Have the Telcos bottomed? (IFL, VOC)

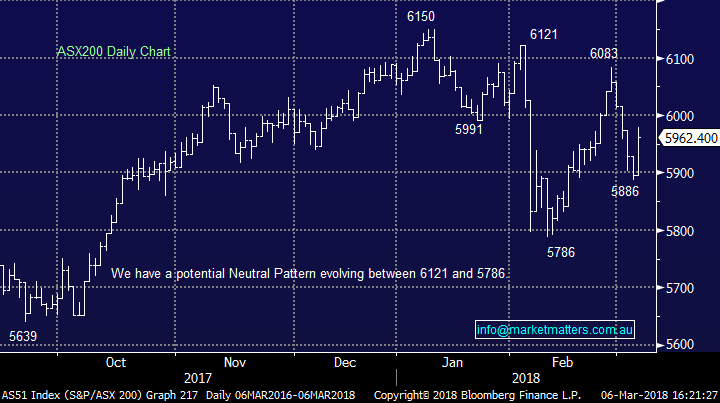

WHAT MATTERED TODAY

The market regained its mojo today thanks to a more upbeat move in global equities overnight – fewer tweets / headlines from Trump and what seemed to be more sensible rhetoric from the House Speaker Paul Ryan… “We are extremely worried about the consequences of a trade war and are urging the White House to not advance with this plan. The new tax reform law has boosted the economy and we certainly don’t want to jeopardize those gains,” said AshLee Strong, a spokeswoman for Ryan, the top Republican in the House.

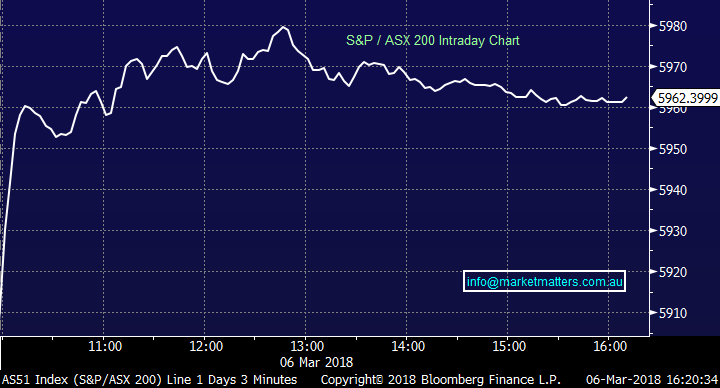

As we wrote this AM, it seems the market is betting against Trumps tariffs and that theme was obvious in the market today. The other obvious thematic playing out was around sector strength / rotation even through all sectors ended the day higher. Resources were bid up strongly on open yet sellers emerged into strength and they closed well off the daily highs, while the beaten up Telco’s led the charge for a second straight session showing rare form on down days + when the buyers are about. Perhaps the TLS low post dividend under $3.30 is now in place?

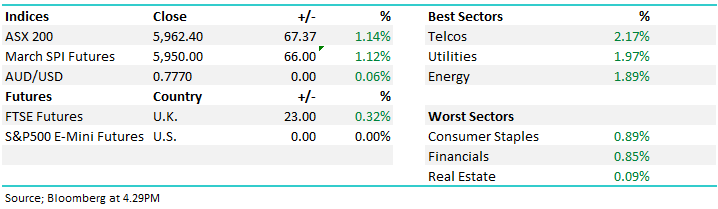

On the data front today we had a weaker than expected Retail Sales number out in the morning, while the RBA kept rates unchanged at 2.30pm the afternoon. That led to a choppy day for the currency.

AUD/USD Chart

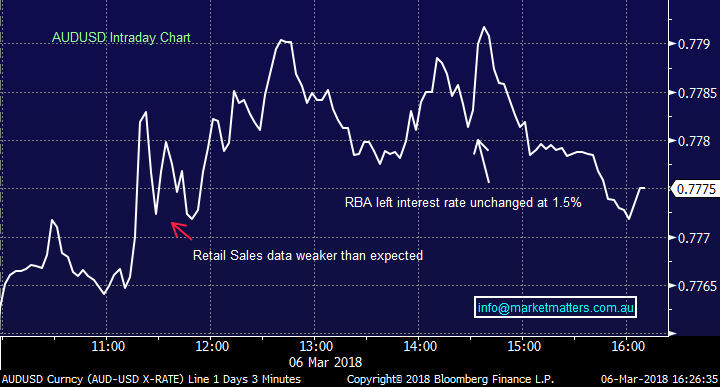

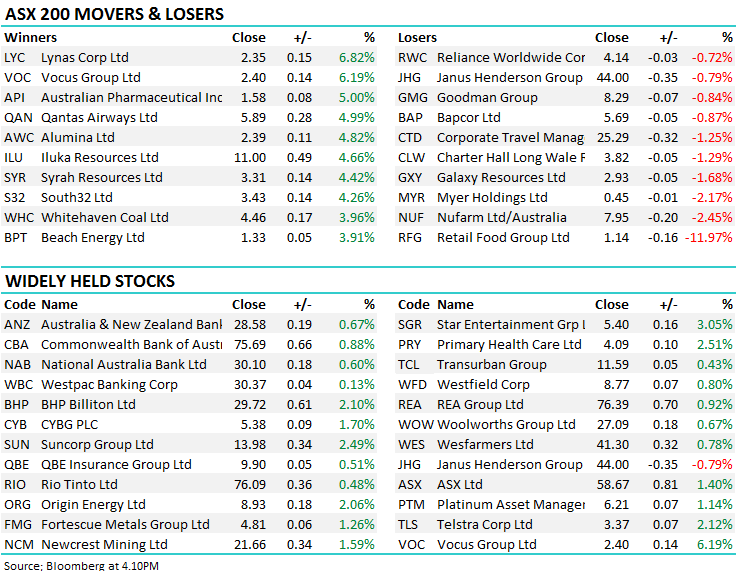

Overall, the S&P/ASX 200 Index finished 67 points higher to 5962 points - a rally of 1.14% - green right across the sector landscape today.

ASX 200 Chart

ASX 200 Chart

CATHCING OUR EYE

1. Vocus (VOC) $2.40 / +6.19%; A rare day in the sun for the struggling Telco with news that the current Deputy Chairman Bob Mansfield would step up into the Chairman’s roll replacing Vaughan Bowen. This comes in the same week they chopped CEO Geoff Horth to round out the ‘ridding’ of the M2 management that floated to the top after Vocus bought them. There was a lot of criticism in the market around Geoff at the time he emerged in the top job – basically M2 was a marketing company whereas Vocus was the network. Vocus took them over but M2 was ultimately a bigger business. The Vocus side (in our humble opinion) where the intelligent ones but the M2 side floated to the top and unfortunately the share price floated to the bottom. Now, the M2 side is largely out which would (our view only) open the door for a re-emergence by James Spenceley…We’ve had a poor history with VOC however could this be the tipping point (low) for the stock? Keep it on the radar. We do not own VOC.

Vocus (VOC) Chart

2. IOOF (IFL) $10.78 / +2.57%; A stock we own in the Growth Portfolio has been written up as Credit Suisse’ top pick amongst diversified financials….they reckon that exposure to growth in independent advice market through its advice and platform offering and increased penetration in the Australia and New Zealand customer base via the ANZ Wealth acquisition make IOOF their pick. They have a target of $12.10 for the stock. We’re slightly less optimistic targeting a move back up to the top of its trading range - just shy of $12.

IOOF (IFL) Chart

OUR CALLS

No trades on the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/03/2018. 5.10PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here