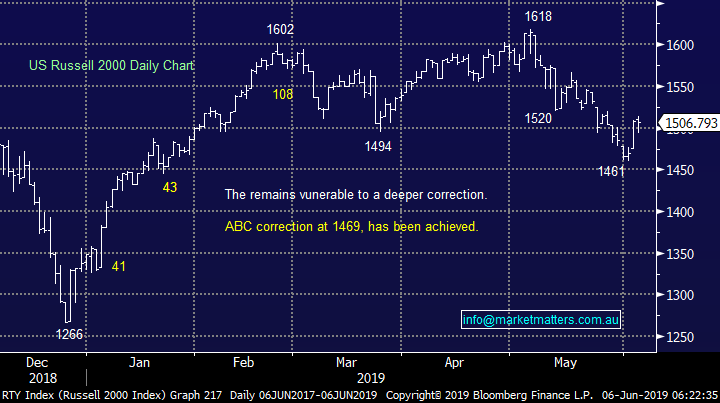

Nothing new with our preferred scenario being the recent pullback was a buying opportunity although we are only looking for a test of / slight new 2019 highs from US indices.

US Russell 2000 (small cap) Index Chart

No change again with European indices, we remain cautious European stocks but the tone has improved in 2019.

German DAX Chart

Overnight Market Matters Wrap

• The US continued its rally this week, as tariffs between the US and Mexico is now assumed not to take effect with investors hoping for the Fed to cut rates in the near future.

• On the commodities front, crude oil slid and is now trading on lows not seen since February over fears of a supply glut – note US stockpiles jumped the most in 30 years as domestic output hit a record.

• Copper Futures are on a decline, giving up all of this year’s gains - as an indicator of the health of global growth, we see further downside risk.

• The June SPI Futures is indicating the ASX 200 to open 21 points higher, towards the 6380 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.