Fortescue makes play on Atlas Iron, Prospa – anything but! (FMG, AGO, PGL)

WHAT MATTERED TODAY

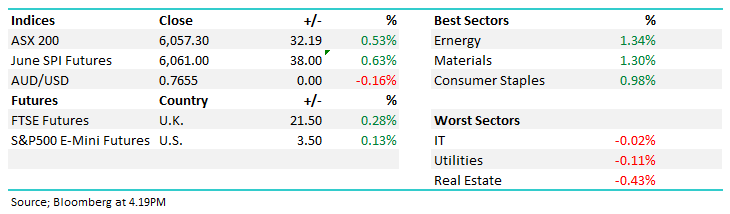

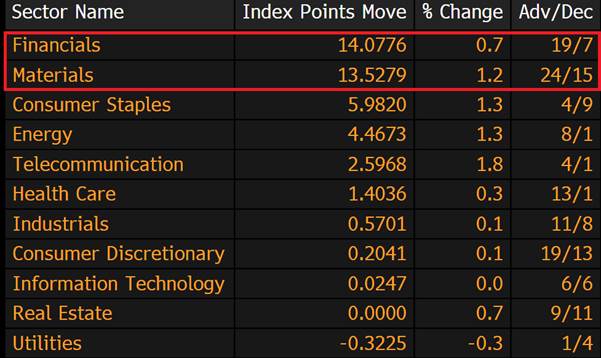

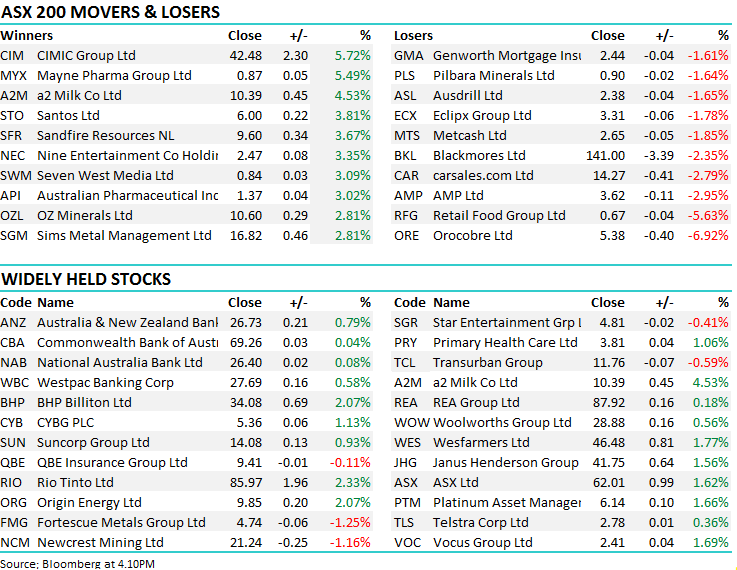

This morning we suggested that our market is currently lacking coordinated strength with different sectors taking it in turns to drag the market kicking and screaming higher e.g. yesterday the resources were strong but the banks fell -0.8% stifling any chance of an explosive advance. That changed slightly today with both the banks and material stocks making ground and as a consequence the index had a decent session – breaking its recent slumber. The below chart highlights index point contribution today .

As at 1pm

Overall the ASX 200 index added +0.53%, or +32points to 6057 – the highest close since May 21st – a reasonable session + DOW Futures are trading up +83pts at time of writing.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; BHP in focus today after they said that the first-round bids for the companies U.S. onshore oil and gas assets are seen in line with valuations and therefore the focus turns to likely capital management. It seems that all the guys you want at the table are there with oil majors including BP, Chevron. and Royal Dutch Shell. The stocks rallied hard today, adding +2.07% to close at $34.07

Elsewhere….

· Investore Property Cut to Underperform at Forsyth Barr

· Sandfire Downgraded to Sell at Morningstar

· Santos Upgraded to Hold at Shaw and Partners; PT A$5.40

· BHP Downgraded to Neutral at BofAML (Earlier)

Foretscue Metals (FMG) $4.74 / -1.25%; I was just on Sky Business discussing Fortescue, Atlas Iron, Lithium and the relevant stock moves just after the close today following FMG taking a 19.9% economic interest in Atlas Iron. Mineral Resources (MIN) was already making a play on Atlas Iron and now FMG seems to have scuttled the deal. Looking at the way the relevant stocks traded today – being FMG down, other Lithium stocks down & MIN up, it seems to me that the market is now betting on FMG being an acquirer / consolidator in a the currently hot Lithium sector – increased Lithium production underpinned by a new entrant (FMG) is a net negative for other producers such as our holding in Orocobre (ORE) .

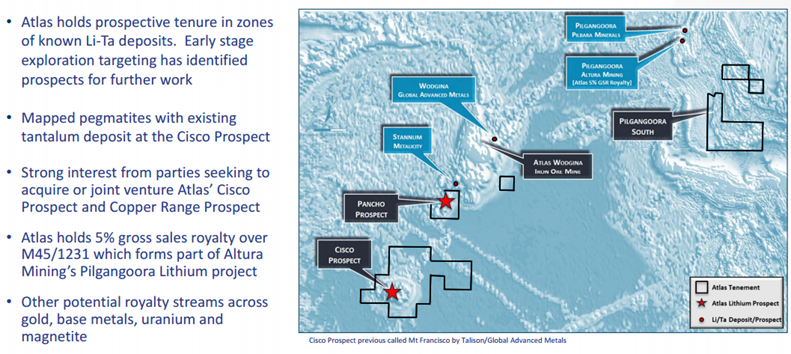

The more obvious conclusion would be that FMG are buying into Atlas for more port access at Port Headland or for more Iron Ore which can be used to blend with their product – and that was certainly the view of many that we’ve heard from today, however I think it’s more a play on Lithium than Iron Ore. We all know about Atlas as a struggling Iron Ore play however here’s a quick look at Atlas’s Lithium exposures. FMG has previously highlighted lithium as an area “of interest”.

AGO non iron ore assets – “To Lithium and beyond”

The move today really throws a spanner in the works for MIN & AGO - AGO is currently working thru a board approved scheme of arrangement with suitor Mineral Resources (MIN). I would love to be a party to the conversation that the respective major shareholders of FMG and MIN might have if they bumped into one another on St Georges Terrace. Anyway, looks like FMG’s 19.9% stake has/will scuttle the MIN tilt at AGO.

Fortescue Metals (FMG) Chart

Atlas Iron (AGO) Chart

Prospa (PGL); the small business lender had proposed to list yesterday, however a last minute decision was made to delay trading for 48 hours to allow the company to respond to ASIC queries of the company. The market was informed of the delay just 15 minutes before it was scheduled to start trading, with many questioning the timing of the float while the Royal Commission probes lending standards across the industry.

Prospa had managed to raise $146.5 mil as it continues to seek a larger share of the small business lending market. Most of the companies loan book is considered high risk lending, often the big banks won’t touch it, allowing Prospa to charge a significant interest rate on the loans – currently the average rate across the book is over 40%. Prospa has been forced to review loan terms twice in the past in 2015 and again in 2017, disclosing this in the prospectus while highlighting that terms continue to be reviewed. The issue in this case is believed to be around penalties for early repayment of loans – an issue the Royal Commission spent a fair amount of time discussing last week. The board has called an emergency meeting this afternoon to form a response to ASIC, and will likely discuss the possibility of pulling the IPO all together. Ouch!!

OUR CALLS

Vicinity Centres (VCX) was existed from the Income Portoflio today at $2.715 while we have orders to buy IGL at $2.25 limit, with a close today at $2.28.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 7/06/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here