3 stocks we like if a market correction unfolds (RFF, WSA, IGO, AMP)

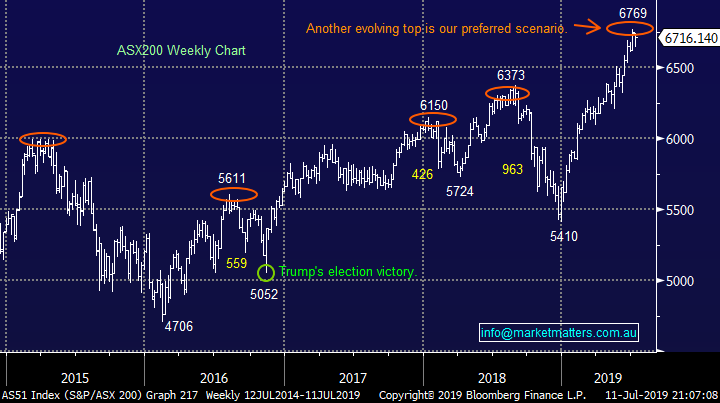

The ASX200 followed US futures higher throughout Thursday finally closing up +0.4% with the S&P futures making fresh all-time highs. Upon further digestion of the Feds testimony overnight investors were clearly focusing on 2 potential rate cuts in the US in the next 6-months, as opposed to worries around the health of the global economy. Our market enjoyed strong breadth with winners outnumbering losers by 2:1 with the Energy, IT and Resources stocks leading the gains on a day when all sectors closed positive. Volumes remain fairly light with school holidays having just over a week left to run – my kids are loving it and we’re heading for a weekend up in Terrigal to see the cousins!

We live in unusual times when bad economic news is taken as good news but today’s markets are almost entirely focused on falling bond yields but as we often say don’t fight the tape, this interpretation will eventually change and our “Gut Feel” is it’s not far away. Unless we see central banks step up and announce an aggressive QE program its hard to imagine further good news for equities / assets but we must remember with the RBA Cash Rate at 1% stocks with sustainable yields around 4-5% should remain well supported unless a painful recession does engulf the world and Australia.

At MM we have moved to a fairly large cash position of 25% in our flagship Growth Portfolio for 2 simple reasons:

1 – Following the 25% rally by the ASX200 (before dividends) the risk / reward is not compelling.

2 – August reporting season is only a few weeks away and it usually throws up a few excellent opportunities when the market overacts to a quality business not satisfying overzealous expectations e.g. ResMed (RMD) back in January which we bought.

MM remains comfortable to adopt a more conservative stance over the next 6-months.

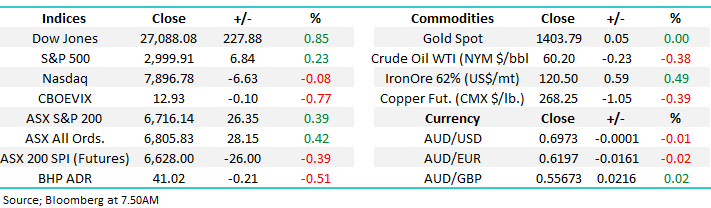

Overnight US stocks were mixed with the Dow breaking 27,000 for the first time to close up +0.85% while the NASDAQ was actually down -0.1%, the SPI futures are calling the ASX200 to open this morning down around 25-points. With the US futures at the same price as we closed yesterday the inference is there’s a little selling around for Australian stocks today.

Today we are going to look at 3 stocks we like if a market correction does unfold – we have one excellent point of reference, how they performed last November December.

ASX200 Chart

Historically when crude oil rises US bond yields follow suit although there’s usually a lag while investors take their time to become convinced that oils rally is real / sustainable.

Crude oil prices bottomed in mid-June and Wednesday’s sharp 4.3% kick higher we feel is about to put upward pressure on bond yields which should have a decent impact on which sectors enjoy the coming weeks i.e. the Energy sector should remain “bid” while the Utilities, Transport, Healthcare and IT sectors look set to witness some profit taking.

We believe bond yields will bounce over coming weeks dictating which sectors outperform short-term.

Crude Oil Chart

“Buy the rumour sell the fact” is an old adage thrown around regularly in markets and we witnessed this exact phenomenon unfold by US bond yields following Jerome Powell’s (FED Chair) testimony this week. The Fed could not have delivered a more encouraging statement to the dovish positioned investors / traders but we’ve seen bond yields bounce i.e. when everyone’s positioned one-way whatever the news it’s hard for the market to embrace it.

MM remains mildly bearish US bond yields medium term but over coming weeks a bounce feels likely.

US 10-year Bond yield Chart

Three Stocks MM likes in a falling market

There a couple of things we are looking for in a stock to fit todays category:

1 – A relatively low Beta stock or in simple terms a share which theoretically is less volatile than the underlying ASX200.

2 – A company that is priced reasonably given its outlook for earnings, its balance sheet & debt profile, that importantly has a potential catalyst to move higher.

3 – A stock which held up well in the aggressive correction in late 2018 e.g. not the high growth / valuation IT sector which tumbled almost 20% compared to the ASX200 which fell 15%.

Obviously historical reasons why markets rally or decline evolves with the market cycles but it’s still a solid gauge for where to be overweight at any given time.

ASX200 Software & Services Index Chart

Moving onto 3 stocks and ideas where we are considering investing in the second half of 2019, obviously before additional opportunities are potentially thrown up by August’s reporting season.

1 Rural Funds Group (RFF) $2.35

RRF is a Real Estate Property Trust which owns Australian Agricultural assets, a great long term play in our opinion.

The stock currently yields 4.4% unfranked and importantly only slipped a few % at the end of 2018. Its tightly held, trades on low volume but certainly an income focussed stock to consider

MM is positive on RFF in the second half of 2019.

Rural Funds Group (RFF) Chart

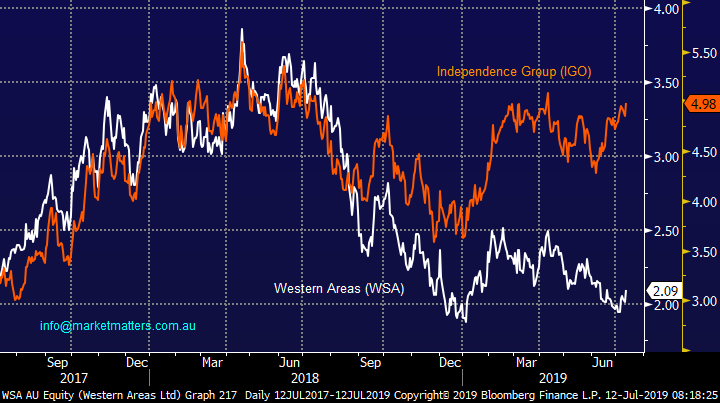

2 Western Areas (WSA) $2.09

WSA has been on our radar for months as the nickel miner slips back towards multi-year lows – definitely no correlation to the ASX200 here.

Unfortunately WSA only yields ~1% fully franked but we do still like the resources over the years to come. As always, the price to buy it is the most important consideration – the halving of WSA over the last year demonstrates the clear volatility in the sector, an active investors dream.

Ideally from a technical perspective we will be accumulating below $1.80.

Western Areas (WSA) Chart

Also catching our eye is the increased short position in WSA which has soared from 1% to over 7% while sector rival Independence Group (IGO) has seen its shorts collapse from over 10% to well under 1% - a very stretched elastic band – its smells to us that traders / fund managers are using WSA to fund purchases of IGO.

We expect WSA to outperform IGO in the months ahead although the price differential may have one final pop to provide an optimal buying opportunity.

MM is positive on WSA in the second half of 2019.

Western Areas (WSA) v Independence Group (IGO) Chart

3 AMP Ltd (AMP) $2.14

Arguably this inclusion will prove as unpopular as Telstra (TLS) was when we bought it last year, perhaps even more so! AMP has deservedly been in the doghouse for many years but we now believe that the bad news may well be built into today’s price – a major investor agreed with us this week buying a line of over 34 million shares - lows in stocks are often characterised buy large volume days.

AMP currently yields a very unreliable 6.8% but this is not the reason to buy the stock.

MM likes the risk / reward in AMP below $2.

AMP Ltd (AMP) $2.14 Chart

4 Add to existing positions within our portfolio

As mentioned earlier MM has 25% in cash plus we also have a number of positions we are considering adding to, as well as others in our sell sights, a quick snapshot:

Potential adds : Tabcorp (TAH), BlueScope Steel (BSL) and Orocobre (ORE).

Potential sells : Healius (HLS), Ausdrill (ASL) and Orica (ORI)

Conclusion (s)

MM likes both RFF, AMP and WSA for the second half of 2019 plus potentially adding to the 3 positions mentioned above.

Global Indices

At this stage US stocks are only having a rest in the scheme of things, compared to its 28% rally from December lows, a break of 2960 by the S&P500 should concern the bulls and especially 2925, still a few % lower.

We reiterate that while US stocks have reached our target area but they have not yet generated any technical sell signals.

US NASDAQ Index Chart

No change again with European indices, we remain cautious European stocks and their tone has become more bearish over the last 2-weeks.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets closed mixed overnight, with the Dow outperforming its peers and the Nasdaq 100 with little change.

· Focus on investors at present are the US-China trade war resurfacing as well as quarterly corporate earnings begin next week, with the average expectation on the street to decline from a year earlier.

· BHP is expected to underperform the broader market today after ending its US session off an equivalent of 0.51% from Australia’s previous close to test the $41.00 level.

· The September SPI Futures is indicating the ASX 200 to option 19 points lower, testing the 6700 support level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.