3 positions MM are considering this morning (NCM, APT, JHG US)

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

Yesterday we saw results from GMA, JHG, FMG, MQG while we saw some quarterly updates from key technology stocks overnight. AMP also out with an update this morning. I cover those this morning.

The ASX200 put in a solid performance after the Fed promised to keep the stimulus tap well and truly open although it felt like more of a grind higher as opposed to an impulsive move, especially with over 30% of stocks closing down on the day. It’s very early in the reporting season calendar but it appears to be adding a net positive influence on the market although its only on the stock level where things are particularly interesting at present. We all know by now how the index has been glued to the 6000 area but when we stand back and consider what happened after the GFC’s plunge / recovery perhaps we should prepare for a far more protracted period of consolidation:

1 – After stocks plunged 3731-points / 54% mainly during the GFC the ASX recovered 1904-points / 51% of its decline fairly rapidly, before consolidating for 2-years!

2 – This year the coronavirus sent the local market plunging 2795-points / 38% in just 2-months before a rapid 1796-point / 64% partial recovery of the drop.

If we simply apply some “back of the envelope” extrapolation / comparison between the 2 severe pullbacks I could easily comprehend a few months choppy price action between say 5800 and 6200 with the 6000 area continuing to exert its magnetic force, if this or something similar proves correct then our current mantra of - “buy weakness and sell strength will have a field day”.

Overnight we saw US stocks plunge after some awful economic numbers and a Tweet from President Trump suggesting they should delay the election because of the massive virus problems in the US, or far more likely because the polls say he’s about to be walloped in Novembers vote. However when the market closed the Dow had retraced over half of its initial 546-point plunge showing the buyers are stepping up into weakness and fresh virus cases is a passé news.

MM remains bullish the ASX200 medium-term.

ASX200 Index Chart

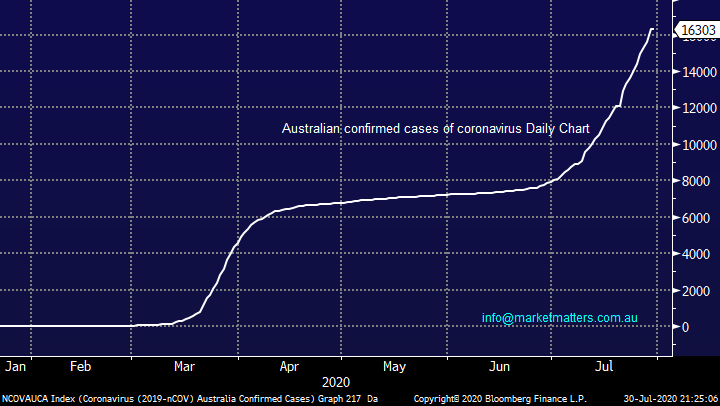

I was impressed by yesterdays rally in the face of the worsening pandemic picture, on Thursday Victoria reported 723 fresh cases in just one day, a huge chunk of the 16,303 total number of Australian cases since the outbreak started back in January. The chart bellow illustrates what’s unfolding now in Victoria is already noticeably worse than March / April, I really fear for what comes next with NSW and QLD feeling ever closer to joining Victoria’s pain and lockdown.

I know the uncertainty and mystic around the virus has been largely lifted but if we go back into a full lockdown the economic damage could be colossal, I’m very comfortable that we increased our cash level slightly on Wednesday.

Australian Confirmed cases of COVID-19 Chart

The US economy shrank at a record 32.9% in the 2nd quarter of this year as the virus continues to extinguish any signs of a “V-shaped” recovery, not that Wall Street cares! A huge rally in the tech sector on Thursday night cushioned the earlier broad based losses as both Trump and the economy weighed on Equities, it feels like as we work our way through US earnings season the market remains comfortable that the likes of Microsoft (MSFT US) and Apple (AAPL US) will report good numbers – which has just been the case with Apple after-market (stock up +6%).

US personal spending has now fallen by the most in over 80-years and jobless claims are continuing to grow, stocks are undoubtedly putting huge faith in the Fed and global central banks to keep stimulating the economies, until this changes asset prices look set to defy logic – “don’t fight the Fed”.

These devasting economic figures clearly illustrate why governments are keen to keep economies open for business as much as is humanely possible – unfortunately an oxymoron. While 7.5 million people have gone back to work after the US re-opened things, it still feels like the country is going in the wrong direction. As we’ve seen locally it, only takes a few stupid and selfish people. To put things in perspective apparently almost 30 million Americans didn’t have enough to eat last month, this is the balance facing the US government which has seen more than 150,000 citizens lose their lives to COVID-19, it’s almost akin to playing god.

US bond yields / interest rates look destined to be lower for longer as the economy struggles to recover.

US10-year bond yields Chart

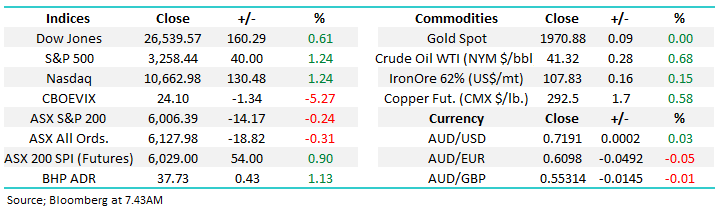

Overseas Indices & markets - their reaction to the Fed

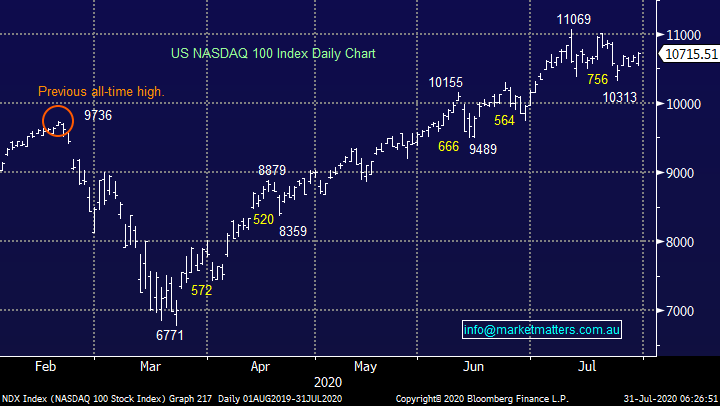

US stocks recovered impressively after Trumps Tweet and the devastating economic news that came out early in the session, pullbacks continue to bought and the only logical selling is into strength. The bullish technical picture we outlined previously for the tech based NASDAQ remains in play, we can still see fresh all-time highs in the coming days / weeks but its only ~4% higher, not earth shattering stuff.

MM remains bullish US stocks short & medium-term.

US NASDAQ Index Chart

Conversely, European Indices appear to be already correcting their 50% rally from Marchs low, we are buyers of weakness but ideally closer to the 3000 area or ~6% lower – remember the ASX is more correlated to Europe than the US.

MM is looking to buy weakness in European stocks.

EURO STOXX50 Index Chart

Positions MM are considering this morning.

With volatility under the hood increasing locally because of reporting season and in the US because of a deteriorating economic backdrop MM has taken the opportunity to outline 3 positions we are considering over the coming week.

1 Precious Metals.

Precious metals have come off the boil this week after exploding to multi-year highs into the Fed meeting, a classic case of buy on rumour and sell the fact. However at MM we remain bullish over the next 1-2 years hence we see corrections as opportunities i.e. gold has corrected ~2% while silver has been far more aggressive retracing over 10% from its recent highs.

MM remains bullish precious metals.

Gold ($US/oz) Chart

Gold ETF’s, like the Vaneck Gold Miners ETF (GDX US), declined almost 3.5% overnight implying local stocks will follow suit this morning. Our preferred vehicle at current levels from a combined valuation and quality perspective is Newcrest (NCM) which has already corrected over 6% this week. Anticipated weakness this morning feels like an ideal opportunity to start establishing a position, while leaving room to average at lower levels.

MM is bullish NCM initially targeting ~20% upside.

*watch for alerts.

Newcrest Mining (NCM) Chart

We are also looking to establish a position in silver for our Global Macro ETF Portfolio and after silvers almost 11% pullback the ideal time to start accumulating feels like now. For most investors we like the ASX listed Physical Silver ETF from ETF Securities. The security is underpinned by Silver bars held in a vault and is known as an exchange traded commodity (ETC). .

MM is considering buying this for ETF for our Global ETF portfolio.

Silver ($US/oz) Chart

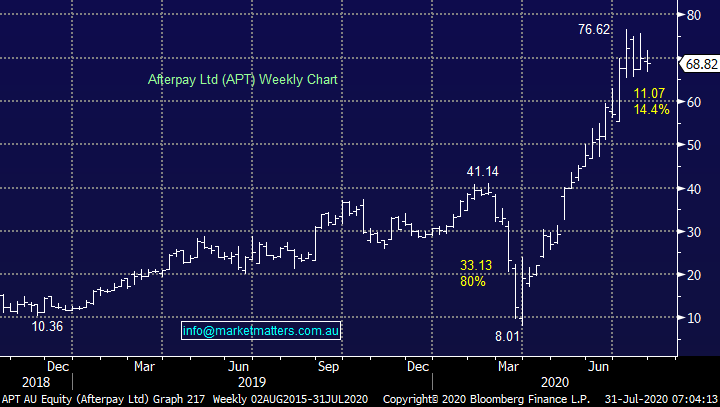

2 An Australian IT stock.

Over recent months MM has been looking for a “blow-off” top in the US tech space but all we keep getting is buy signals! This morning Apple (AAPL US), Facebook (FB US), Amazon (AMZN US) and Alphabet (GOOGL US) all reported quarterly numbers overnight - all were strong and In after-hours trading, all bar GOOGL are trading up more than 5%.

In terms of Apple, they smashed earnings expectations delivering ¼’ly revenue of almost $US60bn, up 11 year on year, what pandemic! Numbers like this look likely to bring our bullish outlook for the NASDAQ to fruition but will it create a meaningful blow-off top is the question.

Afterpay (APT) has been the leading player in the local space and it still looks set to test $80 in the next few months hence until then we are likely to monitor but hold our IT exposure but never say never with the lagging Bravura (BVS) the most likely, ahead of Xero (XRO) and Zip (Z1P), to be cut.

MM is watching our 3 IT related stocks carefully.

Afterpay Ltd (APT) Chart

3 Janus Henderson (US) $US20.96.

This week Janus Henderson declared huge outflows, significantly worse than anticipated – the 7th straight quarter of this trend as they lost a number of large mandates. While the stock remains cheap and this may be a turnaround story, we’ve lost patience. Hence as discussed in Wednesdays International Report we are looking to cut JHG (US) in our International Portfolio at breakeven.

MM is looking to cut our JHG (US) position – we may even switch to Barrick Gold (GOLD) which fell ~2% overnight.

Janus Henderson (US) Chart

Conclusion

MM is poised to action some precious metal “plays” this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.