Domino’s hit as US namesake disappoints (DMP, BHP, EHE)

WHAT MATTERED TODAY

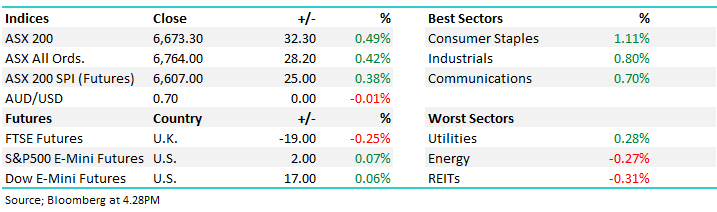

A solid two hour morning session today which saw the market +40pts from the early lows before a tight trading range played out for the rest of the day. There was more volatility today, particularly across the MM portfolios with strong moves on the upside from some of our value plays, Pact Group (PGH) +2.27%, Emeco (EHL) +3.29% and Bluescope (BSL) +4.30% however on the downside our recent purchase of Dominoes (DMP) was hit, off by -5.13%, more on that below while Estia Health (EHE) which resides in the income portfolio fell by -5.76% on news of a class action. Pleasingly, NiB Holdings (NHF) recovered today to close up +2.09% to $7.81 after yesterday’s sell-off on broker downgrades.

At a sector level, Consumer Staples were strong as Coles and Woolies tested recent highs while the property and energy names were the weakest link.

Overall, the ASX 200 added +32pts today or +0.49% to 6673. Dow Futures are trading up +17pts / +0.05%.

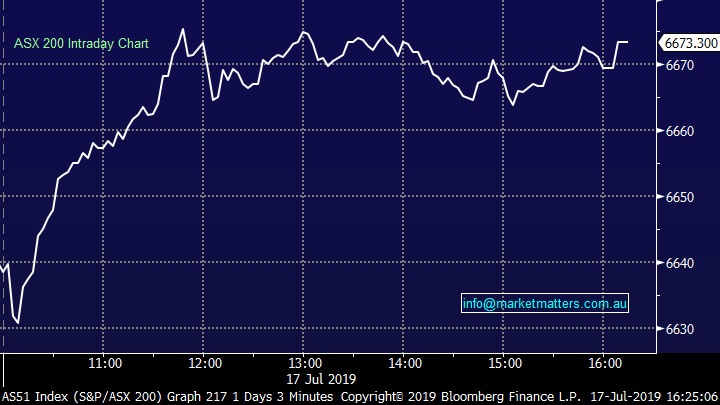

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Dominos (DMP) -5.13%: Hit for the second session in a row today closing at $36.60 after the original Domino’s in the US (which is not part of DMP listed in Australia) missed earnings numbers overnight forcing to local entity to close well below our flagged stop level of a close below $38.50 – we will cover our plans for DMP in the AM report tomorrow, however the stock is trading at a level that ultimately I’d rather be a buyer than a seller.

Overnight, we saw DPZ US which is the US listed entity grow sales at 3% for the second quarter which was a miss on the 4.6% expected by the market. The shares dropped 8% on the news and this has dragged down the locally listed DMP today. The rise of well-funded home delivery menu apps that are prepared to run at a loss was one of the reasons sighted for the miss which is also one of the concerns facing DMP in Australia. While this is an obvious concern, the argument is that DMP in has been pricing in these concerns for some time, while the US operation has clearly not as the below chart implies. Currently, DMP trades on 22x FY19 with EBIT growing at 10% while DPZ trades on 26x FY19 with very similar growth expected at the EBIT line while top line revenue is expected to see around half the growth expected by DMP in Australia. More on this in the AM .

Domino’s Pizza (DMP) Chart vs DPZ US both in $US terms

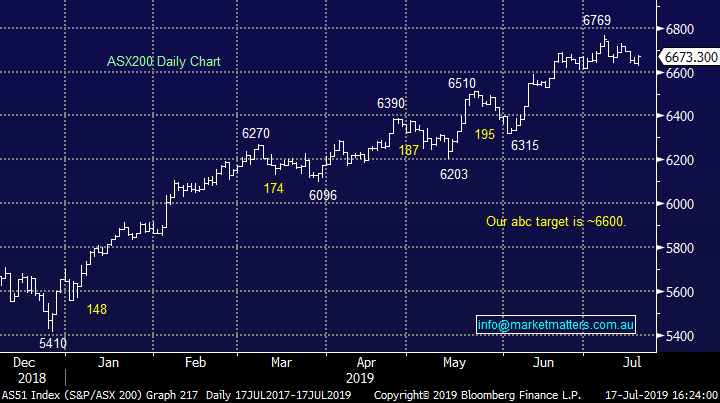

BHP Group (BHP) +1.41%; met guidance across the board for their 4th quarter, and as a result the full year from a production standpoint - FY20 guidance was also pretty much as per programmed. Here’s the commodity deck from BHP:

On the costs side of things, BHP broadly hit expectations with the slight exception of the their NSW Thermal Coal which was raised on some production issues. The report also noted a number of one-off costs will be absorbed in the full year result due out next month. These mostly stem from redundancy payments and the Samarco rehabilitation. Despite this, BHP are poised to report a stellar profit at the result given the tailwind of significantly higher iron ore price in the back half of the year. We like BHP, and other iron ore names, into pullbacks, initially targeting $38 as an entry point.

BHP Group (BHP) Chart

Estia (EHE) -5.78%; hit hard on the announcement of a class action against the company regarding disclosures of the troubled integration of the Kennedy Healthcare acquisition in late 2015. At the time the company assured investors that it was going to plan and had provided guidance that was later slashed significantly. We bought Estia for an income play and were sitting around even until this announcement. The outlook remains reasonable despite the class action, it does however bring in a little more uncertainty around its ability to repay shareholders. We are remaining positive but keeping an eye on the stock – we only have a small position currently, which gives us flexibility to step up and buy any excessive pessimism.

Estia (EHE) Chart

Broker moves; While UBS does not provide their research to Bloomberg (which is where the below list comes from) we see today they upgraded their price target on Bingo to $2.70, up +35% on the prior target largely on the back of positive earnings revisions following planned price hikes. We sold BIN recently and are now watching closely, there upcoming results remain the key.

- Fletcher Building Cut to Underperform at Forsyth Barr

- Ramsay Health Cut to Neutral at Macquarie; Price Target A$75

- JB Hi-Fi Downgraded to Sell at Morningstar

- Seven Group Upgraded to Hold at Morningstar

- Galaxy Resources Downgraded to Neutral at Citi; PT Set to A$1.60

- Aristocrat Upgraded to Overweight at Morgan Stanley; PT A$35

- ResMed Downgraded to Neutral at UBS

- Rio Tinto Cut to Hold at Renaissance Capital; PT 52 Pounds

- Elders Upgraded to Add at Morgans Financial; PT A$7.30

OUR CALLS

We switched from CBA into ANZ today for both the Platinum & Income Portfolios

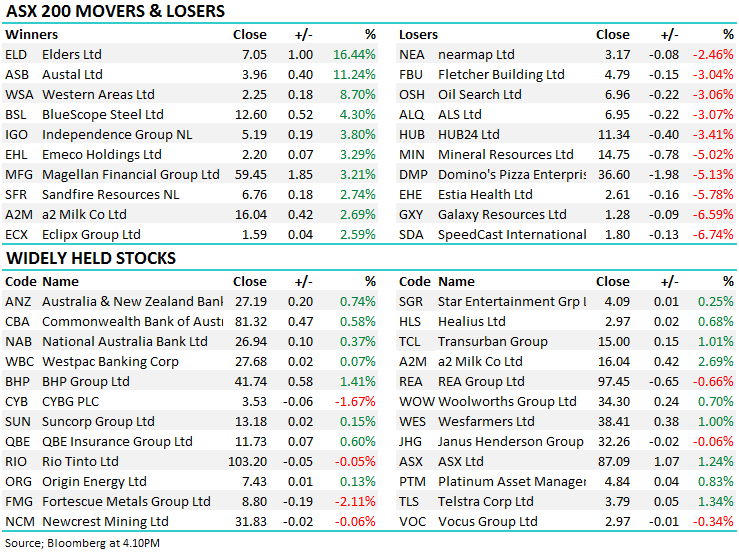

Major Movers Today – Big move on ELD today post cap raise while WSA caught my eye as Nickel prices rally

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.