Consumer Confidence capitulates (OZL, LYC)

WHAT MATTERED TODAY

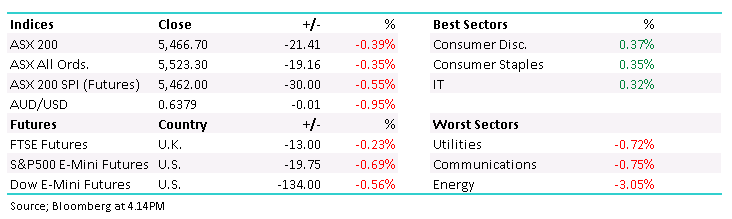

Although much of the overnight strength was baked in, the local session was pretty underwhelming as the ASX failed to go on with yesterday’s risk on momentum. In part the underperformance came from strength in the Aussie dollar which hit a one month high early this morning. Although only its best in a month, the rally to 64c against the greenback represents a 16% pop from the mid-March panic low below 56c. Back to the stock market, the flat open was quickly sold into with the pace of selling picking up around the 10.30AM release of Consumer Confidence data which disappointed, plummeting to 75.6 which was below the lowest point of the GFC. The market took it as a sign that the population isn’t quite ready to buy into the Government’s stimulus work.

Energy names took a step back after their recent form tracking oil lower after the sugar hit from this week’s historic production cuts wore off and global recession fears picked up again. The consumer names held up the best despite the confidence data.

Overall, the ASX 200 fell -21pts / -0.39% today to close at 5466.70 - Dow Futures are trading down -134pts/-0.56%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

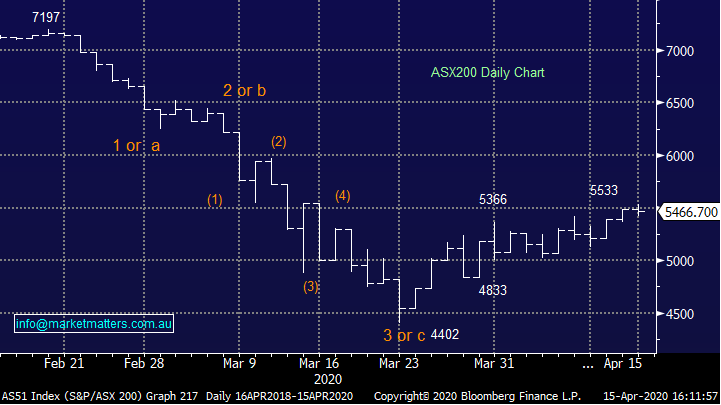

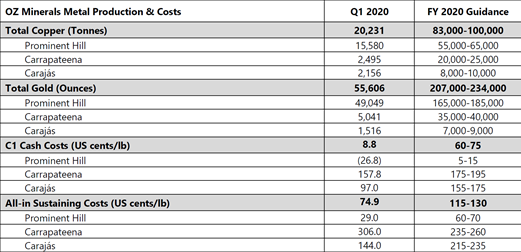

Oz Minerals (OZL) +2.46%: traded higher today, although did come off some early session highs. OZL published their March Quarter production report before market, with numbers looking on track for full year guidance. The company was out last week to confirm that they weren’t expecting any impacts to production as a result of the COVID related shutdowns, and the numbers today reflected that. Investors were keen on the developments out of Carrapateena which is seeing volumes ramp up ahead of schedule, and while costs remain above guidance for the mine, it is expected to fall as production nears capacity. Costs elsewhere were under control.

Source: Oz Minerals

We own OZL and remain keen on the holding as copper and gold see some strength. Everything is in order operationally.

Oz Minerals (OZL) Chart

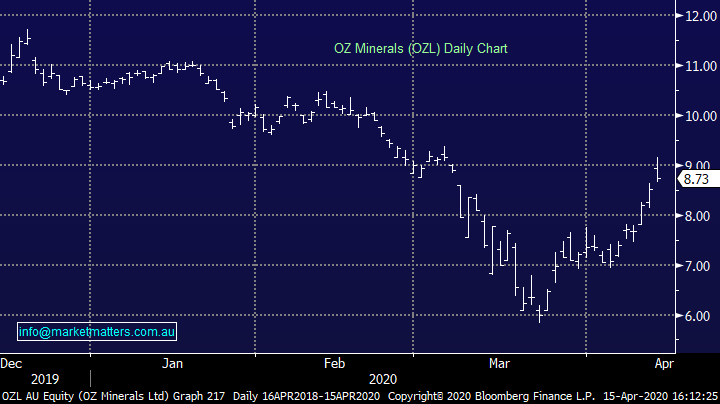

Lynas (LYC) +5.19%: another miner out with their quarterly, Lynas moving through the 3rd quarter of their reporting year without too much of a hiccup. The company noted that despite some constraints to capacity in the quarter, volumes improved on the 2 quarter but were slightly behind the same quarter last year. Processing remains the most impacted with Malaysia’s Movement Control Order coming into effect in late March halting work. Lynas has a decent cash backing of over $120m and looks in good shape to weather the shutdowns.

Lynas (LYC) Chart

BROKER MOVES:

· Pendal Group Raised to Add at Morgans Financial Limited

· Coca-Cola Amatil Cut to Neutral at JPMorgan; PT A$9

· Afterpay Cut to Neutral at Goldman; PT A$25.75

· Mesoblast Rated New Hold at Jefferies; PT A$2.15

· Fletcher Building Cut to Neutral at JPMorgan; PT NZ$4

· Adelaide Brighton Raised to Overweight at JPMorgan; PT A$3

· CSR Raised to Neutral at JPMorgan; PT A$3.80

· Inghams Rated New Buy at Bell Potter; PT A$4.20

· Northern Star Raised to Buy at Shaw and Partners; PT A$11

OUR CALLS

We sold Stockland (SGP) and bought Super Retail Group (SUL) in the Income Portfolio today.

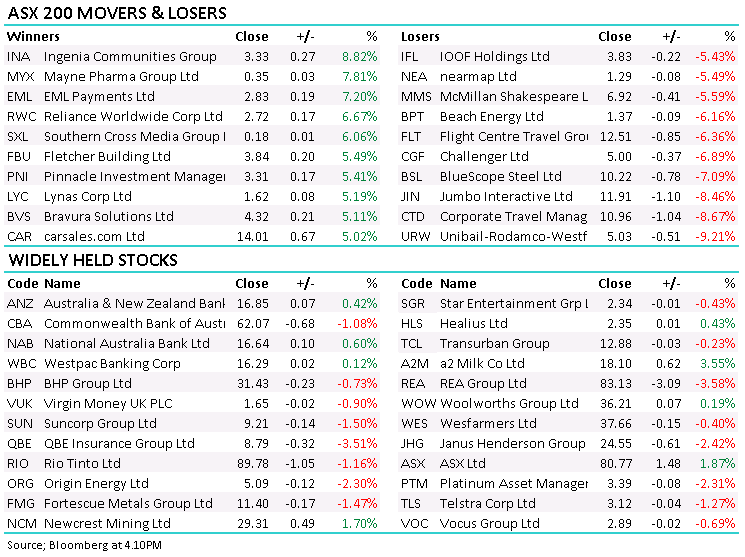

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.