CSL crashes into unknown territory

Stock

CSL Ltd (CSL) $233.35 as at 14/08/2019

Event

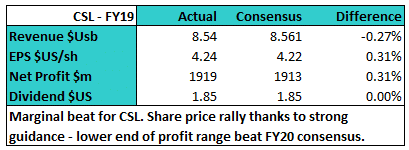

Blood medicine company CSL has shot higher in today’s session to set new all-time highs on a solid set of FY19 numbers and an even better outlook. Those fearing the company had seen the back of its strong growth rate welcomed the guidance pointing to profit growth of around 9% in FY20.

The FY19 result was broadly in line with expectations, hitting the earnings number on the head. The slight miss in revenue was more than offset by a better effective tax rate.

Each division appears to be (at a minimum) delivering on the strategy, while the immunoglobulin & albumin therapies are showing better than expected growth. The company noted a strong rebound of the albumin sales into China in the second half helped see global sales here grow 15% in the year.

The FY20 profit guidance of $US2.05b to $US2.15b was better than expectations at $US2.044b prior to the result. This includes the impact of CSL’s China restructure which will see it develop a direct distributor model, in line with the groups wider model but causing a $340-$370m hit in the financial year (which they view as a one off)

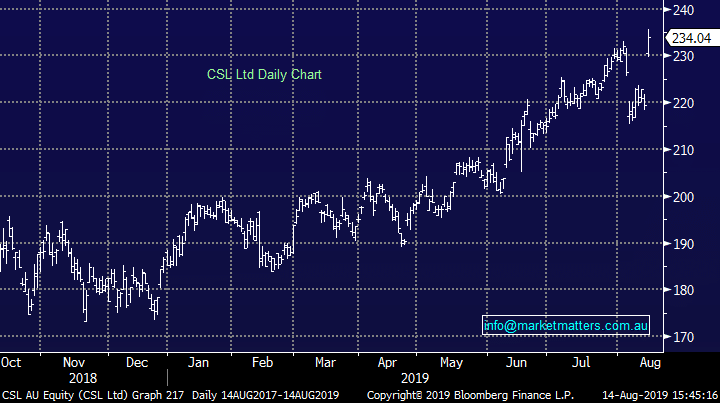

CSL Chart

Each division appears to be (at a minimum) delivering on the strategy, while the immunoglobulin & albumin therapies are showing better than expected growth. The company noted a strong rebound of the albumin sales into China in the second half helped see global sales here grow 15% in the year.

The FY20 profit guidance of $US2.05b to $US2.15b was better than expectations at $US2.044b prior to the result. This includes the impact of CSL’s China restructure which will see it develop a direct distributor model, in line with the groups wider model but causing a $340-$370m hit in the financial year (which they view as a one off)

CSL Chart

Market Matters Take/Outlook

Market Matters Take/Outlook