3 stocks of interest as we learn from March – Part 2 (OZL, BIN, BLD, WHC)

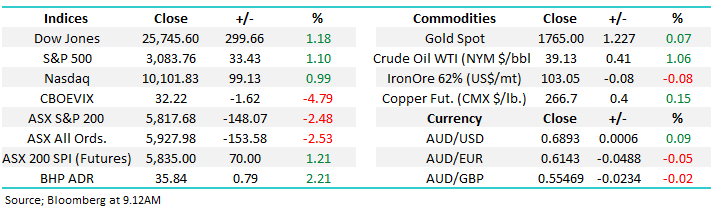

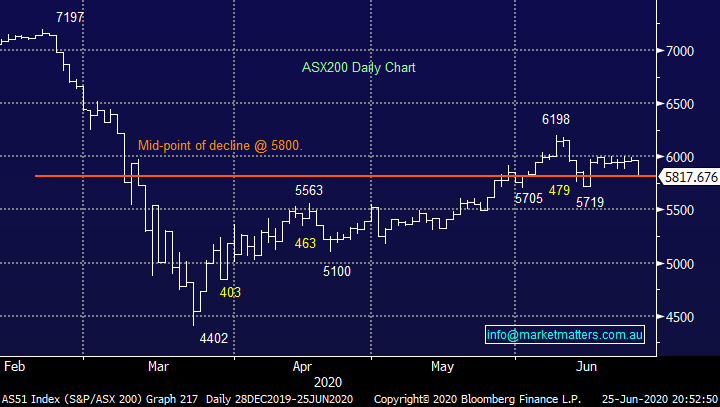

After 6-trading days in a tight 125-point / 2% range the ASX200 gave any complacent investors a quick COVID-19 shot across the bow as the local market tumbled -2.5% on Thursday. The catalyst for the selling was the increasing cases of coronavirus creating serious doubt in many investors’ minds around how quickly the global economy can put the pandemic well and truly in the rear-view mirror. Our current opinion at MM is equities did get slightly ahead of themselves in writing off the virus but we’re better prepared for secondary outbreaks plus of course every week that passes is a week closer to a vaccine Hence MM remains buyers into weakness. Plus, to help us all from an investing perspective we’ve now got a potential road map of sector performance from March until today.

Under-the-hood the story was extremely clear, sell anything exposed to travel, tourism and a general improvement in economic activity although with only 4% of the main index closing up on the day the selling was obviously pretty indiscriminate. Concerns are rising that other parts of the world, and especially the US, will be forced to follow Beijing and Victoria back into partial lockdown. This would clearly not be good news for stocks who have rallied strongly on the combination of huge fiscal / monetary stimulus and downright optimism but if the latter’s removed then we’ve simply rallied too far too fast i.e. its pullback time with the question being how far. For the doubters on the optimism out there just consider Webjet (WEB), it managed to rally within a whisker of getting back to pre-COVID-19 levels after its capital raising (based on the higher share count), as if the virus wasn’t going to negatively impact tourism!

A number of players who I respect in the market are still calling for further significant capital raisings in H2 of 2020 and if QANTAS is anything to go on they may just be right - Australia’s iconic airline is tapping the market for a chunky $1.4b institutional placement along with a $500m share purchase plan. Institutions were offered stock at $3.65 a share, an ok 12.9% to yesterday’s close. The raise will add 25% to shares on issue with the cash being put to work to support the recovery plan and strengthen the balance sheet. From reports I hear yesterday, the raise was well covered early on and it closed on time.

Capital raisings have largely performed admirably post the March melt-down but I question if this is another “trade” that may start to trick investors into believing they cannot loose, personally considering the uncertainty around flying in the foreseeable future I’m not particularly excited by a 12.9% discount on QAN shares – MM is neutral QAN. There are 2 simple points MM believes we should be cognisant of moving forward:

1 – There is never an easy way to make money as an investor as all good things come to an end, just like the decade old bull market did in February. MM believes investors should evaluate any further capital raisings on their individual merits as opposed to buying blindly.

2 – If we are going to see another wave of capital raisings it will erode the huge weight of money looking to buy pullbacks in stocks however we don’t believe it’s an issue at this stage.

QANTAS (QAN) Chart

There’s still no major change to our target areas for the ASX200 where we are likely to further tweak the Growth Portfolio – we are looking to increase risk around 5% lower and / or take some money off the table about 8% higher, the levels are the same just the percentages have just adjusted after yesterday’s sharp decline.

Following on from yesterday and previous recent reports 2 of my favourite sectors into weakness remain nickel and gold – Newcrest (NCM) breaking $31 is putting us on alert for exposure to the precious metal as our ideal entry area approaches fast whereas nickel play Western Areas (WSA) held up better through yesterday’s selling but another leg lower will still have us warming up our “buy alert button”.

MM still remains overall bullish equities medium-term.

ASX200 Index Chart

“Dr Copper” remains comfortable.

Copper is often regarded as a great indicator of future economic activity and at this stage its showing no signs that secondary outbreaks of COVID-19 are going to put a meaningful dent in the economic recovery. Stocks are twitchy beasts at times that can whiplash in exaggerated fashion on rumours and worries around news flow, just as we saw yesterday. However markets like copper are generally driven far more by good old fashioned supply & demand with the current picture telling us all’s well with the Chinese & global economic engines getting back to work – MM can see a test of 2020 highs in the months ahead for copper, pretty amazing performance under the circumstances – our core view here is one of the reasons MM is letting our OZ Minerals (OZL) position run, as opposed to grabbing a quick profit.

MM remains bullish the reflation trade.

Copper Futures ($US/lb) Chart

OZ Minerals (OZL) Chart

Global Markets.

Overnight the US S&P500 returned back to its 2020 playbook by shrugging off any economic worries and bouncing strongly overnight, its exactly why MM believes investors should remain patient with their levels to increase / decrease risk, importantly we so no reason to be selling weakness. Like the ASX200 we are patiently watching 2 potential scenarios, while ignoring the noise in between:

1 – we are correcting the whole advance from the March 23rd low with our ideal target now ~6% lower i.e. the time to again commence accumulating stocks.

2 – stocks will again shrug off coronavirus fears and we’re heading ~10% higher before MM will consider reducing risk / market exposure.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

3 additional stocks to target if we get another leg lower.

The coronavirus has certainly elevated volatility in 2020 but with it as I regularly say comes opportunity for the prepared, our “Gut Feel” scenario remains a pop above 6200 before we correct the whole rally from March 4400 low but either way MM believes we should be buying weakness and selling strength with at least another test back towards 5500-5700 feeling likely in the months ahead.

We are still considering 2 very different styles of companies into another potential leg lower:

1 – stocks that have shown their hand in 2020 and look great but decent entry has proved tricky, hence a reasonable pullback will attract MM.

2 – stocks very sensitive to economic growth and the coronavirus, another sharp drop may yield good risk / reward buying levels.

NB One of the 3 considered today is running its own race and doesn’t qualify into the above categories but we felt MM should update its thoughts.

ASX200 Index Chart

1 - Bingo Industries (BIN) $2.21.

Waste management and recycling business BIN is a perfect quasi play on an economic recovery albeit in a slightly magnified fashion. The stocks already experienced some huge swings in 2020 but importantly we like the business and its overall industry mix moving forward hence the question we ask ourselves is where does MM want to consider increasing its 3% exposure in the MM Growth Portfolio, the answer is 5-8% lower where we may increase the position to 5%.

MM likes BIN ~5% lower.

Bingo Industries (BIN) Chart

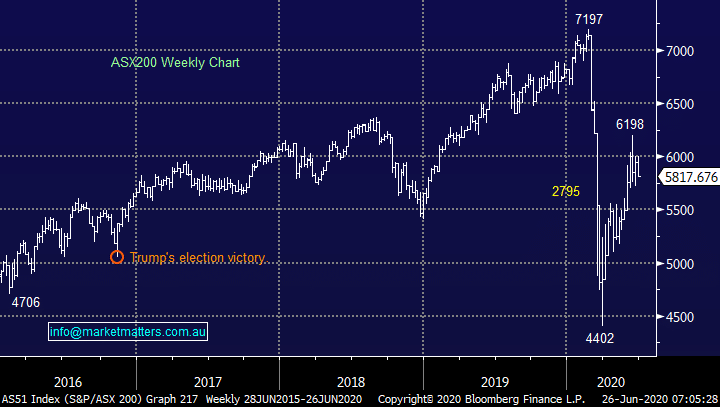

2 Boral (BLD) $3.66

As a supplier of building products to the residential and commercial building markets BLD is an obvious play on economic activity. The Australian Building Sector remains up well over 20% since mid-May, supported by expectations of government stimulus targeting construction, we believe the sector collectively remains bullish. A new CEO was announced recently which has been taken favourably as was the reassurance around their balance sheet, which was a previous concern of ours.

Our only question mark in buying BLD is our existing exposures to construction via Bingo, Lend Lease & Reece.

MM likes BLD ~$3.30.

Boral (BLD) Chart

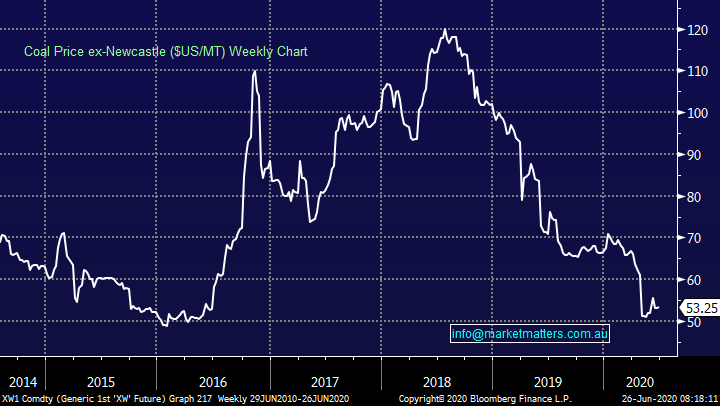

3 Whitehaven Coal (WHC) $1.41.

WHC most certainly cannot take a trick at the moment whether it’s an underlying coal price more than halving, ethical investors regarding you as persona non grata, bushfires or water / operational issues. However like good things come to an end often so do the bad, however the key to catching the proverbial falling knife with stocks in our opinion is be fussy on price while remaining happy not to partake at unattractive risk / reward levels and make “bets” small – remember bear markets have a habit of extending further than many expect.

NB This would be regarded as a very aggressive play and position size would be small accordingly.

MM likes WHC ~$1.

Whitehaven Coal (WHC) Chart

Coal Price out of Newcastle ($US/MT) Chart

Conclusion

MM remains a keen buyer of stocks into weakness with the above 3 on our potential shopping list.

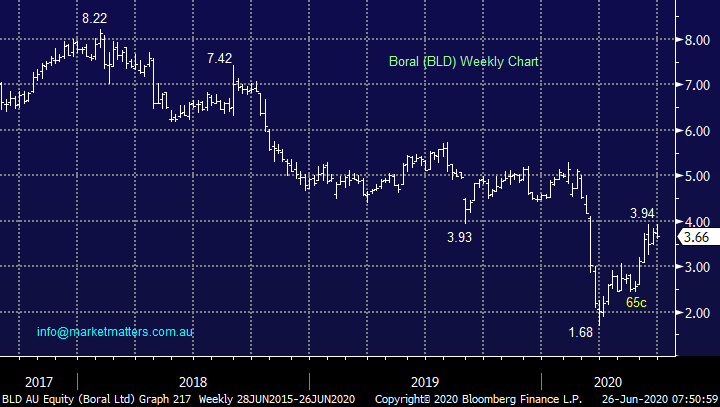

Overnight Market Matters Wrap

- The US equity markets bounced back overnight as investors continue to see the possibility of further stimulus due to the second wave of Covid 19.

- On the commodities front, Gold flat at US$1774/oz, Base metals were relatively flat across the board

- Crude oil pared its weekly losses, following Russia cutting its production output, currently sitting at US$39.13/bbl.

- BHP is expected to outperform the broader market after ending its US session up an equivalent of 2.21% from Australia’s previous close.

- The September SPI Futures is indicating the ASX 200 to advance 88 points higher to test the 5900 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.