Gold & IT stocks best on ground, Energy stocks weigh (CNI, CMA, QAN)

WHAT MATTERED TODAY

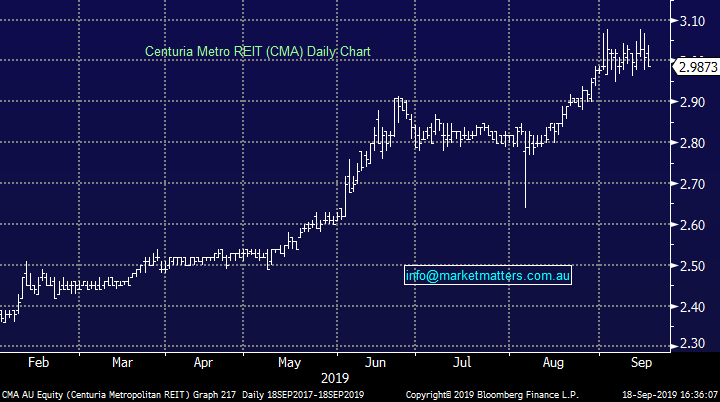

A fairly muted session in Australia today with the market briefly trading in the black early on before the market trickled lower into the close. Energy stocks hardest hit on the downside thanks to the pullback in Crude prices overnight while we saw a move back into the higher growth area of the market, IT stocks best on ground adding +0.55% led by Pro Medicus (PME) which added +5.52% while Gold stocks were also well bid, Resolute adding +4.58% and Saracens (SAR) up +3.49%. We continue to see Gold as a short term bullish trade targeting a quick +10% upside from current levels – we’re positioned accordingly.

We’re now more comfortable holding higher cash levels with a more defensive portfolio set leading into index options expiry tomorrow morning – the market looks tired although no sell signals have been generated as yet.

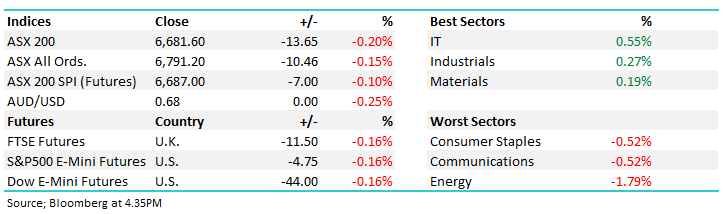

Overall, the ASX 200 lost -13pts today or -0.20% to 6681, Dow Futures are now trading down -43pts/-0.15%.

ASX 200 Chart - obvious buying once again in the match this afternoon.

ASX 200 Chart

CATCHING OUR EYE;

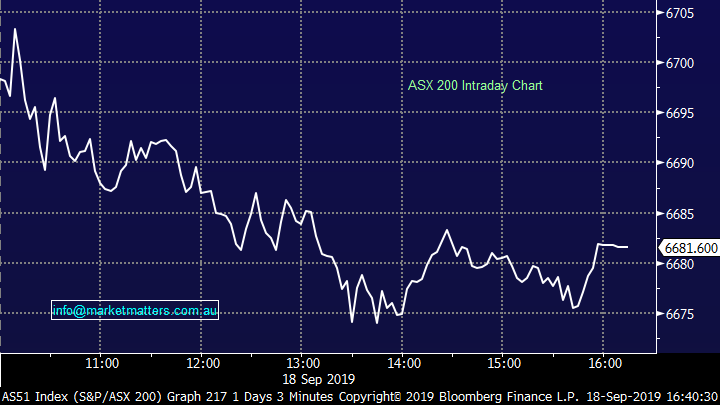

Centuria (CNI & CMA); both spent the day in trading halt as they raised capital in unison. Centuria Metropolitan REIT (CMA) is raising $273m at a 4.7% discount to last close, using the proceeds to purchase 2 properties while Centuria Capital (CNI) is raising $100m to fund their portion of the CMA raise. The first acquisition from the metro REIT is a 50% stake in a 10 year old building on the fringes of the Sydney CBD in Eveleigh. The site is 100% leased with a weighted average lease expiry (WALE) of 8.5yrs – more than 50% of the income stems from two tenants in the State Government and Seven Network. The second acquisition is full ownership of a Perth office block in the CBD. Once again, 100% leased, with a WALE of 7.5yrs. This site is corner stoned by government leases as well as a long term lease from WeWork – more on these guys another time…

The capital raise came with re-iteration of CMA’s funds from operations (FFO) guidance of 19cps, dropping down to a 17.8cps distribution for holders, or 6.2% yield at the issue price. For CNI, they maintained their 9.7c expected distribution for a 4.6% yield on the issue price – which is 50% above NAV.

Centuria Metro REIT (CMA) Chart

BROKER MOVES; Qantas made fresh 52-week highs today on the back of the Morgan Stanley note. The analyst bumped the price target up 17% and slapped a buy on the flying kangaroo against the market view that higher oil prices means higher fuel costs. MS was running the story that Qantas is fully hedged in FY20 and doubts the oil curve has shifted significantly for the medium term. Upside is seen the Loyalty business, which now accounts for a third of the valuation given the much higher EBITDA multiple it attracts. Shares were up 1.78% by the close.

Qantas (QAN) Chart

· QAN AU: Qantas Upgraded to Overweight at Morgan Stanley; PT A$7

OUR CALLS

We sold Estia Health (EHE), Flight Centre (FLT) & Whitehaven (WHC) to buy Spark infrastructure (SKI) and Transurban (TCL) in the Income Portfolio today. See Income Report

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.