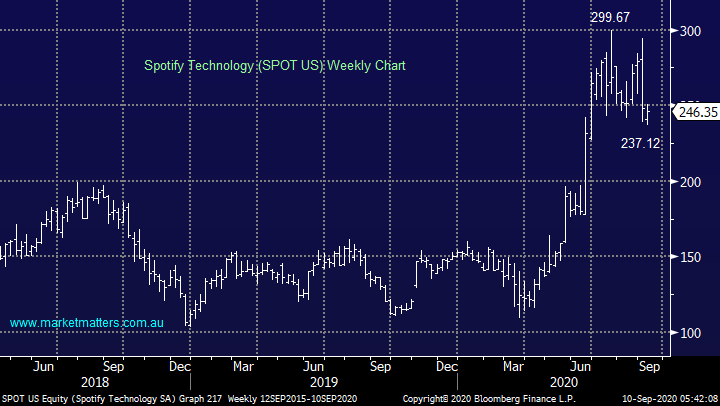

3 local stocks on our radar during the “tech shake-up” (SPOT US, AAPL US, SGM, VOC, IPL)

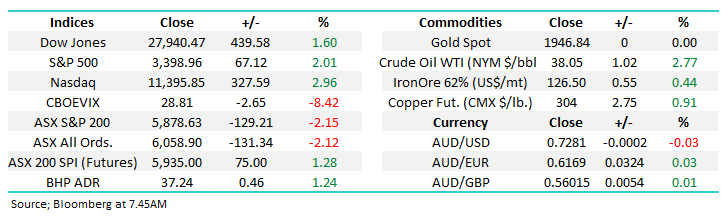

The ASX200 plunged over 2% yesterday leaving a number of bulls in the office questioning their optimism, pretty understandable when 93% of the index closed down on the day. One thing that caught my eye was the short-term traders appearing to abandon the COVID recovery story with stocks like Corporate Travel (CTD) and Flight Centre (FLT) enduring tough sessions although the sea of red was pretty unforgiving across the board. The local market remains within its 3-month old trading band as investors continue to switch between stocks and sectors, the so called “hot money” is having all the fun at present, or not depending if they’re getting it right.

So far into yesterday’s low we’ve fallen over -5.6%, I was a little disappointed / surprised we couldn’t bounce as US futures recovered almost 2% during our time zone but the sentiment reminded me of Tuesday where it felt like people remained non-believers that the US tech space was going to recover anytime soon. Remember we pointed out earlier in the week that the vast majority of the massive US bullish option bets were 2-weeks in duration hence making us believe stocks and the tech space in particular was just experiencing a short-term washout which may flow into next week.

Overnight US stocks have bounced back fairly aggressively, although a late sell-off did dampen the session, the Dow closed up 439-points while the NASDAQ soared almost 3%, not surprisingly the ASX is poised to reclaim most of yesterday’s losses and rally back towards its comfort level ~6000 feels a strong possibility. Outside of the IT Sector the best performing group in the US were the materials which bodes well for our index today e.g. BHP closed up 50c in the US.

MM remains bullish the ASX200 medium-term.

ASX200 Index Chart

Equities are undoubtedly carrying some major risks at present and we thought after the recent volatility it was worth highlighting our 3 main economic concerns:

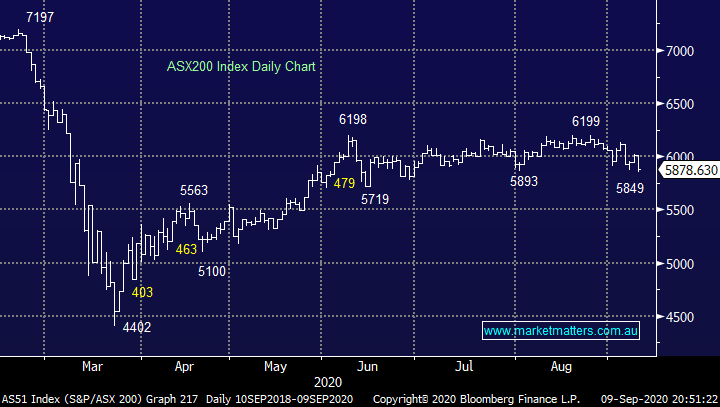

1 – The global pandemic continues to rage on through developing countries while secondary waves roll through the likes of Europe and of course Victoria. Until a vaccine is discovered and made readily available the economic impact on the world will remain huge and therein lies the problem, nobody truly knows where / or what the coronavirus endpoint is and hence where the economy will be in a few years’ time – this is a science issue, not one fund managers are familiar with modelling.

2 – The US election in November will significantly change the investment landscape if the Democrats (Joe Biden) can win both the Upper House and the Senate. At this stage he has a small lead over Donald Trump in the run for the White House but the Senate looks more likely to remain Republican with the favourite scenario at the bookies being Joe Biden President, Democrat Congress but a Republican Senate If the Democrats can win all 3 then I believe stocks will be in for a really tough ride.

3 - Ongoing economic tensions between China & the US remains firmly in the background but nothings improving, most of us are just focused elsewhere.

MM believes moving forward stocks will experience a number of spikes in volatility similar to the last week.

Global Cases of COVID-19 Chart

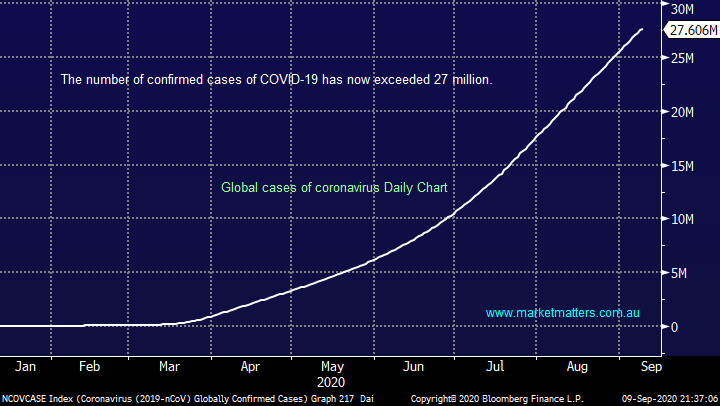

One US stock that we like at current levels is Spotify (SPOT US) which currently boasts an impressive ~138m paid subscribers and when we include the number of free accounts, monthly active users are around 300m – pretty staggering numbers. In Australia alone there are 8m Australian subscribers of the music streaming service – that’s close to 10% of all homes. Music has evolved considerably from vinyl and then CD’s, another great example of “out with the old and in with the new” which investors ignore at their peril. In the tech space the concept that the winner takes all is an important, and Spotify is clearly in the box seat in terms of music.

MM is bullish Spotify at current levels.

Spotify Technology (SPOT US) Chart

Overseas Indices & markets

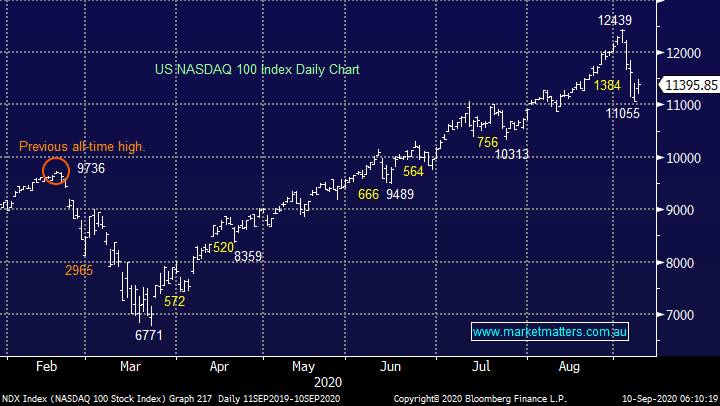

Overnight US stocks regained some of their recent losses but the chart below illustrates its not been much more than a small bounce for the tech stocks, my feeling is we might see more downside into next week before stocks can really get a springboard to rally into October – remember September is traditionally a rocky time for stocks.

MM remains bullish US stocks medium-term.

US NASDAQ Index Chart

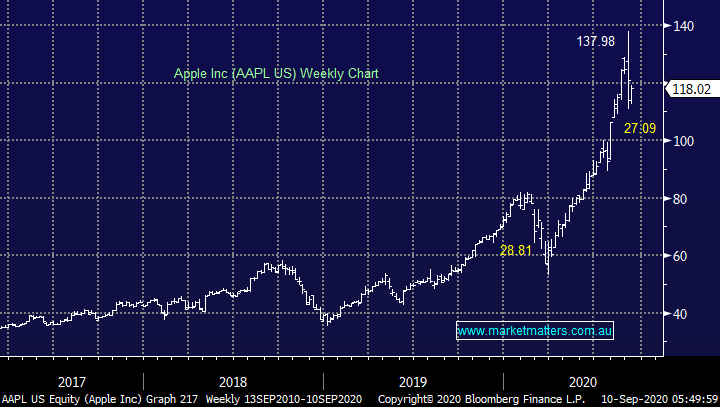

Following its explosive rally post August’s stock split Apple In (AAPL US) has led the recent tech plunge correcting almost 20% over the 2-weeks, it’s not surprising that some tech bulls ran for the hills. When we stand back and look at AAPL it simply corrected a very similar degree as earlier in the year albeit faster in nature. At this stage we see no reason not to anticipate calm returning to this excellent company and an assault on the $US140-150 area unfolding over the remainder of 2020.

MM remains bullish Apple.

Apple Inc (AAPL US) Chart

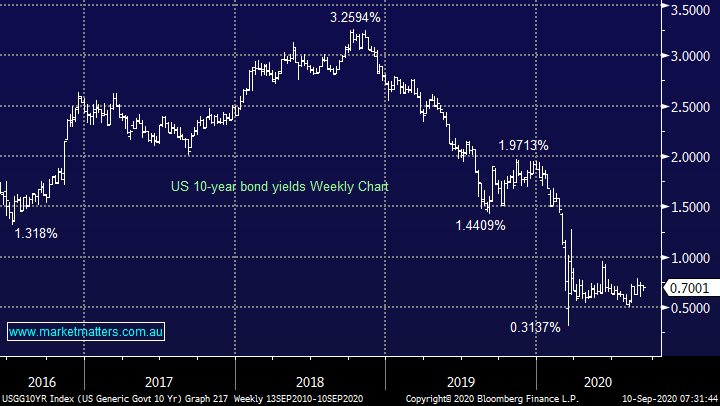

Bond yields / interest rates are a major determining factor in the valuation of equities and as can be seen below US yields are at the same level as in late March giving us no obvious clues to the future uncertain economic backdrop. When things do become clearer on the virus front it’s likely to see a decent lift in yields which we believe will see value stocks such as banks and resources take the baton of performance from the tech sector but without this fundamental backdrop it still feels like a lot of noise, second guessing by investors as to where’s the best place for their hard earned money.

MM is bullish bond yields medium / long-term.

US 10-year Bond Yield Chart

Three stocks on our radar as tech falls.

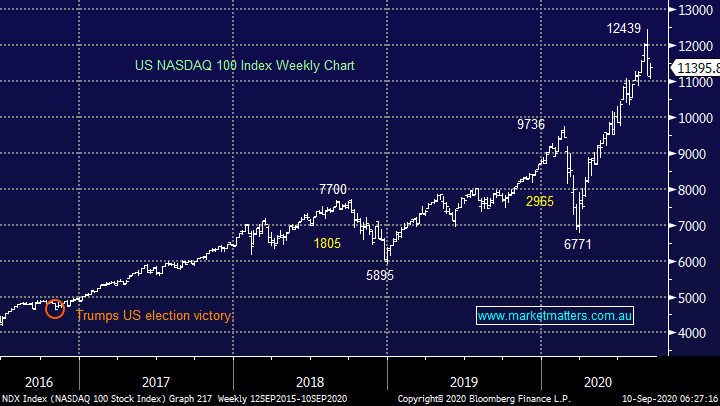

Recently MM has been flagging a likely “rest” by the tech stocks, we certainly used the wrong verb but at this point in time things continue to unfold as we expected. We have enough tech exposure at MM considering we feel their phenomenal bull market is maturing fast, especially on a comparative performance basis. Hence today I’ve looked for / at 3 stocks who may have been caught up in the tech downdraft but we believe are the better areas to be buying for the medium-term.

The NASDAQ is experiencing a breather, but MM remains bullish.

NASDAQ Index Chart

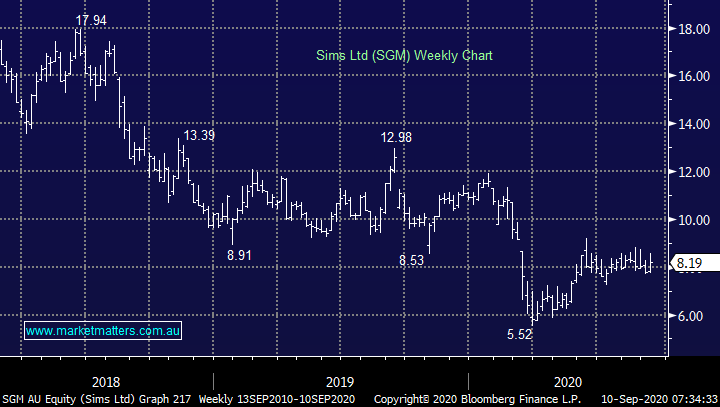

1 Sims Ltd (SGM) $8.19

Metal recycling business SGM has endured a really tough few years but we believe it’s become a perfect vehicle for fund managers who are reviewing the underperforming pockets of the market – its been enjoying some solid days of late and we can see a rally towards $10 in 2020. Also, for good measure the stock resides in the value group which we believe will outperform this year – ideally stops would be placed ~$7.20 which delivers good risk / reward.

MM is bullish SGM initially looking for 20-30% upside.

Sims Ltd (SGM) Chart

2 Vocus (VOC) $3.49

We are already long VOC at MM in our Growth Portfolio but it caught my attention again this morning, we are not looking to add to the position but the telco is currently doing everything we would hope for and an aggressive move towards $4 and potentially beyond is feeling an increasing possibility.

MM remains bullish VOC.

Vocus (VOC) Chart

3 Incitec Pivot (IPL) $2.11

There are by definition only a finite number of stocks in the Australian market and like VOC, Incitec Pivot (IPL) is a stock we’ve liked of late although its not currently in any of our portfolios - IPL is forecast to pay an estimated dividend moving forward above 3% making it an unusual candidate for our Income Portfolio.

The explosives, chemicals and fertiliser business is down over -20% over the last 6-months, failing to regain most of its March sell-off in the process. The company reported a strong trading update in August sending the stock up +15% in the week. As we discussed in our Resources Roundtable miners are likely to spend more in the coming year after a relatively benign period in terms of capex – this trend should help demand for industrial explosives.

We feel this is a strong candidate for a 20% rally with a stop only 7% lower, excellent risk reward in anyone’s books.

MM likes IPL with stops under $1.95.

Incitec Pivot (IPL) Chart

Conclusion

Interestingly the 3 stocks we looked at today have actually consolidated more than fallen with the tech snap back but this has actually reinforced our positive stance on them.

We like the 3 stocks we looked at today in no particular order, unusually they all look & feel good.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.