Excitement fades into the weekend

WHAT MATTERED TODAY

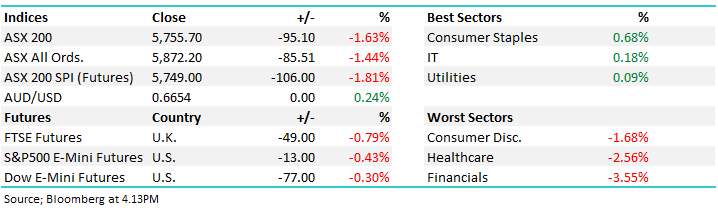

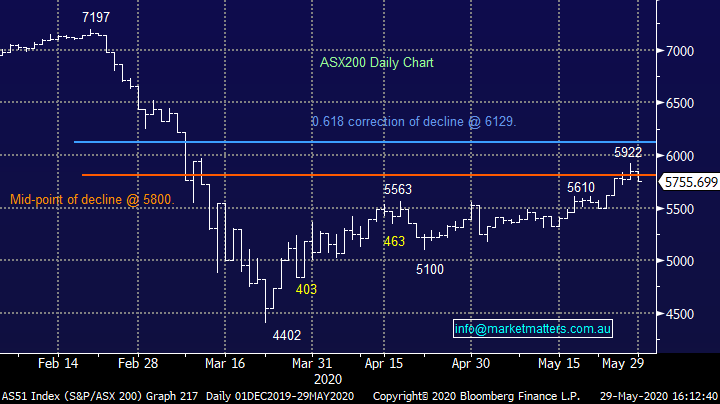

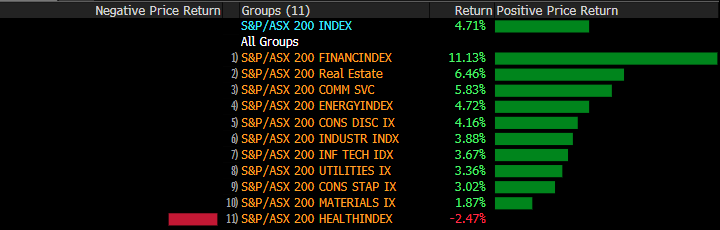

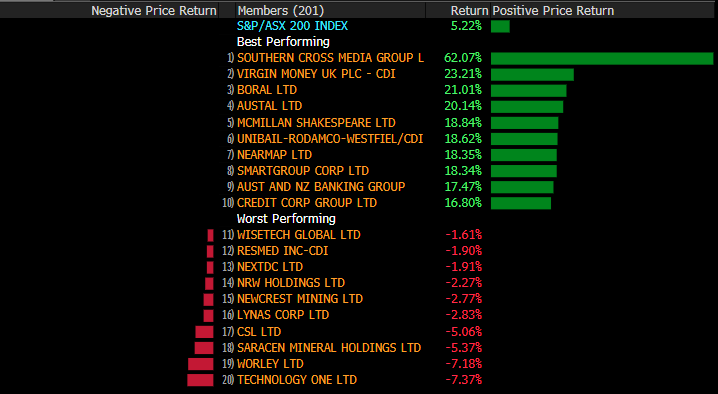

Momentum faded into the weekend today as the market gave back part of the rally seen through the week, the bulk of the selling seen late in the day into the close as the buyers backed off. Equities were sold off ahead of Trump’s press conference tonight where the US president is keen to talk tough on the China’s aggression in Hong Kong. Trump has been talking tough on a number of issues in an attempt to assert his dominance with the US election later this year, and he isn’t expected to back down tonight. Banks were the biggest losers today, though it was really just a relative sell off to their outperformance through the week’s trade. Energy held up on rumours that Russia and the Saudi’s were keen to work together to support oil prices in the short term. Iron ore names outperformed as Brazil continues to see rising cases of corona virus which threatens their supply into the market. The ASX toyed with the 5800 level today, a key technical level for those following Fibonacci retracement as it represents a bounce of about 50% of the crash to the March lows. It will be interesting to see how the market trades to start next week. Despite today’s fall, the week’s 5% gain was the best since the second week of April as liquidity across markets drives equities higher.

Overall, the ASX 200 closed down -95pts or -1.63% to 5550. Dow Futures are trading down -147pts/-0.60%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Sector moves this week

Stock moves this week

BROKER MOVES;

· Viva Energy Group Raised to Add at Morgans Financial Limited

· Centuria Office REIT Raised to Outperform at Credit Suisse

· Blackmores Raised to Market-Weight at Wilsons; PT A$70.50

· Atlas Arteria Raised to Hold at Morningstar; PT A$6.20

· Brickworks Cut to Hold at Morningstar

· Adairs Raised to Buy at Goldman; PT A$2.40

· New Hope Cut to Neutral at Credit Suisse; PT A$1.50

· Ampol Raised to Overweight at Morgan Stanley; PT A$31

· AGL Energy Cut to Hold at Morgans Financial Limited; PT A$17.15

· IDP Education Cut to Hold at Blue Ocean; PT A$17

· Bendigo & Adelaide Raised to Neutral at Credit Suisse; PT A$7

OUR CALLS

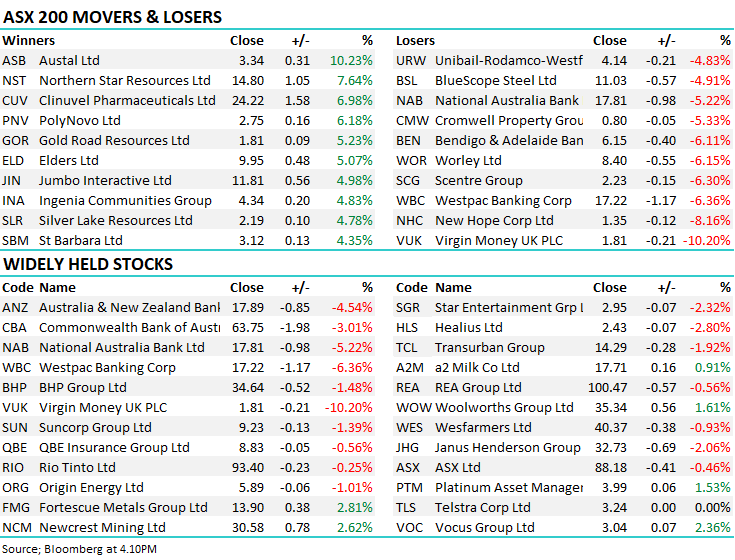

Major Movers Today

Have a great Weekend all

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.