Goldmans uber bullish on Afterpay, Bingo sinks (APT, BIN)

WHAT MATTERED TODAY

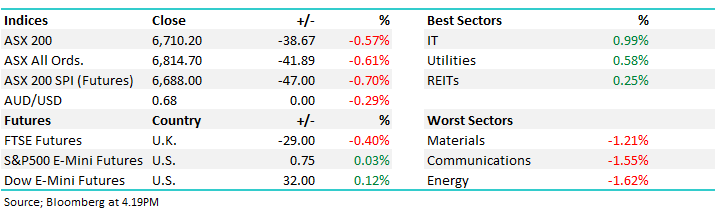

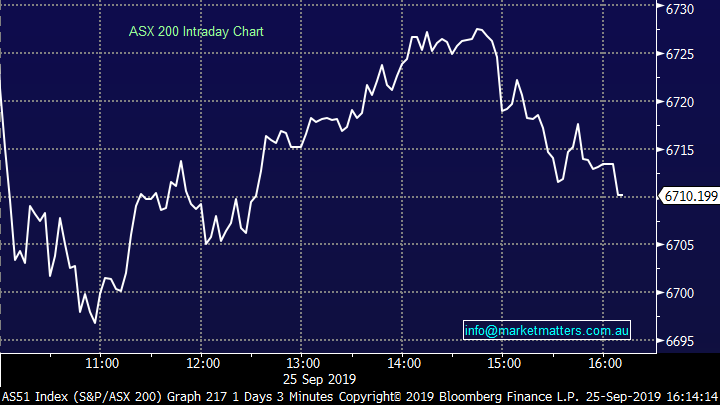

The market opened on the back foot this morning with SPI Futures off ~70pts thanks to weakness overseas, however as the Aussie Dollar tracked lower intra-day, our market found some buyers pushing the index back up above 6700 by mid-afternoon before some late selling bubbled to the surface – the market lost -20pts in the last hour – this has been a fairly typical scenario of late and it’s a sign of underlying weakness.

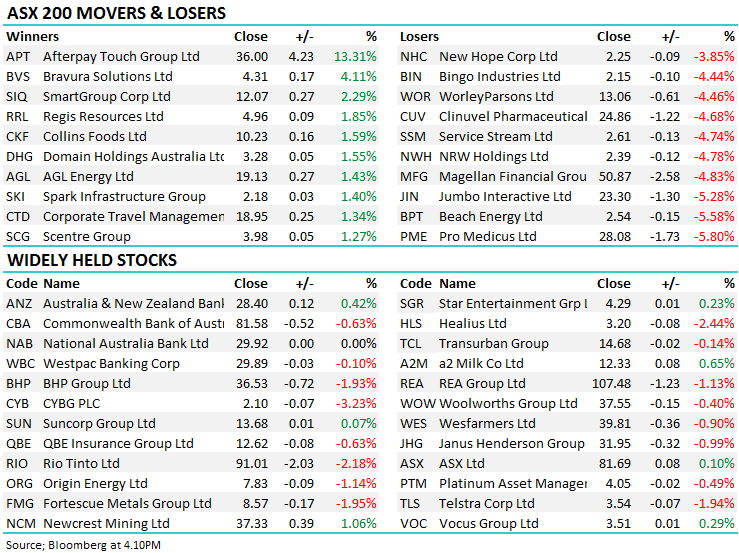

Afterpay (APT) a big mover adding +13.28%, Harry covers this below while on the downside we saw a sell-off in Bingo Industries (BIN) after they announced the sale of their Banksmeadow facility, stock down -4.44% on the session.

Overall, the ASX 200 lost -38pts today or -0.57% to 6710, Dow Futures are trading up +24pts/+0.09%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Bingo (BIN) -4.44%: Closed down today after they announced the sale of their Banksmeadow recycling facility to private equity for $50m. The stock closed at $2.15 today although the low will print $2 thanks to 1000 shares that traded through ChiX at 4.03pm - hence not relevant. We like BIN as a business however I’m concerned about their November AGM. They didn’t provide FY20 guidance at their FY19 results saying they’ll do this at the AGM on the 13th November. If the business was firing, I doubt they’d wait till the AGM to outline forecasts. That’s the key date for the stock – we’ll likely remain patient till then, however they also present at a Morgan’s conference on the 9th October then a UBS conference post the AGM on the 18th November.

If I get my crystal ball out, the window between their AGM , where they’ll likely guide below expectations and the UBS presentation where they’ll reassure the market on the long term story seems the window to buy the stock.

Bingo (BIN) Chart

Afterpay (APT) +13.31%; A double whammy of good news has rocketed APT to new heights today. The first kick came from the AUSTRAC investigation where external auditors were brought in to assess the systems Afterpay had in place to prevent money laundering and terror financing. At the halfway point the audit had yet to uncover any instances of the platform being used for these outcomes. Afterpay is not out of the woods just yet however, with recommendations being held until the final report. The second kick comes from Goldman Sachs which drastically increased its target for Afterpay and put the stock into their conviction buy bucket. The report from the broker is extremely positive, and has revenue increase more than 4 fold in the three years from FY19 through to FY22 to $1.39bn on the assumption that Afterpay significantly beats their own base Gross Market Volume (GMV) by almost 50%.

The bulk of the Goldman’s 58% increase to the target price stems from a continuation of the growth in frequency of use for APT’s customers, as well as significant penetration into the US and UK markets which, when combined with Australian retail presents a $1tr market for the Buy Now Pay Later space. The broker has also thrown an M&A premium on the stock, with the analyst suggesting that an EV/EBITDA multiple of nearly 40x in FY22, and on their estimates suggests the potential for a $47/share takeover bid. Goldman’s target price of $42.90 is 10% above the next highest in the market, while Morningstar are the only broker to have a sell on the stock with a $22 price target. The AUSTRAC investigation will likely be insignificant in the medium term for APT even if some recommendations do come through. The GS note has some ‘blue sky’ assumptions in the model which seem farfetched, but not out of reach given what has been seen in the space already.

We’ve missed this boat for now and from a simple risk / reward perspective, we can’t buy it here.

AfterPay Touch (APT) Chart

BROKER MOVES;

· APT AU: Afterpay Touch Upgraded to Buy at Goldman; PT A$42.90

· WHC AU: Whitehaven Upgraded to Buy at Morningstar

· XRO AU: Xero Rated New Buy at Jefferies; PT A$75.70

OUR CALLS

We bought the BBOZ in the Growth Portfolio, which is a leveraged short position on the ASX200 and also increased the weighting of the long Aussie Dollar position in the Global ETF Portfolio.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.