Edging higher, but wind seems to be coming out of the sails (NHF, SUL, KGN)

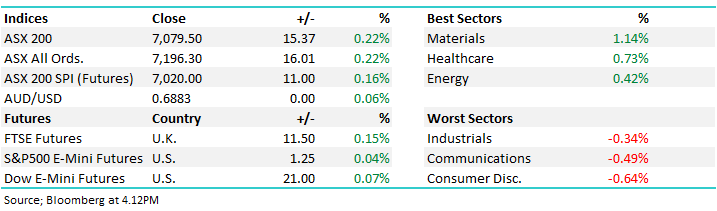

WHAT MATTERED TODAY

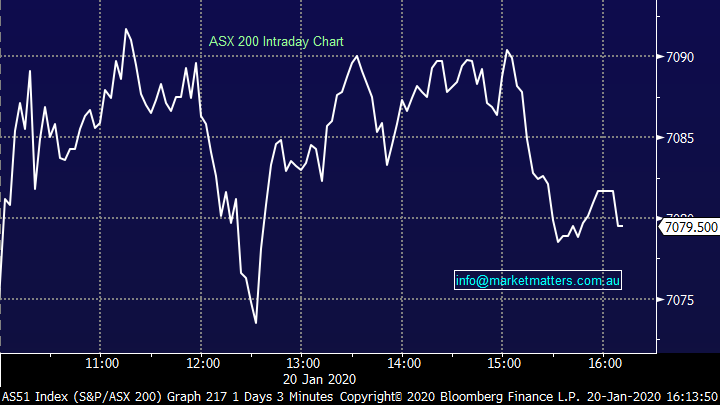

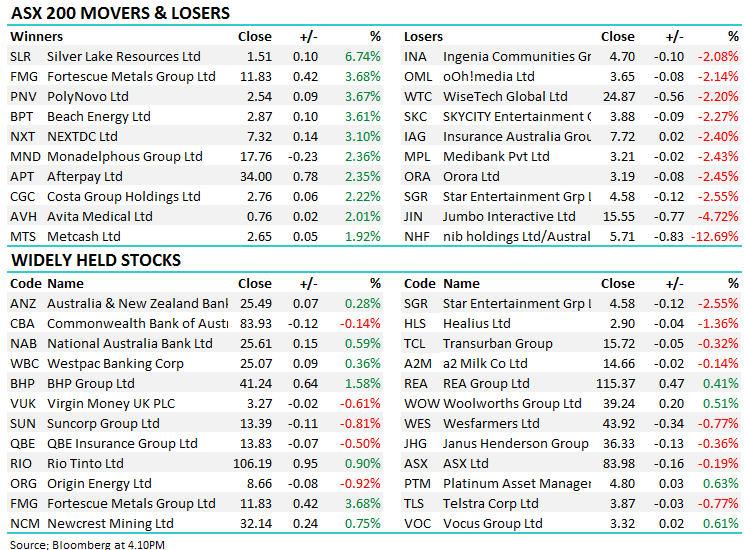

Another positive open to trade this morning with the market again having a second crack at the ~7100 region before a range bound day played out, the ASX 200 ebbing within a ~20pt range, although there was some decent variance amongst the sectors. Resource stocks the clear standout, BHP above ~$41, RIO ~$107 & Fortescue (FMG) ~$11.80 the stars. Elsewhere, confession season kicked in with a number of companies, mostly consumer facing names providing weaker than expected trading updates. Kogan (KGN) and NIB (NHF) whacked, Super Retail (SUL) also down but not as much – Harry covers below.

From a very short-term tactical sense the market is looking tired, struggling to hold higher highs intra-day and it looks likely to pause at least here. Of the 14 trading days in Jan so far, 12 have been positive while only two have been down. The trading updates today were a clear warning of what could play out come reporting season. Most are sighting a liquidity driven rally, MM included however interest rates are low for a reason, remember not to forget it!! As an aside, on Friday I flagged that when stocks finish lower in the match (i.e. at 4.10pm) than they were at 4pm by a reasonable margin, it’s a sign of impending weakness – which hasn’t played out as yet, although that theme happened again today on reasonable volume in the futures.

A mixed bag in Asia today but no real moves of note, US Futures were little changed through our time zone while US markets are closed tonight for Martin Luther King Junior day.

Overall, the ASX 200 added +15pts / +0.22% today to close at 7179. Dow Futures are trading marginally higher up by +21pts/+0.07%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

NIB Holdings (NHF) -12.69%: Hit on the back of a sizable downgrade today with the health insurer saying underlying pre-tax profit would be at least $170m versus their prior guidance for at least $200m. The market was sitting at nearly $211m before today’s announcement implying a ~19% reduction on consensus. They sighted an uptick in claims, and importantly, the cost of claims however it seems ‘claims inflation’ was higher than expected which impacted insurance margins. The stock has been struggling for a while, and todays update could be the final nail in the coffin. Our sale in the MM Growth Portfolio for a ~47% profit now looking a good call. The stock now back on our radar.

NIB Holdings (NHF) Chart

Super Retail Group (SUL) -1.84%: Released 1H20 trading update this morning which showed group sales across the Super Retail brands of nearly 3% growth to 28 December despite the impact of drought and fires late in the second half, however it has not been enough to please the market with shares trading lower throughout the session. The BCF and Macpac brands, Super Retail’s two smallest contributors, were most heavily impacted “due to their higher exposure to the outdoor category” with like-for-like sales falling 0.5% and 7% respectively. Macpac was the only brand to see total sales fall, down 1% in the first half with BCF store openings delivering some growth. Supercheap Auto and Rebel both recorded more than 3.5% total sales; however it was Rebel who won out on a life-for-like basis hitting 3.3%.

The company now expects first half EBIT between $113-115m, around flat on the first half of 2019. The company blamed higher labour costs and a delay in price increases in Macpac ahead of the winter period for tighter margins although they expect this to normalize somewhat in the second half. The market is looking for low single digit EBIT growth over the year, so Super Retail have some work to do in the second half. Although shares were down, they did bounce from the morning lows. We are neutral here.

Super Retail (SUL) Chart

Kogan.com (KGN) –22.17%; the company gave a business update today, covering the trading conditions of the first half which look to have come in behind some lofty expectations the market had. The company has beaten out last year’s half yearly, piggy backed by its highest Black Friday and Boxing Day sales events with Exclusive brands and Kogan Marketplace continuing their strong growth driving active customer growth of more than 10% year on year. Gross profit grew more than 9%, but this was well behind consensus, hence the selloff. We are on the sidelines here, preferring to wait for some buying support to kick in.

Kogan.com (KGN) Chart

Broker moves;

· nib Raised to Neutral at Citi; PT A$6.85

· Qantas Cut to Neutral at Citi; PT A$7.45

· Rio Tinto Cut to Accumulate at Ord Minnett; PT A$112

· Transurban Rated New Sector Perform at RBC; PT A$15

· Metcash Raised to Neutral at Macquarie; PT A$2.65

· Woolworths Group Raised to Outperform at Macquarie; PT A$42.40

· Nufarm Cut to Neutral at Macquarie; PT A$5.77

· Nufarm Cut to Hold at Jefferies; PT A$5.70

· Whitehaven Raised to Hold at Ord Minnett; PT A$2.80

· Independence Group Cut to Sell at Morningstar; PT A$5.20

· Sandfire Cut to Hold at Morningstar

· Ramsay Health Cut to Sell at Morningstar

· Costa Cut to Hold at Morningstar

· Origin Energy Cut to Hold at Morgans Financial Limited

· Metlifecare Cut to Hold at Deutsche Bank

OUR CALLS

No changes across portfolios today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.