3 stocks to buy if coronavirus panic resurfaces (GMG, TWE, 700 HK, A2M, SGM, FMG)

Happy Valentine’s Day all and especially my beautiful bride…16th valentine’s day together, and unfortunately it hasn’t been one of my strong points!

The ASX200 tested its all-time high yesterday morning before falling victim to increased concerns around the coronavirus, the death toll has moved towards 1,400 and over 60,000 people are now confirmed as infected, a change in the methodology for quoting case numbers is to blame for some of it, although the sceptic in me never thought China was playing the outbreak’s statistics with a “straight bat”. In any case, the market has become toppy from a risk / reward perspective, we see the potential for Round 2 of panic selling because of the virus risk hanging over stocks, however if that plays out, it’s important to remember that interest rate policy and liquidity is the key driver in this market, and weakness can be bought.

Reporting schedule available here: CLICK HERE

I give a quick update here along with highlights from this week’s local company reporting. Video lasts ~8mins – CLICK HERE

Overall there remains little change to the MM view, we believe that 2020 will continue to be a choppy year for stocks, in hindsight our ideal target for the ASX200 of fresh all-time highs up towards 7200 may prove to have been too optimistic, its why we started selling on Wednesday and Thursday i.e. technical analysis can be very useful but as we often say investors should always remain flexible and scaling in / out of positions is often the best approach. From an index perspective we’re buyers around 6900 and sellers ~7200 but that’s a small part of the story, we also need to consider what stocks / sectors to buy.

MM has increased our cash holding to 12%, we may do a little more if a suitable opportunity arises.

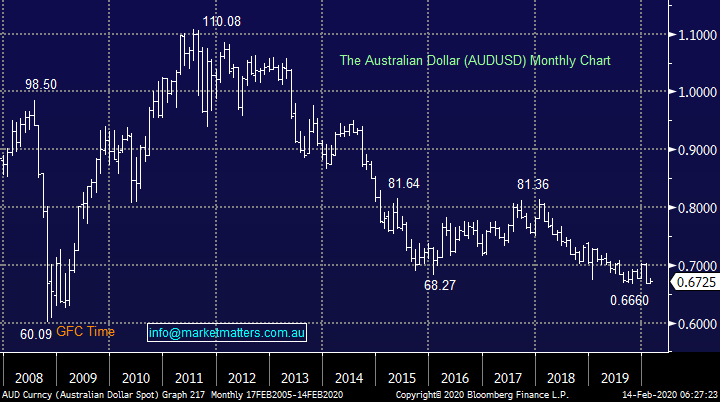

Overnight US stocks recovered stoically from initial sharp losses with the S&P500’s futures recovering from a 1% spike down while most of us slept, although US stocks did eventually settle down 0.20%, the SPI futures are pointing to a flat open locally.

Today we’ve looked for stocks MM will consider buying if we get another wave of selling around the coronavirus / potential impacts on Chinese growth.

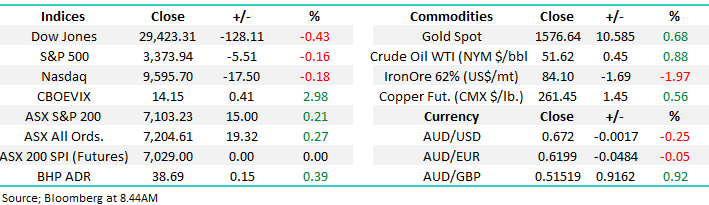

ASX200 Chart

US equities fell early on the worsening coronavirus data but as has so often been the case over recent years they proceeded to recover from the lows solidly to re-test fresh all-time highs, before eventually closing marginally lower.

While MM has switched to a neutral stance for US stocks at current levels, we must stress zero sell signals have been generated.

MM is now neutral US stocks as they approach the 3400 area.

US S&P500 Index Chart

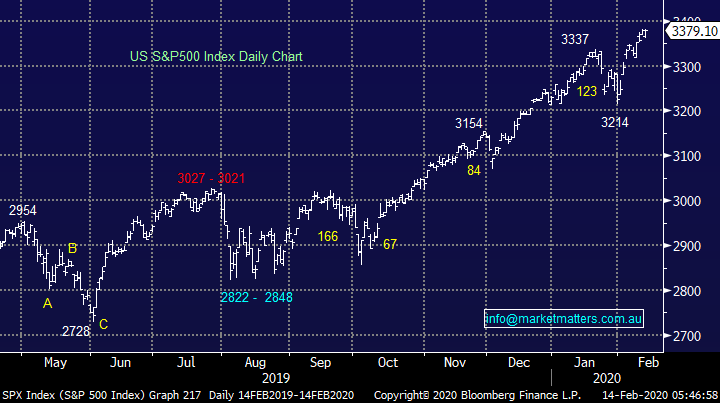

At the start of February, we wrote an AM Report titled: The Real Estate Sector looks to have a little more juice in the tank. Yesterday the sectors largest player Goodman Group (GMG) delivered for investors with its half yearly results increasing operating profit by over 14% to ~$530m which translated to an upgrade in FY2020 earnings estimates – a great example of a quality company repeatedly delivering. In our previous note when GMG was at $15.30, we wrote:

“From a technical perspective we still anticipate another ~5% upside in the stock but it’s not cheap with an Est P/E for 2020 of almost 27x while its yield is now under 2%, however the trend of recent years of chasing the quality end of town without too much concern towards price / valuation feels unlikely to change overnight. MM is short-term bullish GMG.”

GMG has performed admirably over recent years but if we just applied technicals to make our investment decisions we would now be neutral / negative, or long with stops below $15.70 – of course at MM we regard technical analysis as a useful addition to support our fundamental analysis.

Goodman Group (GMG) Chart

The worst performing stock in the ASX200 yesterday was Treasury Wines (TWE) which fell another -5.7% taking its drop from 2019 highs to over 40%, this is one China facing stock which totally ignored the recovery in equities over the last few weeks demonstrating the opposite characteristics to those MM is searching for in today’s report.

Global wine supply remains high, which is clearly a positive for consumers!! there is pricing pressure in TWE’s key segments, grape prices in Australia are going up and China will take some time to bounce back, and in any case European supplies into that market are also increasing. Too many headwinds.

MM still has no interest in TWE.

Treasury Wines (TWE) Chart

What to buy if we get another wave of coronavirus selling

Hong Kong’s Hang Seng Index has been a great barometer for the panic levels through China and Asia around the coronavirus i.e. initially it fell over 10% but to-date it has recovered around half of these losses. This price movement illustrates the common idiosyncratic movements of equities as they panic first and ask questions later, I feel the virus is probably as bad as many feared yet the index has regained over half of its losses – a classic example of how opportunities can be delivered to investors by news.

Our opinion is stocks will maintain their upward bias, albeit in an increasingly choppy / volatile manner until the belief resonates through investors that bond yields / interest rates are poised to increase.

Hang Seng Index Chart

Australian stocks fell a third of the Hang Seng which makes sense considering our relative distance/ influence from China, but some stocks / sectors have fared far worse. Now MM has increased our cash levels back towards their norm we have a degree of flexibility to buy stocks into weakness if this does unfold. We are looking for situations where a stock has been rallying for the correct fundamental / valuation reasons but the news flow (not stock specific) has created a correction in the stock, a great example being Tencent (700 HK) which MM holds in our International Portfolio.

MM remains bullish Tencent (700 HK).

Tencent (700 HK) Chart

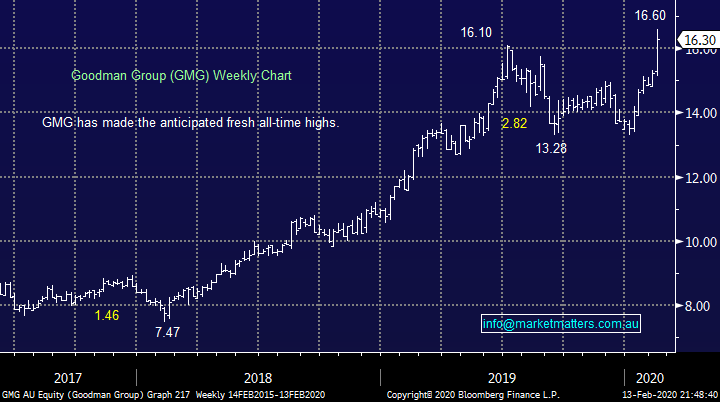

The Australian Dollar has fallen ~5% since the coronavirus outbreak started rattling markets, a very comprehendible decline considering China’s our largest trading partner and its almost lockdown in certain cities has led to a significant correction in commodities that are the backbone of the local economy. Currencies and bonds are regarded by many as “smarter” than equities, primarily because of their relative depth / size when compared to equities hence we feel the $A might give us a heads up when professionals believe the worst is behind us from the virus.

The Australian Dollar ($A) Chart

This morning I have looked at 3 Australian stocks MM is considering buying / adding to if stocks do correct over the coming weeks – no really new names here but these periods of volatility should be around focus and planning.

1 a2 Milk (A2M) $15.20

Milk and protein business A2M have over 80% of its business China facing which we believe is a positive medium term as produce from our fair shores look set to increase in regard to quality following the coronavirus outbreak. On an operational front we like the way the business has refocused on margins while it grows and while the stocks priced for some growth, we feel that’s warranted considering its track record and market positioning.

MM is bullish A2M, ideally a touch lower.

a2 Milk (A2M) Chart

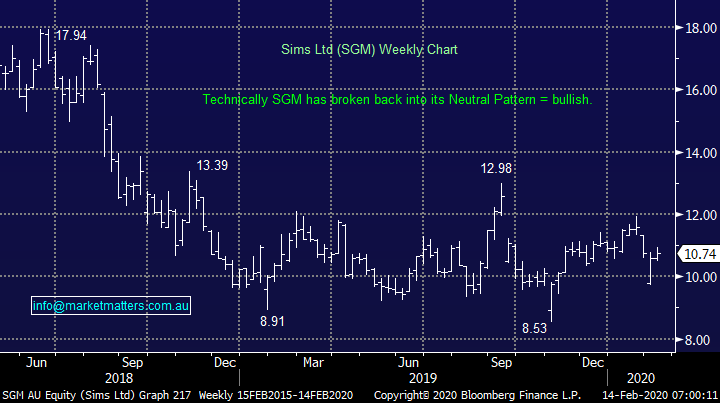

2 Sims Ltd (SGM) $10.74

Metal recycling business SGM has been recovering since its awful 2018 / 9 and last week’s China inspired spike lower lasted just a few hours, an excellent sign for the bullish and long, like ourselves! We like the capital management program SGM commenced last year which should help the share price and following last Octobers profit warning courtesy of falling scrap metal prices we feel the broom has run its course through the business – we may increase our holding in SGM.

MM remains bullish SGM initially looking for 15-20% upside.

Sims Ltd (SGM) Chart

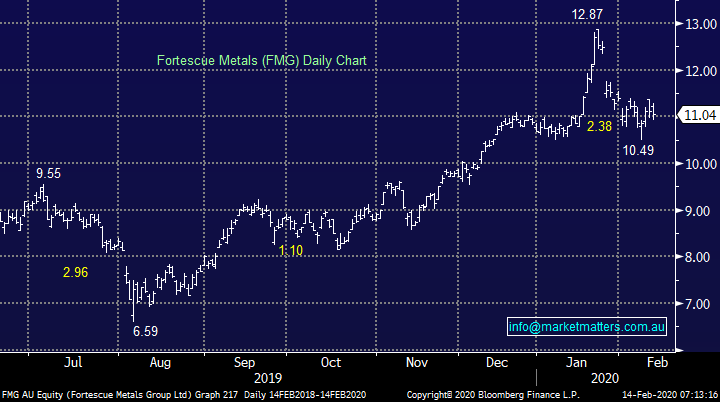

3 Fortescue Metals (FMG) $11.04

Twiggy Forest’s iron ore success story FMG has already corrected over 18% since coronavirus started dominating the press but on balance we feel a further washout is a possibility, although obviously their half-year results in 5-days’ time are likely to have a significant impact on the company’s share price. This cash cow is likely to continue to pay a very attractive dividend as long as Iron Ore prices stay firm, not surprisingly this remains on the radar of both our Platinum and Income Portfolio’s.

MM is bullish FMG with an ideal buy area around $10.

Fortescue Metals (FMG) Chart

Conclusion (s)

MM likes A2M, SGM, and FMG at current levels and even more so into weakness.

Overnight Market Matters Wrap

· Wall St shook off an early selloff, prompted by an upward revision by China of the numbers infected by the coronavirus, to close only marginally lower. The reassessment of the numbers saw the infected tally jump by around 15,000 to over 60,000 and the death rate likewise soar by 254 to 1367.

· The Dow was down over 200 pts and the Nasdaq -0.8% in early trading but recovered throughout the day with the S&P 500 and Nasdaq hitting fresh highs, but all three indices lost ground in late trading to close in the red, with the Dow -0.4%. The World Health Organisation said that the virus was largely contained within China.

· US quarterly earnings reports were mixed overnight, with Cisco dropping 5% after reporting another revenue decline, while Pepsi, Alibaba and Applied Materials all beat expectations, which saw Applied rally 3% to hit record highs.

· Commodities also had another firmer night led by the oil price, with Brent back above US$56/bbl, iron ore above US$88.50/tonne and copper at US2.61/lb as investors tried to look through the near-term economic impact of the virus. The local futures are flat while the A$ is trading around US67.2c.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.