Goon bag bursts for Treasury Wines (OZL, TWE, EHL)

WHAT MATTERED TODAY

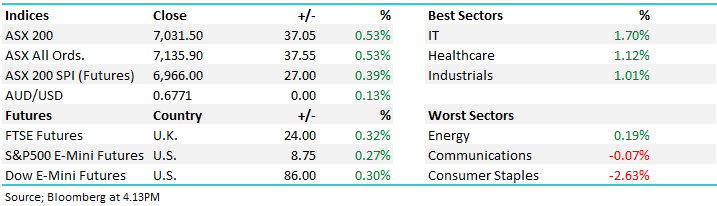

A better session for stocks today with the mkt bouncing back post yesterday’s selloff. The market opened fairly well, ran to a lunchtime high before chopping around into the close, it did lose around 10pts in the match taking some of the shine off. A mixed bag on the stocks front today and a reminder that confession season (just before reporting season) can often throw up some landmines, holders of Treasury Wines feeling some pain today with the stock down by 25% on a bog downgrade – Harry covers below. At a sector level today, the risk on vibe underpinned more positivity within the tech sector today while the health stocks were also well bid.

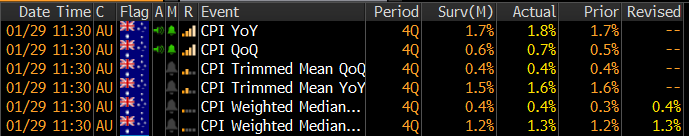

On the economic ticket today, inflation data was released mid-morning and it came in a touch higher than expected – RBA cuts less likely as a result, I though mkt would have pulled back more on this.

Economic data today

Around the region, mainland China remains on holidays while Hong Kong shares lost more than 2% as the death toll of the coronavirus hits 132, with nearly 6000 cases recorded. Japanese stocks closed in the green.

Overall, the ASX 200 added +37pts / +0.53% today to close at 7031. Dow Futures are trading higher by +69pts/+0.24%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

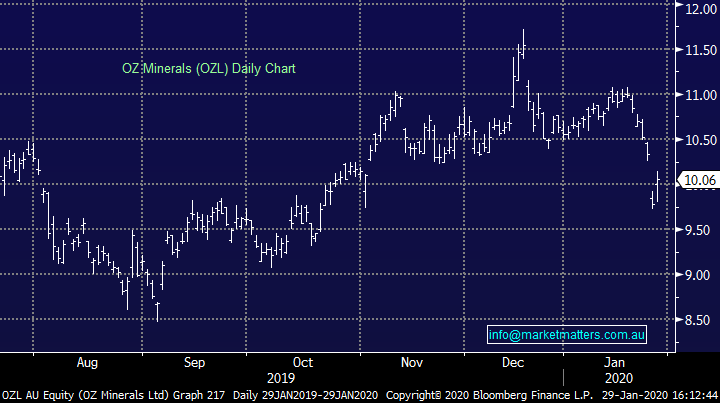

Production Numbers: A heap of production reports out today relevant to us: Oz Minerals (OZL), Sandfire (SFR) & Iluka (ILU) all good, Evolution (EVN) had been pre-released so was inline / No surprises, Beach (BPT) was a touch soft, particularly in terms of cash flows.

Oz Minerals (OZL) +2.86%: Posted another good set of full year production/sales/growth numbers today, which is the 5th straight year they’ve delivered. Might not seem a big achievement but it is for Oz! Production came in-line with guided ranges and in many cases delivered towards the top end. Importantly, costs beat guidance in both Australia and Brazil – all in all, a good set of numbers from Oz and this further confirms our positive view on the stock.

Sandfire (SFR) +1.25%: Operational issues within SFR have often sprung up at reporting time however today it was a fairly clean slate for their Dec Quarter scorecard. Production was 9% better QoQ and based on the current run rate, SFR should meet FY20 production numbers. Grade was going to be a focus today and pleasingly overall mined/milled grade was up nearly 30% to 4.9% vs 3.9% copper with the Monty deposit tipping in copper at the grade of 5.9%. That’s a good outcome. Given unchanged guidance and metrics tracking to plan, consensus numbers are unlikely to change here, SFR simply need a copper price tailwind and they should bounce strongly.

Iluka (ILU) +6.38%: A good day for the Mineral Sands business headlined by an offtake agreement between Iluka and Kronos for 75% of standard grade rutile produced from the Sierra Rutile operation, effective through to December 2022. The agreement provides ILU with certainty around Sierra Rutile’s existing operations, which is especially important as Iluka ramps up elsewhere. Production numbers were down y/y however that was expected and a company response to softer market dynamics. ILU dipped below $9 and has bounced strongly today – ILU one on our radar.

Beach Energy (BPT) -1.92%: Dec Quarter numbers for BPT today and they were on the weaker side, particularly in terms of cash flow. Production was 6.41MMboe v last quarter at 6.55MMboe while revenue came in at $462M v last quarter $438M. Capex was big at $209M for the quarter and $424M for the half year. This is a lot, driven by increased Cooper Basin drilling activity, Waitsia and Otway gas development. I’m not overly positive following this result.

Oz Minerals (OZL) Chart

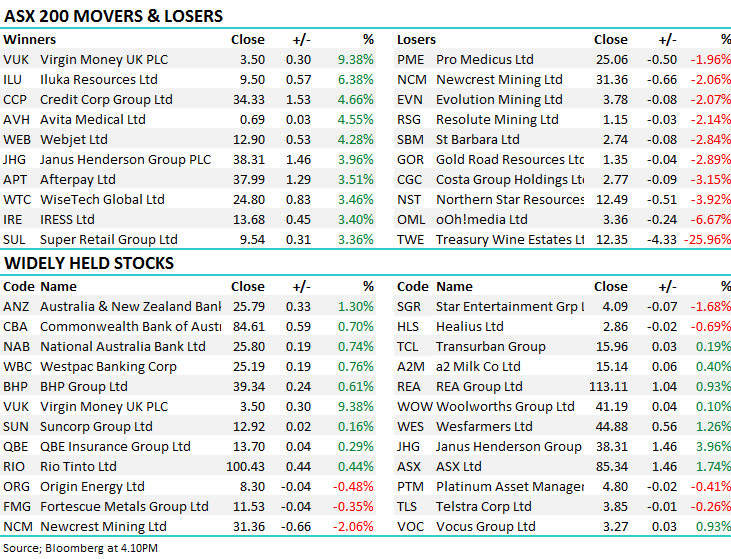

Treasury Wine Estate (TWE) –25.96%; a quarter of the company’s value was wiped off the stock today after they pre-released their first half result. The unaudited numbers show growth has stagnated, while the Americas, which was touted as one of the big opportunities, saw EBITS collapse 26% with falling volume and price. The company blamed the miss on “a loss of execution momentum”!!! after a number of leadership changes in the region combining with aggressive pricing of a number of other players led to a fall in market share. Other regions performed reasonably well with ANZ growing 810 and Europe, Middle East and Africa flat. Asia was slightly behind expectations yet still growing EBITS nearly 20% in the first half.

As a result of the beating the Americas took, Treasury cut their EBITS growth forecasts for FY20 to 5-10%, down from 15-20% and well behind the consensus estimates of 19% for the year. They also gave an early look at FY21 expectations looking for EBITS growth of 10-15% already behind the market’s hopes. The announcement didn’t take into consideration a number of near term risks including the coronavirus, while the company is also undertaking a strategic review on the back of the disappointment. Shares were beaten to 2+yr lows, closing on the low of the session. Not one for MM.

Treasury Wine Estates (TWE) Chart

Emeco Holdings (EHL) Trading Halt: added to yesterday’s announcement confirming the company would acquire underground mining equipment and services business Pit N Portal, fully funded with an underwritten entitlement offer which, as James suggested yesterday, was supported by Emeco’s major shareholder. The deal has been done on a cheap 3.6x FY19 EBITDA which came in at $20m, and looks to be EPS accretive from day one. The share issuance also lowers Emeco’s debt metrics with net debt to Operating EBITDA to fall to 1.8x on completion. The company also released a first half update which showed EBITDA climbing 16% to $119m which was in line with guidance given at November’s AGM. Shareholders will have the opportunity to buy 1 new share for every 10.29 EHL shares owned at $2.07 – a 10% discount to last traded price.

Broker moves;

· Sydney Airport Raised to Outperform at Macquarie; PT A$8.68

· Saracen Mineral Rated New Buy at UBS; PT A$4.40

· Star Entertainment Cut to Neutral at UBS; PT A$4.50

· Star Entertainment Cut to Neutral at JPMorgan; PT A$4.50

· Treasury Wine Cut to Neutral at UBS; PT A$18

· Treasury Wine Cut to Underperform at Credit Suisse; PT A$12.80

· Treasury Wine Cut to Neutral at JPMorgan; PT A$15

· Vocus Raised to Buy at Goldman; PT A$3.85

· Integral Diagnostics Rated New Outperform at Macquarie

· Virgin Money UK GDRs Raised to Buy at Bell Potter; PT A$3.65

· Sims Raised to Hold at Morningstar

· Insurance Australia Raised to Hold at Morningstar

· Soul Pattinson Raised to Hold at Morningstar

· Sandfire Resources Raised to Buy at Morningstar

· Janus Henderson GDRs Raised to Overweight at Morgan Stanley

· Western Areas Raised to Hold at Argonaut Securities; PT A$2.65

· Regis Resources Raised to Buy at Bell Potter; PT A$5.61

OUR CALLS

We trimmed Pact group (PGH) today in the Growth Portfolio.

We took a 56% profit on GMA and bought Metcash (MTS) in the Income Portfolio

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.