How long will we hold 6000 this time? (GXY, S32, SEK)

WHAT MATTERED TODAY

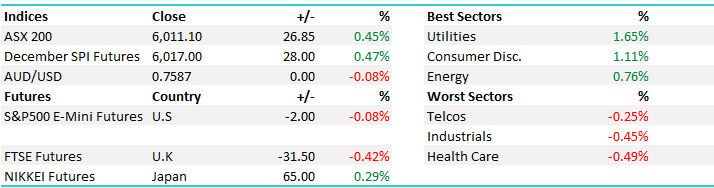

The tune has yet to change with the pattern of investors happy to bid up stocks fairly strongly in early trade, finally breaking the 6000 level, before some selling eventuated after North Korea announced its nuclear program is now complete and that its intercontinental ballistic missile could now reach the US. At this stage, it has brought some interest to the market with the ASX200 losing ~15 points after the announcement. Despite this, the 6000 level was held, and today represented the biggest move by the market in 5 trading days, despite moving less than 0.5%.

With just one day left in November, the seasonal weakness has failed to play out, adding around 1.7% for the month so far. IT and energy have been the most supportive sectors this month, while, as expected, financials lagged on the back of some healthy dividends being paid for 3 of the big 4 banks.

On the mkt today, most buying remained focused in the Utilities sector, led by AGL continuing its strong run, while the Industrials underperformed. – A range on the mkt today of +/- 47 points, a high of 6031, a low of 5984 and a close of 6011, up +26pts or +0.45%.

ASX 200 Intraday Chart

ASX 200 Daily Chart

TOP MOVERS

1. Galaxy Resources (GXY) – today GXY signed a long term offtake agreement we multiple clients, helping the company add 6.96% to close at $3.90. The gold and lithium company is up around 50% this financial year and over 3000% from its lows in 2015, now targeting fresh highs above $4.08. We have spoken a lot about lithium and it’s risks and today’s move by GXY is a smart play to de-risk the business.

Galaxy Resources (GXY) Daily Chart

2. South32 (S32) – rallied about 1% higher to $3.35 as investors welcomed its AGM today. S32 is currently trading a p/e multiple of 11.96x with today’s trading volume on par with its 20-day average. Watch for this space, as most of analysts’ consensus has either a hold or sell recommendation with a short interest of around 83 million shares (3 average days needed to buy back this short position). With short interest so large, any positive news flow will see a sizable move in the price.

South32 (S32) Daily Chart

3. Seek (SEK) – the biggest loser in the top 200 index today, SEK fell 3.6%, giving back some of the strong rally it commenced in October. The fall came after re-confirming guidance at today’s AGM which fell short of expectations as many were predicting upgrades. The stock did briefly make all-time highs above $19 in the mornings trade before a significant reversal in fortunes saw the it close almost 6% from its intraday high. On a PE of 30x, this is a classic example of the market asking a lot in terms of performance and it appears reconfirming guidance is not good enough.

Seek (SEK) Monthly Chart

OUR CALLS

We made some moves today in the Income Portfolio, trading more than 15% of the portfolio, repositioning the portfolio back in favour of rising interest rates which we believe to be under-estimated by the market. Moving away from retail and property by selling AP Eagers and Centuria, and into the financials space by adding Perpetual and up-weighting NAB. Read more about our Income Portfolio moves here.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/11/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Wednesday or Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/11/2017. 4.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here