Has the deal been struck!? (MQG)

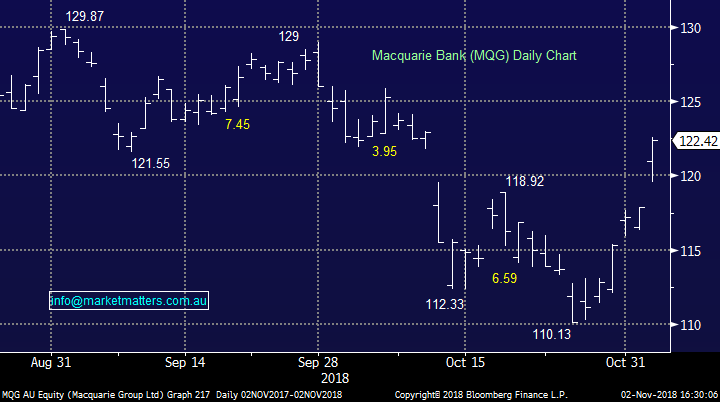

WHAT MATTERED TODAY

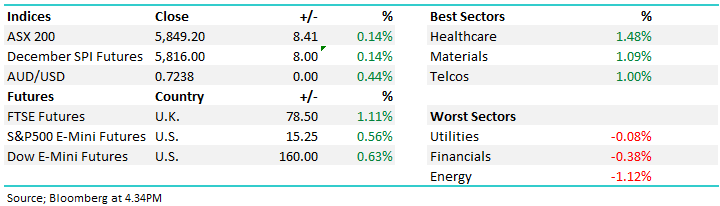

For the third day running, the market was bid up strongly on the close to finish higher again, and now the 6th day of consecutive gains. What a rebound this is.

Late this afternoon, global equity and future markets rallied following reports US President Trump was said to have asked his to draft a possible trade deal with China President Xi. Draft Possible Trade Deal With Xi.Plenty of news flow still to come here but clearly a positive move for markets if this is the end to the trade war for now.

Overall, the index closed up +8 points or +0.14 % today to 5849 – up +3.25% on the week. Dow Futures are trading up 133 points / +0.51%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Citi initiated with a sell on the old market darling Blackmores (BKL). The vitamins company was once the most adored stock in the ASX after rising 10 fold in 2013 – 2015 on the back of a strong China growth story, but is now trading around half of the highs. Citi are looking for an increase in marketing spend to eat away at margins, as well as Chinese regulation to stagnate growth.

Blackmores (BKL) Chart

RATING CHANGES;

· Blackmores Rated New Sell at Citi; PT A$100

· Crown Resorts Upgraded to Buy at Morningstar

· Seven Group Downgraded to Sell at Morningstar

· AMP Downgraded to Hold at Morningstar

· CSL Upgraded to Overweight at JPMorgan

· REA Group Upgraded to Overweight at JPMorgan; Price Target A$79

· BHP Upgraded to Buy at Investec; Price Target 17.74 Pounds

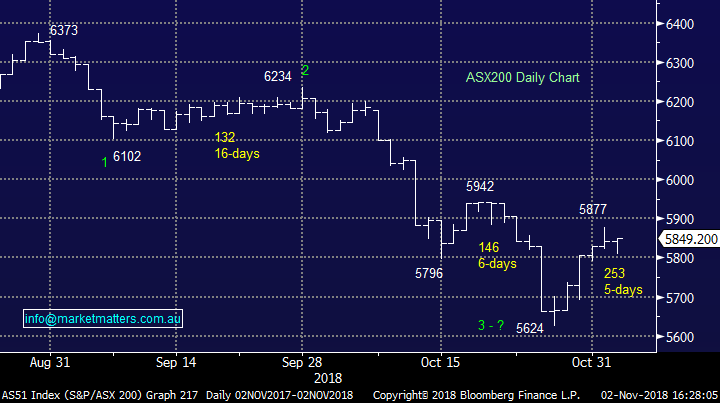

Macquarie Bank (MQG) $122.42 / +3.86%; Investment bank Macquarie today released results for the first half to September 30, comfortably beating their guidance. Net profit was up 5% on the first half of FY18, to $1.31B, although this is in line with the second half of FY18. This helped the interim dividend rise around 5% to $2.15. As has been the case over the past few years, Macquarie used the first half figures to revise guidance higher, now looking for 10% profit growth over the year, implying a big $1.5b second half ahead.

Rumours AMP is in the sights of Macquarie have been circling for the past few weeks, growing more since the fire sale of assets by AMP last week. The deal makes some sense – AMP’s bank is performing well and the combined business would grow to rival the big 4 size, Macquarie taking control of AMPs funds could stem outflows and value remains in AMP’s platform infrastructure among many other synergies. MQG is yet to purchase any shares under the buyback announced at the full year result, potentially holding capital for a big acquisition

Macquarie (MQG) Chart

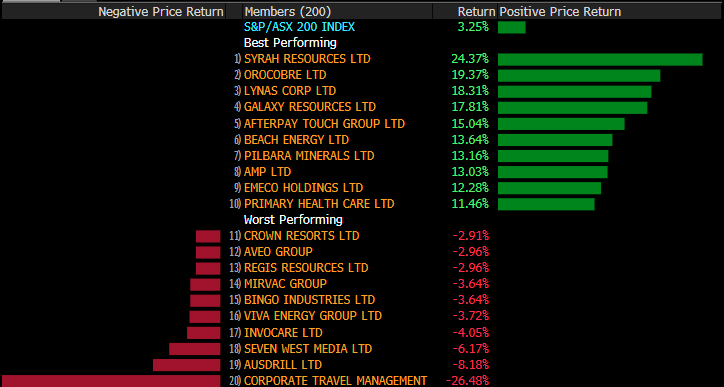

Sectors this week; the two worst in October, Healthcare, led by its biggest weight CSL, and IT strongly outperformed this week. Safe haven real estate stocks struggled. Energy, although moving higher, underperformed as concerns the market will tip into oversupply.

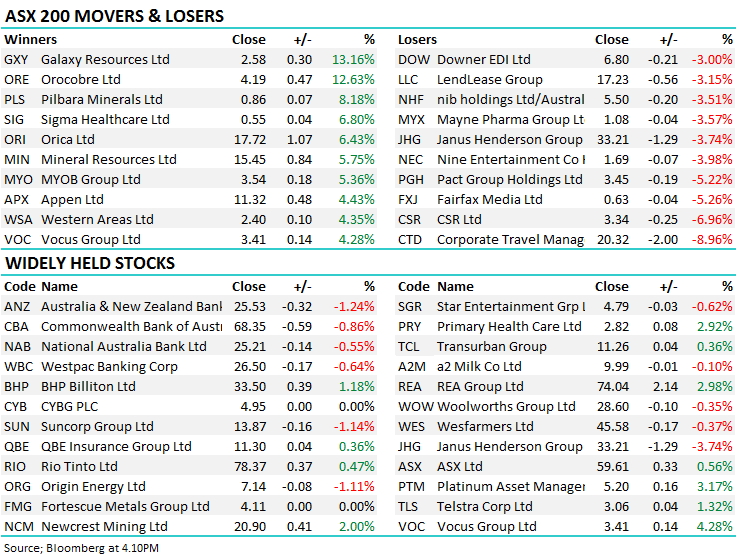

Weekly Movers and Losers

Stocks this week; AMP staged a solid rebound this week after the market rushed for the exit late last week. The lithium names, as well as a number of growth stocks which were particularly poor in October found some love. Corporate travel the worst as the market takes the cautious side following the short thesis by VGI which we have previously discussed.

Weekly Movers and Losers

OUR CALLS

No changes the portfolios today.

Watch out for the weekend report. Have a great night,

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 2/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.