Crude oil is flirting with $US50/barrel can our energy sector defy the weakness?

The following report is an extract of the MarketMatters Morning Report that was published on June 14. Click here to get access to the full report and more

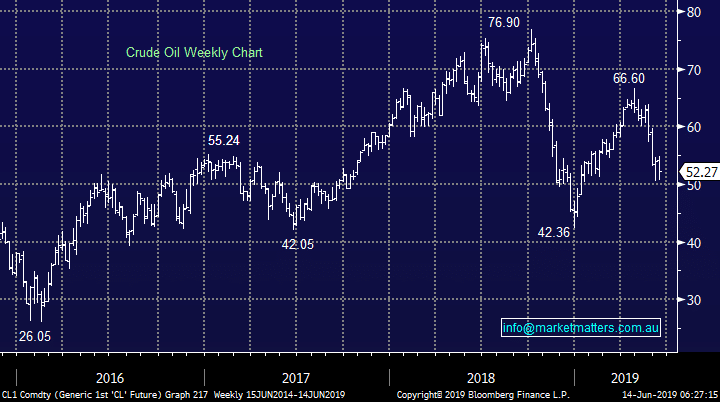

As the title says crude has endured a very tough couple of months as President Trumps constant threat to global trade weighs on this highly regarded economic activity indicator. Crude oil along with bond yields tells us that the global economy is in real danger of slipping into a recession.

We can now see crude oil rotating between $US50 and $56 for a few weeks but the major risks remain to the downside. At MM we believe crude oil is a sell into bounces as opposed a buy into weakness.

This takes us to 2 initial conclusions:

1 – The global economy will get worse in 2019/2020 suggesting interest rates will go lower as bond yields are implying while a recession is likely.

2 – Australian energy stocks are likely to underperform moving forward.

Crude Oil Chart

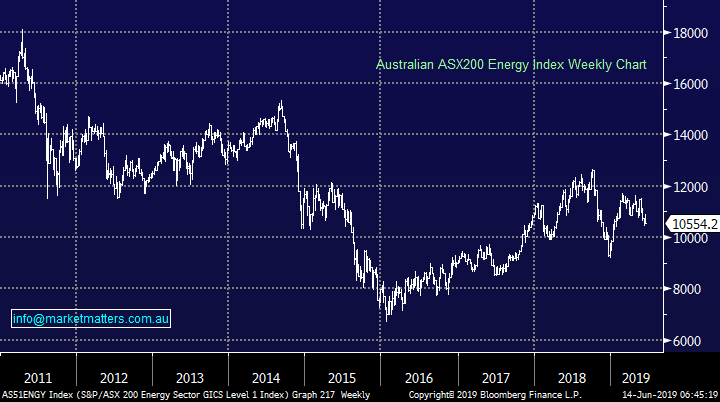

Moving onto the ASX200’s Energy sector which has significantly outperformed crude oil through 2019 – it’s done a pretty good job of ignoring the 25% plunge in the oil price. This suggests one of two things, either we are going to get a straw that breaks the camel’s back sort of fall in the respective stocks and they’ll play catch up on the downside, or the sector is correctly forecasting a recovery in the oil price – the latter of which is not something President Trump wants leading into an election next year.

While local energy stocks have outperformed the price of crude, when considered against a backdrop of a strong local market that’s not a huge surprise. e.g. over the last 3-months CBA is +10.3% and CSL +8.4% but the average move of the 12 names in the ASX200’s Energy sector has been over -11%, that’s a sobering level of underperformance even though the most significant falls have been in the coal names.

Conversely it’s easy to argue that our oil stocks are holding up ok considering the underlying commodity has entered a painful bear market, there’s always 2 sides to a coin!

This leads us to have no firm view at a sector level.

ASX200 Energy Index Chart

Moving onto the ASX200’s Energy sector which has significantly outperformed crude oil through 2019 – it’s done a pretty good job of ignoring the 25% plunge in the oil price. This suggests one of two things, either we are going to get a straw that breaks the camel’s back sort of fall in the respective stocks and they’ll play catch up on the downside, or the sector is correctly forecasting a recovery in the oil price – the latter of which is not something President Trump wants leading into an election next year.

While local energy stocks have outperformed the price of crude, when considered against a backdrop of a strong local market that’s not a huge surprise. e.g. over the last 3-months CBA is +10.3% and CSL +8.4% but the average move of the 12 names in the ASX200’s Energy sector has been over -11%, that’s a sobering level of underperformance even though the most significant falls have been in the coal names.

Conversely it’s easy to argue that our oil stocks are holding up ok considering the underlying commodity has entered a painful bear market, there’s always 2 sides to a coin!

This leads us to have no firm view at a sector level.

ASX200 Energy Index Chart

However all stocks should be evaluated on their individual merits, today we have looked at 3 majors in the 12 strong ASX200 Energy sector

Click here to continue reading

However all stocks should be evaluated on their individual merits, today we have looked at 3 majors in the 12 strong ASX200 Energy sector

Click here to continue reading