3 Stocks MM Doesn’t Like for the Second Half of 2018 (DMP, CSR, BLD, SEK)

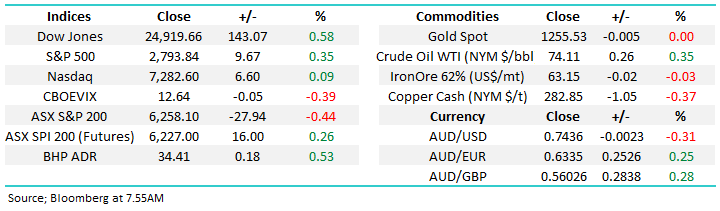

A few dents appeared in the ASX200 armour yesterday as an initial firm opening reversed almost 50-points with the index finally closing down -0.44%. The market felt “wrong” from the beginning and it was an easy decision to avoid pressing the “buy button” on any of stocks / positions mentioned in the morning report. The banks garnered the limelight for the wrong reasons taking the most points from the index but there were only a few bright spots with BHP & RIO standing out both rallying ~1%.

Volumes remain light due to school holidays and this can often lead to increased intra-day volatility due to air pockets, especially in the influential SPI futures market i.e. a 30-point turnaround can easily become the 50-point move like we saw yesterday.

- Short-term MM is positive the ASX200 with a close below 6250 required to switch us to neutral / bearish, however we remain in “sell but patient mode”.

Overnight stocks were firm as investors brace for US reporting season, we remain concerned that optimism is too high especially in the high profile tech based NASDAQ stocks.

The local market did look set to open up +15-points, regaining half of yesterday’s losses. However in the last few minutes of trade the S&P futures erased all of the day’s gains closing in the red as news hit the screens that the Trump administration was preparing a list of more Chinese goods to be hit with tariffs – this is likely to significantly dampen sentiment this morning and a negative start to the day would not surprise.

Today’s report is going to look at 3 stocks that MM believes remain neutral / bearish and best left in the avoid bucket as the new financial year swings into gear.

ASX200 Chart

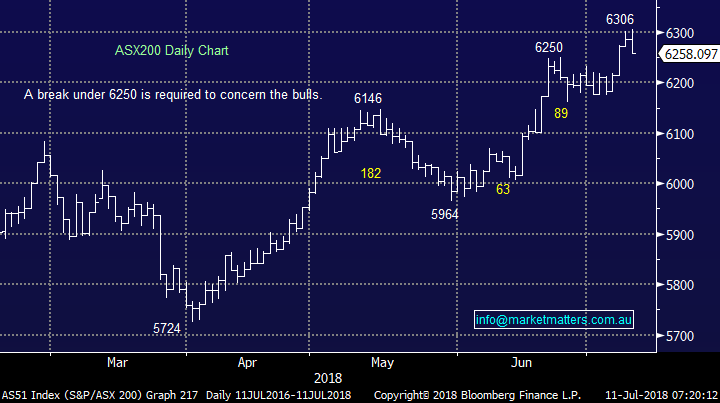

Buy Europe – sell the US

In yesterday’s report we touched on our view that Europe looks better positioned for the coming weeks / month. The following chart illustrates perfectly how the S&P500 has outperformed the EuroStoxx 50 for the last decade.

While we do not believe the EU will exist in its current form in the years to come our view is the elastic band between the US & Europe has stretched way too far, especially over the last 3-years. The market is very optimistic the US while remaining concerned around Europe, BREXIT etc. This is clearly a contrarian opinion at this point in time and one that must be monitored closely – we question is it now a matter of time until Trump does something rash and detrimental to the US?

Our view is this trend is set to at least partially regress, an excellent way to play this opinion is:

- Buy the Betashares Wisdom Tree Europe ETF (HEUR.AU) – this is a currency hedged ETF, with the weightings heavier on the dividend stocks across the Eurozone.

- Buy the Betashares US strong BEAR (BBUS) ETF.

*Watch for alerts.

US S&P500 v EuroStoxx 50 Chart

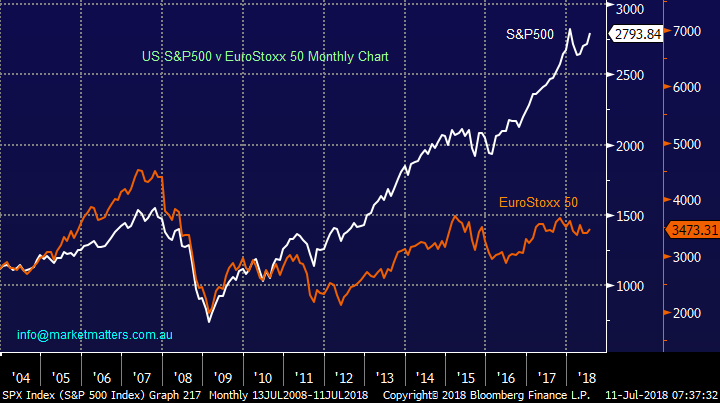

As subscribers know we are bullish the German DAX short / medium-term and the chart below shows the excellent illustration between the DAX and the HEUR over the last 2-years.

German DAX v HEUR Weekly Chart

Now moving onto 3 stocks that MM currently does not like into 2018.

1 Domino’s Pizza (DMP) $47.78

Even after its aggressive 2-year decline Domino’s (DMP) is still trading on a relatively expensive 30.6x valuation based on 2018 earnings while yielding just over 2% part franked.

However DMP plans to over double its number of stores before 2025 theoretically significantly growing profits along the way by both the volume increase and technology improvements.

Conversely the large issue of their franchise model remains – it seems the “small man” franchise owner the majority of the risk.

- Both fundamentally and technically MM does not like the risk / reward of DMP at current levels, the $30-$35 area will be interesting.

Domino’s Pizza (DMP) Chart

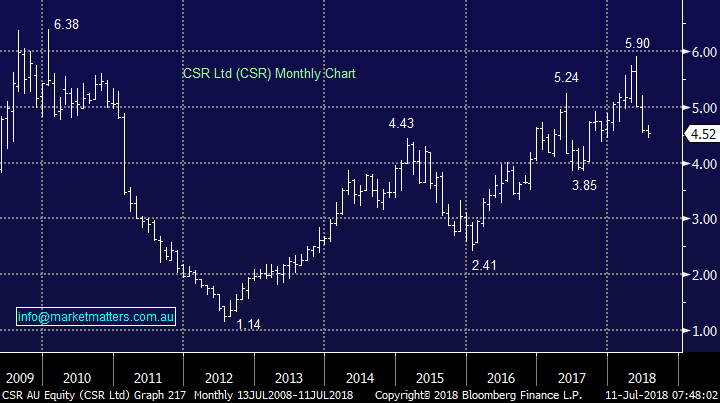

2 CSR Ltd (CSR) $4.52

CSR has had a pretty wild ride in 2018, first rallying over 20% only to then give most of it back since mid-May.

CSR has benefitted from the robust residential housing construction market but we question whether the building products supplier / manufacturer can rely on the tailwind over the next few years and some investors clearly agree. The stock is now trading on a conservative 11.8x valuation for 2018 while yielding almost 6% part franked.

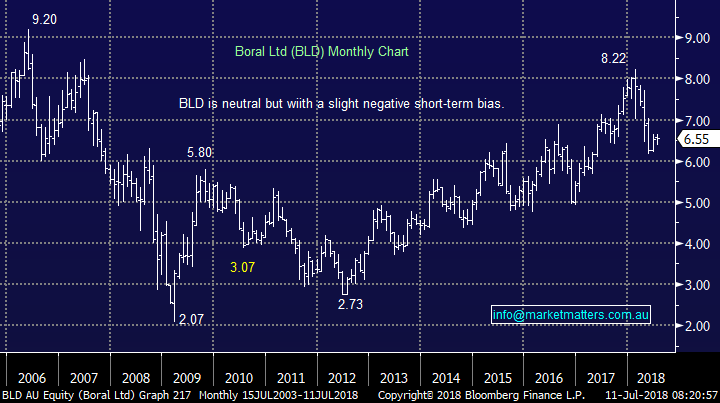

Overall this is not a sector we like and within it we prefer Boral (BLD) to CSR given its US exposure.

- We are neutral / bearish CSR targeting ~$4 while Boral (BLD) will look interesting under $6.

CSR Ltd (CSR) Chart

Boral (BLD) Chart

3 Seek (SEK) $21.27

Time for a large contrarian call – we believe SEK is a sell on a risk / reward basis! The online employment platform has enjoyed a great decade but while its long-term growth potential is undeniable we feel it’s got ahead of itself in a market that has chased many tech shares significantly higher without due concern to the risk / reward.

SEK is currently trading on a valuation of 35x 2018 earnings while yielding just over 2% fully franked.

- We are bearish SEK initially targeting a break towards $19 support, or 10% lower.

Seek (SEK) Chart

Conclusion

We are net bearish Domino’s (DMP), CSR Ltd (CSR) and Seek (SEK) in the second half of 2018 until further notice.

Overseas Indices

US stocks remain around their all-time high but we continue to believe they will be a lot lower in 6-months’ time.

Hence, we are on alert for a decent market correction and are still looking to increase our cash position into EOFY.

Last night the small cap Russell 2000 which has led all US indices higher actually fell on a generally positive night, only a small alarm bell at this stage.

US Russell 2000 Chart

The German DAX remains technically positive targeting fresh 2018 highs, tonight is likely to be a real test after Trumps new moves around China.

German DAX Chart

Overnight Market Matters Wrap

· The US markets closed marginally higher overnight, however the S&P 500 futures this morning is currently trading down 0.72% as trade wars ignite, as Bloomberg reported that a proposed list of $200 billion of Chinese imports could be released as soon as Tuesday US time.

· Meanwhile, the June employment report is latest evidence of US economic outperformance, the upcoming Q2 earnings season is expected to be another bright spot. Expectations are for 20% S&P 500 EPS growth on the back of the tax overhaul, elevated consumer and business confidence and the oil rally. Energy and tech expected to deliver biggest earnings growth, while consumer staples a laggard.

· The September SPI Futures indicated the ASX 200 to open 23 points higher towards 6280, however with the S&P 500 futures off this morning due to trade wars, the global markets including ours look set to lose at least 0.5% lower early in the session.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here