Has Telstra (TLS) turned the corner?

Telstra (TLS) has enjoyed a strong week rallying 30c, or + 8.4% as it embraces a number of broker upgrades courtesy of a reduction in long-term capex estimates however with targets now around the $4 only ~4% away this particular tailwind is likely to diminish. Overall the lack of any bad news for Australia’s largest Telco and comments this week citing potential NBN concessions for the company is good news, plus of course they are well positioned with their 5G expansion since TPG Telecom pulled out of the area.

Lastly the market has been re-rating equity valuations higher for solid / reliable dividend paying stocks and TLS has been left behind, it simply feels like time for some catch up. TLS is trading on an Est. P/E for 2020 of 18.7x while its forecast to yield 4.14% fully franked. To give some context here, over the past 5 years TLS has oscillated between a pessimistic P/E of just 8.9x while the market’s optimistic multiple has been 19.1 times, clearly at 18.7x there is now some decent optimism baked into the TLS cake. The last time Telstra demanded such a high multiple was in March of 2015 when the stock was trading ~$6.50 before tracking down to a $2.60 low. Importantly, in March of 2015 the RBA cash rate was 2.25% versus 0.75% today – if there’s a time that TLS can handle an elevated multiple, it's now!

The stock looks good technically with stops below $3.60 – not exciting risk / reward after this week’s move.

MM is now bullish TLS, initially targeting another ~8% upside.

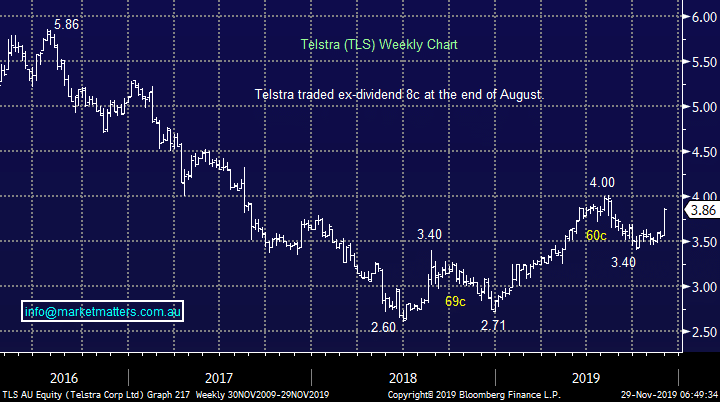

Telstra (TLS) Chart