Crown Resorts (CWN) receives takeover bid, do you sell into the rally?

Stock

Crown Resorts (CWN) $14.10 as at 9/04/2019

Event

The big news out to the market this morning is a takeover bid lobbed at Australia’s biggest casino name, James Packer’s Crown Resorts (CWN). The company today announced it had received a confidential offer from US giant Wynn.

The current proposal offers $14.75/share value to Crown shareholders, split between 50% cash and 50% in Wynn shares. This values Crown at just shy of $10b, and was a 26% premium to yesterday’s close price.

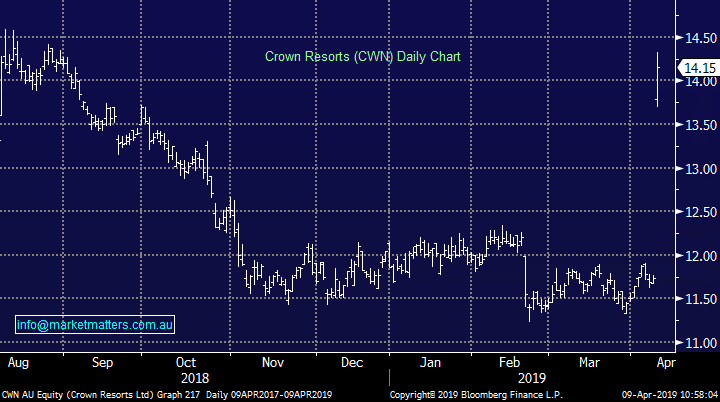

It’s easy to call this bid opportunistic given how CWN shares have traded - they have traded down from the mid $14 area last year to a low of $11.23 earlier this year – however there might be a bit more to this bid. There is a longstanding relationship with James Packer, who holds just shy of half of CWN shares on issue, and Steve Wynn, who built Wynn Resorts and stood down as CEO last year but still remains heavily involved in the company.

Given their relationship, it raises the question as to whether Steve would show this level of interest if he did not have a degree of insight into James consideration to selling Crown. There are plenty of reports over recent year which suggest Packer might not enjoy his involvement with Crown, so we may be looking at a willing seller.

Crown shares are currently trading 20% higher at $14.10, ~4.6% below the implied bid price.

Crown Resorts (CWN) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook