Goodbye FY20, ASX ends down 10.9%, better times ahead! (CKF)

WHAT MATTERED TODAY

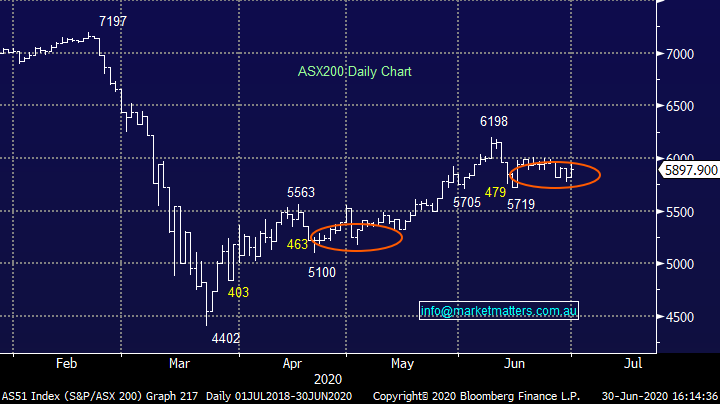

The end of financial year is always a busy time, although this year it feels like most activity happened at the end of the March quarter as we rose from the depths of the COVID-19 induced sell-off. While the year has been the weakest in the last eight, down -10.9% the quarterly performance has been a strong one up +16% offering some optimism for the bulls.

The first half of the year saw the market grind higher from 6630 up to the 7197 high printed on the morning of the 20th February, a commendable gain of ~8.55%, before all hell broke loose, and the market plummeted ~2797pts to 4400 on March 23, a decline of 38.8%. Since then, the ASX 200 has put on +1497pts/ 34% to close today at 5897, around about the midpoint of the trading range. Phew!

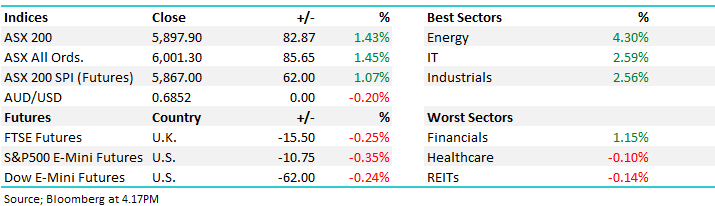

Today the market ended on a positive note thanks to better economic data from the States overnight, Energy stocks bounced back adding a commendable 4.3%, Woodside (WPL) the standout adding 5.25% on a Macquarie upgrade while the tech sector ended a stellar year up another 2.56%.

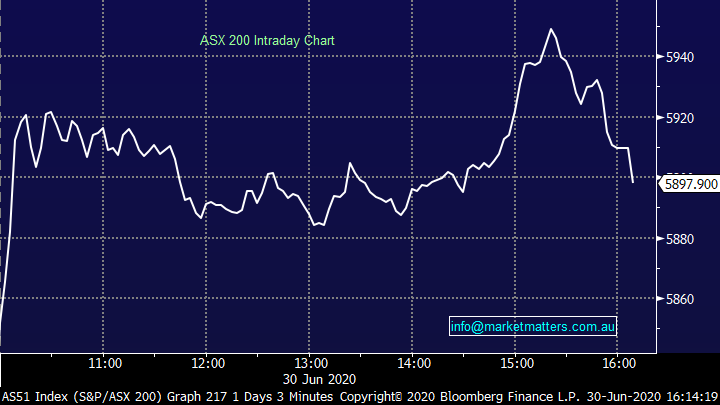

Overall, the ASX 200 added +82pts / +1.43% today to close at 5897 - Dow Futures are trading down -62pts/ 0.24%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Golds: while a large number of brokers are pushing their gold price higher, Macquarie has moved against the tide calling the current earnings season as the high in local gold earnings. The looming strength in the Aussie dollar is the main reason for the call, with the precious metal priced in USD, local currency strength can weigh on earnings. The broker upgraded the gold outlook to an average of $2,440 this year falling to $2,394 next year as the currency drags. As a result of the changes in the price deck caused 10 downgrades across their gold coverage. We’re more positive Gold although we see where MQG are coming from in terms of the AUD, their call may lead to better entry levels in the sector.

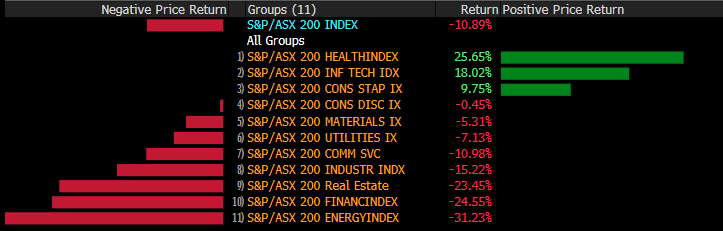

Sectors this financial year: Health the standout followed by IT while the Supermarkets rounded out the only three sectors in positive territory. 5 sectors fell by more than 10% with Energy suffering from a period of low Oil prices, front month futures turned negative for a brief period which was a historic event, there’s been a few of those in the past few months.

Sectors this Financial Year

Source Bloomberg

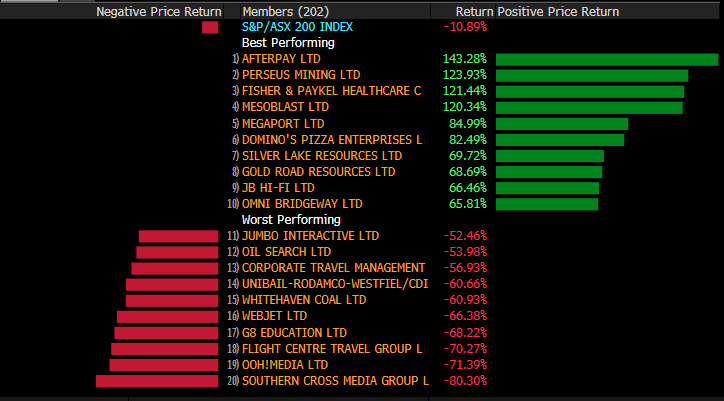

Stocks this financial year: Afterpay (APT), not sure what to say other than we missed this boat big time and not through lack of opportunity given it traded down to ~$9 through COVID-19, to finish the year at $60.99, that’s some extreme volatility. The top stocks are mixed, payments, mining, healthcare and even retail had great years. On the flipside, media was a clear drag as was travel, although the biggest fall from grace must be Jumbo Interactive (JIN) which closed on its lows today, the lottery re-seller suffering at the hands of Tabcorp (TAH) after they flexed their muscle.

Stocks this Financial Year

Source Bloomberg

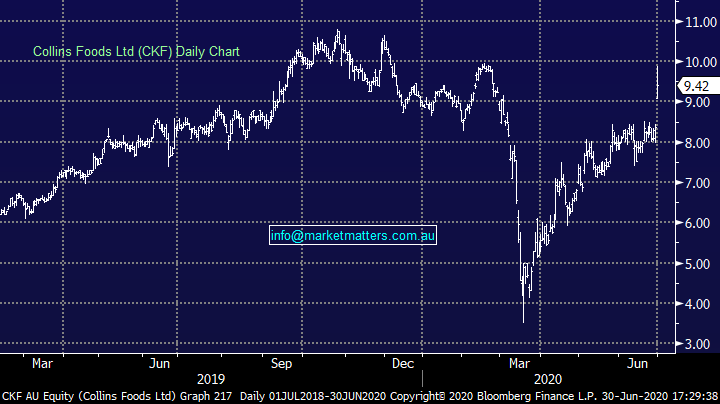

Collins Foods (CKF) +12.68%: runs the KFC and Taco Bell brands in Australia, saw revenue jump 9% for FY20 with profit up 5% despite COVID-19 hit on operations. KFC stores did the bulk of the growth, managing to weather the impact delivery options helping offset falls in in-store sales as a result of the impact on foot traffic. They also run the European brands which saw a greater impact given the wide spread lockdown which Australia managed to avoid. CKF is one to watch as Taco Bell stores continue to roll out nationwide.

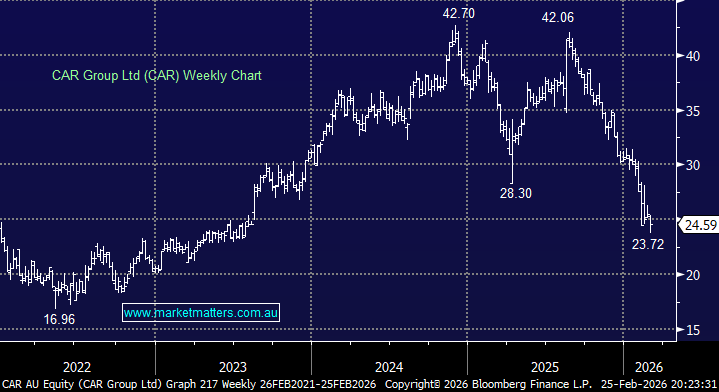

Collins Foods (CKF) Chart

BROKER MOVES:

· Jumbo Interactive Raised to Neutral at Evans & Partners Pty Ltd

· Dacian Gold Cut to Underperform at Macquarie

· Santos Cut to Neutral at Macquarie; PT A$5.50

· Woodside Raised to Outperform at Macquarie; PT A$25

· St Barbara Cut to Underperform at Macquarie; PT A$2.60

· Saracen Mineral Cut to Neutral at Macquarie; PT A$5.40

· Regis Resources Cut to Underperform at Macquarie; PT A$4.50

· Panoramic Resources Cut to Underperform at Macquarie

· Newcrest Cut to Underperform at Macquarie; PT A$28

· Alacer Gold GDRs Cut to Neutral at Macquarie; PT A$9.40

· Resolute Mining Cut to Underperform at Macquarie; PT A$1

· Tabcorp Raised to Neutral at Citi; PT A$3.40

· Iluka Raised to Buy at Morningstar

· SCA Property Raised to Hold at Morningstar

· Scentre Group Raised to Hold at Jefferies; PT A$2.32

· Monash IVF Raised to Buy at Jefferies; PT 65 Australian cents

OUR CALLS

We bought Western Areas (WSA) & Bravura Solutions (BVS) in the Growth portfolio today

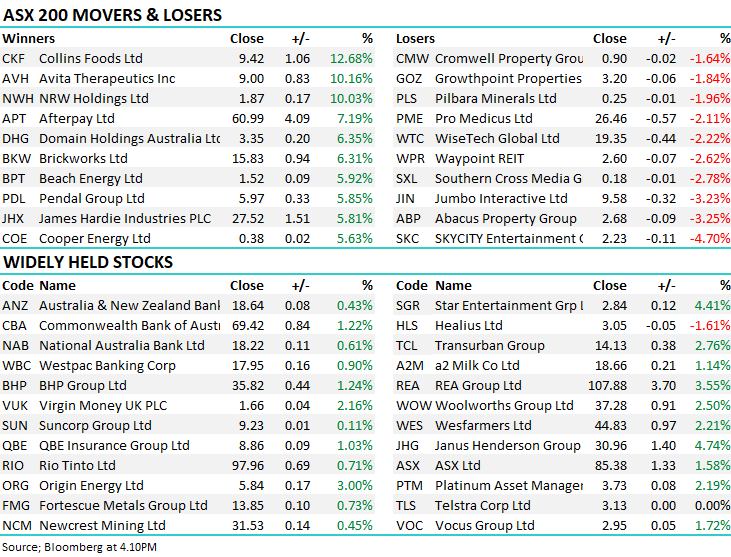

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.