Copper in the crosshairs (TPM, CTD, OZL)

WHAT MATTERED TODAY

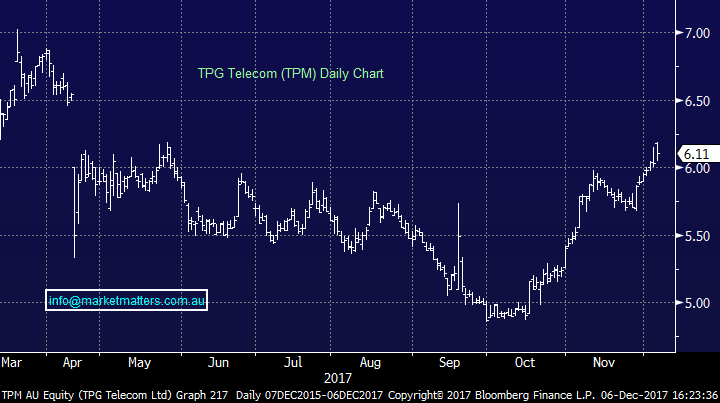

Weakness in the commodity complex overnight weighed on the ASX today with the index finishing in the red for the 3rd straight day. Copper the main target overnight and that provided the topic for our AM report this morning. Last night’s fall in Copper was blamed mainly on a stronger $US but that doesn’t sit particularly right with us at MM as the $US only rallied 0.15%, we feel optimism around the US tax cuts fuelling the global economy has got a little ahead of itself. The copper price is generally regarded as a leading indicator on the global economy and the recent 10% correction is at odds with most economists belief that growth is improving.

There is certainly some debate going on about whether or not Copper will be in surplus or deficit in 2018/19, with most predicting a slight surplus in 2018 followed by a slight deficit in 2019, which means any price increase for now will probably come from a change on the demand side, or in other words, a more bullish growth outlook for the global economy. Overall, we believe the risk / reward has returned for the bulls and while copper holds above the 275-280 region we can be buyers around $US290/lb. To that end, Oz Minerals (OZL) came back into the buy range below $8.00 today.

Nickel was also smacked overnight and it’s now down ~15% from its recent peak just a few short weeks ago – funnily enough just as the topic of Nickel and electric cars was getting most airtime. Today Western Areas (WSA) got sold hard, down -5.26% to $2.88 (-16% from its recent highs) – this is a stock to buy into weakness, but not yet, while Independence Group (IGO) which we own has also struggled, but not as much, trading down ~12% from its recent highs, but is still +42% above its May 17 lows. Clearly a volatile area of the market.

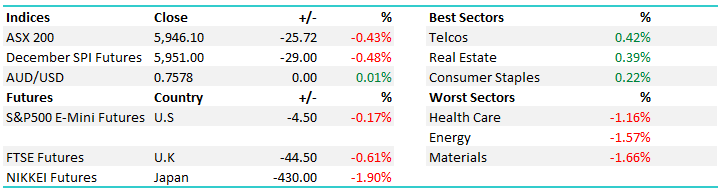

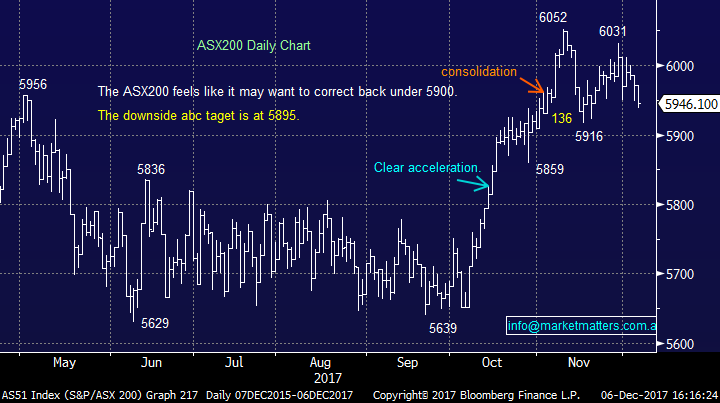

On the broader mkt today, selling came in fairly hard from the open before a tentative fightback into lunch time, however sellers then dominated the afternoon session. Telcos the best of a weak bunch adding +0.42%, Telstra up smalls while TPG re-confirmed guidance and ended +1.33% higher. On the flipside, Materials lost -1.66% with BHP mirroring its performance overseas by dropping ~2%. An overall range today of +/- 26 points, a high of 5964, a low of 5938 and a close of 5945, off -26pts or -0.44%.

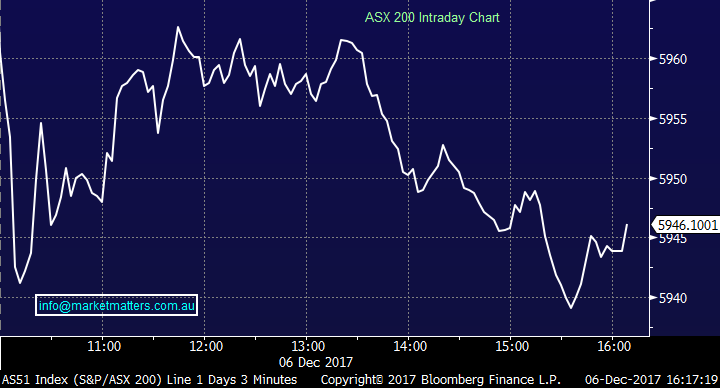

We’re now only 46pts above our shorter term downside target for the mkt, before the usual December strength that typically happens from the middle of the month starts to play out.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

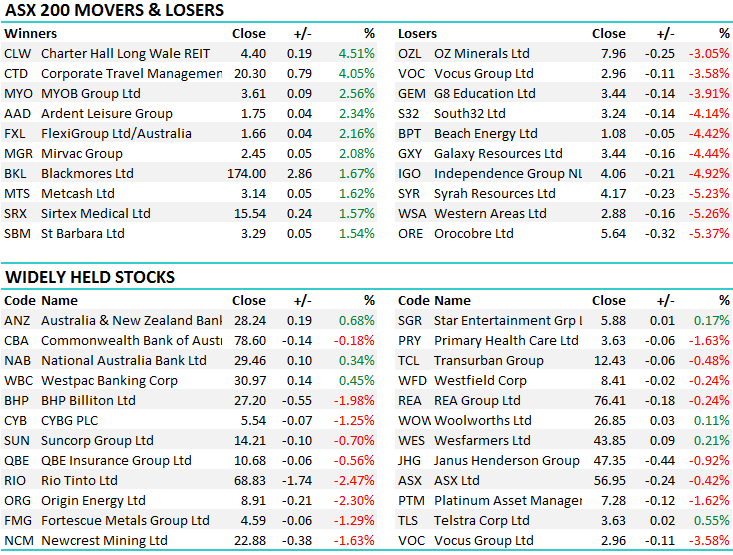

TOP MOVERS

1. TPG Telecom (TPM) – Reconfirmed FY18 Guidance for EBITDA $800-815m + mobile rollout on track + we also had Chair and major shareholder David Teoh show confusion about why the share price was so low – those comments prompted some buying today by the look with the stock closing up + 1.33% to $6.11

TPG Daily Chart

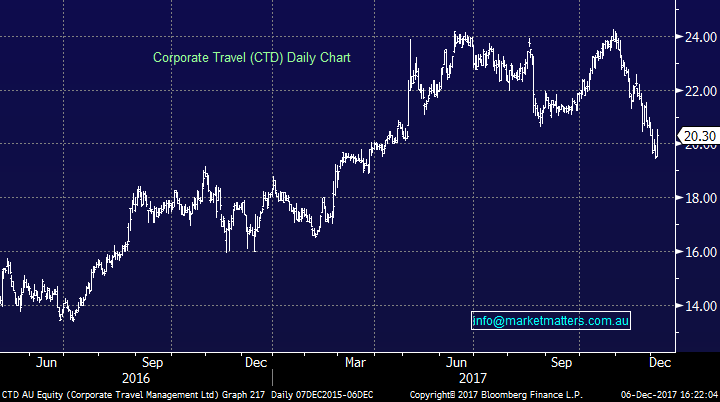

2. Corporate Travel (CTD) – Morgan’s reckon this is a BUY again after the weakness and they tend to have a reasonable impact on stock prices – the pullback here is deep and the obvious pattern below was the marginal new high before the stock rolled over. When that happens, we tend to see a test of the lower extremity of the range, which has now played out. CTD added +4.05% today closing at $20.30.

Corporate Daily Chart

OUR CALLS

Oz Minerals (OZL) – we bought today below $8.00 as per the alert, allocating 3% on the Growth Portfolio

Australian Leaders Fund (ALF) – we added this to the Income Portfolio today around $1.06 with a 5% weighting

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 6/12/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here