2 sleeps until Christmas

Happy Christmas everybody!

We will be closed until the 9th of January, but if there are any significant market moves, we will still publish reports and importantly, alerts will still be sent if we trade on the MM portfolio which currently feels highly likely.

The local market yesterday again continued with its seasonal strength, rallying 30-points to close at another fresh high for 2016. In the previous Morning Report, we looked at the statistics for the next few trading days since the GFC and they were a very powerful / bullish set of numbers:

- The ASX200 has rallied 75% of the time over this period.

- The ASX200 has gained on average 77-points over this period.

- The ASX200 has gained on average 1.6% over this period.

The conclusion to us was easy, for the next week or so investors / traders should be long, or out. We remain comfortable with our current position of significant market exposure, but looking to sell into further strength.

We continue to target ~5700 into 2017.

A few subscribers have wondered if we are bearish the market right from the outset of 2018 and the simple answer is "not yet". The MM portfolio has been aggressively long during recent market volatility that scarred many seasoned / famous investors into hibernation. We now simply want to lock in some of these gains and sit back and observe how the start of 2018 unfolds.

When we look at the statistics for January since the GFC, in a similar manner to above the results are relatively inconclusive:

- Since the market in 2009, the ASX200 has been up 50% of the time in January and unchanged once.

- The net change for the month of January has been negative 159-points.

Overall our interpretation is slightly negative, considering the last seven years has been an impressive bull market.

ASX200 Weekly Chart

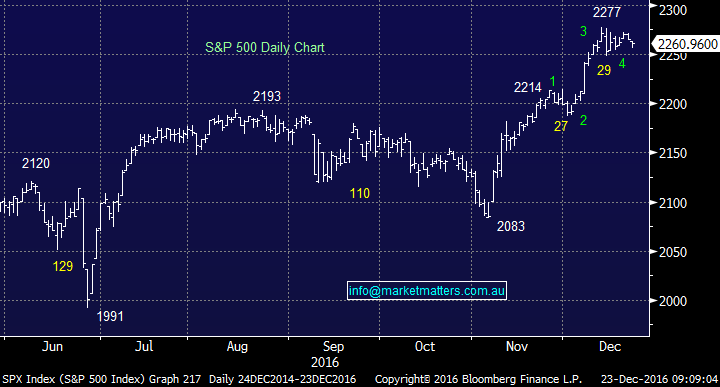

The US market continues to hold firm and we are still targeting around 2% higher into 2017.

US S&P500 Daily Chart

This morning we have again listed the stocks within the MM portfolio, which are approaching our ideal sell levels, while hopefully not giving them "the kiss of death":

VTG - Looking to take profit ~$3.40.

WFD - Looking to take profit ~$9.50.

TCL - Looking to take profit ~$10.80.

MQG - Looking to take profit ~$90.

WBC - We are looking to take profit ~$33, but we may do this in two sell downs of 5%.

Summary

No change, we remain short-term bullish stocks, but are still planning to reduce exposure during the end of December.

* Please watch for alerts.

Overnight Market Matters Wrap

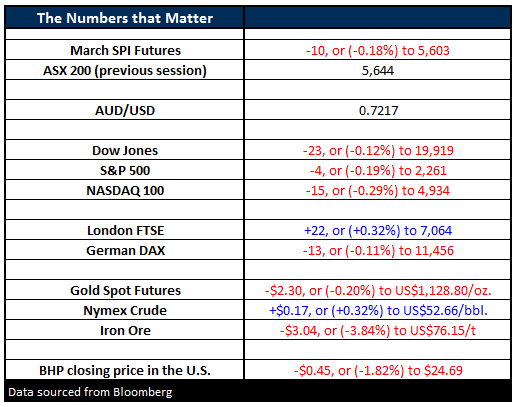

- The US share markets closed marginally lower in a quiet session, ahead of the festive season.

- The Dow closed 23 points lower (-0.12%), at 19,919, while the broader S&P 500 closed 4 points lower (-0.19%) at 2,261.

- The major miners are expected to underperform against the ASX 200 with BHP in the US closing an equivalent of -1.83% to $24.69 from Australia’s previous close.

- A quiet session remains to be expected in the ASX200 today, with the March SPI Futures indicating a ~15 point jump from the gates this morning, testing the 5,660 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/12/2016. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here