Energy stocks flare up again!

What Mattered Today

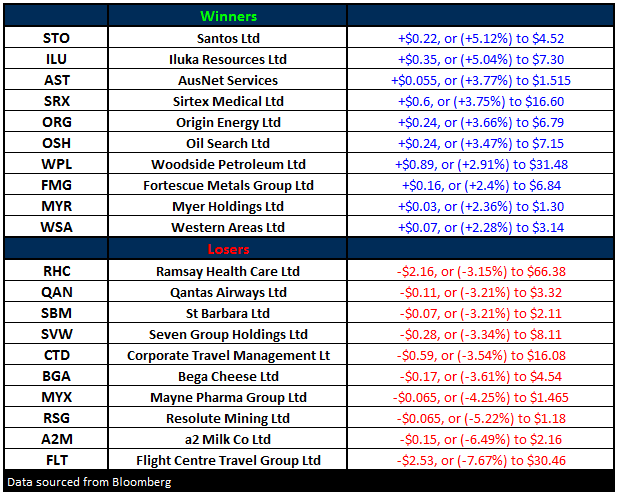

Energy the standout again on the market today following developments over the weekend from non-OPEC countries agreeing to cut production + the Saudis will cut more than previously advised...this put a decent bid tone under the Oils with Santos (STO) the big winner up +5%...while our position in Origin Energy (ORG) continues to please adding another +3.66% to $6.79.

Ansell (ANN) also had a good day rallying +2.08% to close at $25.06, the level we’ve targeted since entering the stock below $22 at the end of October. We took the opportunity to SELL the holding and lock in a ~14% profit. That takes our cash weighting back up to 16% however we are stalking a few stocks that may come back to our targeted levels over coming days…

Ansell (ANN) Daily Chart

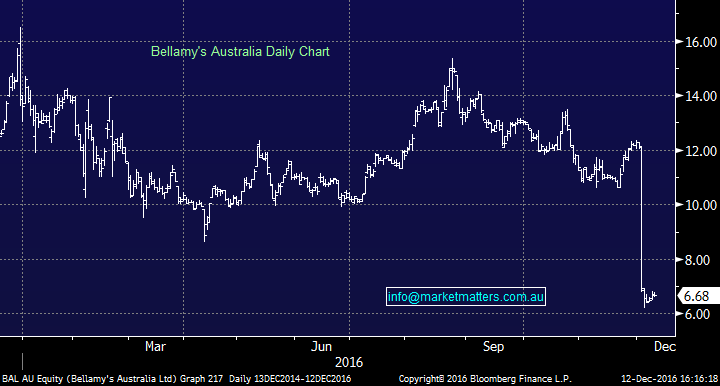

Bellamy’s (BAL) went into a trading halt today pending the release of an updated announcement of the impact of trading conditions on their financial performance, or in other words, they’re about to shock the market for the 2nd time in the past 12 days…something clearly smells here! On the 2nd December they said that changes to regulation in China was crimping sales, and the stock dropped from above $12 to below $7. On the 6th December the ASX queried them regarding disclosure and the company responded on the 8th. They’ve now entered a trading halt and unfortunately for holders (not us) this will more likely than not be bad news. Share in BAL last traded at $6.68…As we’ve said before, all too hard for Bellamy’s at the moment

Bellamy’s (BAL) Daily Chart

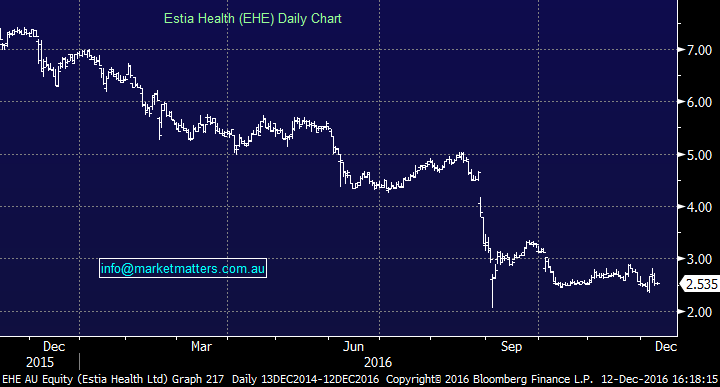

Estia (EHE) also went into a trading halt before trade today confirming they’ll raise $137m via an underwritten deal with Macquarie. It’s a 1 for 3 accelerated rights issue at $2.10 a share, so for those holding to stock, you’ll have the opportunity to buy 1 new share for every 3 you hold at $2.10 versus the last traded price of $2.68. The stock will likely drop when it starts trading again in the next day or so, but will likely trade above the $2.10 level given they confirmed guidance, plus they cut their dividend which (although this seems strange) will be liked by the market given their current gearing. We’ve been targeting a BUY on EHE nearer to ~$2.00 and hopefully this will give us our chance

Estia Health (EHE) Daily Chart

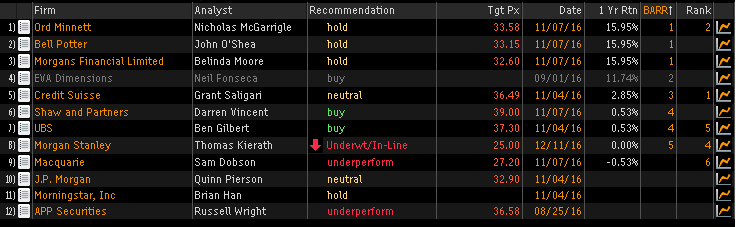

Flight Centre (FLT) dropped today, by about ~7% on a broker downgrade – Morgan Stanley reckon it’s worth $25 a share versus $30.46 close today. The issue is around the companies guidance, which has been reasonably upbeat however with a big 2nd half skew. Some companies naturally have an earnings skew in the second half, but historically FLT’s hasn’t been big, or as big as guidance is now implying. FLT is cheap, has a pretty good track record but it’s simply struggled for the last few years. Is bricks and mortar travel retailing in structural decline and how can FLT compete with online only operators? Simply, we’re not sure, they might be able to muddle through, but it’s hard to have conviction either way. We’re high conviction investors so we’ll stand aside from this one…

Here’s the Broker Calls on the stock which shows big variance in expectations…Too hard for us!

Source; Bloomberg

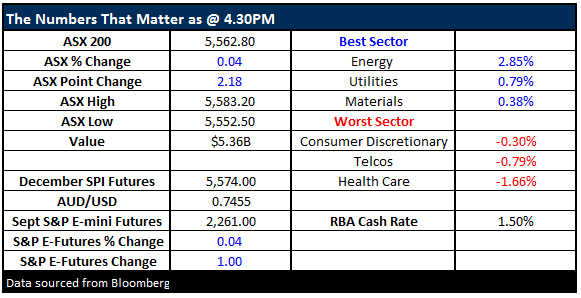

On the market today, we had a range of +/- 31 points, a high of 5583, a low of 5552 and a close of 5562, up +2pts or +0.04%.

ASX 200 Intra-Day Chart

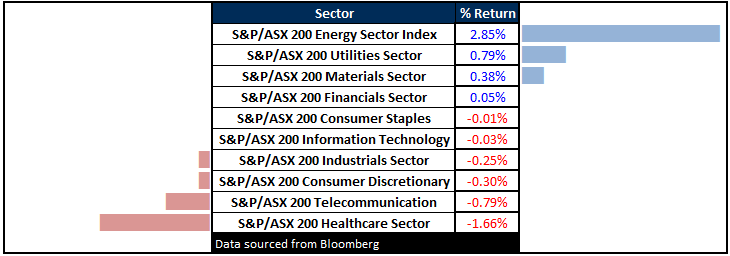

Sectors

ASX 200 Movers

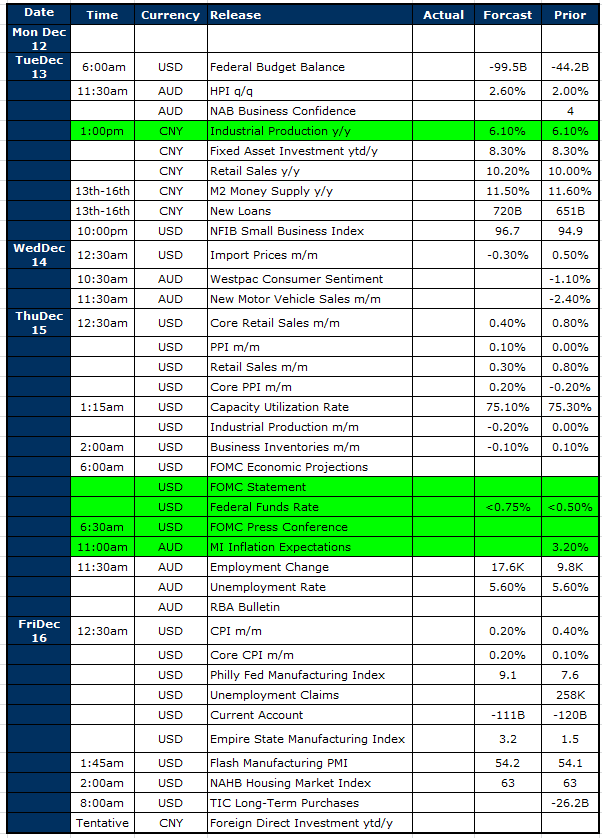

Select Economic Data from China, U.S & Oz - Stuff that really Matters in Green

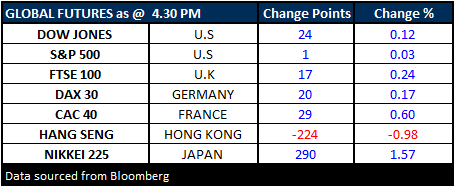

What Matters Overseas

FUTURES higher….

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/12/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here