Fire in the belly of resource stocks (BHP, ILU, SWM, FXJ)

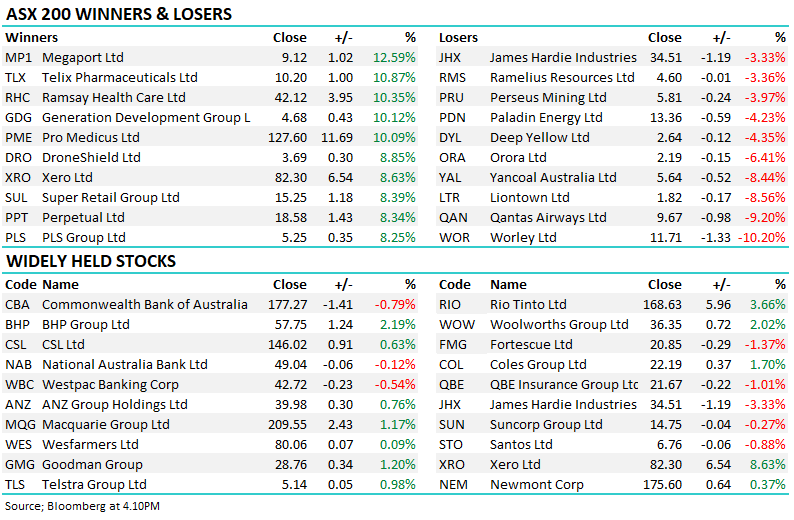

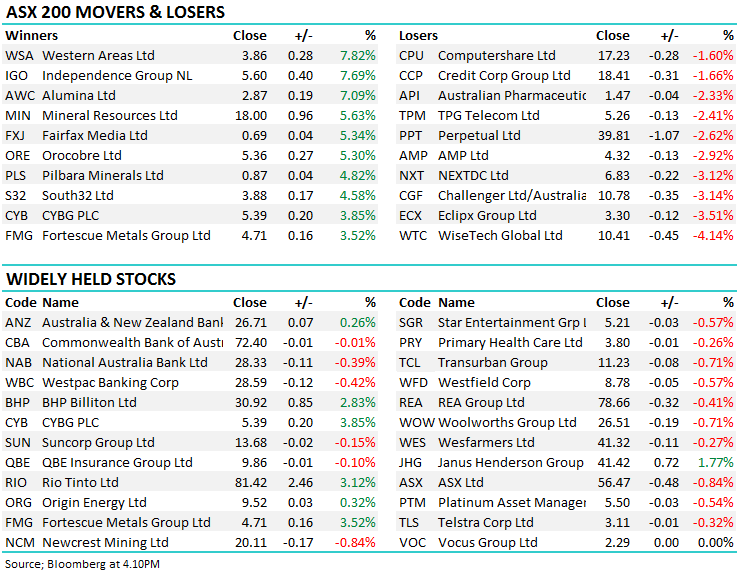

WHAT MATTERED TODAY

The resource stocks were very strong today after big moves in underlying commodity prices overnight put the fire in the belly of buyers, particularly targeting Nickel stocks Western Areas (WSA) and Independence Group (IGO) which both added more than 7%, while the large caps in BHP and RIO roared around ~3% higher. Once again though banks were a no show at the party with three of the big 4 finishing in the red while Bank of QLD continues to suffer from a soft half year result earlier in the week.

Iluka & BHP released their first quarter production numbers, while the media space was set alight with rumours of Seven West (SWM) and Fairfax (FXJ) returning to the table for merger discussions – more on these later. Clydesdale (CYB) bounced back in style after yesterday’s announcement on their provisions, closing 3.85% higher while Challenger Group Financial (CGF) came under pressure after their 3rd quarter funds under management update and annuity sales for Q1 were below market expectations – still hit by 3.14% to close at $10.78.

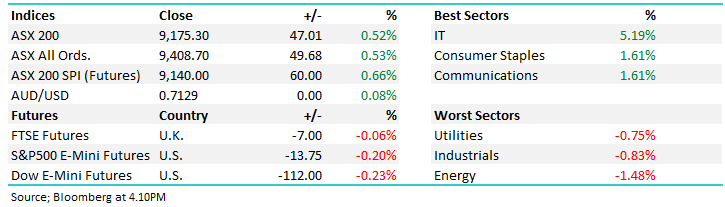

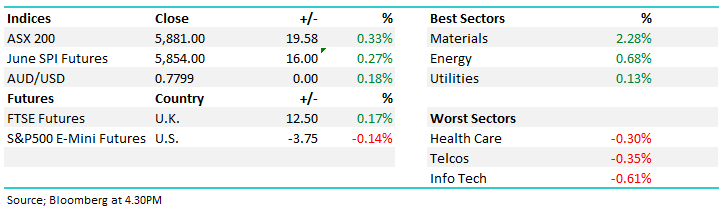

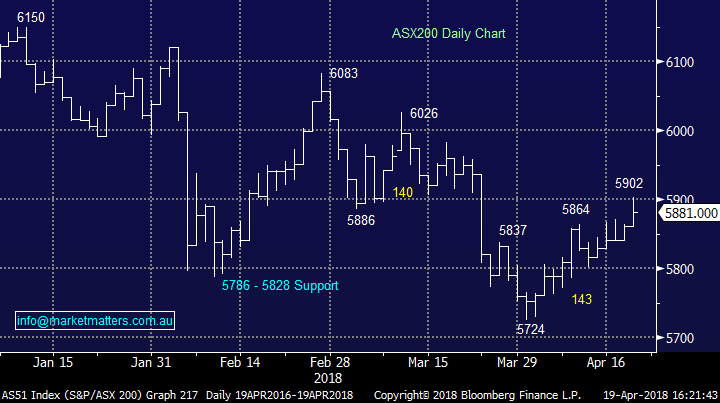

Local employment data showed a slight dip in the participation rate but the actual unemployment rate remained unchanged at 5.5%. Overall, the index finished 20 points higher, to 5881, up +0.33% - a brief push into the key 5900 range wasn’t held with the market finishing 21 points from highs. It seems the biggest dynamic in the market right now is the growth story – with tech related growth in the US leading the charge there while growth orientated resource stocks have been setting the pace locally. This was a theme we flagged in the Weekend Report suggesting that; Looking at the flow of buying in the US last week, it was clearly targeted mostly towards the technology stocks while locally the market was keen to buy Resource stocks. It’s interesting to think that the two respective ‘growth’ sectors or areas that usually do well when optimism is high saw most love last week. This provides a subtle indication that risk appetite is returning, and the tilt back up towards all-time highs for key US indices is still well and truly on the cards.

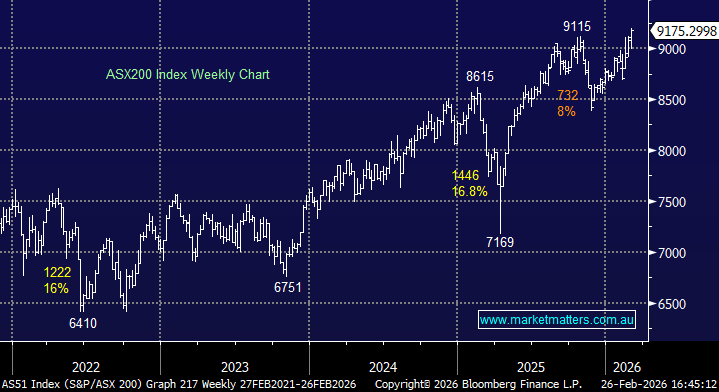

ASX 200 Chart – up early however the banks dragging again

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Shaw’s new Banking Analyst Brett Le Mesurier has come out with a BUY call on Bank of QLD – he’s doesn’t seem that bullish on the stock but more a valuation play – makes sense. He also re-initiated on Challenger with a hard line SELL and $9 price target, a day before the stock dropped 3% down to $10.78

- ARB (ARB AU): ARB Downgraded to Sell at Morningstar

- Bank of Queensland (BOQ AU): Reinstated Buy at Shaw and Partners

- Challenger (CGF AU): Reinstated at Shaw and Partners With Sell; PT A$9

- IOOF Holdings (IFL AU): Upgraded to Buy at Morningstar

- Melbourne IT (MLB AU): Downgraded to Hold at Bell Potter; PT A$3.75

- Regis Resources (RRL AU): Downgraded to Sell at Morningstar

- Rio Tinto (RIO AU): Downgraded to Outperform at CLSA

- SRG (SRG AU): Upgraded to Buy at Hartleys Ltd; Price Target A$2.54

- TPG Telecom (TPM AU): Downgraded to Sell at Goldman; PT A$4.70

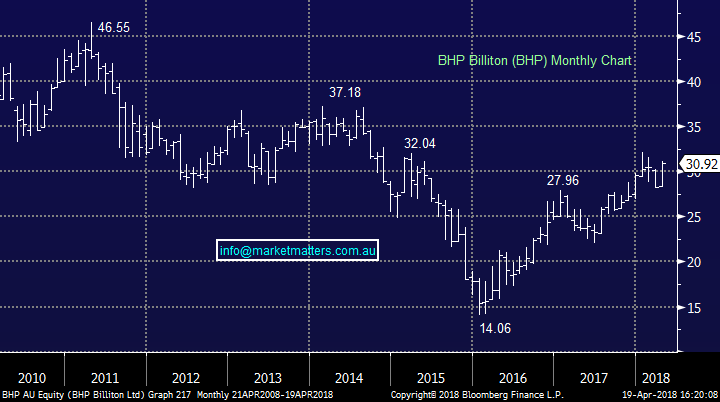

BHP Billiton (BHP) $30.92 / +2.83%; Ripped higher today on overnight tailwinds + they delivered an OK/mixed quarterly production and sales scorecard. From Rocky below…

· Overall more misses than beats – iron ore, coal and conventional petroleum – but some beats from recent laggards – US onshore (just as its approaching sale!) and copper (finally as Escondida ramps up).

· Earnings outlook – Gains in MQ copper prodn and FY guidance should broadly offset the lower MQ iron ore prodn and eased guidance. And if the coal units can deliver on big JQ expectations then FY numbers still look OK … and that’s before we even think about what the last whirlwind of spot commodity prices may do to future commodity price expectations and earnings. That said the latest M2M for BHP - using spot FX and commodity prices – points to 20-30% earnings uplift.

· Guidance tweaked with copper group slighter higher (up 1%) on better Escondida performance (we think copper will beat easily) but lowered modestly for iron ore (2%) citing rail/port issues (train unloading unit issues).

o FY18 guidance:

o Petroleum (MMboe) 180-190, unchanged

o Copper (kt) 1,700 - 1,785 vs prior 1,655 - 1,790

o Escondida (kt) 1,180 - 1,230 vs prior 1,130 - 1,230

o Other Copper (kt) 520 - 555 vs prior 525 - 560

o Iron ore (Mt) 236 – 238 vs prior 239 - 243

o Metallurgical coal (Mt) 41 - 43, unchanged

o Energy Coal (Mt) 29 - 30, unchanged

o JQ has to be a big one … In recent months we have gleaned a sense of growing confidence by BHP in terms of 2H18 financial and operational performance. Hopefully this feeds thru into JQ18 metrics which in most cases have to run well above guidance rates (annualised quarterly performance) to hit FY guidance targets i.e. iron ore unit is required to run at an annualised rate in JQ ~8% above FY guidance rate and at a record rate for the business. Ditto a 9% better rate than guidance in JQ from met coal and a whopping 33% better in steam coal.

BHP Chart

Seven West Media (SWM) $0.51 / +3.03% & Fairfax Media (FXJ) $0.69 / +5.34%; rumblings regarding a $2.3bil merger caused both media giants to rally today. The Australian reported that talks had resumed between the two, after discussions between Fairfax and Nine broke down last year. Seven is under a slight cloud at the moment with rumours of a potential capital raise required to pay for the Cricket rights they picked up last week, which would clearly hurt Seven’s bargaining ability. As this cloud dissipates, the chances of a merger will increase.

Seven West Media (SWM) Chart

Iluka (ILU) $11.69 / +0.60%; A good set of production numbers today from the Mineral Sands miner plus current price tailwinds are now very much apparent in revenue.

Iluka experienced a solid quarter of sales and has seen steady appreciation in prices. Total Z/R/SR sales volumes in the quarter were 205 thousand tonnes, in line with the 203 thousand tonnes sold in first quarter 2017. Sales mix was weighted to high grade titanium feedstock (R/SR), which is consistent with expectations. Weighted average prices for Z/R/SR increased in the quarter from the end of 2017. This reflects the achievement of previously announced price increases for rutile and contractual outcomes for synthetic rutile. The company went on today say that market conditions continue to be strong. The market dynamics remain unchanged, including tight supply in the zircon market and strong demand from pigment producers for high grade titanium feedstocks.

They also maintained full year production guidance.

Iluka (ILU) Chart

OUR CALLS

We took a healthy 12% profit on Rio Tinto in the Growth Portfolio today, increasing cash levels to 13%.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/04/2018. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here