Costa Group shows promise in a weak market (CGC, A2M, Z1P, JHG)

WHAT MATTERED TODAY

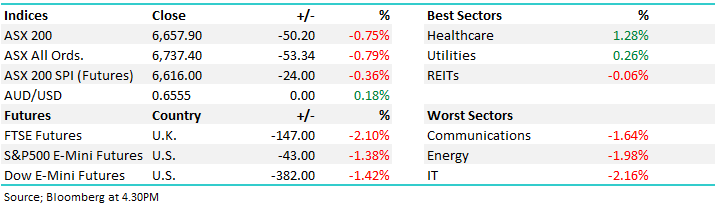

The ASX fell another -50pts today, although it felt more given it was trading in the green early on taking the total decline from the 7197 high set last Thursday to -539pts / -7.47%. US Futures were consistently sold during our time zone today trading down around ~1.5% at our close, so our market actually held up okay considering. There was no appetite to take on any option risk today from the trading desks / institutions we speak to highlighting the current concern circulating around the market – the current headlines certainly not helping, and it seems everyone is now in wait and sell mode.

This morning’s open was reasonable with some buyers stepping up to the plate, however as the day progressed, stocks had a downside bias. 70% of the ASX 200 closed in the red and while the selling wasn’t particularly aggressive, it was consistent. The market clearly needs some type of circuit breaker to change the current trend. We continue to believe that is a probable scenario in the form of stimulus, and while the market is clearly an uncomfortable place to be right now, I fear it would be more uncomfortable watching an aggressive bounce back in stocks from the sidelines if we were to cut positions at the point. While reporting season has taken somewhat of a backseat in recent days, today was the peak of it, with some reasonable hits but some decent misses as well…more on that below.

At the sector level today, IT was again in the crosshairs while some money flowed back into the classic defensive areas, Healthcare, Utilities & REITs the best performers. US Futures were down around 1.5% at our close today while Asian markets were also in the red, Japan down 2% while China kept its head above water.

Overall, the ASX 200 lost -50pts / -0.75% today to close at 6657. Dow Futures are trading up -363pts/-1.36%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

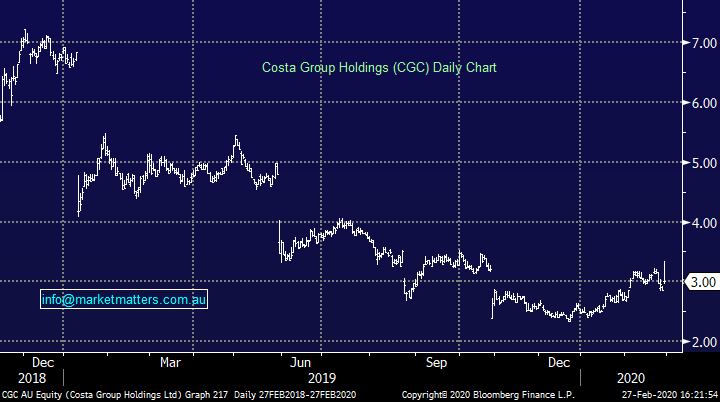

Costa Group (CGC) +4.99%: FY result out this morning and it was decent versus low expectations. Revenue was slightly above at $1.048bn versus $1.025bn expected, with revenue growth coming in at 5.8% versus 2.33% expected = good. While profit was low relative to sales coming in at $28.4m, it was above expectations of $27m, with analysts range being $24-28m. Net debt was also lower than prior forecasts, while they spoke of improving conditions thanks to sustained rain and better pricing for most of their lines. In terms of pricing, they actually said pricing levels improved ‘considerably’, while declaring a token 2cps dividend as expected.

In terms of coronavirus, they say no impact as yet, although they’re monitoring the situation carefully – global supply chains the main potential issue here. In terms of outlook, Citrus the only area that looks weaker with downside potential.

All in all, a good result from CGC after a tough year. Stock was up ~15% early hitting a high of $3.34, clearly some initial short covering before it closed at $3.

Costa Group (CGC) Chart

A2 Milk (A2M) +5%: A good result this morning however a lot of focus on the impact from coronavirus on their business, which they’re saying has actually been positive to date with sales in January and February being strong. They did go on to qualify that by saying “Our sales into China continue to grow, but it is difficult to have a view as to how that will fully play out over the period to June. It could be positive; it could be negative”. A2 said revenue was tracking along ahead of expectations in the 2H while they guided to group EBITDA margins for the full year of 29-30%, which does suggest some softening from here. That said, they’re on track to meet full year EBITDA guidance and momentum remains strong in the business by the look.

A2 Milk (A2M) Chart

Janus Henderson (JHG) -6.22%: the global fund manager was hit hard today as the wave of selling continued across broader markets. They also announced their results before market opened with a beat at the top line but a 4% miss at earnings which concerned the market. Management fees fell in the period despite a 14% increase in AUM given the pressure on fees across the industry in general. Performance fees were more than double 2018 in a sign that performance is starting to turn for Janus which struggled in the prior year leading to outflows. We like Janus, despite the tough result. It is one of the cheapest fund managers in the world. With better performance and some tailwinds out of the UK, JHG should look to move higher when the market settles.

Janus Henderson (JHG) Chart

Zip Co (Z1P) -7.90%: struggled today after announcing an increase in losses for the half year to $30m despite revenue more than doubling. The economics remain solid for Zip who are focussed on growth. Users were up 80% on 1H19 while transaction volumes were close to double at $965m. There was a small miss to EBITDA expectations, however this came as a result of investments being brought forward. All in all a good result, though targets for the full year seem conservative which may explain the fall today

Zip Co (Z1P)

BROKER MOVES

· PolyNovo Raised to Buy at Baillieu Ltd; PT A$2.75

· Servcorp Raised to Buy at UBS; PT A$5.10

· Adelaide Brighton Raised to Neutral at Citi; PT A$3

· Adelaide Brighton Raised to Neutral at Macquarie; PT A$3

· Adelaide Brighton Raised to Add at Morgans Financial Limited

· Adelaide Brighton Raised to Hold at Jefferies; PT A$2.80

· Adelaide Brighton Raised to Equal-Weight at Morgan Stanley

· Metlifecare Cut to Neutral at Macquarie; PT NZ$7

· Insurance Australia Raised to Neutral at Macquarie; PT A$6.70

· Regis Healthcare Raised to Buy at Moelis & Company; PT A$2.64

· Vector Raised to Neutral at Forsyth Barr; PT NZ$3

· CBA Raised to Hold at Morningstar

· Monadelphous Raised to Hold at Morningstar

· Bingo Industries Raised to Hold at Morningstar

· Lendlease Group Raised to Hold at Morningstar

· AMA Group Cut to Neutral at Goldman; PT 66 Australian cents

· InvoCare Raised to Add at Morgans Financial Limited; PT A$15.87

· InvoCare Raised to Buy at Bell Potter; PT A$17

· Home Consortium Ltd Raised to Buy at Goldman; PT A$3.83

· Perenti Raised to Buy at Jefferies; PT A$1.85

· Woolworths Group Raised to Neutral at Credit Suisse; PT A$39.70

· Steadfast Cut to Neutral at Credit Suisse; PT A$4

· Nanosonics Raised to Add at Morgans Financial Limited

OUR CALLS

No changes today

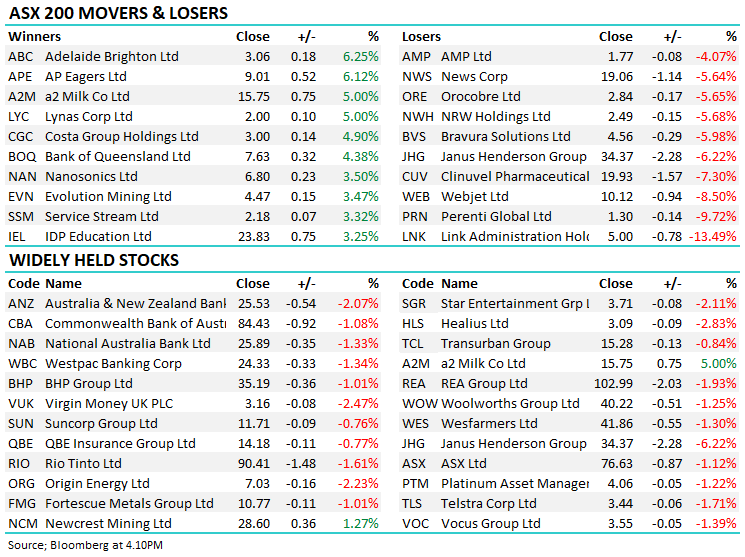

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.