Has the milk turned sour?

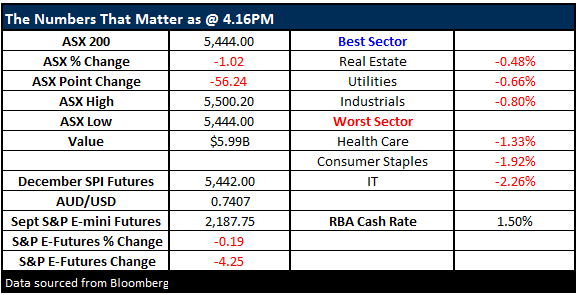

What Mattered Today

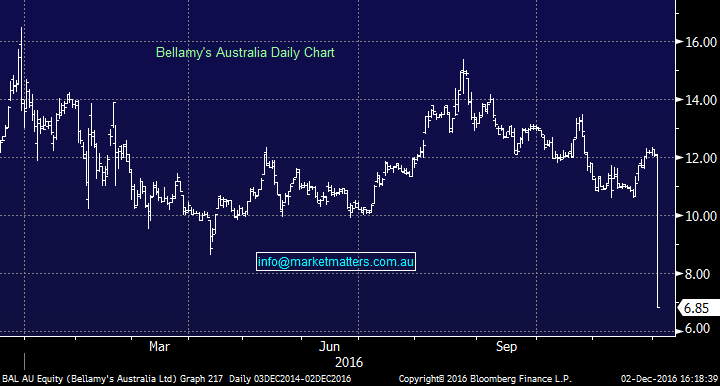

Another day another growth stock disappoints with downbeat guidance and gets taken to the cleaners – this time it was the Tasmania based organic baby food company, Bellamy’s (BAL) dropping more than ~40% early on before closing down $5.28 (-43.53%) at $6.85. In short, it’s a growth stock trading on a growth multiple (30x) and they now say that if trends in the first half continue into the second they won’t grow revenue.

Based on Bellamy’s current view of its end markets, revenue for 1HFY17 is anticipated to be approximately $120 million. While Bellamy's remains positive regarding its long term outlook, if current trends in its existing channels-to-market continue, 2HFY17 revenue will be similar to the first half

It’s pretty much the same announcement made by Healthscope (HSO) a few weeks ago, however HSO based their call on just one quarter of data while Bellamy’s has had the benefit of a full half, which suggests they’ve got a better foundation for making it. The announcement touches on a few interesting points starting with FY17 is a transitional year underpinning the Companies long term growth profile – which could be loosely translated to ‘heightened risk of disappointment in the shorter term’. They also make reference to a temporary volume dislocation in China due to regulatory changeover which highlights the increased risk of having exposure to the vagaries of Chinese regulation. Bellamy’s have got a good business in Australia, but China is where the growth is and it’s that growth that was being used to justify the high multiple.

Bellamy’s (BAL) Daily Chart

Given the big drop in share price in early trade, we naturally tossed around whether or not it was worthwhile taking a position however as has been the case in recent times, the market typically takes a few days to digest negative shocks. Bellamy’s has also been a stock in the cross hairs of shorters with around 12% of the company (12m shares) currently short sold – so we might see some short sharp rallies as some cover however the news today simply gives those short the stock (and short the China theme) more reason to think they’re right. Anyway, the stock is now back on the radar and it’s one we are thinking about given the quality of their domestic operations, however there might be too many things working against it in the short term.

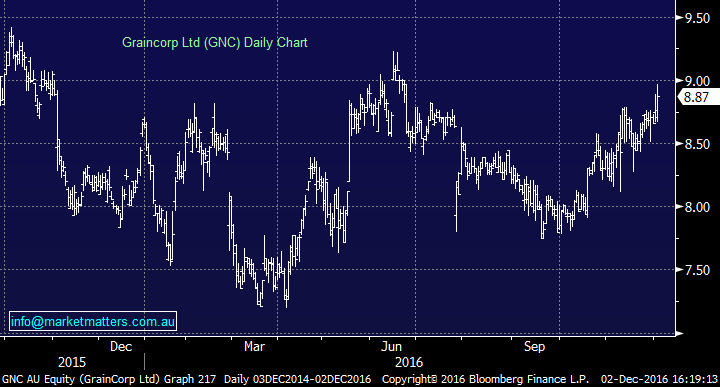

Elsewhere, Archer Daniels Midland’s has thrown the towel in and sold their 19.9% stake in Graincorp (GNC) at $8.53 – about $387m worth of stock after the then Labour Treasurer and now Ambassador to the US Joe Hockey blocked the proposed $3bn takeover back in 2013, and it became clear that the Libs would likely retain the same stance. The stock traded up on the day and is now worth putting back on the radar – the Midlands stake was causing some issues given they were a known seller and institutions knew they’d be able to pick up stock in some type of placement at a discount to mkt– we now have a resolution which should be a positive for the shares going forward

Graincorp (GNC) Daily Chart

As we wrote this morning, we remain bullish the ASX200 into 2017 but seasonally we are entering a poor 2 weeks for stocks, hence we would be patient with any buying for a potential Christmas rally. On the market today we has a range of +/- 56 points, a high of 5,500, a close on its low of 5,444, off -56pts or -1%.

ASX 200 Intra-Day Chart

ASX 200 daily chart

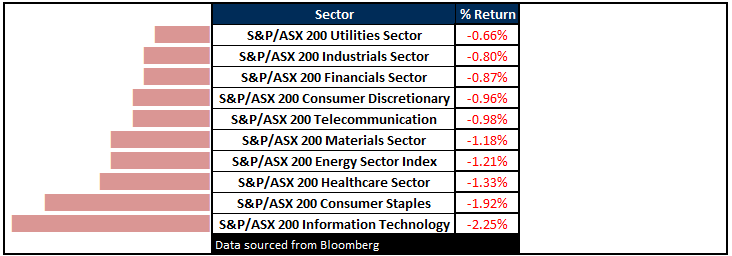

Sectors

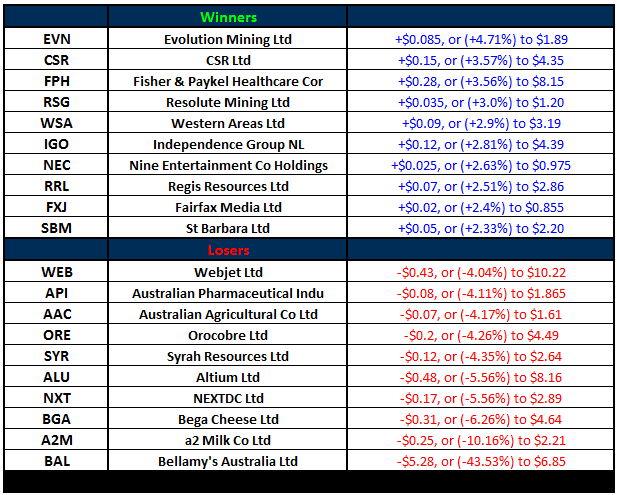

ASX 200 Movers

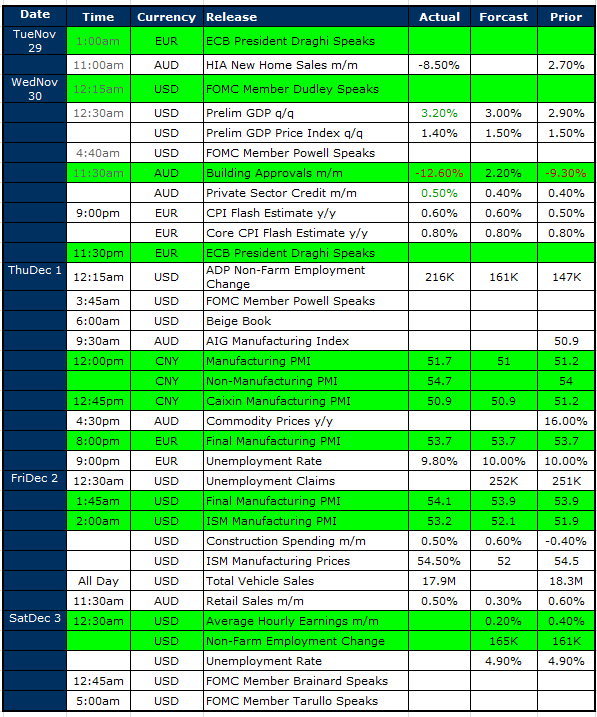

Select Economic Data - Stuff that really Matters in Green

US non-farm payrolls tonight the main economic print + importantly wages growth will again be in focus given this week’s emphasis on the reflation trade. In Europe some risk is obvious around the Italian referendum on constitutional reform, and this could prompt some volatility to kick things off next week.

What Matters Overseas

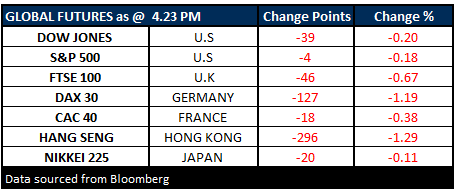

FUTURES WEAK….

Have a great Weekend and watch for the MM report out on Sunday morning

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/12/2016. 4.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here