Fewer hits than misses today – stocks fall (GMG, TLS, WPL, BRG, TWE)

WHAT MATTERED TODAY

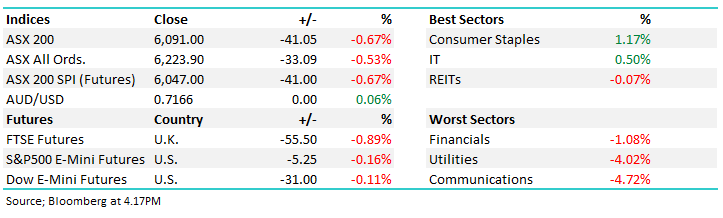

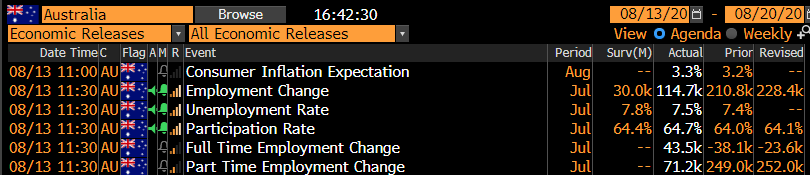

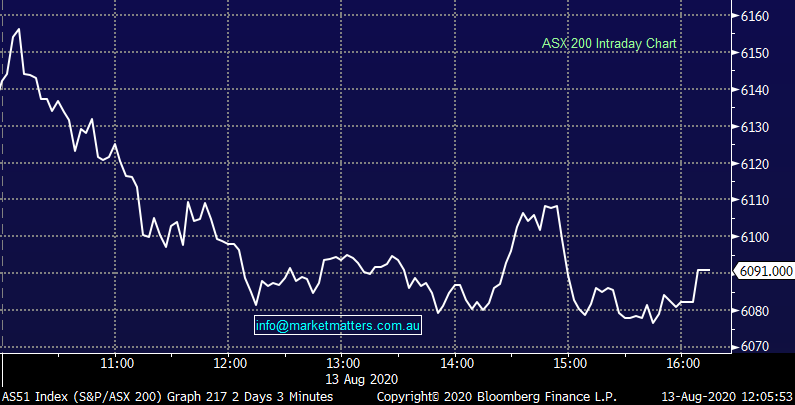

Reporting dominated the news flow today and all up it was a on the negative side, although there were some big moves on either side of the ledger - we cover the bulk of them below. The market was initially positive however the 11.30am jobs data seemed to get sellers off the sidelines. We’ve written a lot about the Australian health outcomes being better than feared and that was supporting better economic outcomes and that was true again today in the employment stats.

Unemployment came in at 7.5% v 7.8% expected plus the participation rate was stronger. The RBA have a 10% unemployment rate pencilled into their forecasts and although todays numbers don’t take into consideration the Melb lockdowns, they are clearly ahead of RBA modelling. That implies the RBA may be too bearish and the market takes that as code for less stimulus, hence the drop.

Economic Data Today

Source: Bloomberg

Asian markets a mixed bag today while US Futures are slightly lower

Overall, the ASX 200 lost -41pts / -0.67% to close at 6091. Dow Futures are trading down -31pts / 0.11%

I was on Ausbiz this morning talking through a few of the results – CLICK HERE - working from home today – back in the office tomorrow. **No logins required anymore**

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

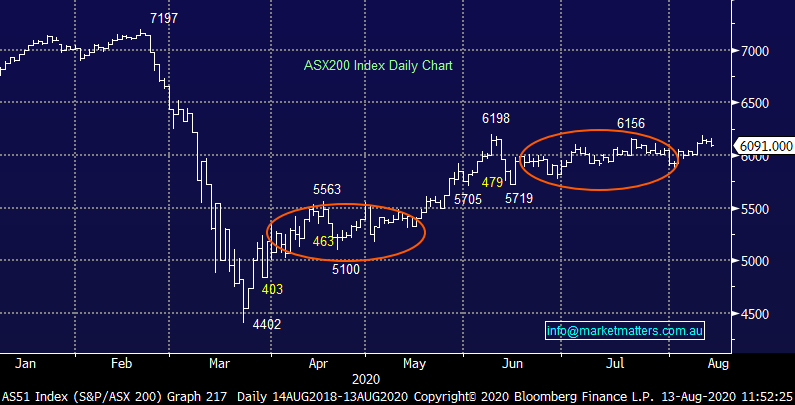

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Goodman Group (GMG) +1.3%: A great set of FY20 results for GMG today plus they’ve guided strongly for FY21. They booked full year core net profit of $1.06b which was inline with expectations however for the year ahead they forecast core profit of $1.165 which is up 10% on FY20, the market was looking for a rise of 8% so we’ll see upgrades flow through here. My neighbour works for GMG and says they have a very strong pipeline of work on the go.

Goodman Group (GMG) Chart

Telstra (TLS) -8.26%: We’ll call it a mixed result although the market clearly didn’t like it. The pro was the dividend being maintained – some thought it would be cut while it seems TLS now have more clarity around what the future holds for them. Earnings for FY20 were a tad weak, the market was looking for profit above $1.91bn and they came in at $1.84bn, plus FY21 guidance was about 8% below expectations, however digital transformation is a topic that will only grow legs as companies move to support a more remote workforce, I can’t help but think TLS is well positioned to take advantage of that. Let’s see how the dust settles, however TLS now a stock back on MM’s radar.

Telstra (TLS) Chart

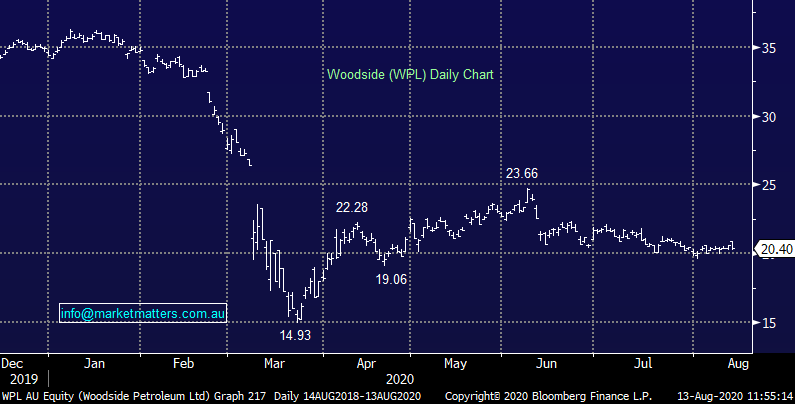

Woodside (WPL) -0.92%:The headline loss was a big one due to asset write downs that had been pre-announced however on an underlying basis the half year profit of $303m was a beat to Shaw’s expectations, but a miss to consensus. That said, free cash flow was strong, the dividend of US$0.26cps was higher than expected and operationally they’ve done well, particularly on the cost side. They just need a decent oil price tailwind and they’ll be off to the races!

Woodside (WPL) Chart

Breville (BRG) -8.39%: Sales jumped 25% at Breville for the financial year, but profit fell as a result of higher debt provisioning and IoT Platform write-down. While a portion of the added expenses was offset by temporary cuts to wages and marketing expenses, the profit of $66m was well short of market expectations at $77m. The market was expecting earnings to rise as a result of COVID as more people cooking at home flowed to purchases of kitchenware, which it did however the profits didn’t get the boost revenue did.

Breville (BRG) Chart

Treasury Wine Estates (TWE) +12.33%: about as inline as a result can be – for FY20 profit was $315.8m vs the market at $315.7m (although it was pre-guided), down 25% on last year with all geographies posting a fall in earnings but the Americas feeling it the most. While the US trade had deteriorated in the first half, COVID was clearly the main driver of declining profit which bodes well for the rebound. The company continues to remain cautious which is unsurprising, however it did note that signs of recovery had started to show in sales. Key to that will be a return to growth in the US as Asia looks to have put the worst conditions behind it.

Treasury Wine Estates (TWE) Chart

AMP +10.87%: pre-released their first half results a few weeks back, so the numbers were largely inline – underlying profit of $149mwas 49% below 1H19, but largely a result of the gain recognized on the AMP Life sale. The stock was higher today on a surprise 10c special dividend as well as a $200m on market buy-back – buyers of AMP shares have been few and far between over recent years so now the company is stepping in to the market to support the stock. Also snuck into the result was plans to buy out minority shareholder MUFG from the AMP Capital business at the cost of $460m. The CEO said the purchase was important as AMP Capital moves into the “next phase of growth.” AMP continues to work on reinventing the wealth management arm despite losing the chief only last week. It means that earnings will likely fall further before any recovery gets underway.

AGL Energy (AGL) 9.59% : They delivered for FY20 with NPAT of $816m v $814m expected however guidance for FY21 was a big miss. They say FY21 will be a very uncertain year on a number of fronts, and profits will likely be in the range of $560m-$660m, a big miss to current expectations of $750m. The earnings here have been in decline for a few years, the share price is following that.

QBE Insurance (QBE) +6.76%: From our analyst who has a passion for beating up QBE… QBE promised a large loss for 1H20 and they met that promise with a $712M loss. Few companies focus on the positives more than QBE. They direct investors to focus on premium rate increases first rather than the circumstances that create the need for such increases, being higher claims. In fact, they say that attritional claims are declining as premium rates and claims are rising. There seems to be a positive correlation between insurance margin and attritional claims, I.e. as attritional claims fall so does the insurance margin. Perhaps the company should focus on this relationship. There is no outlook other than to say that the attiritional loss ratio continues to decline. Perhaps the insurance margin will continue to fall as well…. unsurprisingly, he retains a SELL on the stock.

BROKER MOVES:

· Centuria Capital Raised to Buy at Moelis & Company; PT A$2.30

· Magellan Financial Raised to Hold at Morningstar; PT A$58

· Lifestyle Communities Cut to Hold at Canaccord; PT A$8

· Seek Raised to Hold at Morgans Financial Limited; PT A$17.90

· Seek Cut to Neutral at Evans & Partners Pty Ltd; PT A$21.94

· Nanosonics Cut to Underweight at Wilsons; PT A$4.50

· Seek Cut to Neutral at JPMorgan; PT A$20.15

· CBA Cut to Hold at Bell Potter; PT A$78

· JB Hi-Fi Raised to Neutral at Credit Suisse; PT A$42.71

OUR CALLS

No changes today

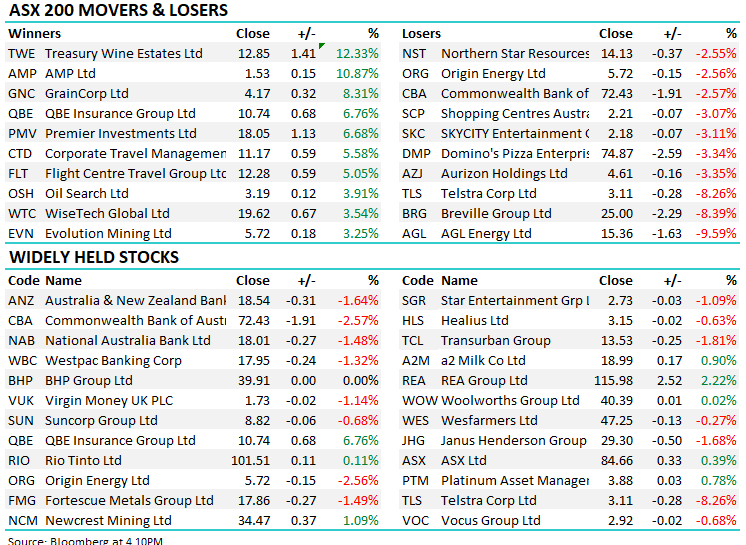

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.