Healthscope (ASX:HSO) & Elders (ASX:ELD) ignite the market

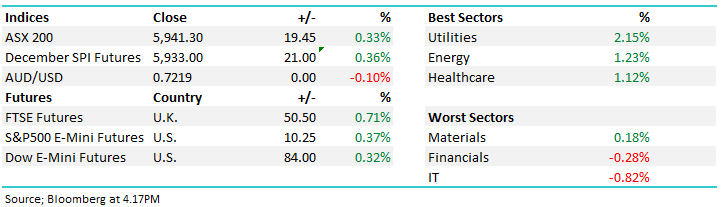

WHAT MATTERED TODAY

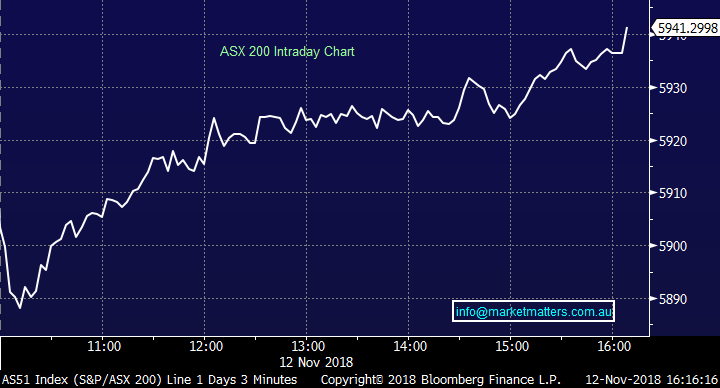

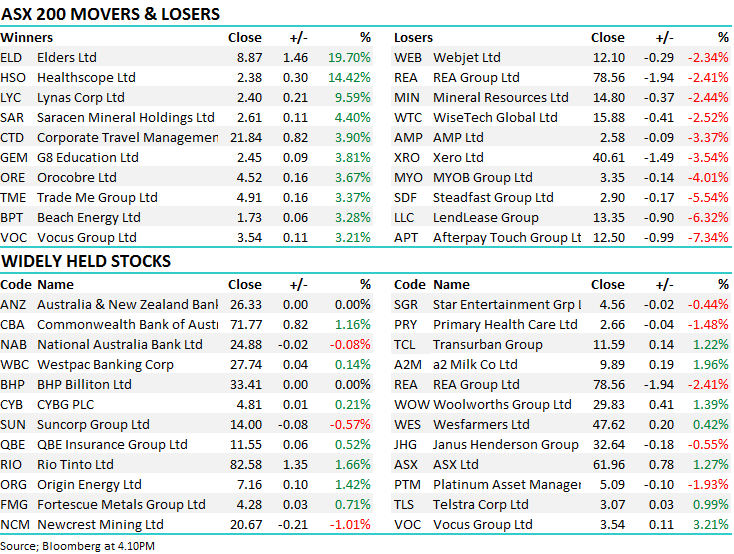

A bullish day for the local market with board based buying from early morning weakness – the market adding +57points from the 5884 low around 10.30am. This morning we wrote, it feels like this morning will be another test of the ASX200’s resolve with some major stocks trading ex-dividend over the next 48-hours plus some negative influences from overseas indices; the combination of ANZ / Macquarie today and Westpac on Tuesday going ex-dividend will take around 15-points from the index.

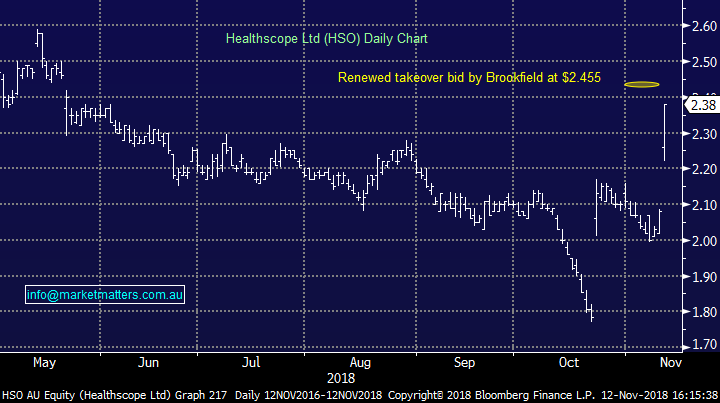

That resolve was tested early on however the bulls took control and pushed the market higher throughout the day – Commonwealth Bank (ASX:CBA) the driving force and the biggest positive influence on the index, accounting for nearly 5 index points on the ASX 200. Healthscope (ASX:HSO) was also in focus today after receiving another takeover tilt from Brookfield that has trumped the current BGH consortium bid which includes Australian Super. HSO now granting Brookfield exclusive access to the HSO books courtesy of the revised $2.455 offer – now over to BGH for a potential counter. We update our call on HSO below including the removal of our sell order that was placed today. We need to remain nimble here and will update our sell level as / when more information comes to light.

Interestingly, in the last hour of the SPI Futures trading session, more than 1/3rd of today's volume exchanged hands - over 10k contracts.

Overall, ASX 200 closed up +19.5pts or +0.33% at 5941. Dow Futures are currently up +80points or +0.30%

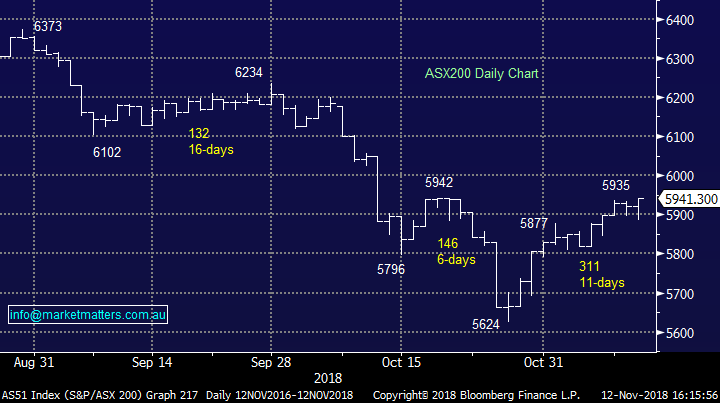

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Interesting comments regarding Lend Lease (LLC) this morning from Citi, saying the share price recovery is now largely dependent on divesting its engineering business “in one form or another.” They went on…We question how this division can get ‘back on track’ when it appears it hasn’t been on track in the first place”. The issue though, and a good industry contact highlighted this to me last week, how do you spin off an entity that continually loses money on projects? A spin off means scrutiny of the 'books’ and that might not be pretty! Realising the need to get rid of Engineering is the easy bit. It’s how to do it that which is the trick.

RATINGS CHANGES:

· G8 Education Upgraded to Buy at Canaccord; PT A$2.90

· Lendlease Downgraded to Neutral at Citi; PT A$15.06

· Primary Health Downgraded to Neutral at Citi; PT A$2.90

· Warehouse NZ Upgraded to Neutral at Forsyth Barr; PT NZ$2.16

· Lendlease Downgraded to Neutral at Macquarie; PT A$15.08

· Corporate Travel Upgraded to Buy at Bell Potter; PT A$26.80

· Charter Hall Downgraded to Sell at Goldman

· Immutep ADRs Rated New Buy at JonesTrading; PT $9

· Steadfast Downgraded to Neutral at JPMorgan; PT A$2.88

Healthscope (HSO) $2.38 / 14.42%; **UPDATED CALL**This morning HSO announced a competing bid from Brookfield at $2.42 plus a potential 3.5c dividend valuing the deal at $2.455. There is also a scheme of arrangement discussed which would equate to a value of $2.585 per share (inclusive of the 3.5c dividend). The scheme of arrangement is more complicated as it would provide shareholders with the option to receive all cash or to receive some of the consideration as shares in an unlisted company controlled by Brookfield that would own 100% of Healthscope.

As we suggested in the Alert sent today, the chances of a takeover occurring have now increased and today we moved our targeted sale price to be $2.40 or better given the deal is still subject to various conditions but is less onerous than the competing BGH bid. Given the fluid nature of this bid and 2 competing parties at play , we will work orders in HSO on a day only basis, updating if/when new information comes to light. For now we are cancelling the current sell limit of $2.40

Healthscope Chart (HSO) Chart

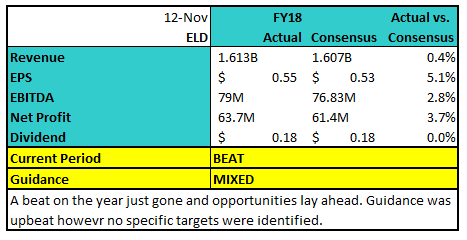

Elders (ELD) $8.87 / +19.7%; The agribusiness and real estate company was the best performer on the market today after delivering in the FY18 result announced today, beating current estimates across the board. Revenue grew, along with margins across most aspects of the business helping profit grow a solid 9% over FY18.

The stock has encountered a volatile year as sentiment deteriorated on fears the drought would impact activities as well as the glyphosate saga (that plagued Nufarm). Elders had been keen to update the market throughout the year reaffirming guidance in an attempt to allay the fears however the companies positivity wasn’t enough to offset the market’s downbeat attitude towards the sector - the stock had fallen over 20% from its May high’s to yesterday’s close.

In the outlook, Elders remain confident in the progress of the company since Mark Allison took over the CEO role in 2014. The result highlight’s the company’s ability to perform in drought times and will likely lead to a market re-rate.

Elders (ELD) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James/ Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

James Gerrish

Senior Investment Adviser

Level 15, 60 Castlereagh Street Sydney NSW 2000 Australia

T: +61 2 9238 1561 | M: +61 405 711 929 | F: +61 2 9232 1296 | [email protected]

www.shawandpartners.com.au | Follow us

From: James Gerrish

Sent: Monday, 12 November 2018 5:01 PM

To: Peter ([email protected]); Harrison Watt; Alexander Aguilan

Cc: Adam Sanders ([email protected]); Vanessa Chin ([email protected]); Denis Pipic ([email protected])

Subject: PM - Out ASAP - ALEX to upload

ASX grinds higher, Cross Counter wins the cup & RBA holds rates again

WHAT MATTERED TODAY

A bullish day for the local market with board based buying from early morning weakness – the market adding +57points from the 5884 low around 10.30am. This morning we wrote, it feels like this morning will be another test of the ASX200’s resolve with some major stocks trading ex-dividend over the next 48-hours plus some negative influences from overseas indices; the combination of ANZ / Macquarie today and Westpac on Tuesday going ex-dividend will take around 15-points from the index.

That resolve was tested early on however the bulls took control and pushed the market higher throughout the day – Commonwealth Bank (ASX:CBA) the driving force and the biggest positive influence on the index, accounting for nearly 5 index points on the ASX 200. Healthscope (ASX:HSO) was also in focus today after receiving another takeover tilt from Brookfield that has trumped the current BGH consortium bid which includes Australian Super. HSO now granting Brookfield exclusive access to the HSO books courtesy of the revised $2.455 offer – now over to BGH for a potential counter. We update our call on HSO below including the removal of our sell order that was placed today. We need to remain nimble here and will update our sell level as / when more information comes to light.

Interestingly, in the last hour of the SPI Futures trading session, more than 1/3rd of today's volume exchanged hands - over 10k contracts.

Overall, ASX 200 closed up +19.5pts or +0.33% at 5941. Dow Futures are currently up +80points or +0.30%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Interesting comments regarding Lend Lease (LLC) this morning from Citi, saying the share price recovery is now largely dependent on divesting its engineering business “in one form or another.” They went on…We question how this division can get ‘back on track’ when it appears it hasn’t been on track in the first place”. The issue though, and a good industry contact highlighted this to me last week, the problem however is, how do you spin off an entity that continually loses money on projects? A spin off means scrutiny of the “books’ and that might not be pretty! Realising the need to get rid of Engineering is the easy bit. It’s how to do it that which is the trick.

RATINGS CHANGES:

· G8 Education Upgraded to Buy at Canaccord; PT A$2.90

· Lendlease Downgraded to Neutral at Citi; PT A$15.06

· Primary Health Downgraded to Neutral at Citi; PT A$2.90

· Warehouse NZ Upgraded to Neutral at Forsyth Barr; PT NZ$2.16

· Lendlease Downgraded to Neutral at Macquarie; PT A$15.08

· Corporate Travel Upgraded to Buy at Bell Potter; PT A$26.80

· Charter Hall Downgraded to Sell at Goldman

· Immutep ADRs Rated New Buy at JonesTrading; PT $9

· Steadfast Downgraded to Neutral at JPMorgan; PT A$2.88

Healthscope (HSO) $2.38 / 14.42%; **UPDATED CALL**This morning HSO announced a competing bid from Brookfield at $2.42 plus a potential 3.5c dividend valuing the deal at $2.455. There is also a scheme of arrangement discussed which would equate to a value of $2.585 per share (inclusive of the 3.5c dividend). The scheme of arrangement is more complicated as it would provide shareholders with the option to receive all cash or to receive some of the consideration as shares in an unlisted company controlled by Brookfield that would own 100% of Healthscope.

As we suggested in the Alert sent today, the chances of a takeover occurring have now increased and today we moved our targeted sale price to be $2.40 or better given the deal is still subject to various conditions but is less onerous than the competing BGH bid. Given the fluid nature of this bid and 2 competing parties at play , we will work orders in HSO on a day only basis, updating if/when new information comes to light. For now we are cancelling the current sell limit of $2.40

Healthscope Chart (HSO)

Elders (ELD) $8.87 / +19.7%; The agribusiness and real estate company is the best performer on the market today after delivering in the FY18 result announced today, beating current estimates across the board. Revenue grew, along with margins across most aspects of the business helping profit grow a solid 9% over FY18.

The stock has encountered a volatile year as sentiment deteriorated on fears the drought would impact activities as well as the glyphosate saga (that plagued Nufarm). Elders had been keen to update the market throughout the year reaffirming guidance in an attempt to allay the fears however the companies positivity wasn’t enough to offset the market’s downbeat attitude towards the sector - the stock had fallen over 20% from its May high’s to yesterday’s close.

In the outlook, Elders remain confident in the progress of the company since Mark Allison took over the CEO role in 2014. The result highlight’s the company’s ability to perform in drought times and will likely lead to a market re-rate.

Elders (ELD) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James/ Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.