Does Tyro Payments (TYR) data show spending peak?

Tyro Payments (TYR) +1.54%

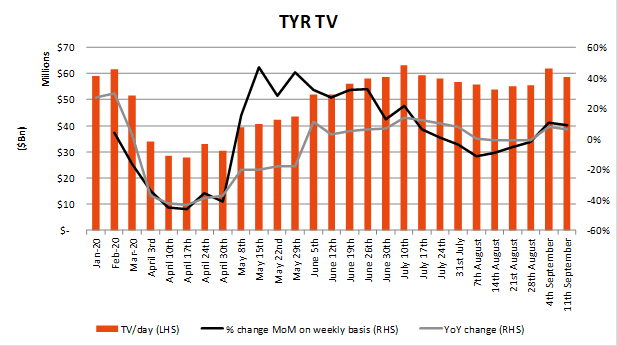

We haven’t covered this in a little while however circling back to Tyro’s weekly trading update they started during COVID which has been very useful in tracking card spend particularly in tourism and hospitality businesses. Overall the data looks to have peaked and offline looks really tough. Victoria lockdowns have contributed to negative sentiment and likely the next few months for offline providers will continue to be tough.

Key points of interest:

· Transaction Value (TV) to week of 11th September was $58m, this is now up 6% YoY;

· However, on a weekly basis this is down ~5%. TV on a weekly basis was ~$55m 2 weeks ago and volumes peaked at ~$63m in July. Although not broken down by geographic areas, likely confidence and decreased movements in Victoria is significantly contributing to the lower volumes. Hard to see how this and offline retail comps well over the next few months as a result;

· Continues to provide a strong proxy for online providers within the economy. Offline particularly those focussing on SME’s, travel and retail (offline) are finding it difficult. The economy in offline nationally is spluttering.

Expect online proxies to continue to rally. Comp sales for July/August continuing to strengthen for these players, should provide a strong 1Q21 update. October the time to own these players into the strongest online environment of the year to January. This chart from Shaw and Partners analyst Jono Higgins looks at total transaction value per day (left hand axis) and the growth rate MoM (Black line) and WoW grey line.

Source: Shaw and Partners

Source: Shaw and Partners