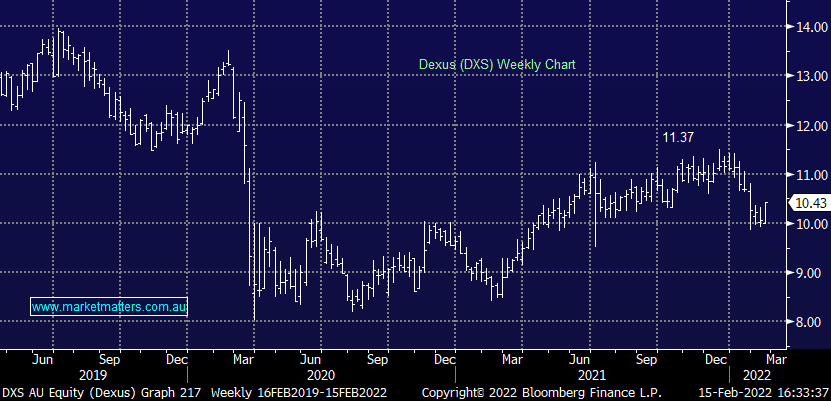

Dexus (DXS) 1H report shows positive signs in office

DXS +2.66%: a strong start to the year for the biggest office landlord in Australia. Dexus saw Funds From Operations (FFO) fall slightly to 28.1cps in the half on the back of a softer trading result, however they maintained full year guidance of at least 2% growth in both FFO and distribution, in line with consensus and important, they are not showing signs of stress in terms of office demand. Occupancy in the office portfolio was 95.1%, and 98.6% in the industrial portfolio while rent collections continue to improve coming in at 97.9%. They noted strong global demand for quality real estate despite the threat of rising interest rates which should provide a good backdrop for improved trading performance. All in all, a decent read through for DXS and the broader property sector given Dexus’ size.