2020 Outlook – 3 key macro drivers, 3 key sectors & 3 stocks we like now (OZL, SGM, 700 HK)

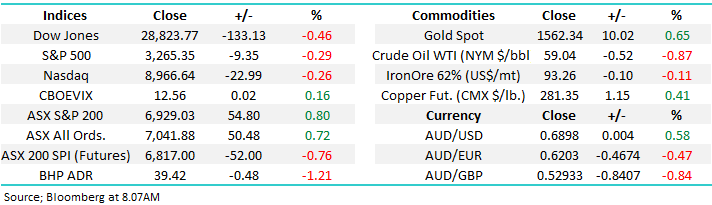

Happy New Year to everyone, unfortunately it’s started off almost incomprehensibly tough so far for many Australians, let’s hope and pray the worst is already behind us. Since our last note on the 24th December the ASX fell -125pts/-1.84% before rallying to make a new all-time high above 6900, closing Friday at 6929, up ~2% from Christmas Eve. As we often say, it’s hard to argue with the tape and for now stocks remain bullish.

This morning, SPI Futures are pricing in a pullback of ~50pts on open thanks to weakness in US markets on Friday.

ASX200 Chart

Today’s report looks to succinctly outline our current planned investment roadmap and reasoning for 2020. MM’s thought process has been segmented into 3 intertwined sections which will influence our decisions in 2020 until further notice.

1 - Top 3 Macro Economic Drivers for 2020 – last year over 20 central banks cut interest rates & / or implemented quantitative easing (QE), we ponder whether they will continue to provide a major tailwind for asset prices this year as Donald Trump faces an election in November.

2 - Top 3 Sector Calls for 2020 – the last 12-months witnessed great returns for the Healthcare and IT sectors while the Banks ignored much of the bullish backdrop with the ASX200 rallying over 18% before dividends.

3 - MM’s top 3 stock picks for 2020 - we take into account our 2 bigger picture outlook thesis’ and combine them with MM’s underlying company views to highlight 3 stocks we like right now. Last year we got 2 out of 3 right, picking Healthscope (HSO) which was taken over, Telstra (TLS) at $2.90, but we also named Costa Group (CGC) at $5. Let’s hope we go one better in 2020!

Firstly, a fond goodbye to calendar 2019, an excellent year for those brave enough to invest in equities, property and bonds which all rallied strongly, unfortunately many sat on the sidelines fearing unpredictable actions from the likes of Presidents Trump and Xi Jinping. The ASX200 was trading at all-time highs late last year as the psychological 7000 area looms large, an impressive performance considering we started the year well under 6000. Global indices outperformed Australia which once again was impacted by our influential banking sector being deservedly dragged through the regulatory mud, the MSCI Global World Index finished the year up 25% as the catchphrase “don’t fight the Fed” rang loud and clear.

Last year was pretty much one-way traffic with August’s 7% pullback the worst investors had to cope with but with the RBA slashing the Official Interest Rate in half from 1.5% to 0.75% stocks enjoyed plenty of support. To give some context around the influence of interest rates, on the 31st December 2018 the ASX 200 was trading on a Price to Earnings (P/E) ratio of 15.40x, however as central banks changed tact from expecting to raise rates, to cutting them, the P/E of the Australian market expanded to close the year at 19.76x. Earnings growth for the year was subdued, the rally in stocks was all about P/E expansion and that was caused by declining interest rates. It seems sensible to question whether or not 2020 will enjoy the same multiple expansion – we doubt it will.

While we are conscious that the 11-year bull market is late cycle, we remain bullish for Q1 of 2020 at least given the benign outlook for interest rates (lower for longer) with more stimulus also likely from central banks around the globe. While the market remains overall bullish, it will likely be a choppy year for stocks for a number of reasons. First and foremost, while rates will remain low, the tailwind from falling interest rates and expanding multiples is likely gone. Growth in stock prices then needs to come from growth in earnings, or at least the expectation that earnings growth will happen. If the bigger picture macro backdrop becomes less supportive than it was in 2019, and we think it will, then picking the right stocks within the right sectors will be hugely important in 2020. Again, we believe this isn’t a market to buy and hold as periods of excessive optimism and pessimism look likely to again surge through markets necessitating open minded investing while being prepared to sell strength and buy weakness, often what feels uncomfortable.

A great example of this has been illustrated by Australian gold stocks where the likes of Newcrest Mining (NCM) started the 2nd week of January over 20% below its August 19 high whereas gold itself is making fresh 7-year highs i.e. they got way ahead of themselves in 2019. Another example of remaining open minded has been the strong rally in growth stocks locally during 2019, where valuations have really been rendered meaningless as momentum clearly reigned supreme., however now, that momentum trade is starting to falter and valuations will at some point come back into focus.

While we are extremely excited by 2020 from both a markets perspective and from the internal developments taking place at Market Matters, lets first consider some of the highlights from the last six Market Matters annual outlook pieces and while obviously they are far from perfect there have been a number of the absolute gems amongst our calls.

2014 - We were unpopular, but correct, when we called BHP down to $20 when it was at $34 plus Woolworths to $25 when it was closer to $34.

2015 - Our favourite 3 stocks were RRL at $2.32 which rallied over 80%, Challenger at $8.05 which rallied 75% and Telstra (TLS) at $5 which then rallied 17% a nice trifecta.

2016 - We suggested this was the year to reconsider resources after they had an awful 2015, a perfect call with heavyweight BHP rallying 40%. Overall 25 of our 35 alerts (70%) were profitable in a year when the ASX200 rallied only 7%.

2017 - We targeted over 6000 for the ASX200 and 2400 for the S&P when many market players continually focused on likely pullbacks – although we did underestimate the strength in the US marginally! We stayed long all year and simply pushed back our call of a 25% correction to commence in 2018. For the first time since the 1980's we felt interest rates were headed higher globally and they did. Plus, we felt Australian house prices and particularly apartment prices would plateau / decline, and importantly would not ‘crash’, this has certainly started to unfold in most parts of Australia – time will tell about the crash part of the call.

2018 – We had a different view to the market for three major market consensus calls in January 2018. The market was bearish the $US and while we agreed in the short term our view that the US currency would actually end up for the year proved correct. Going into 2018, the market was very bullish Australian stocks following a strong end to 2017, we felt differently forecasting a choppy year with a negative bias overall. Commodities were in focus at the end of 2017 with the market extremely bullish thanks to an expectation of coordinated global growth. We agreed with that call overall however warned that resources will have a choppy advance and weakness, not strength, should be bought. BHP traded in a 25% range through the year highlighting that volatility.

2019 – Our 2019 Outlook piece isn’t one for the highlights reel, with our underlying outlook for a choppy year with a negative bias, as opposed to the runaway train which investors enjoyed. At the time the note was penned, central banks led by the US Federal were primed to hike rates and that had us more cautious on stocks. As Mike Tyson once said, everyone has a plan until they get punched in the mouth! Fortunately, we always try to remain open-minded / flexible with our views & investments and once we saw global central banks commence cutting interest rates and in many cases re-engage QE we became far more bullish ultimately enjoying a strong year across our portfolios. 2019 also reaffirmed our firm view that while making predictions can provide interesting reading and are useful to frame ones thinking, markets are fluid and as investors we need to recognise this and adapt along with the changing market dynamics.

Importantly, predications mean very little unless they translate into investment returns, and 2019 certainly delivered on this front. While it wasn’t the type of market that generally lends itself to strong relative returns for an active strategy such as ours, the Market Matters Portfolio’s performed admirably given our more conservative stance around holding higher cash along with portfolio hedges at times in our flagship Growth Portfolio. Returns before costs for our published portfolios for the period between 01/01/2019 to 31/12/2019 were as follows:

Market Matters Growth Portfolio: +25.58%

Market Matters Income Portfolio: +13.65%

In July we added to our two existing published portfolios with two new internationally focussed portfolio’s, one focussed on international equities and the other showcasing our bigger picture macro calls through a global ETF portfolio. Returns since the inception date of 1st July 2019 to 31st December 2019 are shown below:

Market Matters International Equities Portfolio: +9.72%

Market Matters Global ETF Portfolio: +3.55%

**Importantly, past performance may not be a reliable indicator of future performance**

1 MM’s Top 3 Macro Economic Drivers for 2020

Our view remains that a number of major inflexion points ‘showed their hand’ in 2019 and that 2020 will see the continuation of some of these major trend changes, particularly in three key areas of Currencies, Commodities & Interest Rates. Stocks have started believing these changes in trend to a degree however in many cases we think there remains a significant amount of $$ on the table.

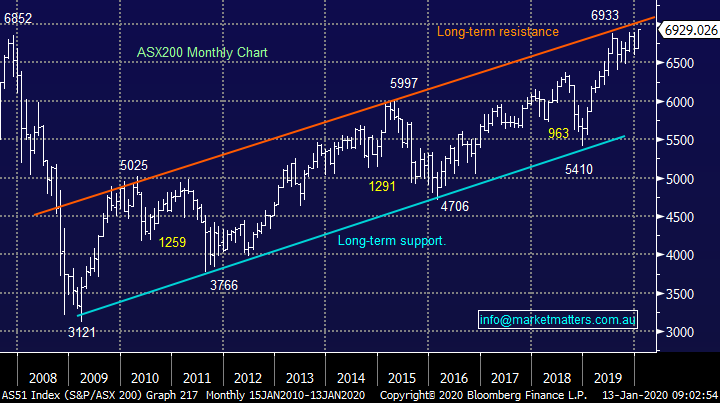

As we said earlier, we are bullish equities in 2020 but volatility looks likely to be elevated – the US & Iran have kicked this trend off already. Ultimately, we initially see 6-10% more upside by US stocks as the small cap Russell 2000 Index plays catch up with its big brother S&P500 and NASDAQ. Smaller stocks in the US have underperformed their larger counterparts in four of the last five years which is very rare. Normally smaller cap stocks outperform their larger counterparts over time, compensation for their higher risk profile. This is one bigger picture trend we are conscious of as we work into 2020.

US Russell 2000 Chart

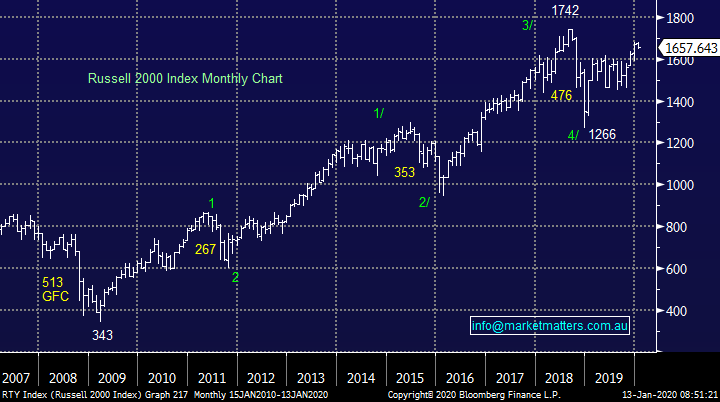

(1) – Currencies: The $US to fall, the Pound is undervalued & the Australian Dollar is set to rally

Markets are global and currencies are very important. The $A is largely driven by interest rate differentials amongst other factors, but it’s the positioning around the $A which makes the local currency a fascinating subject to us at the moment – we believe investors are positioned for a lower for longer $A implying the more aggressive move could happen on the upside.

We have a contrarian bullish opinion on the $A, which if correct will remove the major earnings tailwind that has been helping Australian companies with significant $US earnings.

Our view is primarily driven by a bearish outlook for the $US which we believe has reached a major point of inflection after a decade-long rally since the GFC. As we approach the November 2020 election in the US, the President will likely pull all stops for re-election and applying pressure on the currency in various ways would be very supportive of economic growth. While the Federal Reserve cut rates in October, Chairman Powell made it very clear that any rate hikes will be conditional upon a marked and sustained uptick in inflation while they will cut again if economic conditions warrant it.

US Dollar Index (DXY) Chart

Historically, it's extremely rare to see Australian 10-year bond yields below their American counterparts but that’s very much the case today, a huge contributing factor to the prolonged bear market for the $A. If we are correct and Australian bond yields again converge and eventually go above their US equivalent, as has been the norm for the past 50-years, it’s easy to envisage the $A back up around 80c.

Australian & US 10-year Bond Yields Chart

MM is bullish the $AU versus the $US ultimately targeting the 80c region.

Australian Dollar vs US Dollar Chart

Finally, as the fog lifts around the future of the UK following 3 years of BREXIT uncertainty, the Pound remains cheap in our view relative to the $US. UK Equities have been major laggards in recent years and from a global perspective, could play catch up with other markets, and performance would be improved via a rally in the currency.

MM is bullish the GBP

British Pound vs US Dollar Chart

(2) – Resources & Inflation to rally

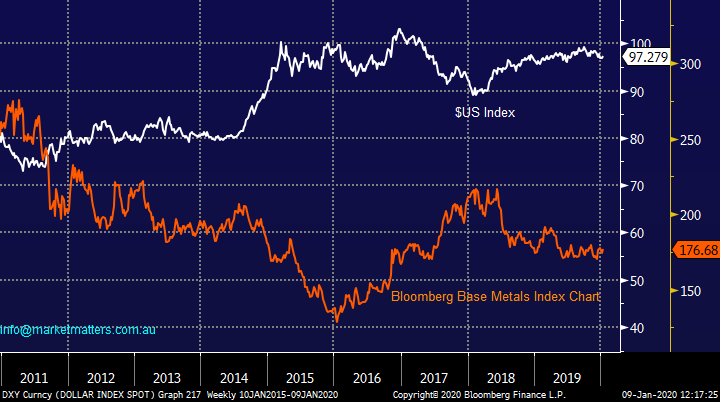

The chart below illustrates over the last few years the clear inverse correlation between the $US and Base Metals, if our opinion is correct on the $US then we believe there’s a strong likelihood that the resource sector will outperform in 2020.

The $US Index & Bloomberg Base Metals Index Chart

Inflation is also key in this equation. After a decade of low interest rates, substantial amounts of unconventional monetary policy (money printing) and global growth numbers that imply interest rates should be higher (global growth currently forecast to be 3.4%% while US rates are just 1.50%-1.75%) there lies a real risk of inflation resurfacing.

We ponder if the Fed will get behind the curve of this reflation rally because of likely political pressure from President Trump leading into an election. While this is more a 2021 concern it’s certainly a risk factor to consider, rising inflation usually puts bull markets to sleep.

Ultimately, with global growth solid at a time when central banks seem reluctant to tighten policy, and could even loosen further, we believe that base metals and inflation are set to rally in 2020 with our initial target for economic bell weather copper ~10% higher. Other base metals like nickel are yet to get excited but we feel they will eventually join the party.

MM Is bullish resources in 2020

Copper Chart

(3) - Bond yields are looking for a low

All good things must come to an end and after over 30 years of declining interest rates culminating in negative real interest rates across much of the globe we feel global bond yields are now ‘looking for a low’ and in some cases they may have already reached the important milestone.

One of the main reasons for the drop in bond yields during 2019 was fear of a recession in the US as manufacturing activity dropped and tariffs hurt the growth outlook. That, along with Trumps influence prompted the US Fed to cut rates. The Fed have now made it very clear they are on hold for the foreseeable future and given the backdrop of likely spending during an election year, along with a resolution around China – US trade, it’s easy to comprehend that US 10 year yields for example could trade up towards 2.5%, not a huge advance in absolute terms however it would represent a ~30% increase in yields.

As bond yields rise, P/E’s should contract creating a headwind for equities in general, however certain sectors are more hurt by this theme than others.

MM believes US interest rates have seen their low

US 10-year Bond Yield Chart

2 - Top 3 Sector Calls for 2020

Following on from our macro views our sector preferences contain no great surprises, and we’ve already started to skew our portfolios towards these themes.

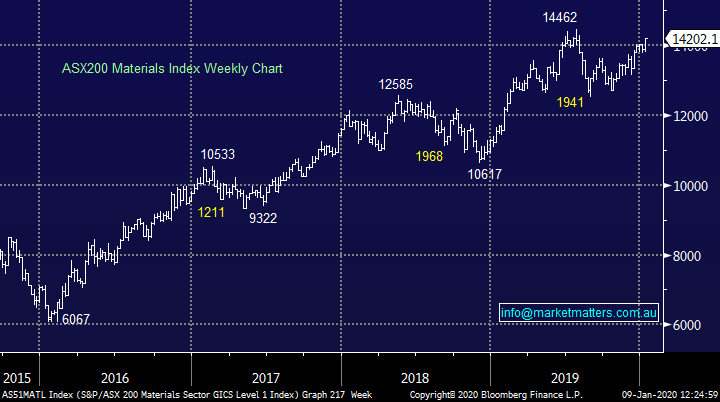

(1) – Materials / Resources Sector to make fresh multi-year highs

Generally, 2019 was a year of very limited supply growth across the spectrum of commodities, and in some cases like Iron Ore, supply was significantly curtailed. Lower demand given weaker manufacturing activity thanks to the trade war meant prices were mostly stable overall, however if trade tensions are resolved and manufacturing rebounds, the lack of recent development will start to impact prices, which should be bullish.

Given our positive views around base metal prices led by Copper rallying in 2020 we are anticipating further strength in the local & international materials / resources sector. This also bodes well for the areas of the market that service them (industrial stocks that sell products / services to the resource sector).

MM is bullish the Resources / Materials Index in 2020.

ASX200 Materials Index Chart

(2) – US banks & yields to drag counterparts higher

As painful as this sector has been for local investors in recent years (us included) we like the banking sector at current levels. The regulatory impost has garnered most of the attention locally and this led to the banks being the weakest sector of 2019. Higher capital requirements & massive fines have been a major impost however looking forward, what really matters for bank earnings is the growth in written loans and the margin achieved on those loans, and the outlook here is showing some cause for optimism.

As an aside, it’s also worth remembering that new technology will continue to reduce the cost base of banks allowing them to prune branch networks and take advantage of new digital platforms to bring big benefits to their retail customers.

Looking overseas, US banks have soared over the last decade and if we are correct that bond yields are poised to increase, they will finally enjoy the tailwind of increasing rates which are good for banks operating margins. Again, looking globally, bank profit margins have started to improve, and this is a trend that could well find its way to our shore’s.

We think the bank sector globally is due for a catch-up in 2020 and this will drag the local banks higher.

MM is bullish Banks from current levels

US S&P500 Banking Index Chart

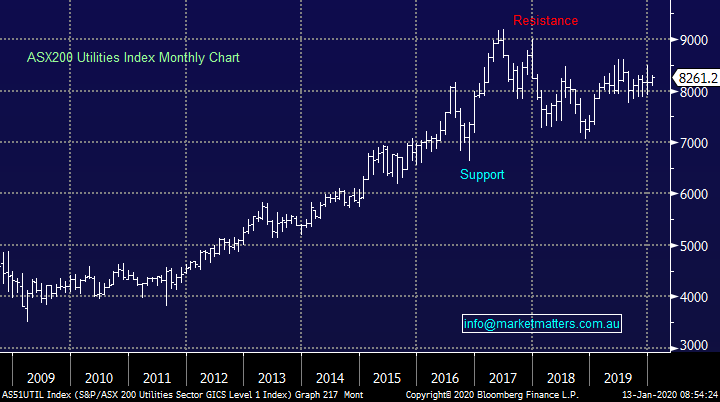

(3) – Avoid yield sensitive sectors

Yield sensitive sectors are those with bond like characteristics and in recent years we’ve seen money that would have generally been allocated to fixed interest find its way into defensive ‘yield’ equities instead. This makes total sense as bond yields plumbed record lows essentially forcing investors up the risk spectrum. If bond yields have bottomed, and we are getting more convinced they have, then higher yields in bonds will attract some of the money forced into equities back into bonds and sectors like utilities will start to underperform.

Importantly, while we are not suggesting a significant move higher in bond yields (drop in bond prices), any pullback in bond prices could be amplified in the equity prices of the ‘bond proxy’ sectors.

At current levels we believe yield sensitive sectors like the Utilities Index are in a holding pattern that should be treated like a classic trading range.

MM is a seller of Utilities 15% higher and buyers 15% lower – i.e. may take a while for us to have interest here.

ASX200 Utilities index Chart

3 - MM’s top 3 stock picks for 2020

The below 3 stocks have been chosen to dovetail with our bigger picture view for market sectors and underlying thoughts around the individual companies. It’s important to recognise that picking three stocks is fraught with danger and taking a portfolio approach has a lot higher probability of delivering a better investment outcome.

(1) – OZ Minerals (OZL) $10.76

Given our positive outlook for Copper, no 1 local copper company Oz Minerals (OZL) looks poised for further gains. Sandfire Resources (SFR) is also worth a mention in this context however from an operational perspective, OZL are superior operators, albeit less leveraged from current levels.

We remain bullish copper producer OZL initially targeting the $12 area.

MM is bullish OZL initially looking for ~15% upside.

OZ Minerals (OZL) Chart

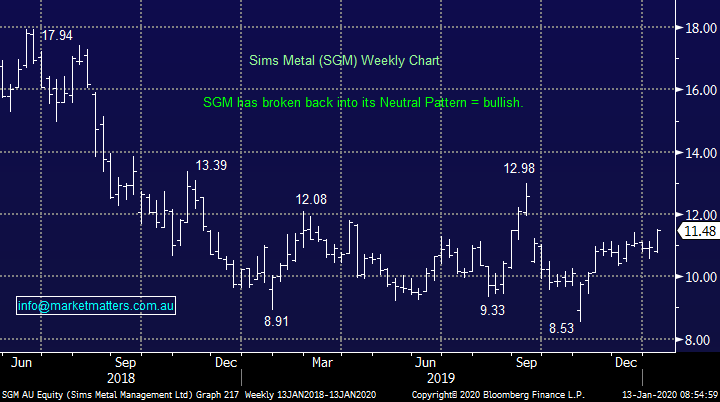

(2) – Sims Metals (SGM) $11.48

As global growth hits a sweet spot in 2020 relative to current interest rate settings, scrap metal business Sims (SGM) can rally strongly from a low base. 2019 was clearly a tough year for the business with trade tensions putting pressure on scrap prices however we are becoming more optimistic on SGM at this juncture. This is the sort of stock that could do very well in the year ahead.

We remain bullish metal recycler SGM initially targeting the $13 area.

MM is bullish SGM initially looking for ~15% upside.

Sims Metals (SGM) Chart

(3) – Tencent (700 HK) HK398.60

Tencent is a global technology goliath involved in gaming, social media, venture capital and other technology-based operations with significant exposure to the changing dynamics of the Chinese population and growth of the middle class.

Under the changing dynamics set out above, the outlook for emerging markets into 2020 is improving and we expect emerging market equities to outperform developed market equities in the year ahead.

One of our favourite stocks in the region is China based Tencent.

MM is bullish Tencent looking for fresh all-time highs.

Tencent (700 HK) Chart

Conclusion

2020 is setting up to be a big year in markets given the chance for major trend changes across many critical asset classes. Currencies remain important in this interconnected world and our non-consensus calls remain:

Bearish the $US while bullish the $AU & British Pound

At a sector level, our main bullish tilt is towards the materials / resource sector and their associated suppliers, while the global banking space looks positive. This provides a positive tailwind for our own banks into 2020. We are neutral / cautious on interest rate sensitive areas of the market like utilities

As always, picking the right stocks remains the key it’s also important to recognise that avoiding too many of the big losers is equally important. While we have identified three stocks we can buy now, the reality is managing a portfolio of stocks in an active way over a period of time will yield the best results.

We’ll continue to remain active in our portfolios, increasing cash when prudent while we also expect to have some ‘short exposure’ at times throughout the year given the increasing maturity of this bull market.

We hope you found our thoughts and predictions thought provoking for the year ahead. As always, we’ll continue to pen our daily notes to subscribers, manage our portfolios of shares and importantly, present our views in the usual straight-talking Market Matters way.

Overnight Market Matters Wrap

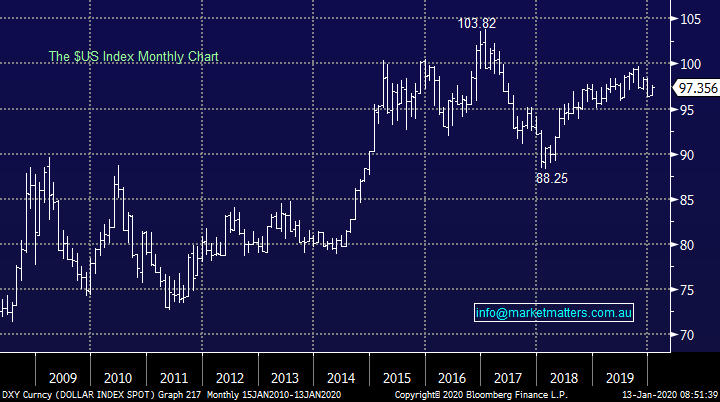

- After hitting record highs earlier in the week, the US closed lower last Friday following weaker than expected employment and wage growth data.

- On the commodities front, crude oil slipt little, while the ‘safe haven’ asset gold gained as global macroeconomic fear lingers around investors’ minds. Hong Kong faces a tapered kitty of funding liquidity, while domestically a range of AUD/USD was sold via options worth an accumulated notional value of close to $2bn – a big bet on a range bound market for the currency however it also means if the range is broken, bigger moves could eventuate.

- BHP is expected to underperform the broader market after ending its US session off an equivalent of 1.21% from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to open 45 points lower, testing the 6885 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.