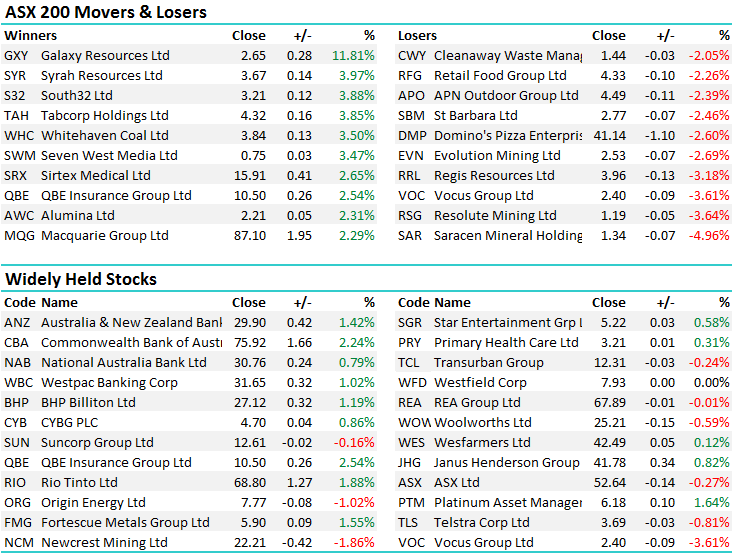

Coordinated buying in banks + materials – a change in recent form! (AWC, QBE, MQG, CNI)

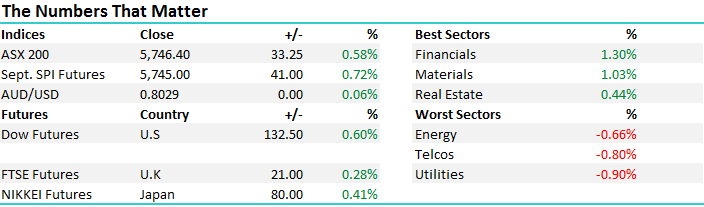

Another day of buying in Aussie stocks with the Financials and Materials seeing coordinated buying – a rare event in recent times! Overall, the financials put on +1.30% to lead the charge while most weakness was felt in the Utilities which lost -0.90% - an overall range of +/- 43 points, a high of 5764, a low of 5721 and a close of 5746, up +33pts or +0.58%

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

The Financial stocks did well following an upbeat session on Wall Street, but more importantly, bond yields have tracked higher in the States and elsewhere which bucks the recent trend. This Mornings note asked the question whether or not is was time to switch from bullish bets on commodities to bullish bets on the banks, and although both were strong today, that trade may take some time to play out. It generally takes a few attempts to break a defined trend, so expect some volatility but and overall bottoming process to play out in the banks while the opposite looks likely amongst the material stocks.

To that end, Alumina (AWC) traded up +2.31% to close at $2.21 and continues to look strong despite paying a recent dividend while BHP also snapped back above $27 to close +1.19% higher. We’re being vigilant on both stocks for potential levels to sell into strength, although slightly higher levels are our clear preference.

Alumina (AWC) Daily Chart

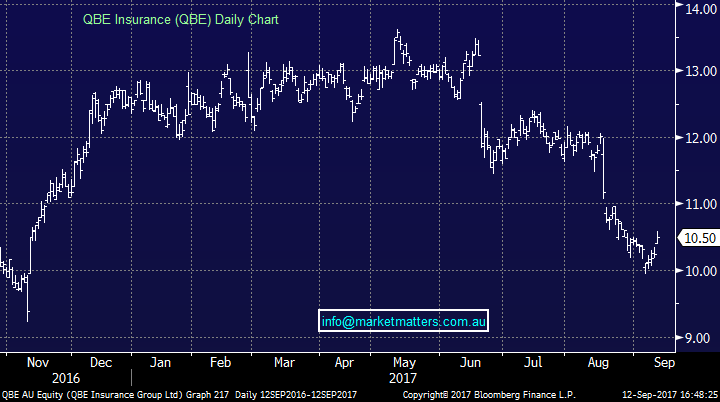

QBE was in focus today, eventually closing up by +2.54% on the announcement of a new CEO – as one Analyst suggested in our morning meeting today, the mkt was waiting for him to be sacked anyway after the recent woes! Probably a bit harsh however the news was met with buying, although that was also helped by the downgrade of Hurricane Irma and a slight but positive change around US interest rate expectations. The current CFO Pat Regan will take over CEO on 1st Jan 2018.

QBE (QBE) Daily Chart

Macquarie was also bid up again today, adding another +2.29% to close at $87.10, however after two days of buying post their re-confirmed guidance + an upgrade from UBS yesterday the stock is starting to look exhausted. On paper the silver donut looks cheap trading on 12x ex its upcoming dividend however the trading action continues to look poor technically – 50-50 at best and better opportunities elsewhere in our view. When something looks good on paper, analysts like it yet the share price is not reacting sin a positive way, it’s worthwhile being wary…

Macquarie (MQG) Daily Chart

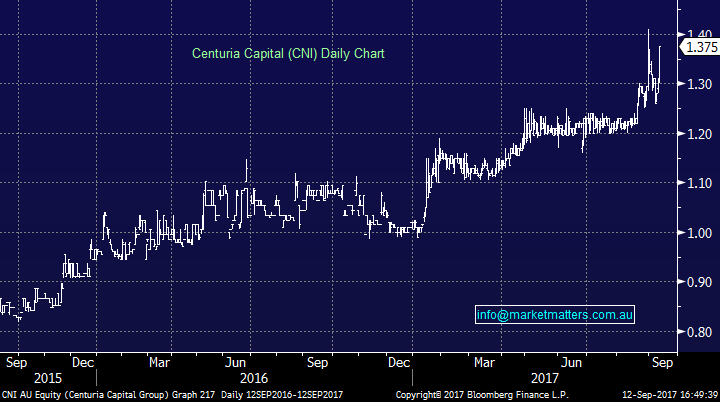

Centuria Capital (CNI) – A stock we hold in the MM Income had another good session today adding +4.96% to close at $1.375. Obviously a good run on some recent corporate news + a void of sellers, however we now start to consider levels to be a seller of this stock – something we’ll cover in the Income Report out tomorrow. Stay tuned!

Centuria (CNI) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/09/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here