Has the ASX peaked? (NAB, NCM, WPL, S32, MFG, BRG, AMP)

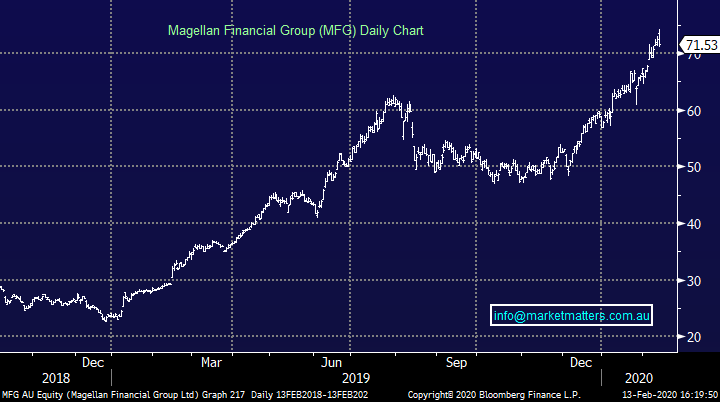

WHAT MATTERED TODAY

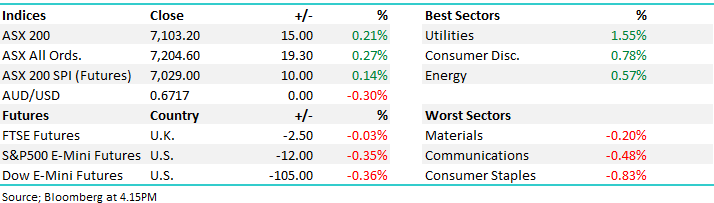

A weak session today even though the market finished little changed. Early optimism (SPI +50pts early on) seemed to stem from another bid for Caltex (CTX) and traders hedging that out in the futures, that unwound when CTX started trading and the mkt dropped fairly hard. We also saw US Futures start to sell off around that time following a big revision to the number of coronavirus cases in Hubei, which is the province at the center of the epidemic. Without going into the details, they revised the methodology for quoting case numbers which now includes “clinically diagnosed” cases in its daily disclosure, that meant an extra 15k new cases appeared on the ticket = negative. That saw a slight sell-off through Asia while US Futures traded lower, but not by a big margin.

Another big day on the reporter calendar and we cover many of the results below.

Reporting schedule available here: CLICK HERE

In the below recording I cover: NAB, AMP, BRG, WPL, MFG – CLICK HERE

Not many on the docket for tomorrow…

Overall, the ASX 200 added +15pts / +0.21% today to close at 7103. Dow Futures are trading down -106pts/-0.36%

ASX 200 Chart

ASX 200 Chart – 7145 capped the market again

CATCHING MY EYE

National Bank (NAB) +1.38%; out with a brief trading update today with a few key points, NAB the latest bank to actually record an expansion in NIM (positive) which is slightly surprising given the trajectory of interest rates. We had CBA’s CFO in this morning and he was saying that there has been a decent shift out of Term Deposits into at-call accounts given the declining spread between the two. Customers valuing access / liquidity more than the slight premium in margin. That means cheaper deposits = less reliance on wholesale funding = good for margins. Makes sense really.

At the top line, NAB reported 1% revenue growth from the quarterly average of 2H19 to 1Q20, due to the small increase in NIM and some slight loan growth. Expenses increased by 3%, excluding remediation costs. There were none of these costs in 1Q20 but the bank cautioned that more could be coming later in the year. The bad debt charge fell slightly due to stable credit quality and low net write-offs. Cash earnings increased by 1% from 2H19 quarterly average to 1Q20 due to the decline in the bad debt charge.

NAB still a work in progress however but todays result a reasonable one.

NAB Chart

Newcrest (NCM) –1.73%: The final nail in the coffin today for our position in the Gold miner with earnings missing expectations. The top line was slightly weak and dropped down to a miss in 1H20 earnings of around 5%. They did reaffirm full year production guidance however still a lot to do in the second half to achieve it. We gave NCM the benefit of the doubt, however this morning we cut it to increase cash. We retain Evolution (EVN) as our gold exposure, the stock upgraded to a buy today from UBS and it put on +2.5% as a result

Newcrest (NCM) Chart

Woodside (WPL) -0.35%: FY19 result released today and all was in line with expectations / no great surprises. There was a big write-off of the Canadian asset although not a big deal overall, no-one really thought it would ever happen and it came with the purchase of the Wheatstone assets from Apache years ago. Underlying NPAT was $US1063m for the year, a touch light on while 2020 production guidance of 97-103MMboe is unchanged. The risk in this stock comes from weaker spot LNG prices in Asia, obviously on the back of the virus-related slowdown.

Woodside (WPL) chart

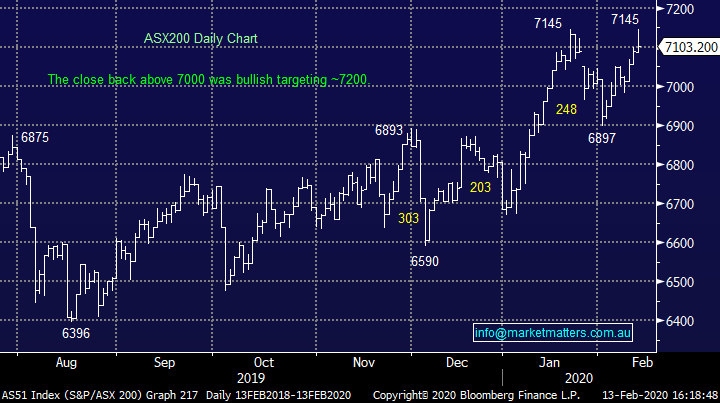

South32 (S32) +1.57%: Expectations here were very low but they did beat them. Underlying NPAT of $131m for the half was ahead of expectations ($110m) but down significantly from a year ago ($642m) highlighting how weak their underlying suit of commodities have been. That said, things look like they’ve turned, manganese – after a ~2-year grind lower is starting to tick up while met coal followed suit in early January 2020 and alumina price just recently. This is one on our radar.

South 32 (S32) Chart

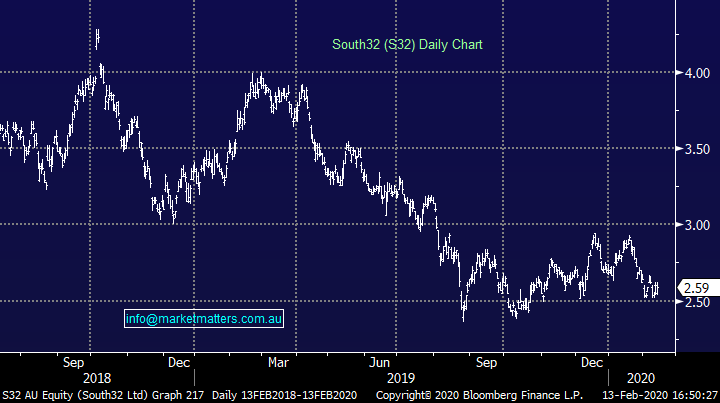

Magellan (MFG) -1.22%: opened strong but was sold off throughout the session as the market tracked lower. The half year was broadly in line with expectations for the fund’s manager, who recently cracked $100b under management, lifted adj. profit 23% to $216.8m helping lift the interim dividend to 92.9c a share. As we wrote when the January FUM update was announced, “the beast continues to grow with little sign of slowing down. If the market can continue to catch a bid, MFG will be dragged higher with it as the stock looks set to breakout.”

Magellan Financial (MFG) Chart

Breville (BRG) +27.63%: the small appliance manufacturer topped the local leader board today, cracking all-time highs on a beat at the half year result. Profit was up 14% for the first 6 months of the year with revenue up over 25%. All regions saw double digit revenue growth though Europe was the main driver of demand. Breville noted that the coronavirus has had no impact on current inventory levels with the company’s Shenzhen operation required to adopt some safety measures to limit transmission of the disease, but operations were unhindered at this stage.

Breville (BRG) Chart

AMP -0.55%: a bad result for the group today, but something the market expected. Wealth Management outflows have crippled earnings which sank to a loss of $2.5b. on an underlying basis, earnings fell around 30% to $464m for the full year. There was $6.3b of outflows in the year, although around a third came from pension payments.

For the year ahead, AMP were looking for earnings to stabilize with the market priced around the same level. AMP Capital and the banking arm look reasonable, but the wealth management guys are replacing high margin with low margin with plenty of remediation costs along the way. Stock eased only slightly, a decent result despite the miss which might signal a turning of the tide for the market’s view of AMP.

AMP Chart

Broker moves;

· Evolution Raised to Buy at UBS; PT A$4.60

· Carsales.com Cut to Sell at UBS; PT A$17.50

· Carsales.com Cut to Neutral at Credit Suisse; PT A$18.80

· CSL Cut to Neutral at Macquarie; PT A$324

· A2 Milk Co Raised to Buy at Citi; PT A$17.45

· IDP Education Raised to Buy at Goldman; PT A$25.40

· Collins Foods Raised to Overweight at Wilsons; PT A$10.65

· Bapcor Cut to Hold at Morningstar

· Metcash Cut to Sell at Morningstar

· Computershare Cut to Underweight at JPMorgan; PT A$16

· Computershare Raised to Outperform at Credit Suisse; PT A$19.40

· Centuria Capital Raised to Overweight at JPMorgan; PT A$2.75

· Amcor GDRs Cut to Neutral at Credit Suisse; PT A$16.25

· Orora Cut to Hold at Morgans Financial Limited; PT A$3.15

· Downer EDI Cut to Neutral at JPMorgan; PT A$7.70

· CBA Cut to Reduce at Morgans Financial Limited; PT A$74

· Oil Search Raised to Buy at UBS

OUR CALLS

We sold CPU & NCM from the growth Portfolio today. We are getting keen on SIQ for the Income Portfolio

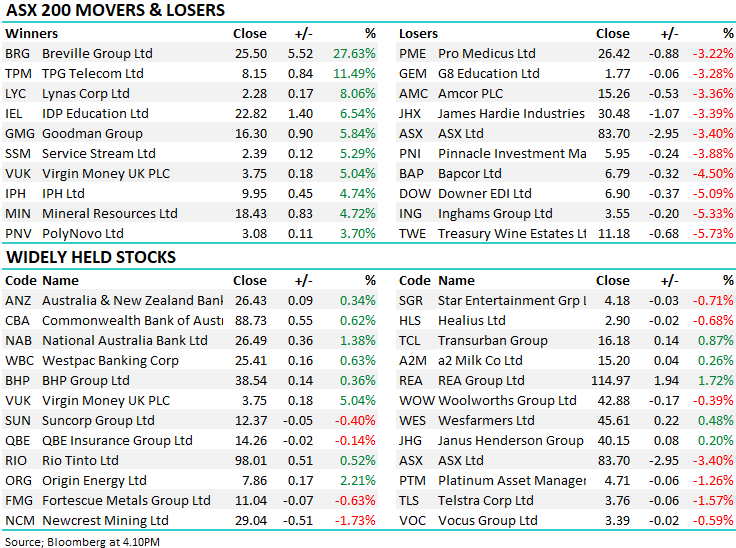

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.