Costa Group (CGC) shares in trading halt, acquisition on the cards

CGC: shares in the fruit grower will spend Wednesday in a trading halt as it looks to fund the acquisition of 2PH Farms for an initial $219m. The business is a Queensland mandarin grower with around 1,500 hectares of citrus plants with another 210 hectares to be planted by 2023. The business will produce around 30,000 tonnes with plants still maturing helping to growth that figure, expecting to print EBITDA of $29m this year. The acquisition includes land and water entitlements, as well as the full economic benefit of the CY21 citrus season, however an additional $31m will be paid to 2PH on completion of the planned 210 ha. of trees.

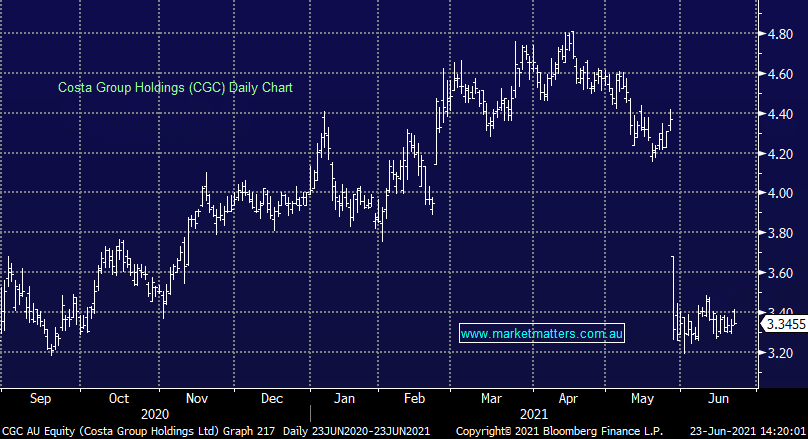

To raise the money Costa is completing a 1 for 6.33 entitlement offer at $3/sh, a ~12% discount to last netting $190m, with the remainder to come from undrawn debt facilities. The deal expected to be 10% EPS accretive with further upside seen in synergies and increased crop yields as the plants mature. Along with the acquisition, CGC said it expects EBITDA for CY21 to marginally ahead of CY20, around in line with market expectations.