How to play gold at these elevated levels

**This is an extract from the Market Matters Morning Report from 19 July. Click here to get access to the full report and more

I’m currently reading a book from the famous investor Ray Dalio called Principles – a good book and I intend to buy a copy for each member of the team. Overnight I also read an interesting article in the AFR written about Dalio’s thoughts on investing in the years ahead, he feels gold may be the key, especially when we see a reflation environment combined with more than a few economic headaches that will need controlling.

"I believe that it would be both risk-reducing and return-enhancing to consider adding gold to one's portfolio," – Ray Dalio, Bridgewater & Associates.

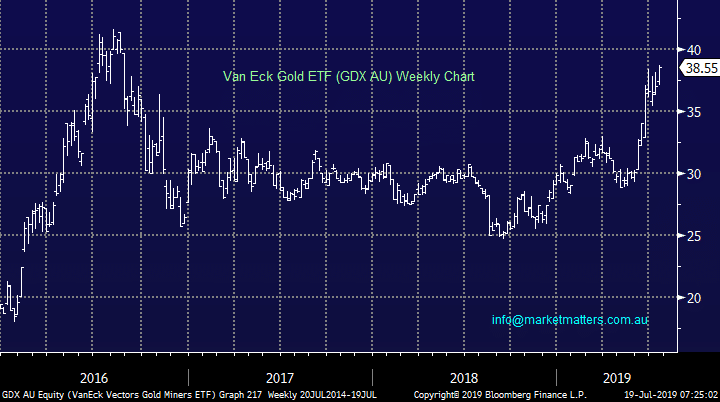

We agree with the famous US investor on this one and MM has been bullish gold throughout 2019, arguably my favourite position across our 4 MM Portfolios is the Van Eck GDX ETF which resides in our new ETF Portfolio: https://www.marketmatters.com.au/new-global-portfolio/

If we are correct this ETF is very bullish, initially targeting at least 20% upside while importantly not being meaningfully exposed to any resurgence in the $A. The ETF tracks the NYSE (New York Stock Exchange) Arca Gold Miners Index hence gaining exposure to gold miners across the globe with the largest weighting to those in north America, principally Canada.

GDX ETF description https://www.vaneck.com.au/funds/gdx/snapshot/

MM remains very bullish the GDX ETF initially targeting ~20% upside.

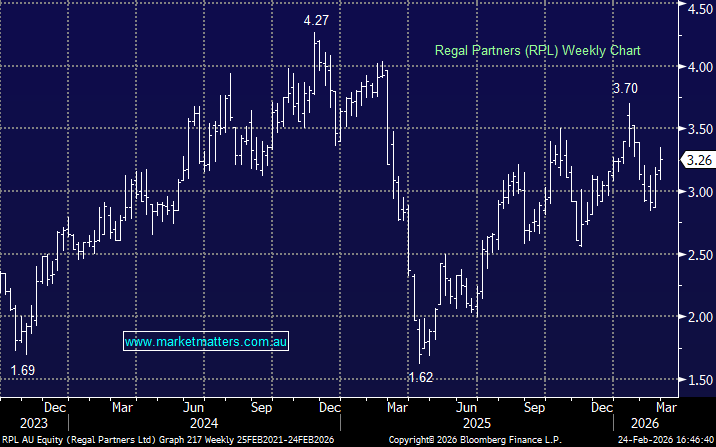

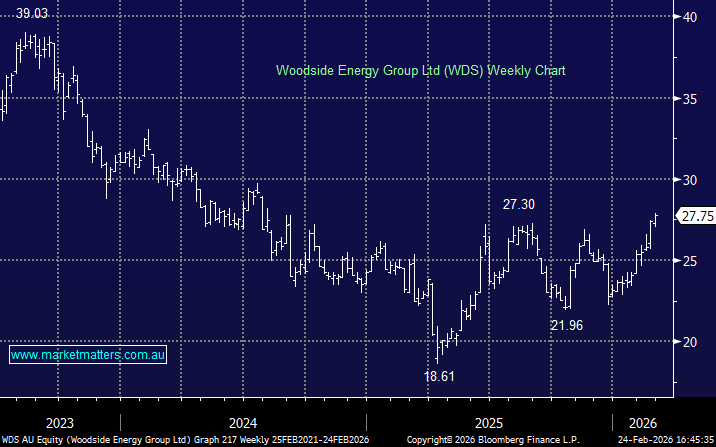

Market Vectors (GDX) Chart

At MM one of our core macro views is that the “little Aussie battler” either has, or is looking for, a major low with the next meaningful move a rally towards 80c i.e. a contrarian view that we are also positioned for in our ETF portfolio.

We feel this FX view has a very important impact on how Australians should consider investing in the rising gold price as we move towards 2020.

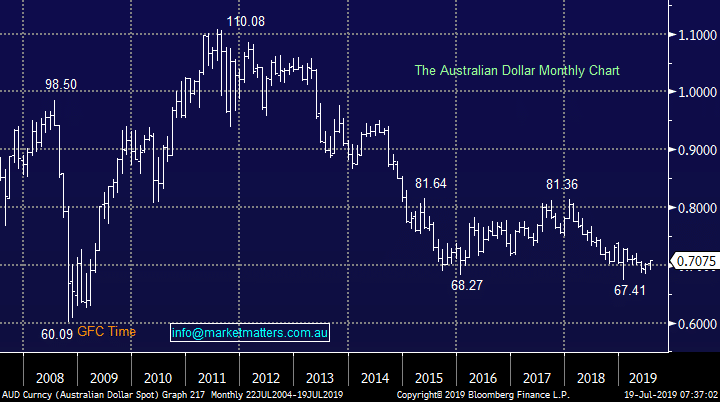

Australian Dollar ($A) Chart

At MM one of our core macro views is that the “little Aussie battler” either has, or is looking for, a major low with the next meaningful move a rally towards 80c i.e. a contrarian view that we are also positioned for in our ETF portfolio.

We feel this FX view has a very important impact on how Australians should consider investing in the rising gold price as we move towards 2020.

Australian Dollar ($A) Chart