Fortescue (FMG) outperforms on buy-back news

Stock

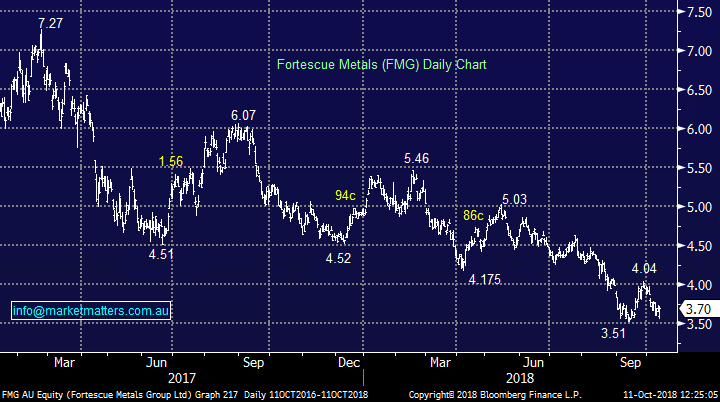

Fortescue Metals (FMG) $3.70 as at 11/10/2018

Event

Within the market rout today, there remains one shining light that has held up well. Fortescue has edged higher today, compared to Rio and BHP which are both languishing ~3% lower, on news that a $500m buyback will be launched after the quarterly report on October 25th. With gearing well below target levels and the next major debt repayment not due until 2022, Fortescue has taken the recent share price weakness as an opportunity to buy stock on the cheap. Early reactions from the market suggest this wasn’t on the radar – all the focus had been on capital management from Rio & BHP while FMG slipped through the cracks.

Fortescue (FMG) Chart

Market Matters Take/Outlook

FMG has gone from heavily indebted to printing cash in just a matter of years, and with cash comes returns to shareholders. The buy-back surprised a few, but given how the share price has performed, management clearly think the market is undervaluing the stock which is trading just above the 52-week low. The buy-back should be accretive, anywhere between 2%-4% EPS growth according to the analysts around.

Market Matters Take/Outlook

FMG has gone from heavily indebted to printing cash in just a matter of years, and with cash comes returns to shareholders. The buy-back surprised a few, but given how the share price has performed, management clearly think the market is undervaluing the stock which is trading just above the 52-week low. The buy-back should be accretive, anywhere between 2%-4% EPS growth according to the analysts around.