How does our interest rate view impact our market outlook?

**This is an extract from the Market Matters Weekend Report from 21 July. Click here to get access to the full report and more

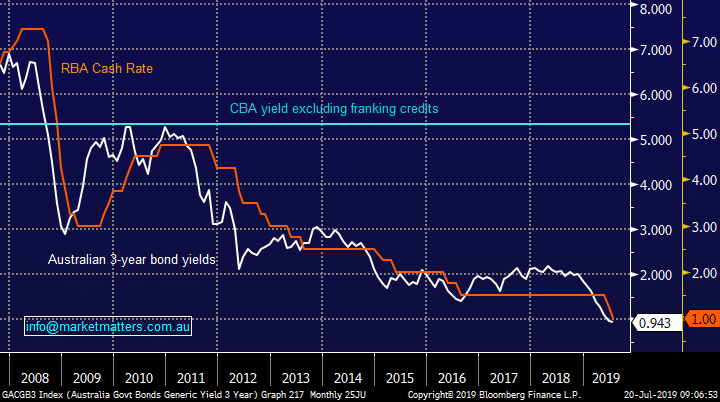

In our opinion today’s market is all about interest rates, if they stay where they are we believe stocks are cheap, let alone if they actually fall further as many predict. Hence our almost fixation with bond markets at this stage of the economic and market cycle. Both Australian 3-year bond yields and the RBA cash rate have halved since the ASX200 corrected well over 20% in 2015/6, producing a subsequent huge positive tailwind for asset prices, including equities.

MM are not convinced of a 3rd rate cut in Australia this year but we do believe the downward trend by bond yields is intact.

Moving forward interest rates can go up, down or sideways with 2 out of 3 good news for stocks but with 3-year bond yields hovering below that of the RBA Cash Rate the implication is the RBA will cut again moving forward, importantly not raise. Local bond yields may have slowed their descent but we still feel the path of least resistance is down so we are not standing Infront of this train just yet. Although subscribers should remain cognisant of the 2 risks which we see evolving in the months ahead:

1 – Global equities tumbled in Q4 of 2018 due to concerns that the Fed would raise rates too far and push the US into a recession, Australian bond yields / interest rates were largely unmoved over the same period, once stocks get a “a bee in their bonnet” its best not to fight the tape. Its been a while since stocks have been sideswiped by a surprise event.

2 – Markets become concerned that central banks will not be able to prevent a recession, even with their combined attack of interest rates and QE.

Equities with sustainable yield remain arguably cheap with interest rates at current levels – term deposits are paying way under half of the average yield of the ASX200.

Comparative Australian interest rates / bond yields Chart