3 Macro Plays Catching Our Eye This Week – (700 HK, CYB LN)

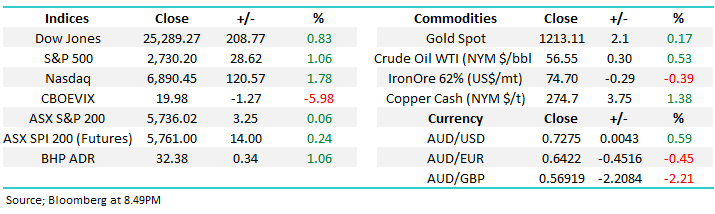

The ASX200 finally found a little love in the last hour of trade yesterday rallying aggressively 50-points into the close but this was unfortunately still only enough to push the market to a marginal gain of +3-points. Also, before we get too excited about the local market finally closing in the black we should note the strong performances by a number markets in our region e.g. The Hang Seng +1.75% and China +1.36% - in other words it did feel a little like the Australian market was dragged higher kicking and screaming.

Local stocks were actually looking ok until the Australian Employment data was released at 1130am, it came in better than expected with unemployment steady at 5% but wages advanced the most in 3-years. Markets appeared to focus on the wages as the $A rallied as did bond yields, this combination was enough to send the ASX200 down ~50-points in just over an hour – we certainly have been behaving like a “glass half empty” market this week.

MM is now more cautious the ASX200 short-term targeting an eventual retest of the psychological 5600 area.

Overnight US stocks were strong with the Dow closing up 208-points while European indices were slightly lower as they saw the worst of the US session – the Dow surged more than 500-points from its intra-day low. The SPI futures are pointing to an open up around 16-points with BHP up just over 1% implying our resources should be ok.

Today’s report is going to look at 3 macro scenarios that are catching our eye in global markets with all 3 having an important bearing on stocks / sectors / positions within the ASX200.

ASX200 Chart

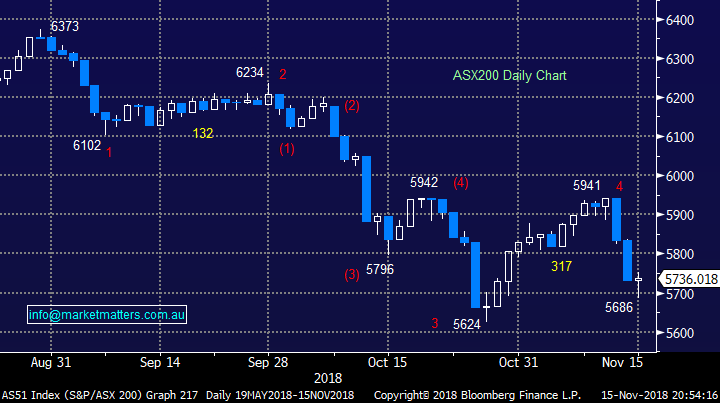

Global equity markets are having a tough few weeks but spare a thought for those still holding Bitcoin, it’s now fallen over 70% since its December high, it makes the ASX200’s recent -11.7% pullback feel like a walk in the park.

We are not suggesting stocks can fall anything like 70% but another 10-15% over the next 1-2 years would be fairly “reasonable” compared to the gains of the post GFC bull market, especially by the US market.

Bitcoin $US Chart

We made a comment in Thursday's report which was the catalyst for our missive this morning:

“What surprised us was the US and Asian markets were also pointing to an ok day in equities land but one or more major players had a very different idea – yesterday was all about selling Australia, not global equities.”.

So far this week the ASX200 has fallen -3.1% but Europe is down just over -1%, Emerging Markets (EEM) are up +2.6% but the Dow is -2.9% at 5.45 this morning. A perfect example that our market has been latching onto whatever bad news it can – over recent years we have been far more correlated with Europe and the EEM but not this week.

Hence today we thought we would peruse a few macro themes in case something jumped out as to why we have been underperforming, or is it simply the “noise” of a few large orders in the short-term.

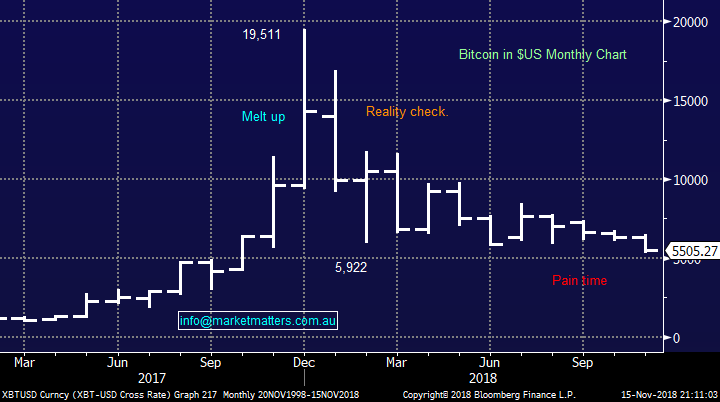

1 Emerging Markets are regaining their mojo - just!

The last few weeks has seen the Emerging Markets (EEM) slowly but surely appear to find a short term bottom and potentially commence a decent recovery.

We remain comfortable with our view that Emerging Markets will outperform US indices into 2019 although this could of course mean they simply fall less!

Emerging markets v US S&P500 Chart

Hong Kong tech goliath Tencent rallied +5.8% yesterday following some excellent earnings – a 30% rise in profit eclipsing analysts’ expectations.

The company which owns / operates WeChat and video gaming businesses to name just a couple is the largest component of the MSCI Emerging Markets Index with a whopping 4.5% weighting! Not only can the stock almost drag the index up single handily the sentiment flow on effect can be significant.

The stock is still ~30% lower in 2018 but looks poised to continue its current bounce at least.

MM is short-term bullish Tencent (700 HK) targeting further 8-10% gains.

Tencent Holdings (700 HK) HKD Chart

Moving onto our position in the emerging markets ETF (IEM) which we entered in late September against our bearish exposure to US stocks, again via an ETF (BBUS).

As subscribers know who have followed / taken this position we “lifted a leg in the air” by taking profit on our BBUS position leaving us long the Emerging Markets which feels on point this morning.

Our target for the IEM ETF is ~58.50-59

2 BREXIT turmoil escalates

Theresa May looks odds on to lose her position as the UK’s PM by next week as her BREXIT plans create turmoil on the political front with a number of senior ministers resigning. I actually feel sorry for her as she was a major campaigner for the “Remain” campaign, not BREXIT, we ask where’s Boris Johnson and Nicholas Farage when the heavy liftings required! Farage has actually been spruiking an overpriced speaking tour calling himself The BREXIT King of Britain - what a joke!

The current political turmoil sent the Pound plunging -1.6% overnight which is not good news short-term for Australian stocks with UK earnings.

We believe another major vote looms in the UK whether it be a second BREXIT referendum, a general election or a combination / version of the two. Markets generally hate uncertainty but while the Pound was clobbered the UK’s FTSE was the only major European index to close in the green courtesy of the weaker Pound.

Politics is a crazy game to predict but we keep thinking the British public now want to remain in Europe assuming you believe the polls, hence what a campaign angle for an election – we are confident predicting politicians can be fickle but that’s as far as we go! We believe a second referendum would be very bullish for the UK.

British Pound GBP v $US Chart

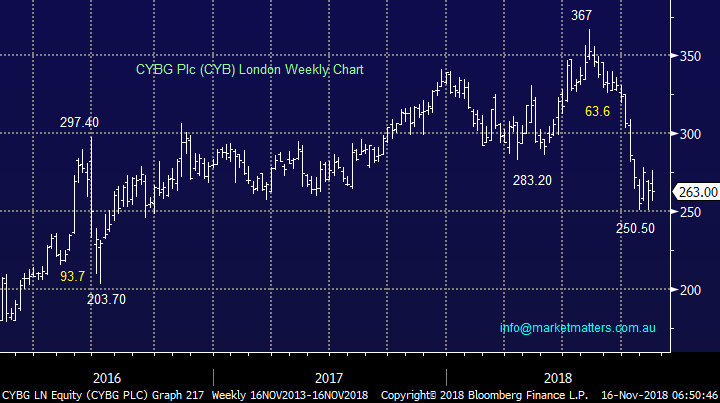

Overnight CYBG Plc (ASX: CYB) was smacked -3.6% as the turmoil unfolded in Britain. We like CYB below 250 basis UK pricing i.e. into fresh 2018 lows.

MM likes CYB ~10% lower not unrealistic if BREXIT fears escalate.

CYBG Plc (CYB) UK Chart

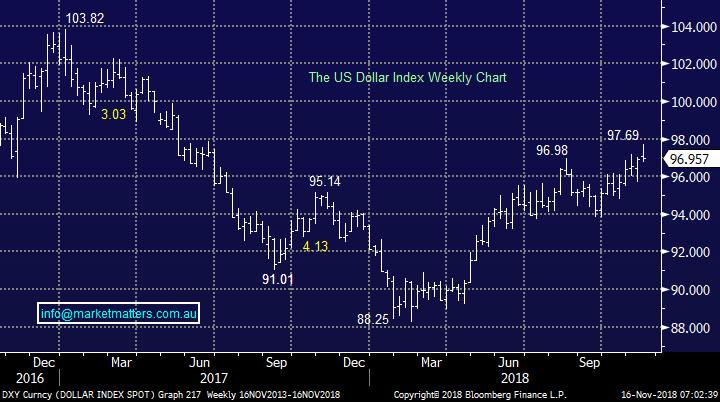

3 The $US feels very “tired”.

The $US has been a proxy for safe money since late September. So far in 2018 the $US Index has probably been our best “call” and its again looking fairly clear to us, hopefully its not 3rd time unlucky! The probability for a rate hike in the U.S next month now sits at 71.3% , down from high 90’s only a few weeks ago. A falling oil price along with a strong US currency is deflationary and coupled with current trade tensions, I wouldn’t be surprised if the

US Fed held tight in December. MM is bearish the $US looking for a pullback towards the 94 area / the lows in September.

If we are correct the strong implication is US equities will recover into Christmas / 2019 – certainly one to watch carefully.

NB This move should also be good news for commodities / resource stocks.

The $US Index Chart

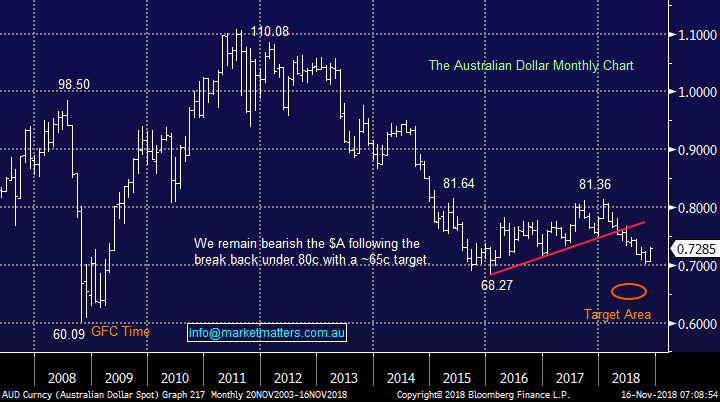

The $A not surprisingly is gaining some traction and we can see the current bounce surprising many - perhaps rallying back over 75c. The fall in 2018 has been steady and many trend following systems / hedge funds will be short hence its easy to envisage a squeeze higher.

MM is short-term bullish the $A which may become a headwind for $US earners into Christmas.

Australian Dollar $A Chart

Conclusion

We remain mildly bullish stocks from current levels / around 5600 with the 3 macro themes generally supporting the view.

1 – Emerging Markets looks set to rally another 5% minimum short-term, led by Tencent (700 HK).

2 – BREXIT is a mess but we like CYB if it becomes major collateral damage.

3 – The $US looks weak to us implying strongly that US stocks will hold / rally into Christmas and our resource stocks are a buy

At this stage we see nothing more sinister from our recent underperformance than some likely switching from Australia to the Emerging markets.

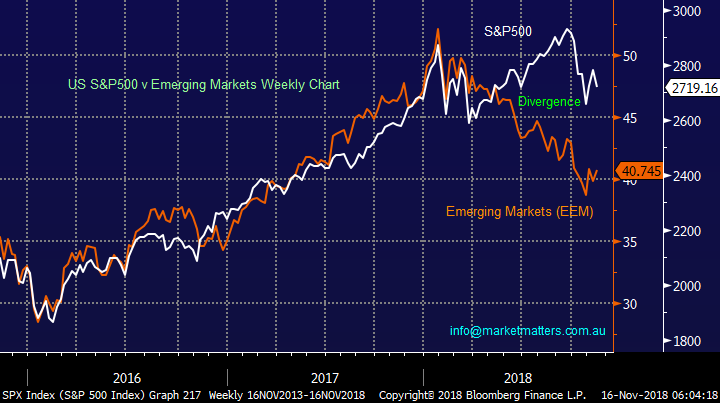

Overseas Indices

The S&P5009 has basically held our targeted 2700 area in the Weekend Report as the intra-day volatility shows a very skittish market with two differing opinions – today alone the Dow swung in an almost 600-point range.

We are still bullish US stocks into Christmas / 2019

US S&P500 Chart

European indices are now also neutral with the German DAX hitting our target area which has been in play since January. To turn us bullish we still need to see strength above 11,800.

German DAX Chart

Overnight Market Matters Wrap

• The US had a breather from its recent selloff overnight, ending the session higher led by the tech heavy Nasdaq 100 as investors found some value from the recent weakness and anticipate the current US-China trade war to calm down.

• On the European front, there are now calls for a vote of no confidence in Britain Prime minister, Theresa May. Her Brexit deal and her government are on the verge of falling apart after two ministers quit. The pound fell the most in nearly one and a half years.

• Copper and zinc rallied, while aluminium and nickel fell on the LME. Iron ore lost ground, while oil continues to bounce, 0.53% higher overnight.

• BHP is expected to outperform the broader market today after ending its US session up an equivalent of 1.06% from Australia’s previous close.

• The December SPI Futures is indicating the ASX 200 to open 16 points higher, hovering above the 5750 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.