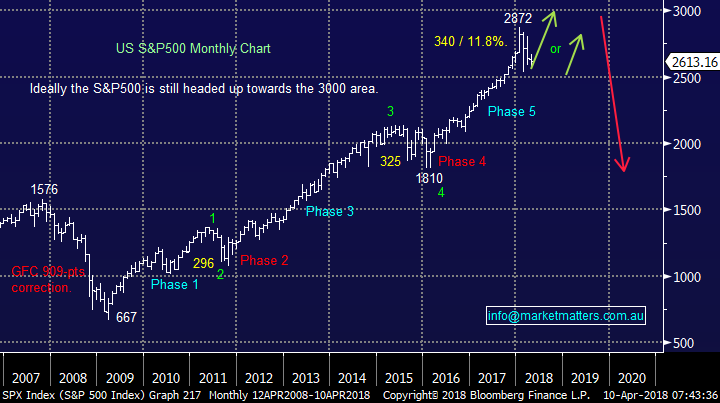

3 MM stocks in our sights to be sold in 2018 (SUN, AWC, CYB)

The ASX200 had a great Monday rallying 20-points ignoring the Dows greater than 500-points plunge on Friday night – we stick with our view from the Weekend Report stock that markets are looking for a low. However we also reiterate that we believe this is not the time to chase any strength in stocks / the market generally. Today will be an interesting test as while the Dow closed up 46-points it was up well over 400-points with an hour to go before Trump did it again, this time news hit the market that the FBI had raided the offices of Trumps lawyers who have dealt with his legal matters including the investigations into Russian election meddling and a payment to an adult film star!

Our overall short-term bullish outlook for stocks is based on old fashioned valuations as we move into the US reporting season. We’ve witnessed a 10% correction in stocks against a backdrop of earnings growth - the elastic band feels ready to snap back. The US market is now offering the best value in over 3-years as it trades on 16.74x forward earnings compared to over 20x in January – dropping to 15x expected in 2019 based on current earnings forecasts. Our own market is on 15.56x expected with forecast earnings growth of 5%...which looks okay. (Resources 11.1%, Banks 1.7%, everything else 5.2%).

Unfortunately while we have Mr Trumps trade war and overall personal uncertainty simmering away in the background the markets overall valuation is likely to be capped but the pessimism - optimism tussle looks to have gone too far and we can easily see equities rally back towards at least 18x forward earnings. Also, globally we have Europe trading on a 20-year valuation discount to the US which points towards value in more places than just the US. We simply need the Trump trade war and personal mess to vanish into the background just as we saw with Kim Jun-on and stocks can rally hard to achieve our goal of fresh 2018 highs in the coming months.

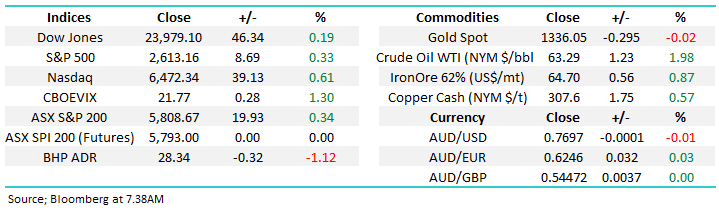

We can easily envisage a bounce by the ASX200 to the 5850 area but a close above 5900 is still required for us to become bullish short-term.

Today’s report is going to take a close look at our 3 most likely sells in coming weeks – the area of investing that often receives the least attention.

NB Due to our medium-term outlook for stocks we are far more likely to press the button on sell opportunities as opposed to buy ones.

ASX200 Chart

Overseas Markets

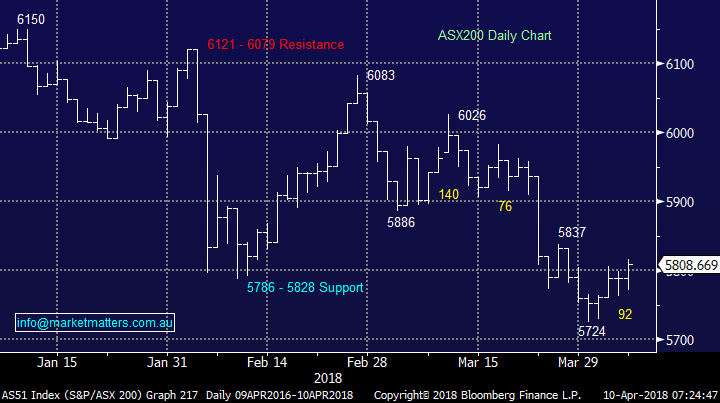

Overnight the US broad based S&P500 spluttered up +0.3% to continue the choppy trading action since February between 2872 and 2532. From our technical perspective the more time the S&P500 spends between 2600 and 2800 the greater the potential for a renewed rally to fresh all-time highs.

Overall we must remain neutral just here but our preferred scenario moving forward still remains a doomed attempt to break upwards towards the psychological 3000 area.

US S&P500 Chart

Now to look at 3 stocks who have been strong enough during these periods of uncertainty to reach potential “profit taking” areas moving forward.

Subscribers should remember that we are in “sell mode” and hence part of our plan moving forward is to increase our cash levels.

1 Alumina (AWC) $2.54

AWC is enjoying a number of tailwinds today and when everything looks the most rosy is very often the optimum time to take profit on stocks:

- AWC owns 40% of global alumina business Alcoa World Alumina and Chemicals (AWAC) whose share price has tracked upwards steadily over the past 12-months.

- AWC reported in February a NPAT of almost $340m compared to a loss at the same time last year.

- AWC is yielding an extremely attractive 6.76% fully franked.

- In 2017 China mandated a 30% production cut at smelters to reduce pollution sending the aluminium price higher.

- The global alumina market looks set to pass the billion dollar level in the next 5-6 years led by the Asia Pacific region.

- Last night in London the aluminium price soared 4% to its highest price in a month as US sanctions on Russian aluminium producers cut global supply.

The supply disruptions caused by US sanctions on Russian oligarchs may just create the spike we are looking for i.e. only another 4-5% higher.

Our profit target remains ~$2.65 but because of the above reasons we are unlikely to sell below $2.60.

Alumina (AWC) Chart

Alcoa Corp $US Chart

The surge in AWC also highlights the current volatility within our resources sector which can provide some excellent switching opportunities for the nimble:

- Over the last month AWC is up +10% while OZ Minerals is down 3.22% and iron producer Fortescue has tumbled -9.9%.

2 CYBG Plc (CYB) $5.56

CYB, the UK banking assets spun out of NAB, has been the best performing bank locally over the last 5-days (+3.2%) and last year (+16.8%).

- CYB have the nice problem of excess capital which may become dividends or used for acquisitions – a better position than our “big 4” at present.

- In 2019 the board has forecast a 5.4% dividend yield that is likely to get the local retail investors out of the closet and onto the register.

- CYB is cheap, like a lot of Europe, when compared to other global markets and they have a very aggressive cost strategy ahead

- Over the next 6-months CYB should have a regulatory tailwind not being embroiled in the Royal Banking Commission +

- Technically CYB looks excellent targeting ongoing strength up towards +$6.

Our profit target remains over $6 but again because of the above reasons we are unlikely to sell at lower levels.

CYBG Plc (CYB) Chart

3 Suncorp (SUN) $13.44

We have included our largest holding SUN, which we’ve held for about 2 ½ years because if we get a general kick higher by global equities SUN has a strong chance of reaching our target area i.e. the $15.50 - $16 area.

- SUN reported an almost 16% drop in profits in mid-February which disappointed many, including ourselves, with shares initially falling -3.7% on the news before closing almost unchanged.

- The market has clearly believed managements optimism around the future including better margins and an expected cash return on equity of ~10%.

- However, IAG has clearly shown how it should be done being the sector outperformer over the last year, a feat we believe SUN can at least partially emulate moving forward.

Our profit target remains well over $15 (10% higher) but assuming the company doesn’t fail badly we are likely to be patient while enjoying a 5.4% fully franked yield. NB We may scale as exit in SUN given our large weighting

Suncorp (SUN) Chart

Conclusion

- We remain sellers of AWC, CYB and Suncorp (SUN) at our targeted sell levels within the MM Growth Portfolio

Overnight Market Matters Wrap

· An optimistic start to the week proved to be short lived as US indices gave back its session gains of more than 1% in late trade. Whilst positivity around earnings season and a rally in tech stocks saw strong morning performance, an FBI raid on President Trump’s personal lawyer’s office tempered investor’s enthusiasm. It is hoped that strong earnings season results will help shift the focus away from trade headlines back to company fundamentals, which should have been strengthened by new tax policy and a lower US dollar.

· Iron ore was slightly stronger, whilst aluminium jumped 5% after sanctions were imposed on a large Russian producer. – Expect AWC to benefit from this.

· Closer to home, substantial shareholder notices have revealed that BlueSky Alternative’s (BLA) 4th largest shareholder (Adcock Private Equity) has recently offloaded $2.9M worth of stock following the Glaucus report.

· The June SPI Futures is indicating the ASX 200 to open with little change from previous close of 5808.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/04/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here