4 stocks we believe can rally ~50% from here (CWY, MFG, STO, PMV, JBH)

Last night Prime Minister Scott Morrison updated the nation on the next level of restrictions that will be imposed on Australians from midnight tonight to mitigate the spread of the coronavirus. The devils always in the detail but the major takeout is social distancing is not negotiable as food courts, open houses, beauty salons and that sacrosanct domain of Australian life the barbeque to name but a few are forced to close, however draconian the measure might appear to some they make sense to me. My team has been out of the office since last week and yesterday I relocated home, sharing an office with the bride - what could go wrong!

However the likes of retail premises and schools remain open which is different to what is being experienced in Europe – the Liberal government is trying to walk an extremely narrow and dangerous tightrope enforcing a partial shutdown while still letting people work whenever possible; their dichotomy is of course easy to comprehend.

I actually find it incongruous where Australia is positioning itself compared to the rest of the world, unless a vaccine is discovered in the coming weeks I feel an aggressive lockdown will be in force by early April, unless of course the Liberal government dances Donald Trump’s jig of “We can’t have the cure be worse than the problem” or in other words as he plans to reopen the US for business in a fortnights time because he’s happy to sacrifice some / many lives for the sake of their economy - coincidentally of course the US election looms in November. I prey we get it right but I do get that feeling of inevitability with regards to a full lockdown.

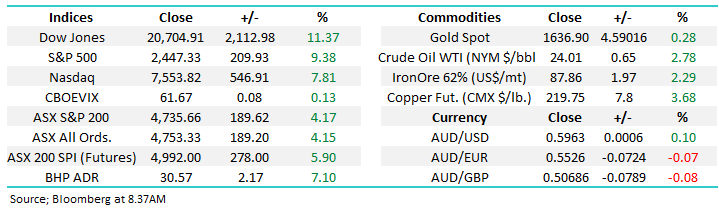

Our Chief Investment Officer at Shaw Martin Crabb has provided some modelling on the time frames for peak new cases globally. Our best guess at this stage is that peak new cases in the US will happen towards the second week of April and will peak at somewhere around 65k a day as shown below. We think the market will start to look across the valley when growth in new cases peak, if not before.

Source: Shaw and Partners

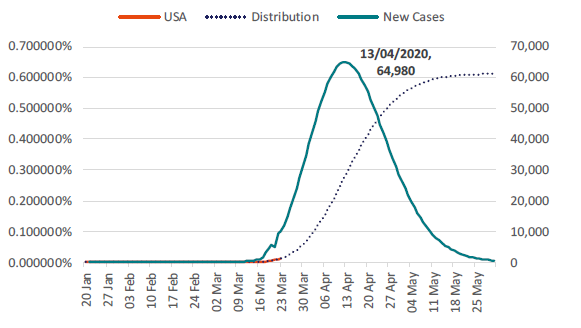

In terms of the Australian experience, the modelling shows a peak in new cases at the start of May, implying the negative headlines locally still have a month or so to play out.

Source: Shaw and Partners

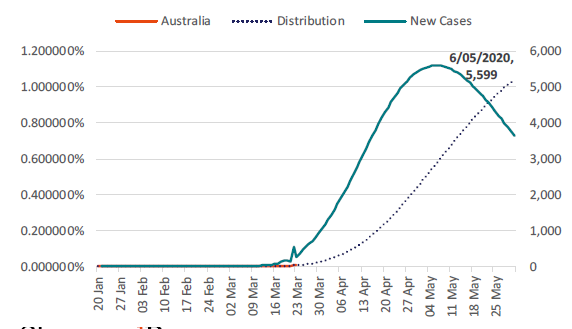

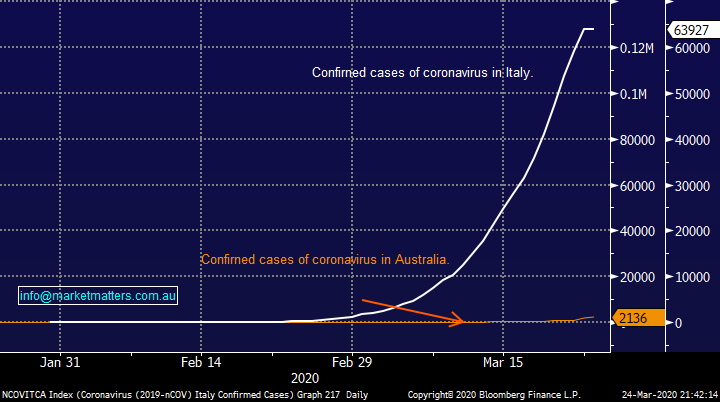

Incidentally, the modelling also showed Italy would peak in mid-April, however we’ve now just had the second consecutive day of fewer new cases only around 3-weeks after lockdown was imposed on the community.

Confirmed cases of Coronavirus in Italy Chart

Today due to an increasing number of requests I have replaced the usual Wednesday Overseas Report with a morning report in which MM has selected 4 local stocks which we believe can rally 50% in the short-term, most people were asking for examples of stocks that might double but that would have forced to us way too far away from the “quality end of the curve” in our opinion but the sheer volume of positive facing communications suggests subscribers are regaining confidence at these lower levels.

The ASX200 enjoyed a strong rally yesterday with almost 80% of the stocks closing in the green, it was actually Asian equities best day in 11-years with the local markets +4.2% rally adding to the euphoria. On the sector level we saw the Energy & IT stocks lead the charge as investors aggressively bought many if the battered stocks of the last month while funding some of this net buying by selling the outperformers of the last few weeks e.g. InvoCare (IVC) -9%.

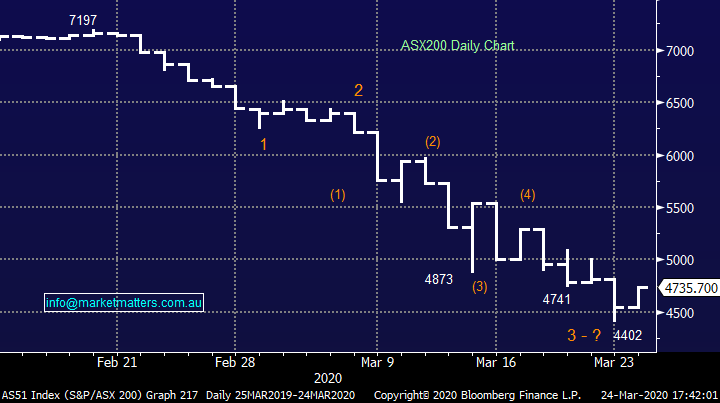

As MM has alluded to a number of times over recent days market bottoms are formed when things look the most dire, when the negativity is at its peak and that’s certainly been the case during the last few days e.g. India went in a 3-week lockdown last night. We believe that equities are now presenting some excellent opportunities, even if we do get another spike lower under 4400 we believe it’s a buy, not another time to sell – MM believes the market has commenced what’s likely to be a volatile basing phase before recovering at least a significant portion of losses over the next 12-18 months.

MM believes investors should be in “buy mode”.

ASX200 Chart

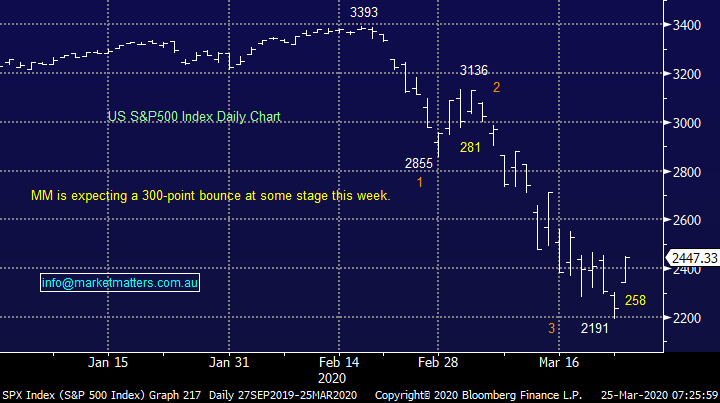

US stocks roared back to life overnight enjoying their best day in 87-years with the Dow finally closing up 2112-points / 11.4%, at MM we have been looking for a 300-point bounce for the S&P500 this week and its delivered in typical rapid fashion, clearly the risk reward is not as compelling as yesterday but we do remain net bullish US stocks at least short-term . The Fed’s stimulus has hit the spot as we expected following their announcement to basically buy all financial instruments except stocks, and now fund managers are “betting” the senate will have no option than to approve the Republicans new $US2trillion rescue package, it will be ugly if they don’t!

When we look at the overnight bounce compared to the last months savage decline it hardly registers but all recoveries have to start somewhere, MM is now advocating accumulation stocks into pullbacks.

US S&P500 Index Chart

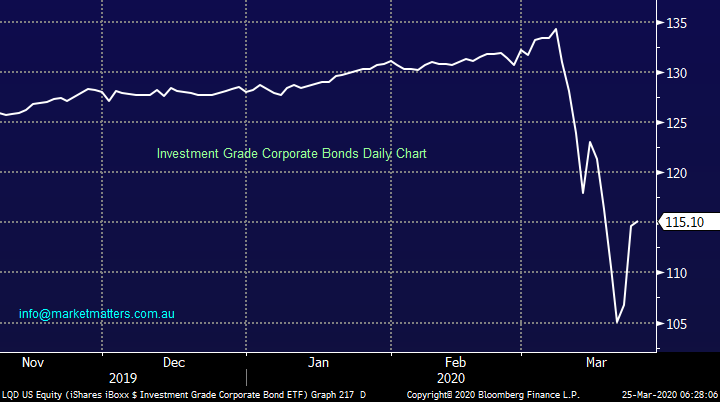

Following the Feds aggressive stimulus package we saw a recovery in the important bond markets but the inability of corporate bonds to hold onto much of their early gains has made me feel we’re unfortunately not out of the woods yet.

We feel the tame “bounce” by investment Grade Corporate Bonds is still a concern – more work to be done here.

Investment Grade Corporate Bonds Chart

Four stocks MM can see rallying ~50% from current levels

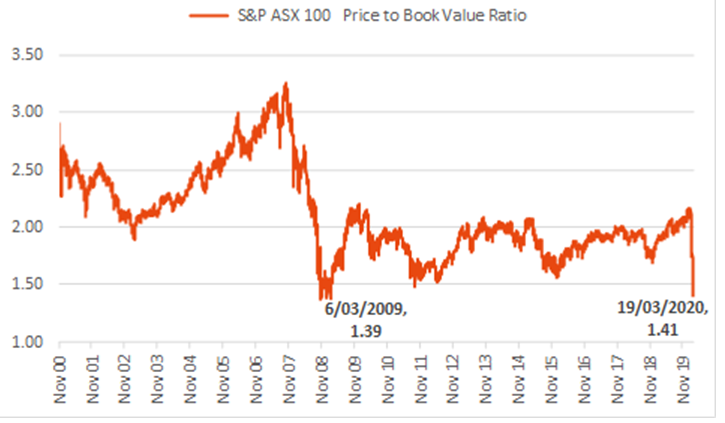

Initially I decided to write todays missive due to the volume of questions on the topic but the chart below convinced me it was undoubtedly the opportune time as Australian stocks became as “cheap’ as during the GFC, some bargains are undoubtedly on offer its our “simple” job to identify them while keeping a close eye on the risk / reward. Obviously anybody can toss a coin with a 50% chance of doubling your money but the downside is unacceptable, were looking for quality stocks which MM believes have been too aggressively oversold and are poised to snap back towards a more appropriate valuation.

While MM is far from convinced that we have seen the end of the COVID-19 volatility and weakness we do believe strongly that the market will be higher at Christmas and into 2021, the question is what stocks are poised to give investors the best ROI.

MM likes Australian equities at current valuations.

ASX100 Price / Book Value Ratio Chart

Source: Shaw and Partners

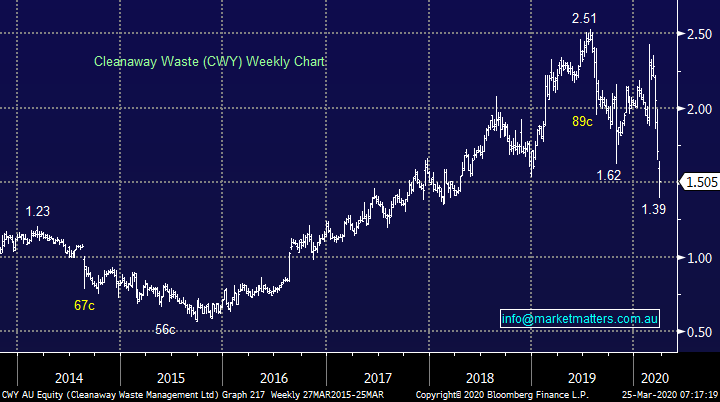

1 Cleanaway Waste (CWY) $1.505.

MM likes the waste management sector as is depicted by our holding in Bingo Industries (BIN), we have no doubt this is a strong and important industry for the future. CWY has been unceremoniously dumped over 40% in recent weeks to what we regard as bargain basement levels for this growth business.

In the last 6-months of 2019 CWY increased revenue over 4% to almost $1.2bn increasing its net profit to $76.,2m in the process, in other words this was a strong business before COVID-19.

MM likes CWY at current prices.

Cleanaway Waste (CWY) Chart

2 Magellan Financial Group (MFG) $34.31.

Hamish Douglass’ MFG has been hammered over the last few weeks tumbling almost 60% as the CEO changed his tune just 6-days ago on COVID-19, previously he was confident that the virus wouldn’t become a global pandemic to now anticipating a 2-6 months total lockdown of the world economy – an easy mistake to make, not far off our path.

However the world will move on from COVID-19 at some stage in 2020 and then Mr Douglass will go back to being an excellent visionary stock picker / fund manager with a bias for overseas tech stocks, its easy to see MFG back around $50 in the coming months.

MM likes MFG at current prices.

Magellan Financial Group (MFG) Chart

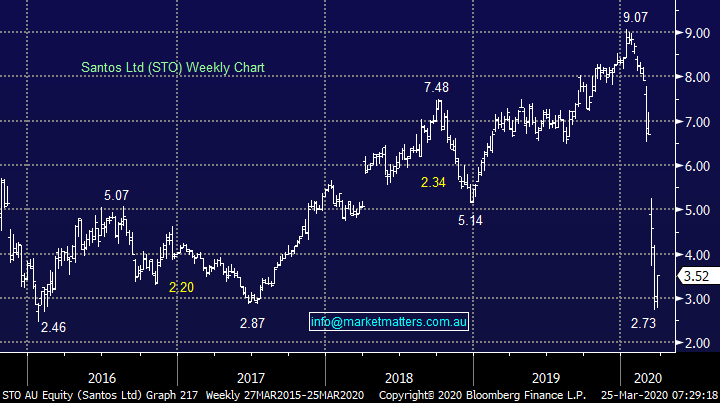

3 Santos (STO) $3.52.

Santos is a simple scenario to us, investors are building into the share price a risk the company might go under, this is way too pessimistic in our opinion – the oil and gas producer is a far stronger operation than during the GFC. Santos is the lowest cost producer of oil in Australia, with most leverage to any improvement in the Oil price.

To gain best exposure to a potential increase in the Oil price while buying an undervalued asset in the process STO ticks all the boxes for MM.

MM likes STO at current levels.

Santos (STO) Chart

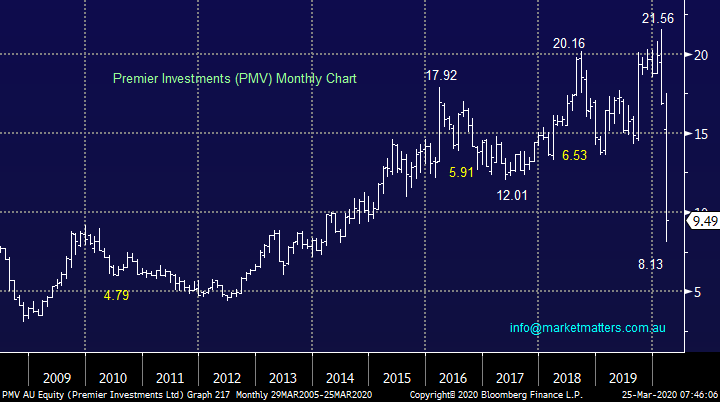

4 Premier Investments (PMV) $9.49.

Solomon Lew’s PMV retail operation is obviously under pressure as the world goes into lockdown but they’re sitting on $100m of cash just when assets and businesses are on offer at bargain prices – potentially the perfect environment for this shrewd cashed up operator.

The current brands under the companies umbrella which include Just Jeans, Portman’s and Peter Alexander are obviously struggling as the 60% plunge in share price illustrates but I reiterate they have cash on the balance sheet and a strong online presence to ensure they will be well positioned post COVID-19.

MM likes PMV at current levels.

Premier Investments (PMV) Chart

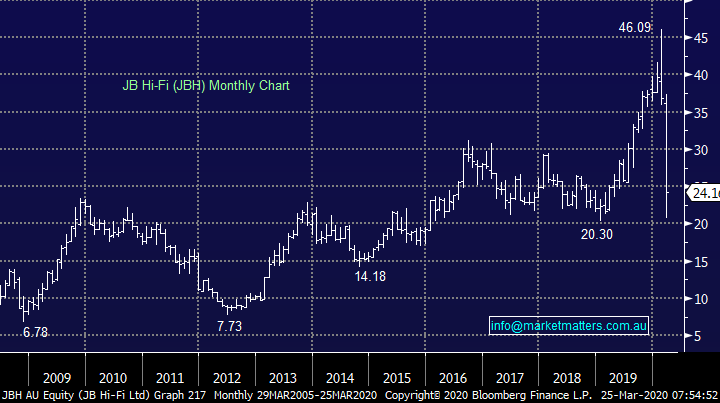

JB HI FI (JBH) came extremely close to occupying this fourth slot, we believe this a quality operation with solid on-line presence that MM values as cheap under $25.

JB H HIFI (JBH) Chart

Conclusion

MM can see 50% upside in all 4 of the stocks looked at today: CWY, MFG, STO & PMV.

NB We also feel JB HIFI is extremely well positioned below $25.

Overnight Market Matters Wrap

· The US equity markets were strong overnight as a late rally sent the Dow to its best 1-day performance since 1933, while the broader S&P rebounded from its lowest level since 2016

· Although all are still cautious and raw, the US started its day with a circuit trigger, surprisingly to the upside as lawmakers are negotiating the final sticking points in a ~$2 Trillion stimulus bill to assist the US economy.

· Although the VIX (Fear) Index remains at high levels, investors saw a glimmer of hope with emerging markets expected to follow suit and rise as one.

· BHP is expected to outperform the broader market after ending its US session up an equivalent of 7.20% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to rally 290 points higher, towards the 5025 level this morning, despite an expected further loss in employment locally, following a tougher stance against the covid-19 pandemic.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.