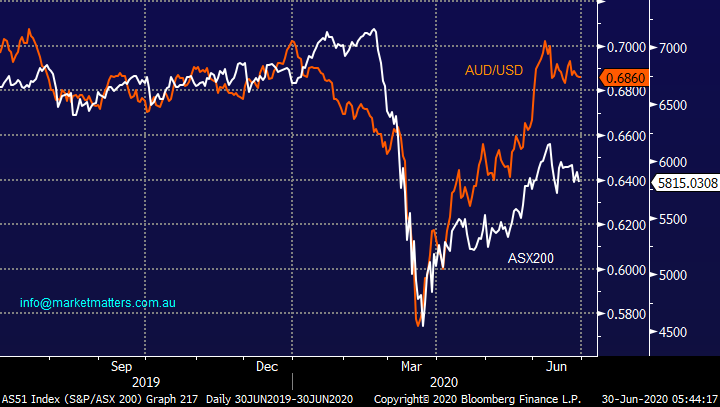

3 “Buy buttons” MM is looking to press very soon! (WSA, BVS, SBUX US, IEU)

Today is the last day of the financial year and amazingly we’re already halfway through 2020, there’s nothing like a pandemic led crash to make time fly! Yesterday saw the ASX200 fall -1.5% as fears of a major second wave of COVID-19 rattled markets, but we felt local stocks put in a stellar performance under the circumstances:

1 – China has now sealed off a county of 400,000 people to quarantine the Beijing outbreak while in the US California metropolis LA has closed its bars after only just re-opening them.

2 – For the 4th consecutive day new cases in the US have surged by around 40,000 illustrating exactly why MM has been cautious of how the world’s largest economy is dealing with the virus.

3 – However as the world is recovering from the virus, in a patchy manner at best, equities remain strong with the US S&P500 still within striking distance of its all-time high leading many to believe a correction is inevitable.

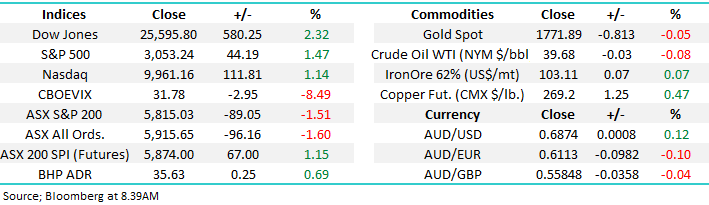

The 3-points above plus many others we could easily call on are implying MM is looking at stocks through rose coloured glasses but as we said yesterday – “don’t fight the tape”. The combined fire power of world’s major central banks / governments are on the proverbial bid pumping money into the system in a more aggressive manner than has been witnessed before in history – the chart below of M2 Money Supply illustrates how active the Fed has been in recent months. Also the key in our opinion is how the world is now dealing with the surging numbers of COVID-19, Tokyo has seen daily cases hit a record but there’s been no panic lockdown, governments are largely putting their economies first at this point in time. i.e this time around, there is more certainty about how to deal with the outbreaks, and markets appreciate an existing roadmap.

This leaves equity markets likely to remain fuelled by massive stimulus while the global economy and hence company earnings are starting to look more like a “U-shaped” recovery by the day but this now appears to be slowly built into stocks – overnight the Dow surged almost 600-points following some solid US housing data shrugging off COVID-19 worsening statistics like it was “old news”. It’s very important to remember that a market which can rally / hold on bad news is a strong market whose path of least resistance is up.

MM still remains overall bullish equities medium-term.

M2 Money Supply Monthly Chart

Yesterday saw well over 80% of the ASX200 fall on a clearly tough day with only a few pockets of “safety stocks” enjoying any degree of support, as we implied earlier MM feels local equities are slowly regaining strength for another rally above the psychological 6000 area. Interestingly today with current elevated levels of volatility we might not see the usual EOFY shenanigans today, but you never know, there can be a lot of motivation for people to tweak portfolios on June 30th. I’m starting to rapidly evolve my market view to a more bullish stance which I can imagine will scare / surprise a number of readers, the chart below illustrates my thinking, remember that markets regularly move in a rhythm which repeats itself:

1 – The ASX200 corrected 463-points in April and 479-points in June, extremely similar pullbacks.

2 – The local market then proceeded to track sideways for a few weeks, absorbing bad news as it meandered along, before popping higher in May as underweight fund managers became impatient.

My preferred scenario is we will now see a move above 6200 in the coming few months as FOMO (fear of missing out) again takes hold before stocks might become extended and subsequently more capable of a meaningful pullback.

MM still remains overall bullish equities medium-term.

A number of stocks that MM is watching carefully with a view to accumulation / fresh buying were sold-off in the last few days hence taking our more bullish view into account MM is considering pressing the “buy button” today.

ASX200 Index Chart

Two major growth indicators remain strong?

Reasonable global growth is critical to some parts of the ASX, such as the resources sector, and the message we are receiving from some key markets is still positive on this front.

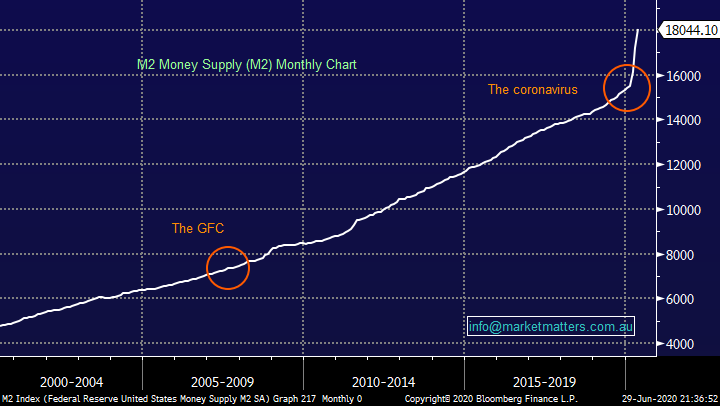

Copper

Historically copper has often been regarded as a great indicator of future economic activity and at this stage the industrial metal is showing no signs that secondary outbreaks of COVID-19 are going to put a meaningful dent in the world’s economic recovery. Commodities like copper are generally driven far more by good old fashioned supply & demand, as opposed to news flashes, with the current picture telling us all’s well with the Chinese & global economic engines getting back to work – MM can see a test of 2020 highs in the months ahead for copper, pretty amazing performance under the circumstances – our core view here is one of the reasons MM is letting our OZ Minerals (OZL) position run, as opposed to grabbing a quick profit.

MM remains bullish the reflation trade.

Copper Futures ($US/lb) Chart

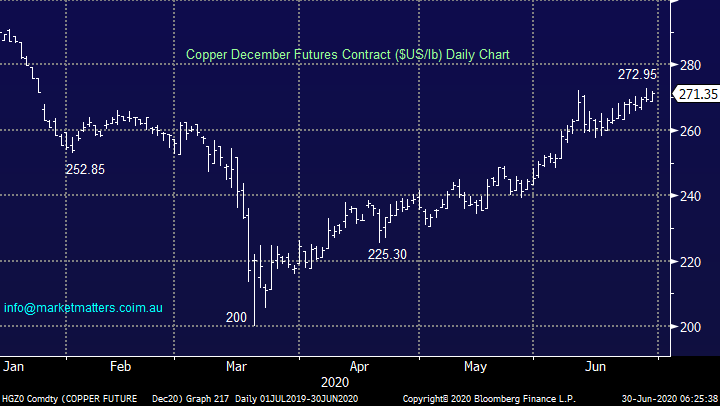

Australian Dollar ($A)

The little “Aussie Battler” is another classic quasi trade / position for global growth and the local currency which has been highly correlated to the ASX200 of late is like the S&P500 almost positive for 2020. One of MM’s core macro views for 2020 / 2021 is the $A will head back towards 80c against the $US and we feel comfortable with this call considering the $A hasn’t fallen this year despite having the kitchen sink thrown at it from a growth perspective.

MM remains bullish both the $A and ASX200.

ASX200 v $A Chart

Global Markets.

Overnight the US S&P500 returned back to its 2020 playbook by shrugging off virus worries and bouncing strongly overnight, its exactly why MM believes investors should not be selling weakness. We have been patiently watching 2 potential scenarios, while ignoring the noise in between:

1 – we are correcting the whole advance from the March 23rd low with our ideal target below 2900.

2 – stocks will again shrug off coronavirus fears and were heading ~10% higher before MM will consider reducing risk / market exposure.

At this stage the former looks more likely for the S&P500 but if you looked at the tech based NASDAQ you might find it hard to be anything except bullish. Considering we’ve moved more towards the bullish corner short-term for the ASX if this proves correct the likelihood is the US will follow suit and cashed up buyers waiting to buy the market cheaper will remain unsatisfied.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

MM is looking to move up the “risk curve”.

We have stuck to our “buy weakness and sell strength” mantra for a while with the key underlying theme being we’re bullish through 2020 / 2021 hence as we’ve now tweaked our interpretation of the local market MM is comfortable increasing our exposure to local stocks with the candidates below most likely to be in our alerts.

Growth Portfolio.

We are still only holding 8.5% in cash hence as we run a real money portfolio which cannot just “buy” every stock in town, it’s now a matter of 1-2 specific targets: https://www.marketmatters.com.au/new-portfolio-csv/

1 – Western Areas (WSA) $2.60.

MM has talked about pure nickel play Western Areas (WSA) a number of times of late, it’s both a stock and sector we like. Some positive drilling results at the South Australian Western Gawler Project got the ball rolling on the upside last week plus I feel the markets now got the bit between its teeth for the sector – even the papers are picking up on things.

MM likes WSA at current levels.

Western Areas (WSA) Chart

2 Bravura Solutions (BVS) $4.31.

Wealth management software company BVS has struggled a touch over the last 12-months but earnings growth is solid which should be ongoing following acquisitions which also gives the company some diversification. Working day in / day out in the wealth management / portfolio management space tells me that demand for technology is set to grow, the complexity around remote working under a growing regulatory regime will naturally find its solution in technology, and BVS are well positioned to capitalise.

MM likes BVS at current levels.

Bravura Solutions (BVS) Chart

International Portfolio.

We are holding 10% cash in this portfolio, we have one candidate that’s standing head and shoulders above the rest as an ideal fit for our current portfolio: https://www.marketmatters.com.au/new-international-portfolio/

Starbucks Corp (SBUX US) $US75.49

On this one we agree with Hamish Douglass from Magellan, before the coronavirus SBUX were opening a store in China every 15-hours, that’s expansion! This is a great company to use as proxy for exposure to the growing Chinese middle class with 40% of its profit growth coming from China.

MM currently likes SBUX around $US70-75.

Starbucks Corp (SBUX US) Chart

Global Macro ETF Portfolio.

Lastly the MM Global Macro Portfolio which has 24% in cash affording a little extra flexibility : https://www.marketmatters.com.au/new-global-portfolio/

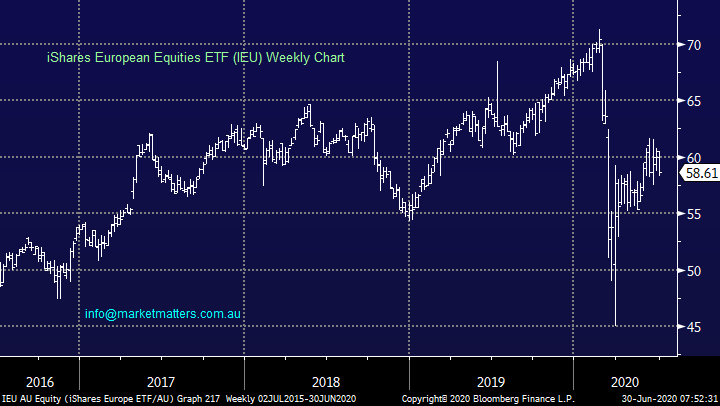

iShares European Equities ETF (IEU) $A58.61

MM believes it’s just a matter of time until European indices start playing some catch up with the US, to invest accordingly we like the local IEU ETF which has a current market cap around $530m.

MM now likes the IEU around current levels.

iShares European Equities ETF (IEU) Chart

Conclusion

MM remains a keen buyer of stocks with the above 3 / 4 on our potential shopping list.

*Watch for alerts.

Overnight Market Matters Wrap

- Better economic data underpinned US stocks overnight with renewed optimism supported by a record increase in pending home sales.

- On the global macroeconomic front, US-Sino relations are deteriorating after the US revoked Hong Kong’s special status as China looks to impose more draconian legislation on the city.

- Today, investors wait for the China PMI data, with our financial sector expected to outperform the broader market.

- The September SPI Futures is indicating the ASX 200 open 122 points higher, testing the 5940 level on the last session of the financial year.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.