Crude spikes, Bellamy’s bid while Sims scraps guidance (BAL, SGM, BHP)

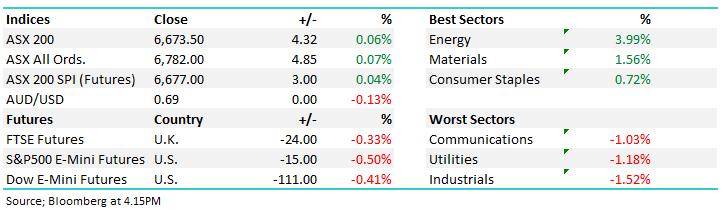

WHAT MATTERED TODAY

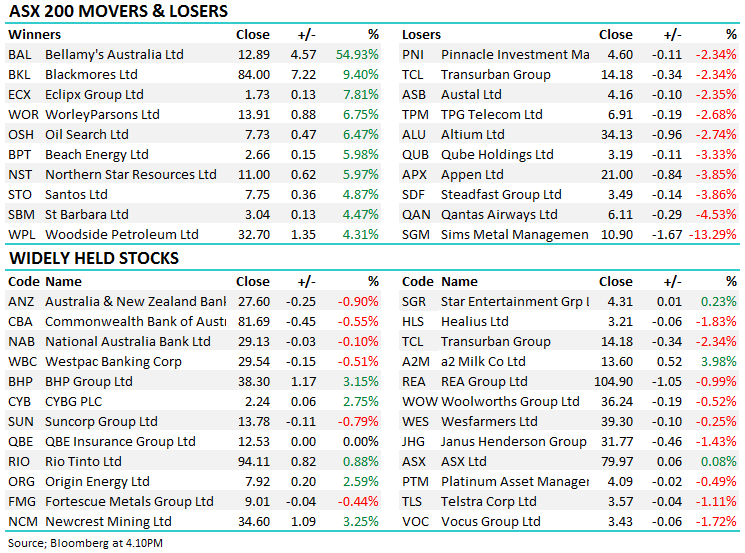

An interesting day for local stocks with the energy sector the clear standout thanks to a spike in the Oil price, Futures trading +9.7% at time of writing underpinning moves in Beach Energy +5.98% Santos +, Oil Search +4.87% & Woodside +4.31% while BHP also caught some of the tailwind to put on +3.15%. Elsewhere, Bellamy’s (BAL) added +54.93% on the back of an aggressive takeover tilt from a Chinese suitor while metal recycler Sims Group (SGM) scrapped its profit outlook saying for a variety of factors its now likely to be materially lower than last year – the stock ending down +13.29%.

The weekend attack on key Saudi Arabian oil facilities has caused the worst disruption to world supplies on record which has prompted the biggest price spike in history, Trump coming out saying the U.S. was "locked and loaded" to respond. Iraq or Iran are being labelled as the perpetrators and the weekends activities saw Brent Crude put on +20% early on this morning before settling up around half that amount.

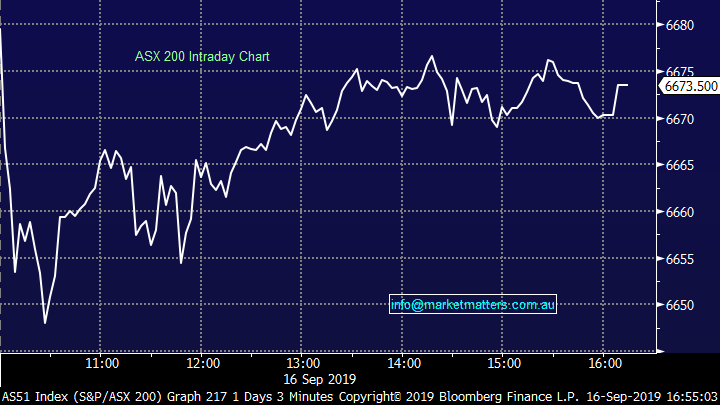

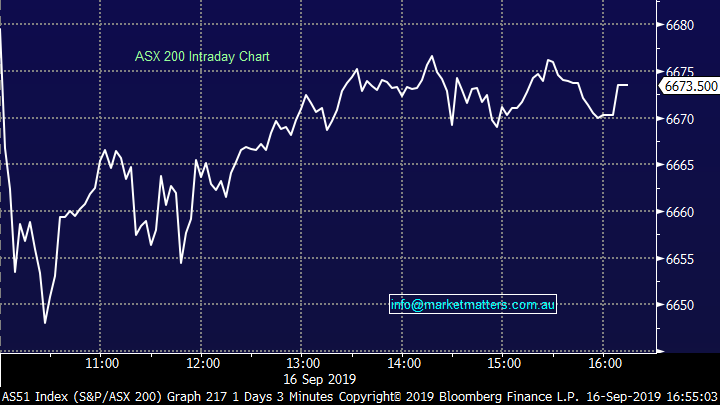

We saw some big comebacks from stocks hit on open this morning and that flowed through to the index level, the ASX 200 down ~30pts early on before grinding up from a 10.30am low…not a bad effort overall.

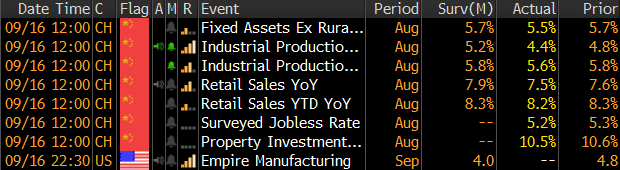

Chinese data today was weaker than forecast, Industrial Production which measures the output from manufacturing, mining and utilities came in shy of expectations while Retail Sales were also a touch on the light side. Asian markets were mixed today while US Futures were trading down around 0.50% for most of our session.

Economic Data Today

Overall, the ASX 200 was up +4pts today or 0.06% to 6673, Dow Futures are now trading down -102pts/-0.38%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Comebacks: A number of stocks were hit hard on open this morning only to recover throughout the day, while the stocks influenced by the rally in crude generally gapped higher on open before sellers tipped in. This fits our current approach of buying weakness but selling into strength. Bluescope (BSL) an example here down ~5% early before closing off -1.48%, ditto for Orica (ORI) with the stock trading up ~4.4% from the lows versus WPL which opened higher but traded -3.3% from its early highs. The Oil market is clearly tight hence the spike in crude and rhetoric coming from the US implies that this situation could well escalate in the short term. If we see BHP back up near $40 we’re likely sellers.

BHP Billiton (BHP) Chart

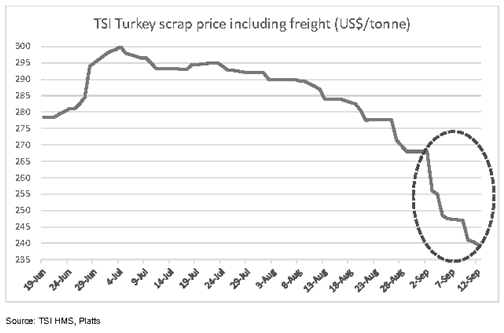

Sims Metals (SGM) –13.29%; the scrap metal trader warned on profits for the first half of the year after prices crashed in recent weeks. The company said that the trade escalation continued “to reduce the demand for steel and aluminium” to the point where scrap purchases and outlook from steel mills had eroded. Sims also noted that the spot prices had fallen to a level where it would not be economical for some suppliers while others “may choose to sit on inventory until the price recovers.” On the other side of the ledger, Sims has also been hit by rising freight costs which has not been possible to pass onto customers.

Source; company

These issues have forced Sims to update the market for their half year result saying they are “expecting the outcome (profit) to be materially lower than the prior corresponding half year,” while holding fire on the full year, leaving the door open to a recovery in the price in the remaining 9 months of the year. The market was expecting an 8% increase in profits to $174.9m over the full year, while they managed $76.5m in the first half of FY18. A materially lower first half would leave a big margin to make up in the second half. We see it going to test the lower end of the range around $9 before pushing higher. It remains leveraged to global growth and positive news from the US-China talks.

Sims Metals (SGM) Chart

Bellamy’s Australia (BAL) +54.93%; Baby formula and organic food producer Bellamy’s has soared today on news the board has recommended a takeover offer from China Mengniu Dairy at $1.5b or $13.25 a share which was a 59% premium to last close. Bellamy’s has had a bumpy ride over the past few years, and Mengniu have used this to have a crack at the company. Bellamy’s does have a number of licences and approvals to sell its non-organic products into China, but has seen significant delays in receiving the same approvals for the organic versions.

Mengniu clearly sees this as a strategic opportunity, believing that they could fast track the approval process as well as leveraging their existing distribution channels to vastly improve sales for Bellamy’s. The BAL board aggress, and has unanimously recommended the offer. Shares closed at a reasonably tight ~2.7% discount to the bid, yet we see elevated risk in the ability for Mengniu to receive FIRB and court approvals to buy the Tasmanian based company and suspect the discount is only so tight because of the significant short interest seen in BAL.

Bellamy’s Australia (BAL) Chart

Broker moves;

· ALL AU: Aristocrat Downgraded to Sell at Morningstar

· CGF AU: Challenger Downgraded to Hold at Morningstar

· CCP AU: Credit Corp Downgraded to Sell at Morningstar

OUR CALLS

We bought Newcrest (NCM) in the MM Growth Portfolio today - recent weakness presenting an opportunity.

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.