Gerry robs Peter to pay Paul (HVN)

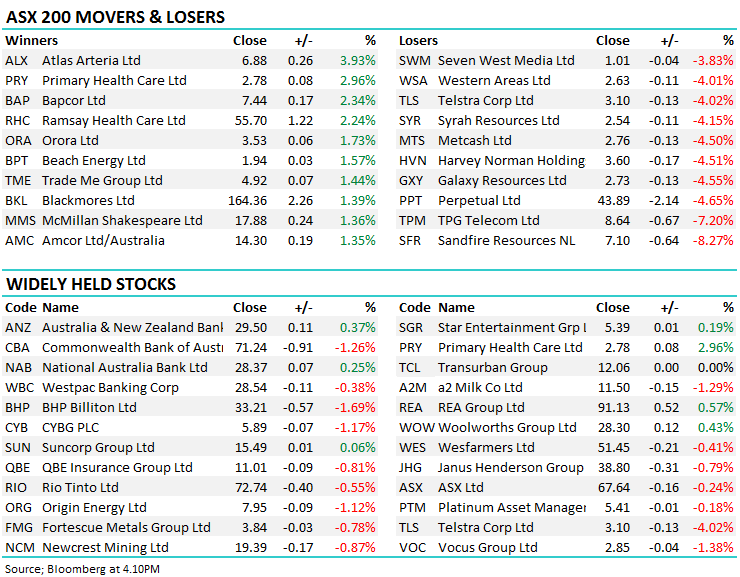

WHAT MATTERED TODAY

A more subdued end to a fairly hectic week with the Australian reporting season now winding down. Overall reporting season has been ‘good enough’ for equities to trade at 10 year highs yesterday, before some selling kicked in today. Leading into the reporting season, the market was optimistic resources, which was tipped to be the markets main driver of earnings growth, optimistic energy given the tailwind of higher Oil prices, cautious on the high growth ‘IT’ stocks and negative on retailers, banks and healthcare.

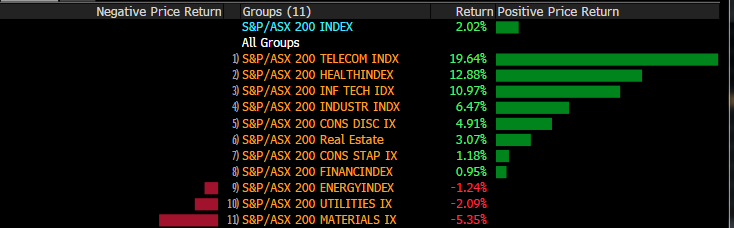

As it turned out, expensive growth became more expensive, Materials were generally underwhelming, Healthcare ran hard thanks mostly to CSL and Cochlear while the Telcos had a significant about turn with extreme pessimism overcome with optimism following some corporate activity. The other area worth noting were the retailers with the markets bearish positioning towards the sector thanks to fears around debt, Amazon, confidence etc., proving the wrong call. All in all, the Australian economy is chugging along and by in large so too are Aussie corporates.

We’re now two months into the Financial Year with the index up 2.23% before dividends – on track for a fairly standard year overall, however I can’t help but think the lack of volatility at the index level, but some extreme moves at a stock / sector level is a little appetizer of what might come next for global equities!

Financial Year to Date Performance

On the market today, early strength was sold into however it was a fairly lethargic session overall. Harvey Norman (HVN) made an interesting move as they released full year results, paying a big fully franked dividend but then raising capital to pay down debt. Seems to me Gerry is simply trying to offload some franking credits to shareholders (including himself), with a $164m equity raise v a $200m dividend being paid! More on that below.

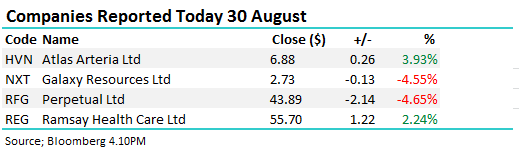

Elsewhere, Mineral Resources (MIN) traded ex-dividend today for 40cps and so too did Fortescue Metals (FMG) for 12c while Ramsay Healthcare (RHC) rebounded from yesterday’s weakness – adding $1.22 / +2.24% on the session to close at $55.70

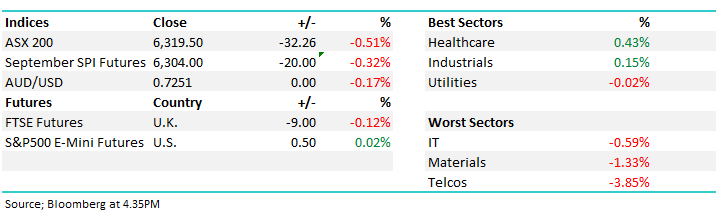

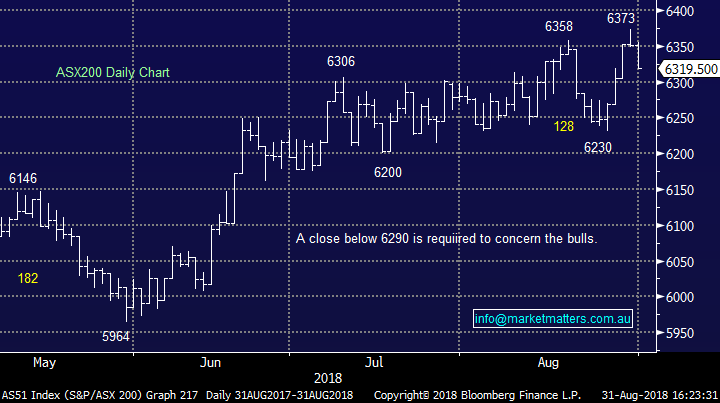

Overall, the index closed down -32 points or -0.51% today to 6319. The index added 72 points for the week, up 1.15%

Stocks that reported today

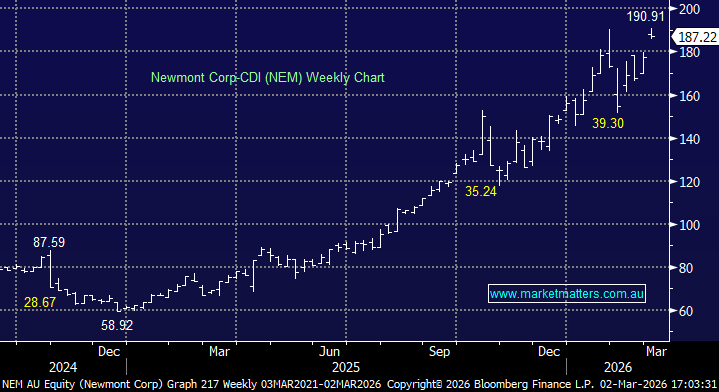

ASX 200 Chart

ASX 200 Chart

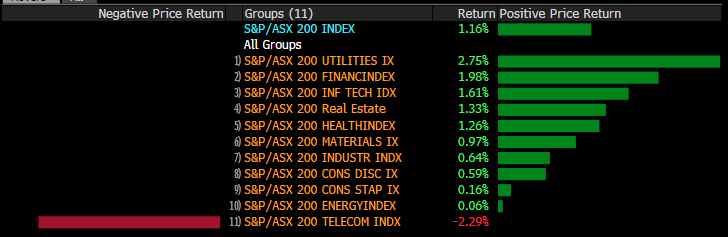

Weekly Moves – Stocks & Sectors;. On a sector level, sellers stepped in today and halted the Telco rally while the financials and utilities were the main positive drivers over the week.

Sectors over the past Week

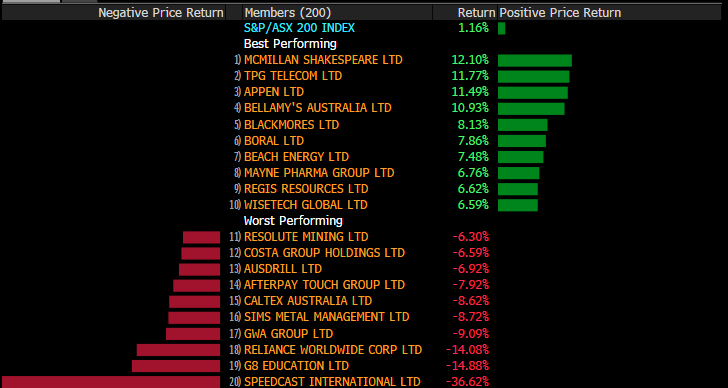

At a stock level, some well held names felt the pinch this week, none more so than Speedcast (SDA) after disappointing the market with their results. G8 Education was also soft suffering from a decent uptick in child care capacity which is driving down occupancy.

Stock moves over the week

CATCHING OUR EYE

Broker Moves; Morgan Stanley out an optimism note on TPG Telecom’s merger with Vodafone Hutchison Australia, saying it makes strategic sense and is positive for the wider Australian telecommunications industry. On the flipside, they were less optimistic about Ramsay saying that FY19 Earnings Forecast Looks Challenged with flat growth in France and U.K. continuing its downward trend

Rating Changes:

· Sandfire Upgraded to Buy at Deutsche Bank; Price Target A$8.80

· Perpetual Downgraded to Hold at Bell Potter; PT A$48.65

· Genesis Energy Cut to Neutral at Woodward Partners; PT NZ$2.52

· Virgin Australia Rated New Hold at Deutsche Bank; PT A$0.23

· Northern Star Upgraded to Buy at Citi; PT A$8.25

· Sandfire Upgraded to Neutral at Citi; PT A$7.70

· Perpetual Downgraded to Underperform at Macquarie; PT A$43

· Northern Star Upgraded to Buy at Canaccord; PT A$8.20

· Northern Star Upgraded to Overweight at JPMorgan; PT A$7.50

· Virgin Australia Cut to Underperform at Credit Suisse; PT A$0.20

· Northern Star Upgraded to Outperform at RBC; PT A$7.50

· TPG Telecom Upgraded to Add at Morgans Financial; PT A$10.40

· Gold Road Rated New Buy at Numis; PT A$0.90

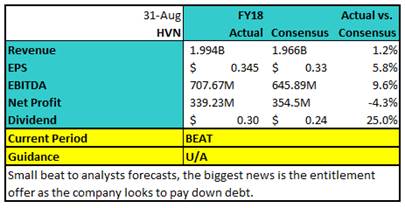

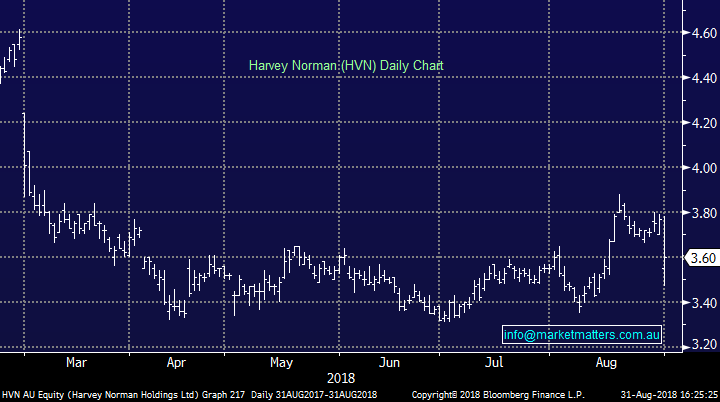

Harvey Norman (HVN) $3.60 / -4.51%; The retailer announced FY18 numbers this morning packed with plenty of surprises. The result itself looked positive, especially on an underlying basis stripping out one off impacts with underlying profit at 377M, 6.5% above forecasts, along with a big dividend taking the total pay out to $0.30 for the year. The result was driven by overseas store and sales growth while impacted by lower property revaluations, a -7.2% fall in franchise income and a $49.44m impairment from the company’s dairy investment Coomboona. The franchise performance was the most concerning aspect here – Coomboona has been written down to zero by the market and Harvey’s property portfolio had a stellar 2017, so was known it would contribute less this year.

The short thesis on HVN centres on concerns that franchises are being kept afloat by lower franchise fees and even franchise debts being paid by the head company, while deep discounting has been forced on the franchises to compete with Amazon/JB Hi-Fi/Bing Lee.

No real outlook was given by the company, just commentary that focus has well and truly moved to building the overseas business.

The biggest surprise this morning though was the 1 for 17 entitlement issue to raise funds to pay down debt. New shares are to be issued at $2.50, a huge 32.4% discount to yesterday’s close. Harvey Norman’s debt has crept higher over the past few years, up almost 47% from $514m in 2016 to $754m this year, which has seen the net debt to equity ratio rise from~19% to 25.5%. Although this is not a stressful level of debt, the business is clearly trying to grow and will continue to need capital to do so over the next few years. It does seem fishy though that the dividend can rise 15% but an equity raise is still required – the final dividend of 18c/share is more than the company could raise with the entitlements ($2.50 for 17 shares = 14.7c/share). Perhaps they’re being smart by getting rid of franking credits now, while investors can still utilize them, including Gerry himself!

Harvey Norman (HVN) Chart

OUR CALLS

No trades across the MM Portfolio’s today. We are looking at HVN from an income perspective should it trade down to ~$3.30 before it trades ex-entitlement on Wednesday 12th Sep.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here