Healius (HLS) to sell medical centres

Healius (HLS) +18.97%: received a $500m bid from private equity firm BGH for the medical centre portion of the company over the weekend which helped shares pop today. The bid represents around 80c/share with around 18% of the group’s revenue and 22.5% of the group’s EBIT attributable to the sold segment at the FY19 results. Healius will maintain ownership of pathology, IVF clinics, imaging, and day hospitals. HLS has been tussling with suitors consistently for nearly 18 months now – Hong Kong’s Jangho and Swiss PE firm Partners Group had both launched takeover bids. The deal is expected to be completed by year’s end and will simplify the business and sure up the balance sheet. The hope now is that Partners Group will return to the table to collect the rest of the business.

Along with the sale, the company provided further update to the market on how business had tracked since deferring the interim dividend in mid-April. Demand for pathology has been strong on the back of COVID testing while dental, IVF and day hospitals were seeing a recovery, moving back towards pre-COVID utilization levels. The company is confident that it will remain within debt covenants of 3x net debt to EBITDA at the end of the financial year while it successfully refinanced the facility today, providing an extra $70m worth of liquidity. It’s rally today puts it on the expensive side, though further corporate interest seems likely.

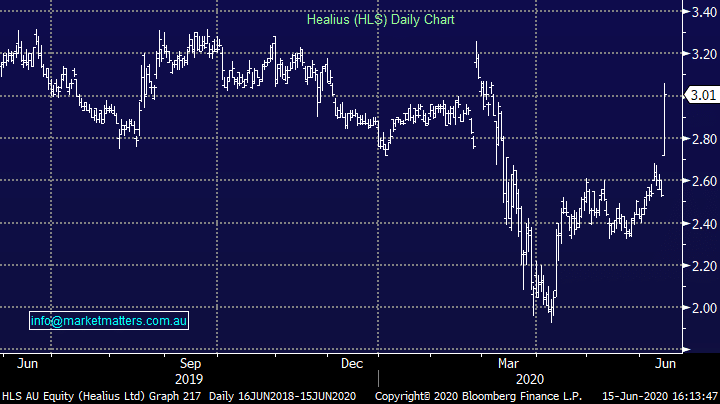

Healius (HLS) Chart